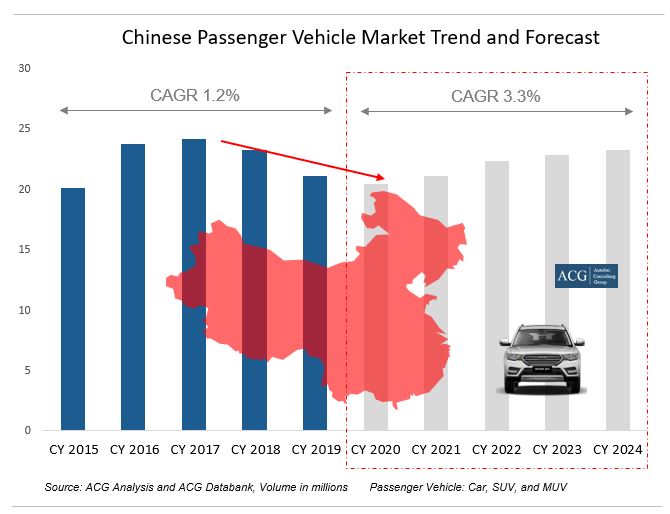

How the Chinese car industry is going to shape its future is our latest detail Study on China Car Industry. The Chinese car market is the world’s biggest passenger car market. It grew into one of the largest Auto markets and has remained the same till now. The China passenger vehicle Industry registered a 1.2% CAGR from 2015 to 2019 and expected to register a 3.9% CAGR in the next 5 years.

In 2019, the Chinese Passenger vehicle Market recorded a 10% fall compared to 2018. The outlook for the year 2020 China car market is critical considering the latest market dynamics. The Chinese Industry is expected to show a 3 to 4% degrowth in 2020.

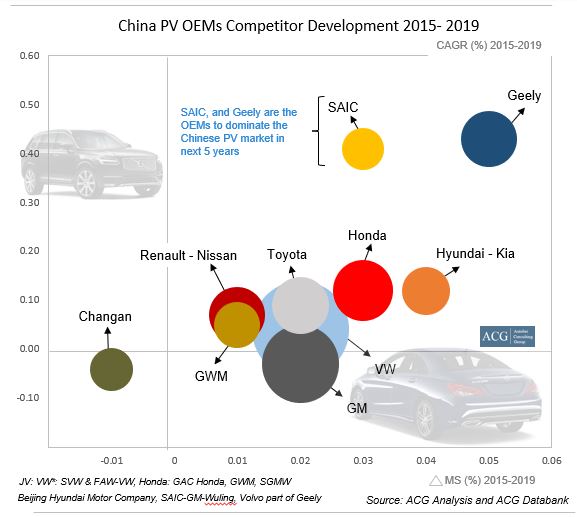

In the Passenger vehicle segment (Car, SUV, and MUV), the Honda, Geely, BMW, Mercedes, Baojun, Roewe, Volvo, Cadillac, and MG are considered the top players as per CAGR and Sales analysis from 2015 to 2019. The overall segment registered a 1.2% CAGR in the last 5 years. In the next 5 years, it’s expected to rise and reach almost 3.3% CAGR.

Chinese Brands like Haval, Geely, Changan also started to dominate the Russia Car market in 2019. It shows how Chinese brand perception is going to change in major auto markets like Africa, Russia, India.

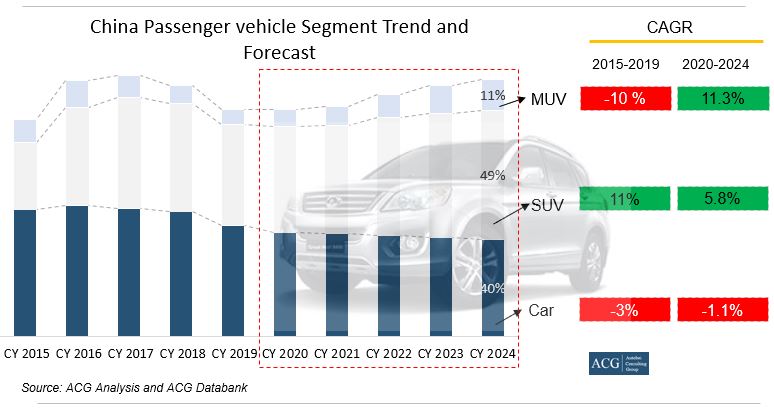

Car Segment:

VW, Honda, Toyota, Nissan, and Buick are major players with a combined market share of 53% in 2019. Premium German automakers Audi, BMW, and Mercedes were also top players in this category. The segment noted a -3% CAGR from 2015 to 2019 and expected to decrease further i.e -1.1% CAGR from 2020 to 2024.

SUV segment:

The SUV segment showed 11% CAGR from 2015 to 2019 and expected to fall and reach 5.8% CAGR from 2020 to 2024. VW, Haval, and Geely are considered the top 3 players of this segment with a combined market share of 23% in 2019.

VW registered 34% CAGR from 2015 to 2019. They also added a 5% market share in the last 5 years. Geely’s performance is excellent with a 6% increase in its market share from 2015 to 2019. BMW, Jeep, Skoda, MG further registered a double-digit CAGR growth from 2015 to 2019.

MUV Segment:

The MUV segment is dominated by Chinese, American, and Japanese players. The MUV segment registered -10% CAGR from 2015 to 2019 and expected to show an immense growth of 11.3% in the next 5 years. This forecast estimate is based on a new customer survey and a new product range plan. Customers perceive MUV as more spacious and more convenient than SUV. Similarly, customer centricity was observed in the US market.

Currently, the Chinese car segment is encountering some challenges. As a result, the consumer confidence index was fallen due to the China-US Trade war; however, the US has given some signs to lower this pressure this year. New emission standards in China, tighter restrictions on buying cars in the biggest cities, rising inflation, and a growing used-car market all these would give a negative impact on car sales in the domestic market.

Segment share of Car, SUV, and MUV:

In 2019, the Car, SUV, and MUV had 48%, 44%, and 8% segment share respectively. It is anticipated that this will become 40%, 49%, and 11% by the end of 2024.

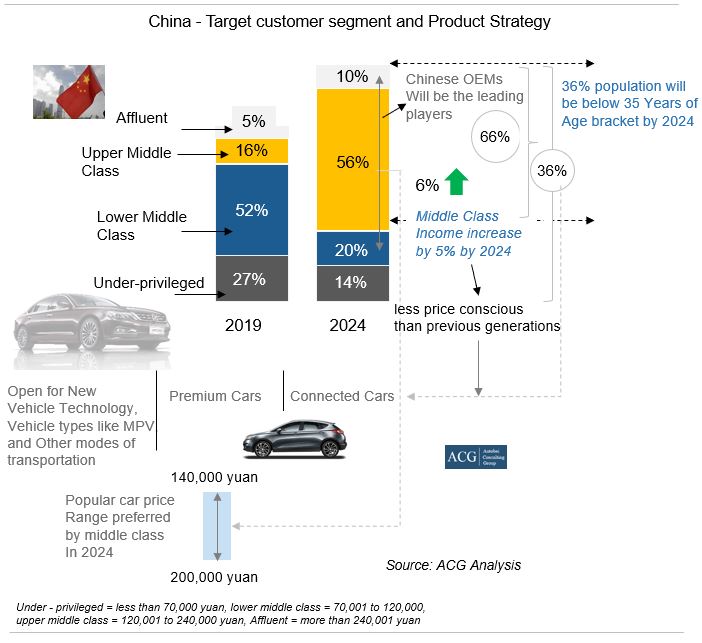

Customer behavior pattern and Product Strategy:

The overall pace at which Chinese consumption has grown is hard to imagine; just a decade ago, urban Chinese had no enough money to cover their basic needs like food, clothes, and housing and now, half are living in relatively well-to-do households, where they get ample funds from perks like regular meals, premium products, latest electronics, and holiday travel. China maintained stable employment factors last year.

Currently, urban consumers are now the prime drivers of the Chinese economy, with their spending account crossing over 60 percent of GDP growth. In the next 5 years, the Tier II system is believed to engage actively to drive the economy.

It is expected that the new employment factor will continue to score more than 13 million jobs for the five consecutive years. In December 2019, the Consumer Price Index (CPI) rose by 4.5 percent year-on-year, with an increase of 4.2 percent in the urban sector and 5.3 percent in the rural sector.

In 2019, the per capita consumption of the whole country was 21,559 yuan, which is a trivial increase as compared to the same period of last year, but a steep increase i.e 5.5 percent after deducting the price factor.

In the coming decade, household consumption will grow by an average of 6% annually; which will be mainly powered by upper-middle-class people who will expand to represent an estimated 56% of households by 2024. The new job creation and population movement from rural to urban areas, where incomes are higher will be their key drivers. The resulting income growth will elevate underprivileged and lower-middle-income households to an upper middle class and affluent respective with income support of around 66% of the total population.

New Customer segment:

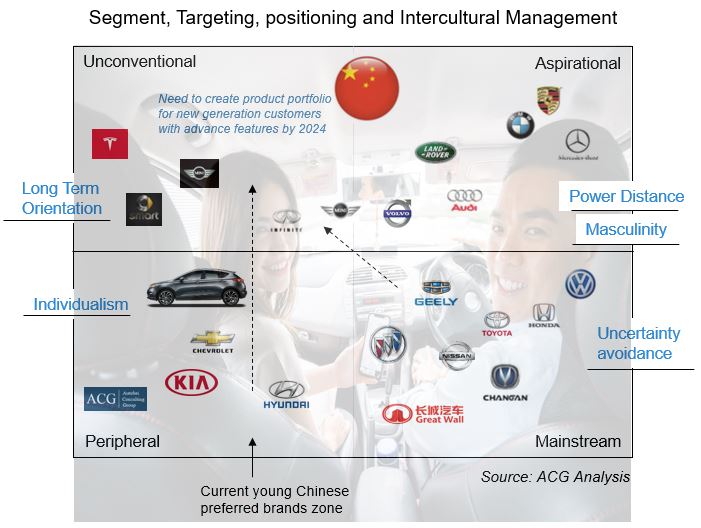

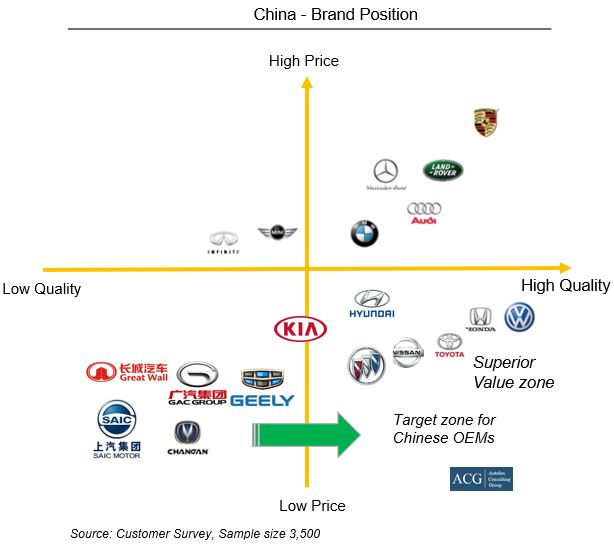

China has got the world’s most fascinating customer base. They have the youngest buyers for a premium vehicle. It is expected that Chinese OEMs will be the first choice for most of the middle-class buyers.

They will have high expectations for products and services and China meets their interests. The current product portfolio of Car demands to be upgraded upon considering the new generation i.e Chinese customers’ lifestyle and purchase pattern. The new generation obtains meaningful financial support from their parents and grandparents, and they grew up in a short period with rapid improvements that are steered by a quality life empowered by technology and digitization. They’ll continue to depend on technology and digitization as they begin to enter the workforce with them. They will consume a higher rate than their predecessors, seeking instant gratification to maintain higher standards for convenience, quality, and variety. This group is comparatively less price-conscious than the previous generations.

Companies must develop premium and personalized products and services to meet these higher standards that might influence the buyers. Digital media will play a significant role than kith and kin. They would be ready to adopt any new technology vehicles. The communication strategy reports convincing the new generation. These young and digital-savvy consumers are more open to new things than older consumers are. These traits create opportunities for new business models to attract buyers. Also, more two-child families will form in the coming decade, leading to an increase in the demand for specific products and services for growing families. It is expected that the average premium buyer of a premium vehicle in China will be less than 35 years old. It is predicted that about 30 percent will be first-time buyers in China for premium vehicles.

Brand Strategy:

Our study showed that customers are becoming more loyal to a specific brand name. Our study suggested how companies can change their advertising, and corporate communication strategy to make it more effective for the next 5 years.

OEMs Strategy:

Chinese OEMs are aiming to increase market share in the domestic market. They are acquiring reputed brand names like Volvo, Hammer, MG to use expansion on new markets. The middle class is their target segment; VW and Toyota successfully won the Chinese market especially the middle-class market with the right strategy appealing the consumers’ demand.

Key Highlights of the report:

- China Passenger Vehicle Market size Trend and Forecast

- OEMs sales, market Share Analysis

- Model wise Sales Analysis and positions of the models

- Challenges and Opportunities Analysis

- Mass, Premium, and Sports Car market Analysis

- Competitor Analysis

- Customer Survey

- Product Strategy and Product Planning

- Vehicle Pricing Strategy

- Customer Group and mapping with Vehicle type, Price and Social parameters

- Customer demand Analysis

- Brand Strategy for foreign and Chinese OEMs

- Regulation impact on vehicle Sales

- After Sales Analysis