Electric vehicles have captured widespread attention and become an extremely alluring sector for Original Equipment Manufacturers (OEMs), customers, suppliers, governments, and a broad spectrum of stakeholders.

The electric car market is experiencing a remarkable surge, with sales surpassing 10 million units in 2022. Electric cars accounted for 14% of all new car sales in that year, marking a significant increase from approximately 9% in 2021. The first quarter of 2023 witnessed the sale of over 2.3 million electric cars, showcasing an impressive 25% year-on-year growth. Projections suggest that sales could reach ~15 to 16 million units by the end of 2023 with the support of government subsidies.

The electric vehicle industry’s expansion is fuelled by various factors. The convergence of the supply chain and technology is progressing steadily, although a noticeable gap persists between the availability and demand for essential EV components, including semiconductors, inverters, and power modules. As a result, EV OEMs and suppliers have acquired valuable understanding regarding the challenges, technology maturity, and the roadmap for advancing electric vehicles.

Tesla is a prominent and influential player in the electric vehicle industry, constantly adapting its approach to broaden its market share. While Tesla was relatively not that famous in the past, today, all conventional automakers are embracing elements of Tesla’s technology and business model. A noteworthy breakthrough by Elon Musk is the introduction of the Discrete Power Module, which not only cuts costs but also ensures a smooth and uninterrupted supply of power modules for their electric car line-up.

The electric vehicle segment poses a challenging phase for German OEMs as they strive to maintain their market share, not only in their domestic market but also in key regions like China and the US. This situation significantly jeopardizes the longstanding European legacy in the automotive industry.

The business strategy utilized by established OEMs and suppliers:

A considerable number of OEMs and suppliers have set up separate departments within their organizations to cater specifically to the electric vehicle (EV) market. Initially, the financial attractiveness of this vertical may be limited due to the substantial initial investments and uncertainties related to technology development.

The strategy for achieving a suitable product-market fit for electric vehicles (EVs):

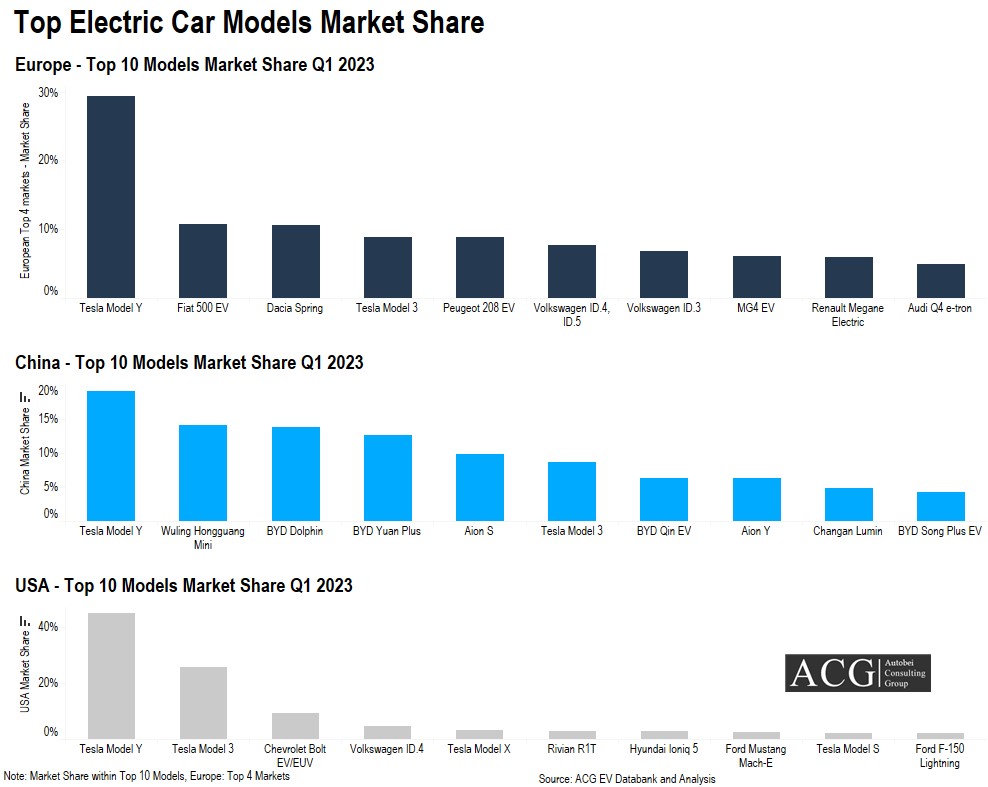

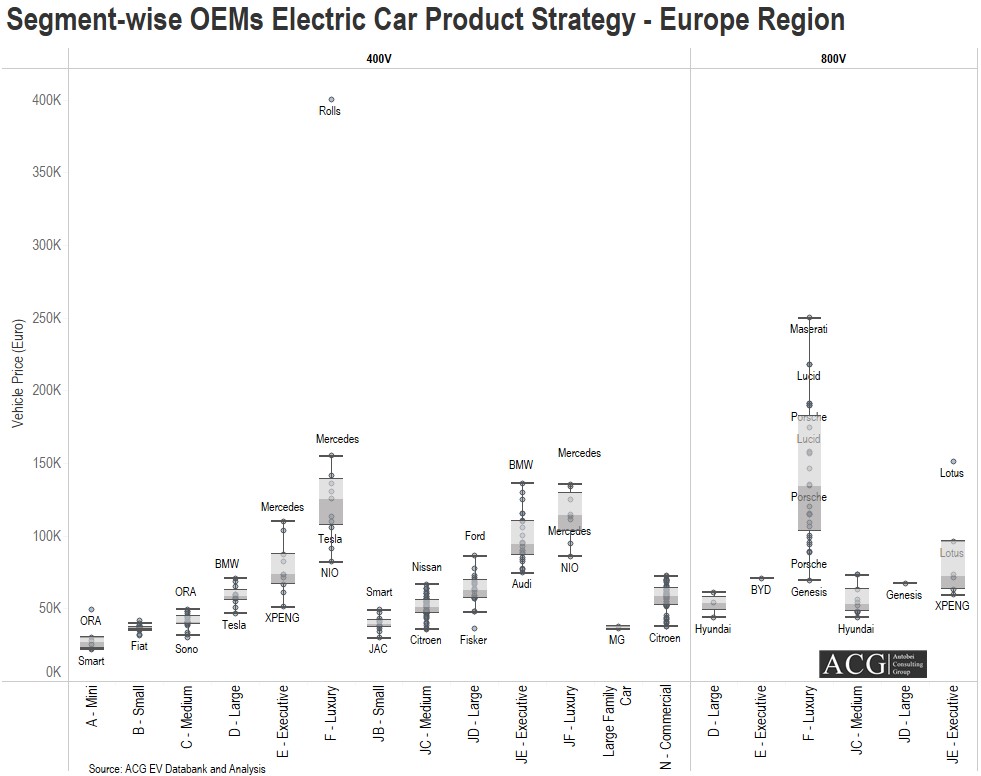

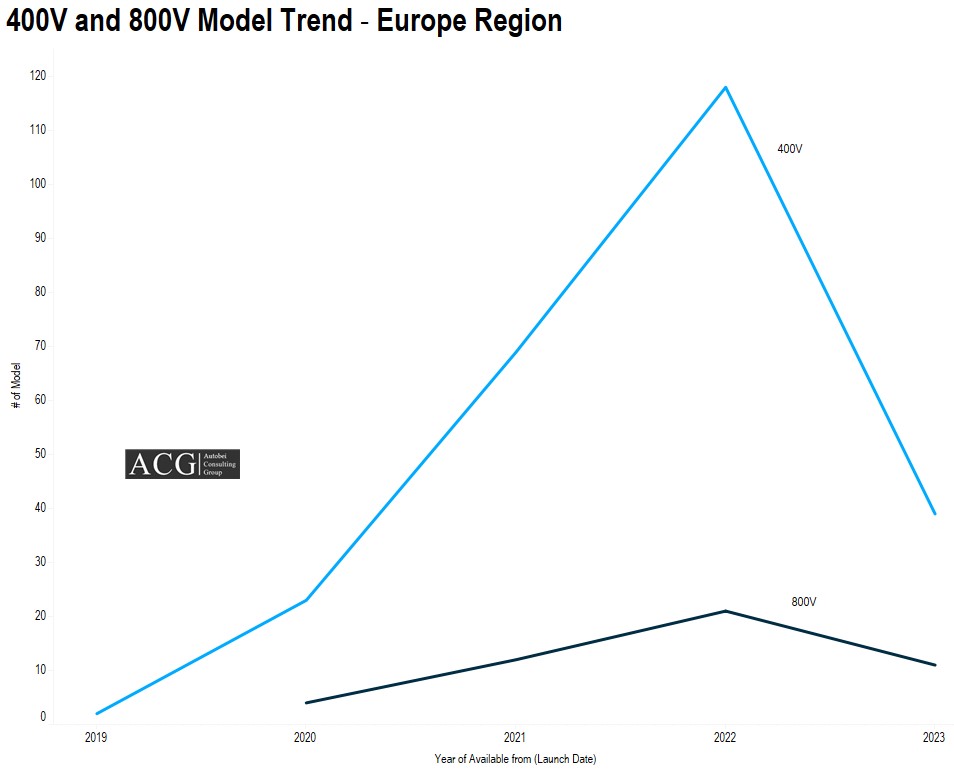

Numerous new models from major OEMs are currently in the development pipeline, driving the growth of the electric vehicle (EV) industry. The strategic planning of EV products plays a pivotal role in both defining the industry’s expansion and fostering the overall business growth of OEMs. During the initial phase of electric vehicle product launches, Luxury, Premium, and SUV models are dominating the markets in Europe and the USA. In contrast, the Chinese EV market has already experienced significant growth in the small electric car segment during its first phase, with the Economy EV segment now prevailing in China. Although the Electric Vehicle Subsidy in China concluded in 2023, there were still local-level subsidies available to a limited extent. Recently, the Chinese government decided to extend the EV subsidy until the end of 2027, with one of the reasons being to provide continued support to the country’s economy.

In a bid to promote the adoption of premium electric vehicles, the Chinese government is actively encouraging a shift in the electric vehicle (EV) market. As part of their policies, tax waivers for high-end EVs will continue, but there will be a cap of CNY30,000 during 2024 and 2025 for vehicles priced above CNY339,000. This unexpected extension of the waivers is expected to alleviate concerns among local automakers, providing them with an incentive to explore and invest in premium EV brands. Moreover, it serves as a significant motivator for traditional luxury car manufacturers to expedite their transition towards embracing EV technology. In the following years, the cap will be further reduced to CNY15,000 in 2026 and 2027, broadening its impact to encompass a wider range of EV models.

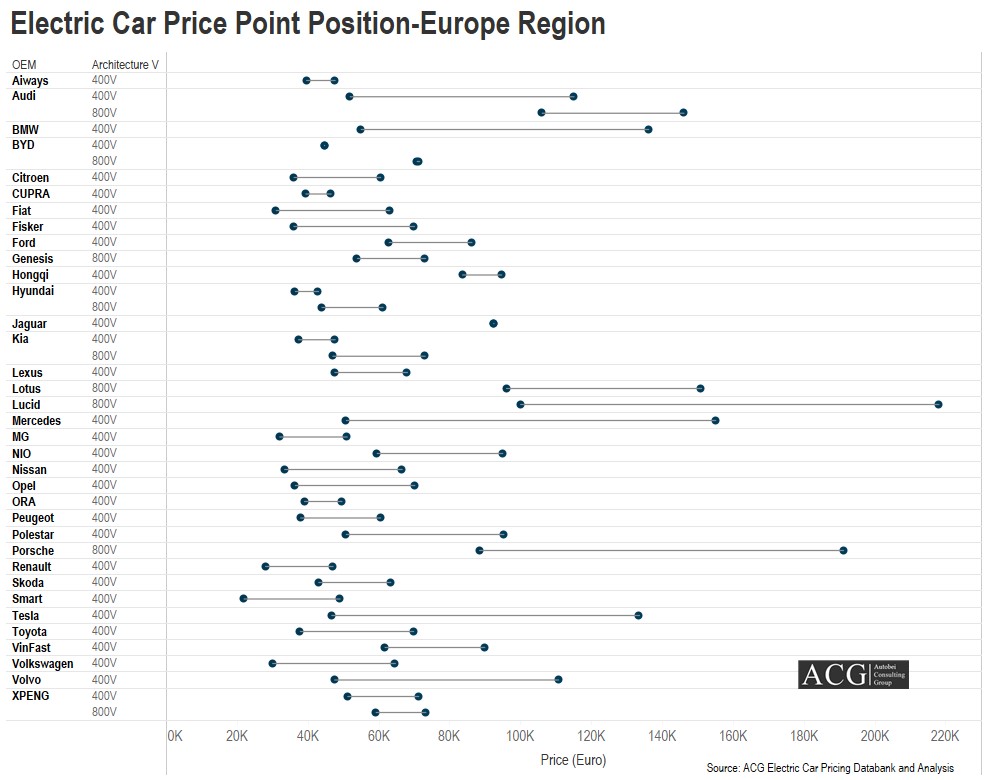

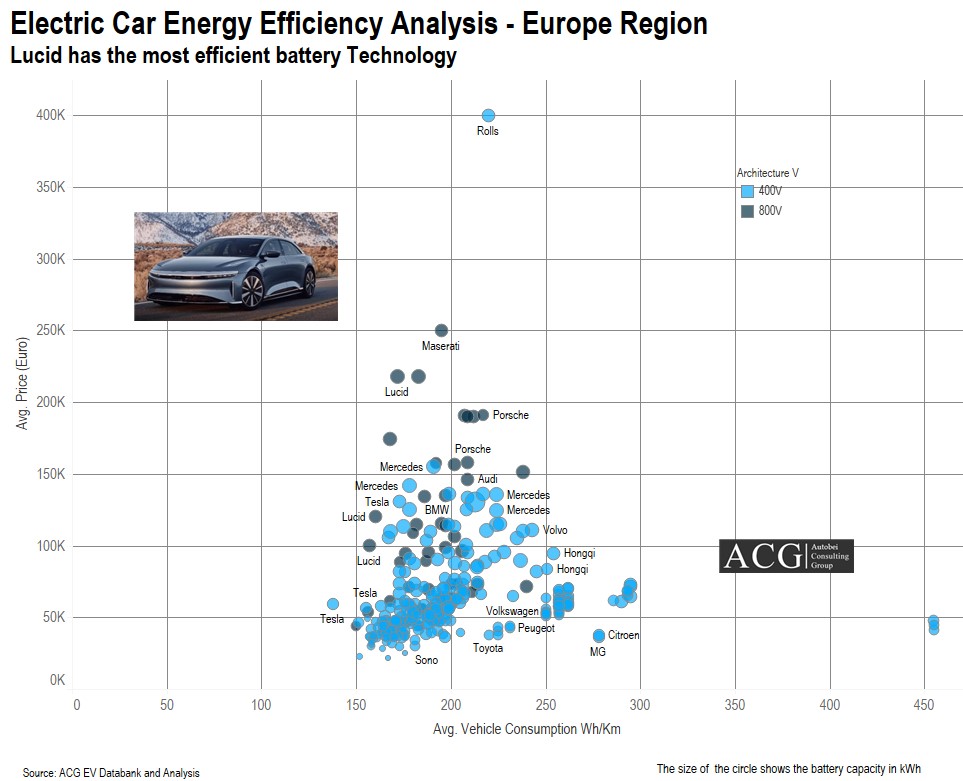

European car manufacturers are actively engaged in developing economical electric cars to introduce to the European market. Among them, VW stands out as a proactive player, determined to establish its presence in the EV segment. Additionally, Peugeot, Citroen, and Renault have ambitious plans to launch their own cost-effective electric car models by 2024. These upcoming vehicles are set to utilize Si IGBT technology, enhancing their performance and efficiency. Moreover, renowned brands like Mercedes and BMW are placing their faith in the 3-level switch technology, which is anticipated to offer a significant 4 to 5% improvement in efficiency compared to the conventional 2-level switch technology.

There are five key technological attributes that significantly influence electric vehicles:

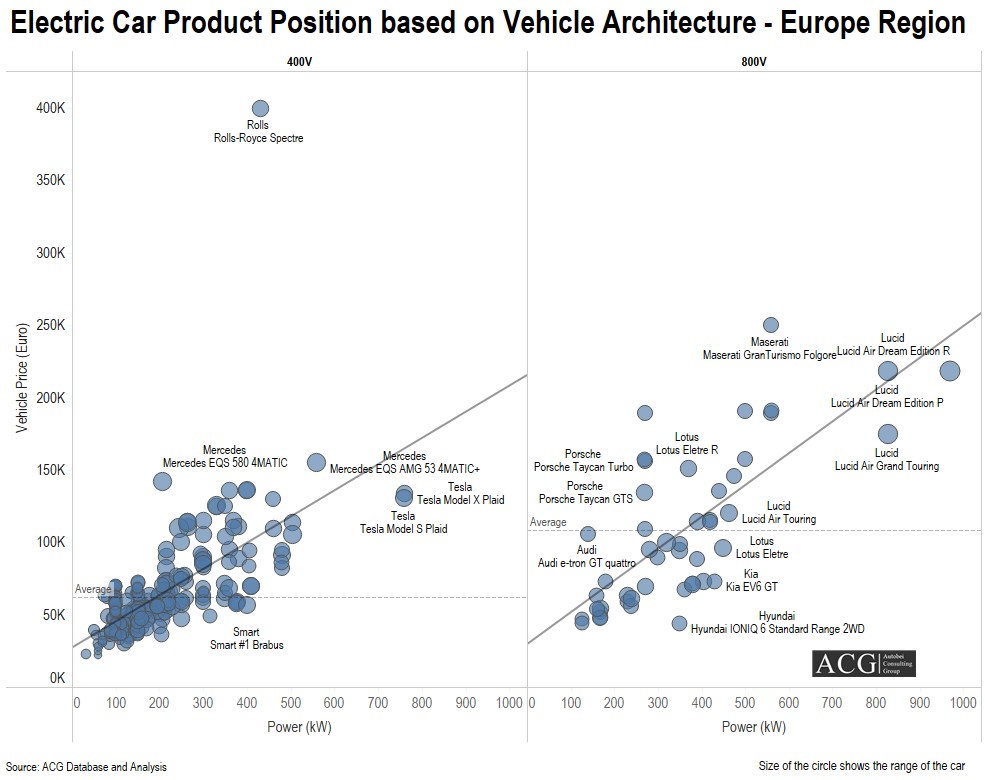

1. 400V Vs 800V architecture

2. Si and SiC Semiconductor

3. Battery Type – Li comes with other types of metals

4. Motor efficiency

5. Overall vehicle Efficiency

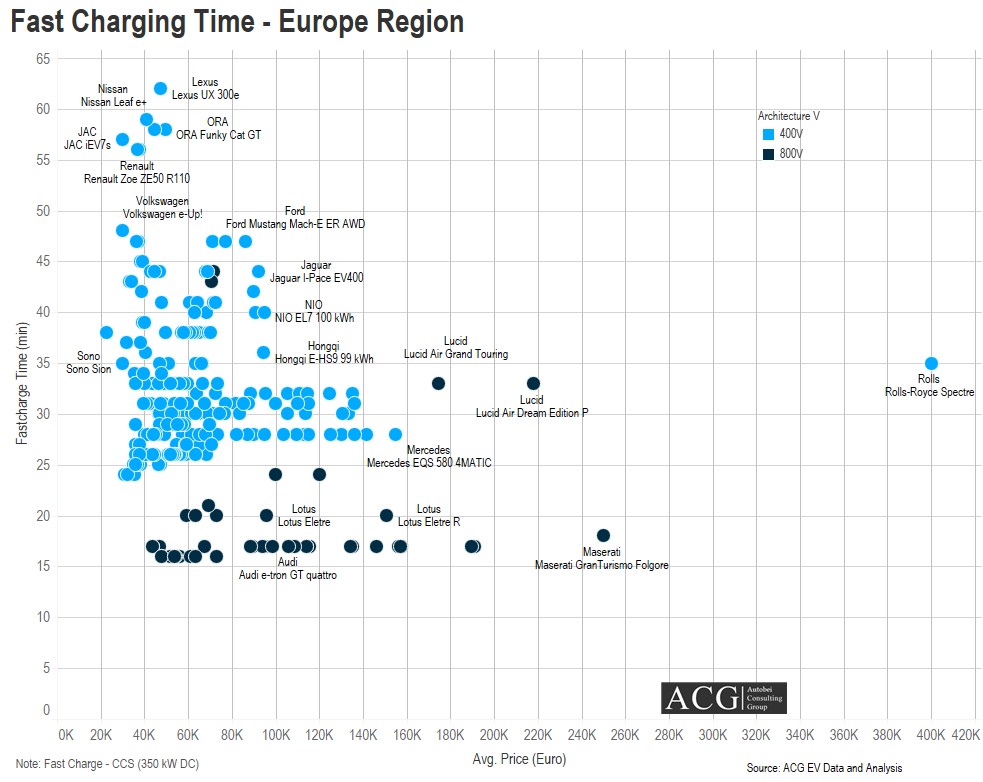

The data underscores the prominence of the 400V architecture as the primary choice, with the 800V architecture offering quicker battery charging capabilities.

There is straightforward correlation between an electric vehicle’s range and its price.

Among electric vehicles, Tesla’s Model S and Model Y stand out as prime examples of exceptional efficiency, providing customers with a highly attractive proposition. Equally noteworthy, Hyundai’s IONIQ model features a meticulously developed and efficient e-powertrain, adding to the array of top-performing electric cars available to consumers.

Here are some key highlights of OEMs’ strategies:

BYD is making substantial strides in the $10,000 USD electric car market, establishing a strong foothold not only in China but also in other targeted markets, where it enjoys an impressive 60% market share. In a bid to strengthen its position in the electric vehicle segment, Volkswagen (VW) has made a bold move by investing $700 million in start-up XPeng, acquiring a 4.99% stake, and forging deeper cooperation with SAIC. These strategic endeavours highlight the OEMs’ commitment to the evolving electric vehicle landscape.

The electric vehicle market classifies its models into distinct segments based on price and power specifications. Within the economy segment, there are entry-level models priced below Euro 30K, equipped with 250kW power and utilizing IGBT technology. Meanwhile, vehicles falling within the economy segment boast a range of 400km or more, and those surpassing Euro 60K are categorized as premium car segment offerings.

In terms of technology strategy, Chinese OEMs are actively exploring the feasibility of implementing 400V architecture with SiC technology, while their European counterparts are adopting different approaches in their pursuit of advanced EV technologies.

Tesla’s innovative influence spans across various markets, where it is at the forefront among Original Equipment Manufacturers (OEMs). Not only has Tesla taken the lead in the vehicle sector, but its impact extends to the component level as well. A prime example of this is Tesla’s pioneering adoption of Silicon Carbide (SiC) in Power Modules. Observing Tesla’s successful integration of SiC technology, other manufacturers have swiftly followed suit, embracing this cutting-edge material in their own products. This trend highlights Tesla’s position as a trailblazer, setting new standards and prompting industry-wide advancements. As a result, Tesla’s forward-thinking approach continues to shape and elevate the automotive and tech sectors, inspiring further innovations and fostering healthy competition among OEMs.

In the ever-accelerating race towards automotive innovation, Tesla is at the vanguard, harnessing cutting-edge heat pump technology to extract thermal losses while Stellantis forges ahead with their ingenious Intelligent Battery Integrated System (IBIS), channelling direct AC power to the battery. These advancements redefine efficiency, unveiling a new era of cost-effectiveness, spatial ingenuity, and lightweight prowess.

As the EV landscape unfolds, some narratives point to China as the frontrunner, with European and American counterparts appearing to lag behind. However, let us view this spectacle not as a static snapshot but as a thrilling relay of progress. China may be leading in this exhilarating lap, but the next leg of the EV journey promises exhilarating twists, turns, and formidable competition from all corners of the globe. The finish line is far from reached, and the world eagerly awaits the thrilling crescendo of the next round of EV evolution.

Reimagining Charging Infrastructure:

The landscape of charging infrastructure presents numerous challenges, particularly from a customer perspective. However, strides have been made in Europe, China, and the US to enhance accessibility, especially for apartment dwellers. Leading the charge in this domain is Tesla, with its cutting-edge charging infrastructure that seamlessly supports both Slow and Fast charging using a single, versatile charger.

In the quest to develop a comprehensive network, companies like ABB, EVBox, Scheider Electric, Siemens, BP, and Shell are diligently working to establish a dense charging presence. While progress is evident, there remains a significant opportunity to further refine charging functionality and introduce innovative features, driving the widespread adoption of electric vehicles.

An essential aspect of this transformation is the standardization of charging plugs. By defining a universal version, customers can enjoy a hassle-free charging experience across diverse points, making electric vehicle charging an effortless and convenient reality.