German Electric Car Market Forecast is an exclusive Customize report. Germany is the largest car market in Europe. Electric cars are more popular than diesel cars. European Automotive Industry contributes 7% of Europe’s GDP and employs around 14 million people.

There could be a deep impact on Germany’s Economy and its worldwide Automotive Business if the country loses its strong grip on the Automotive Business or Electric Car market.

The European electric car market is projected to reach a 25% market share by 2026. If Chinese brands control the German Car market, they will dominate most of the markets globally. There is a risk that German or European manufacturer will lose their control for the next 2 to 3 decades.

German car brands have ruled the world with their quality and innovation for decades. The Automotive Industry is the backbone of the German economy. But now, the German Car Market is facing heavy headwinds from Chinese OEMs. The Chinese Electric Car brands are ready to shake the German Electric Vehicle markets.

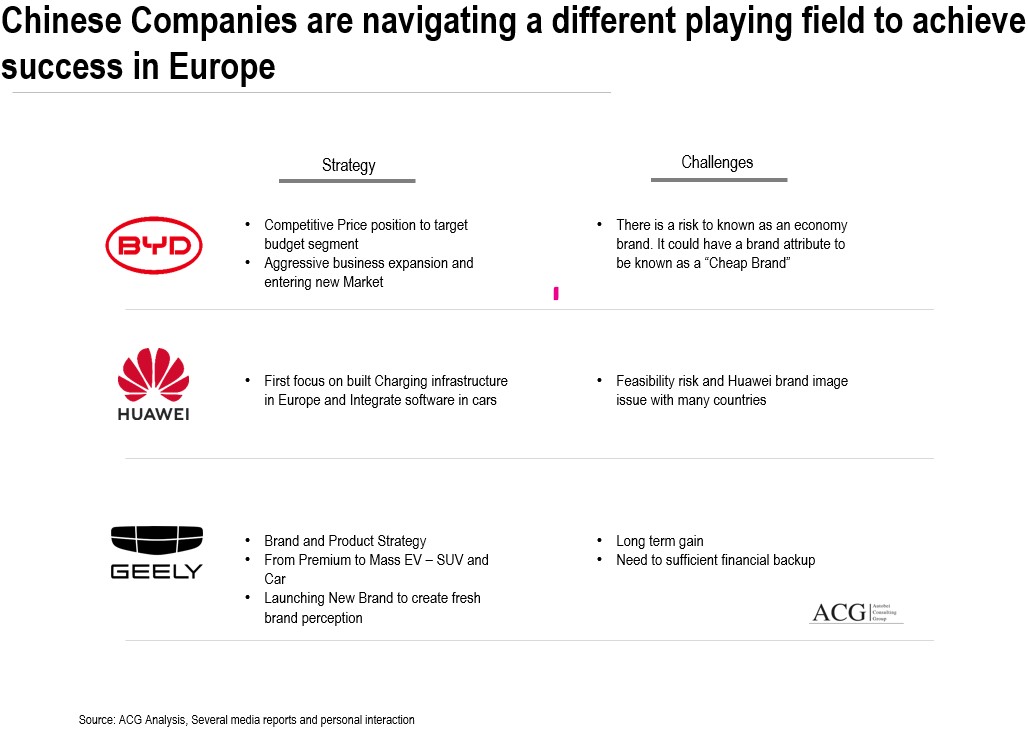

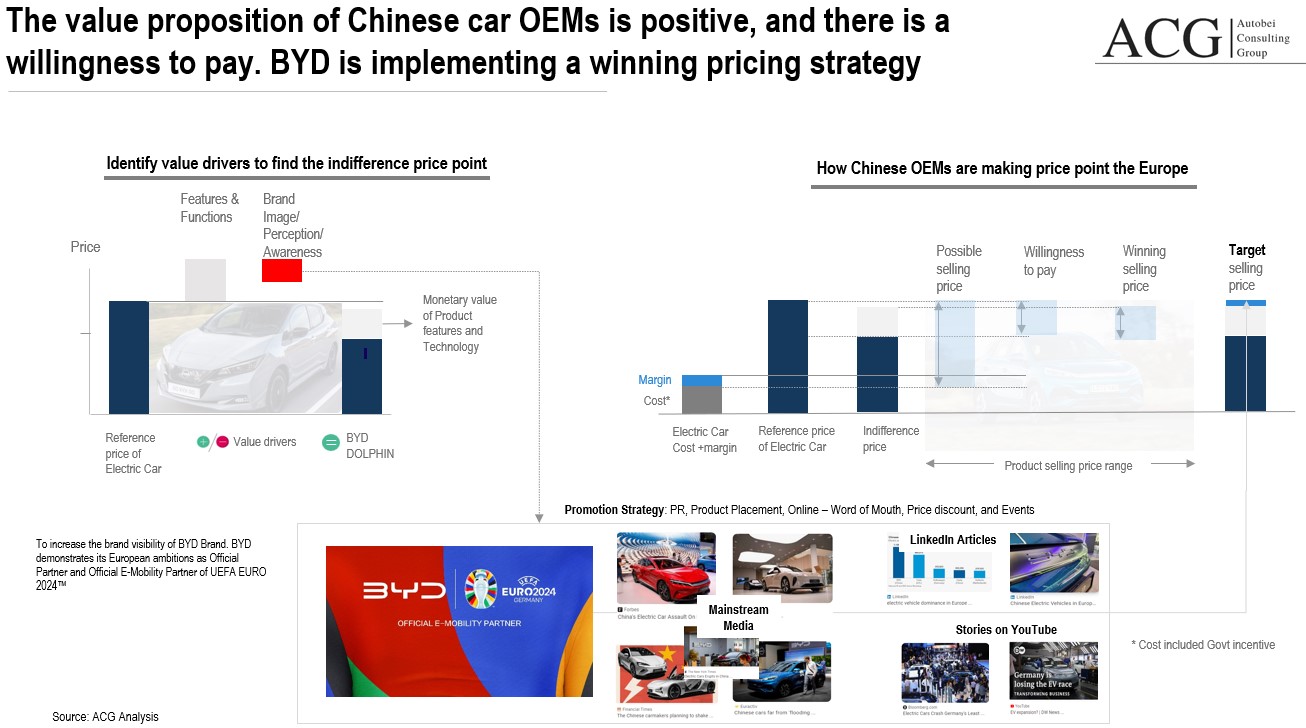

The BYD is aggressive in winning the German customer’s trust. To win the battle of the European Electric car market the one who can offer the affordable Electric Vehicle first. Geely Group, NIO, are also in a queue to make their effective presence in Europe and Germany. Through aggressive marketing strategies, Chinese brands strive to be the first choice in brand recall.

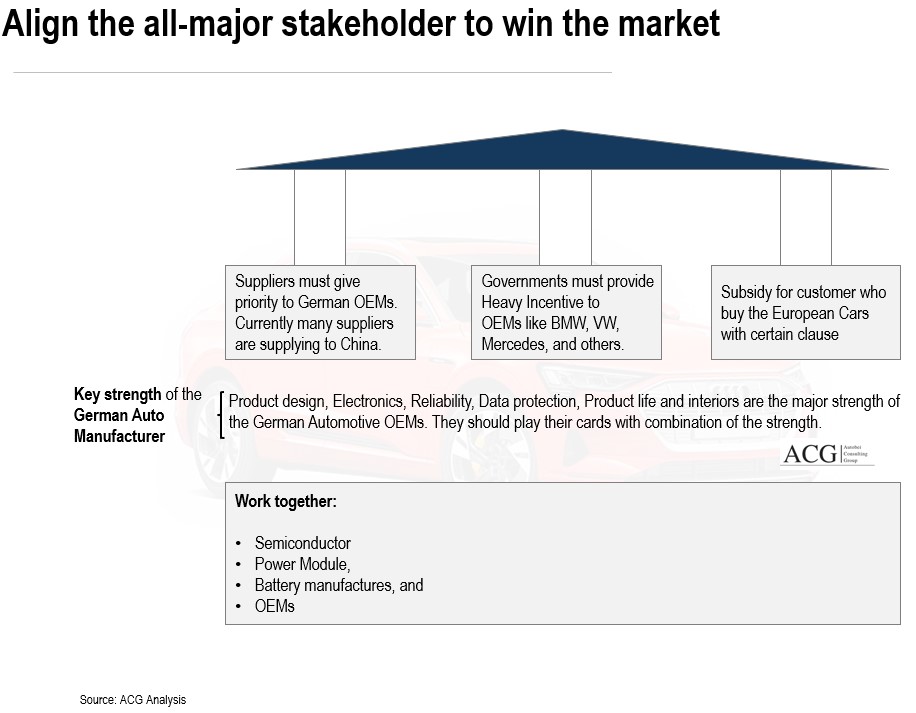

The German legacy brands like BMW, Mercedes, Volkswagen, and Porsche need to be innovative in a short time and handle the supply chain issue to keep their leadership position in Europe and the Global market.

The support from the European Union and the German government plays an important role in bolstering the industry. It’s worth heavily supporting the German automotive industry; it’s akin to supporting your economy.

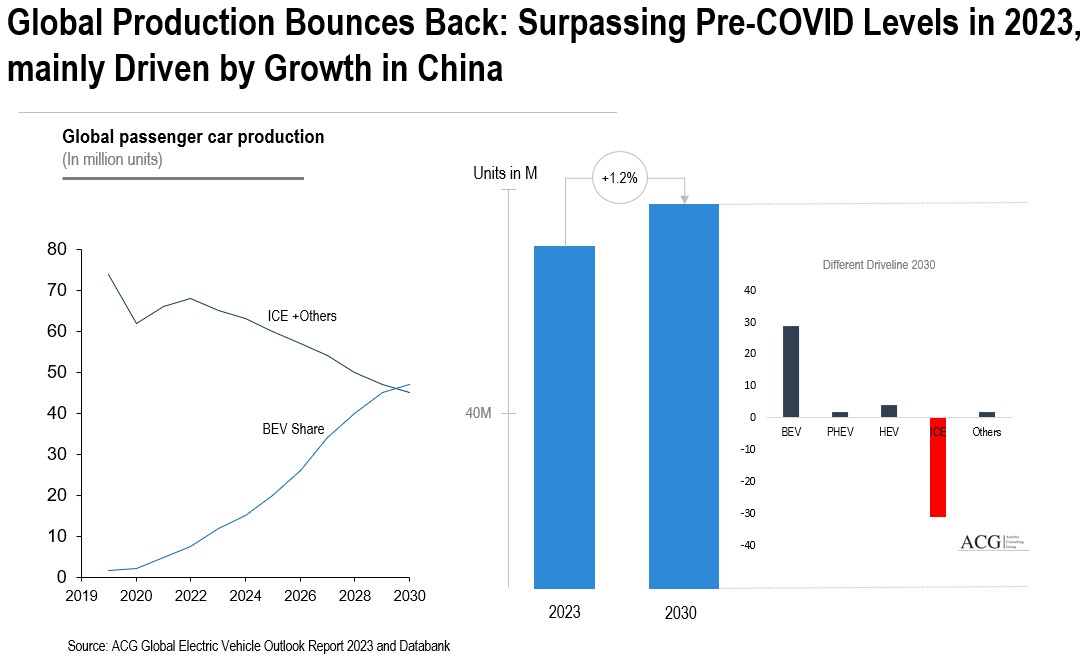

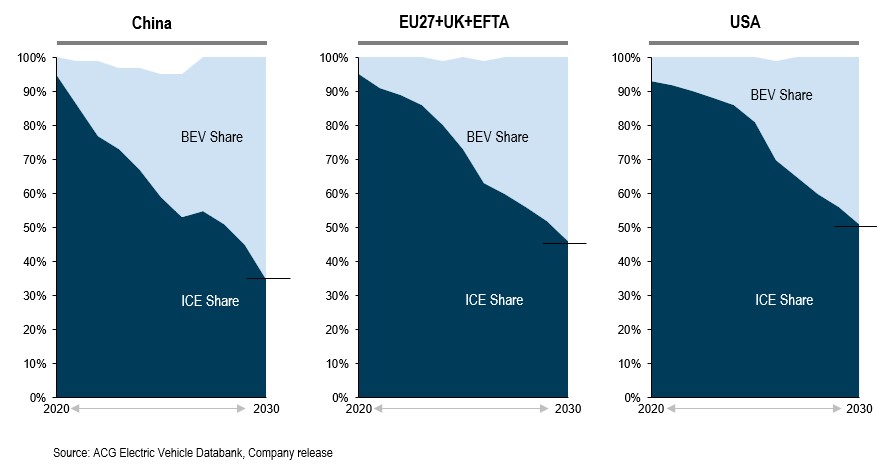

The BEV market share is registering impressive growth every year globally. China is the main key driver behind this BEV sales growth. The ICE and mix of other fuel-type vehicles is expected to limit around 40 per cent market share by 2030. The vehicle’s total production will touch 82-83 million units by 2030. BEV would have a 45 percent market share by 2030 globally.

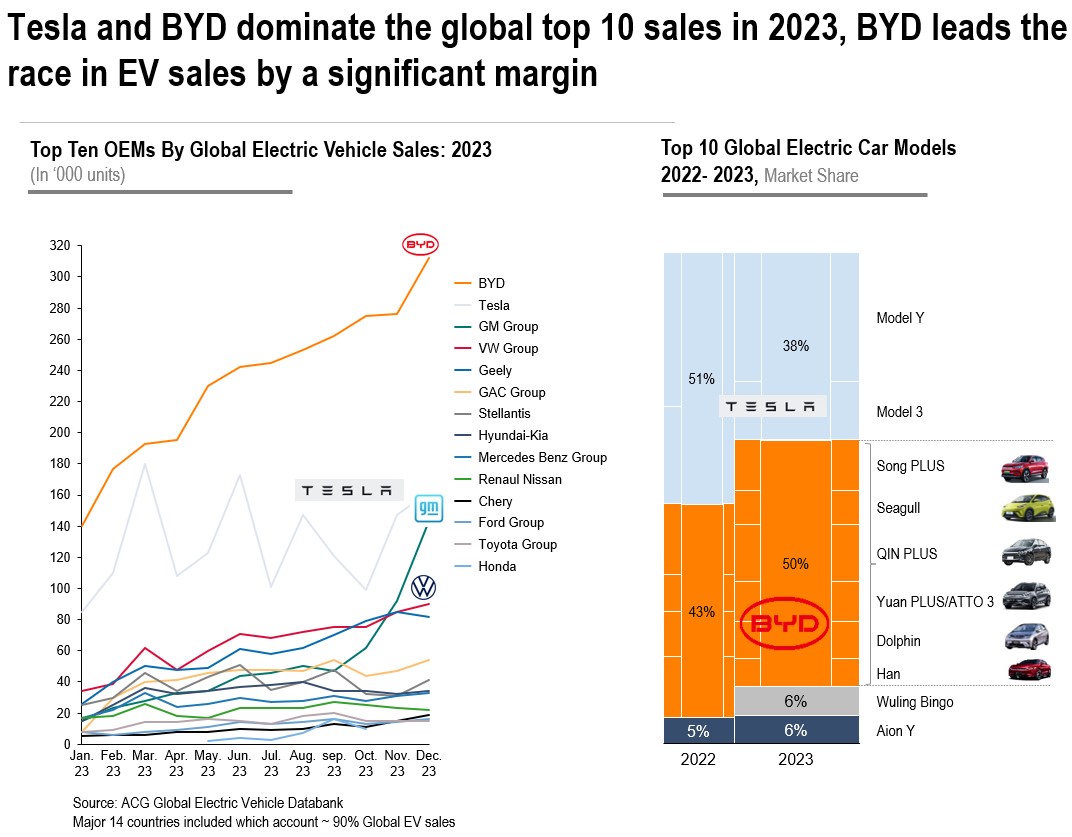

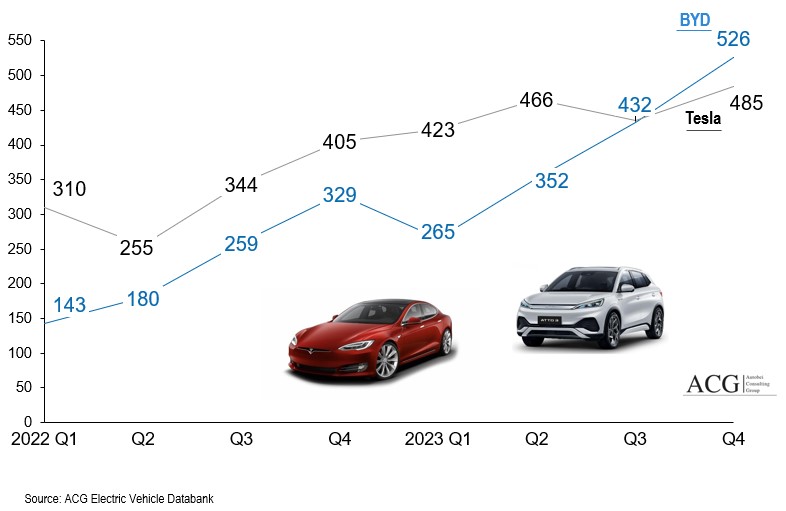

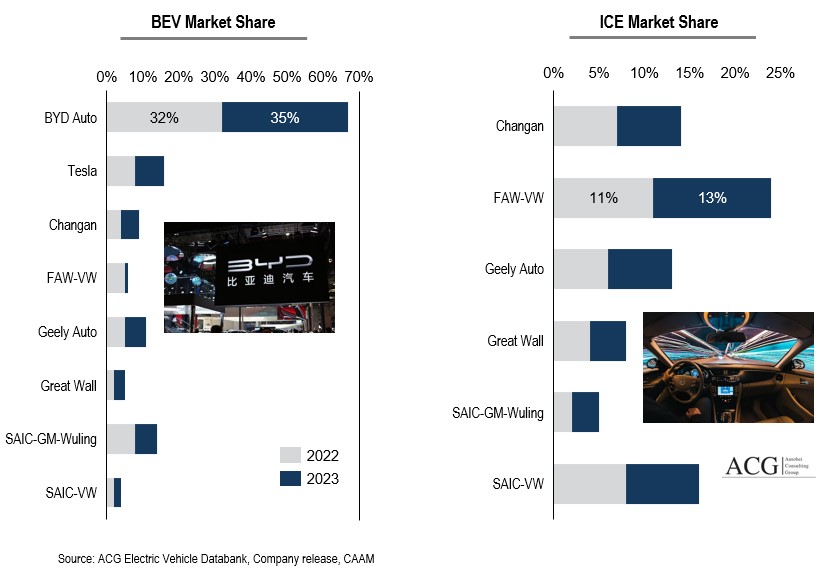

In 2023, BYD experienced consistent month-on-month sales growth, while Tesla’s market share declined by 13 percent compared to 2022. Despite this, Tesla’s Model Y saw a remarkable 50% growth. Conversely, BYD’s market share increased by 7%, indicative of Chinese OEMs’ dominance in the top 10 sales of 2023. BYD Seagull and Song PLUS play major role to increase company market share in 2023.

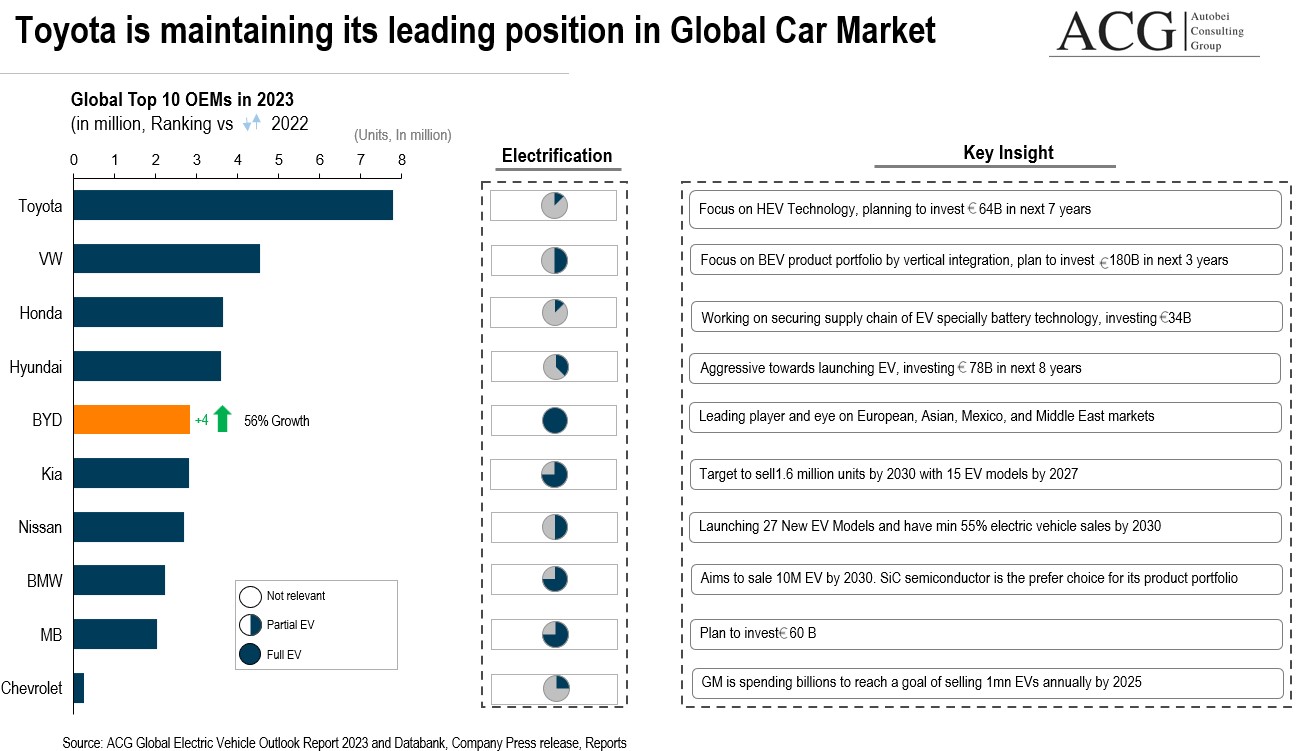

Toyota maintains its leadership position in Global Car Production. The top 10 OEMs control more than 45% of the global car sales in 2023. Volkswagen and Honda are in the second and third position in 2023.

BYD reached 5th position. The company is currently focused on HEV Technology by investing around 64B euros. Electrification and Digitization are two major areas where OEMs and Suppliers are investing in the next 6 to 7 years.

More than 600B Euro is planned by OEMs to invest in developing Electric Vehicle and digitization.

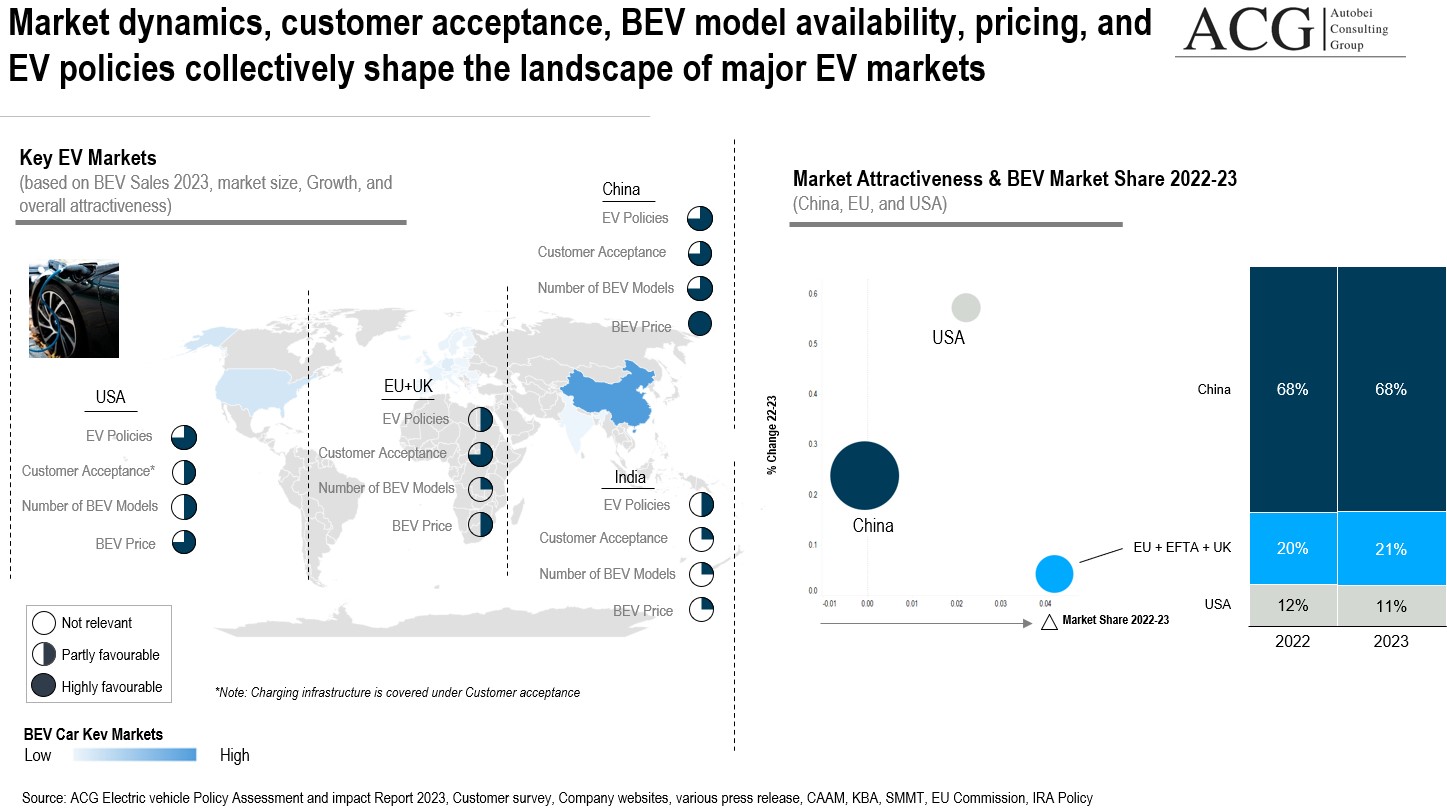

China, Europe, and USA are three major markets for Electric vehicles. In the second phase, India and some other markets will drive EV growth. In the next 2 years, the European EV market will touch 35 per cent, China 40 per cent, and the USA 30 per cent of the market share. The USA is playing smartly by introducing the IRA which is working like a no-entry phase for Chinese brands. Now Chinese brand is trying to enter Mexico. BYD is building a production plant in Mexico.

The Chinese market is very competitive and price-sensitive. There are many affordable Chinese models available starting from 9000 euros.

Each major market exhibits unique characteristics in terms of EV ecosystem, customer acceptance, availability of number of BEV model, pricing after subsidy, and EV policies. Among these factors, EV policy emerges as particularly influential in driving initial EV sales penetration.

More than 100 new electric car models has been launched in China.

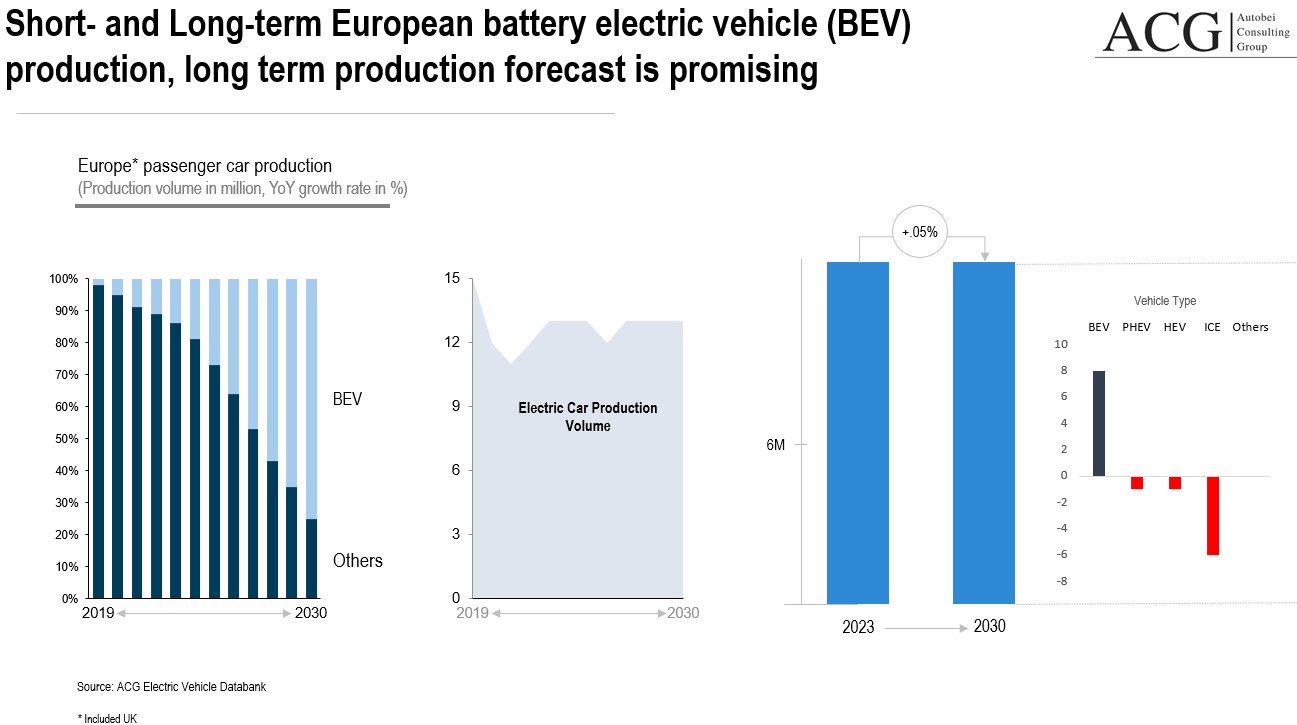

Short and Long-term European battery electric vehicle (BEV) production, long term production forecast is promising.

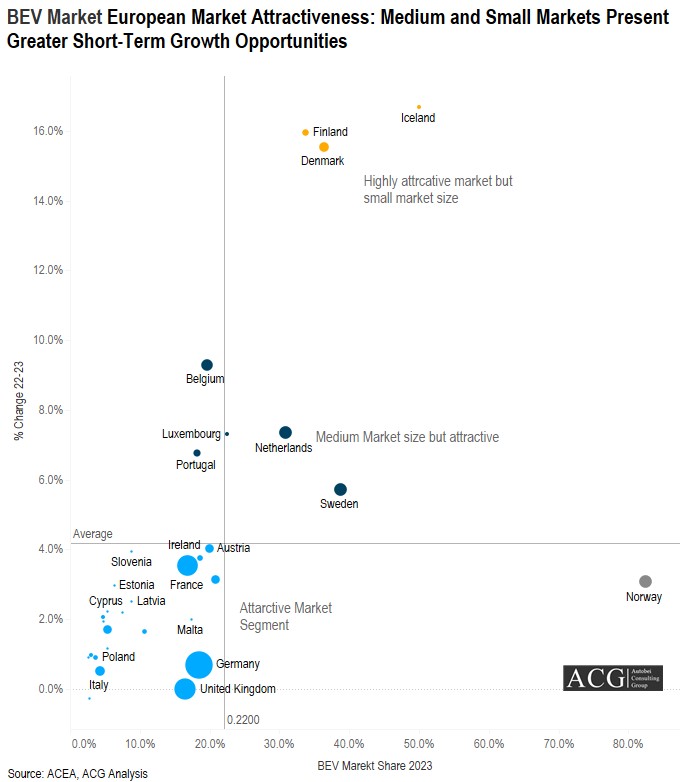

There are four clusters in the European Electric Car market. Larger markets such as Germany and France require government support or effective policies to boost BEV sales, while countries like Belgium and Denmark benefit from robust government support across various initiatives. France has taken some steps to protect its market from Chinese electric brands. It’s evident that certain nations offer a particularly attractive landscape for Electric car penetration.

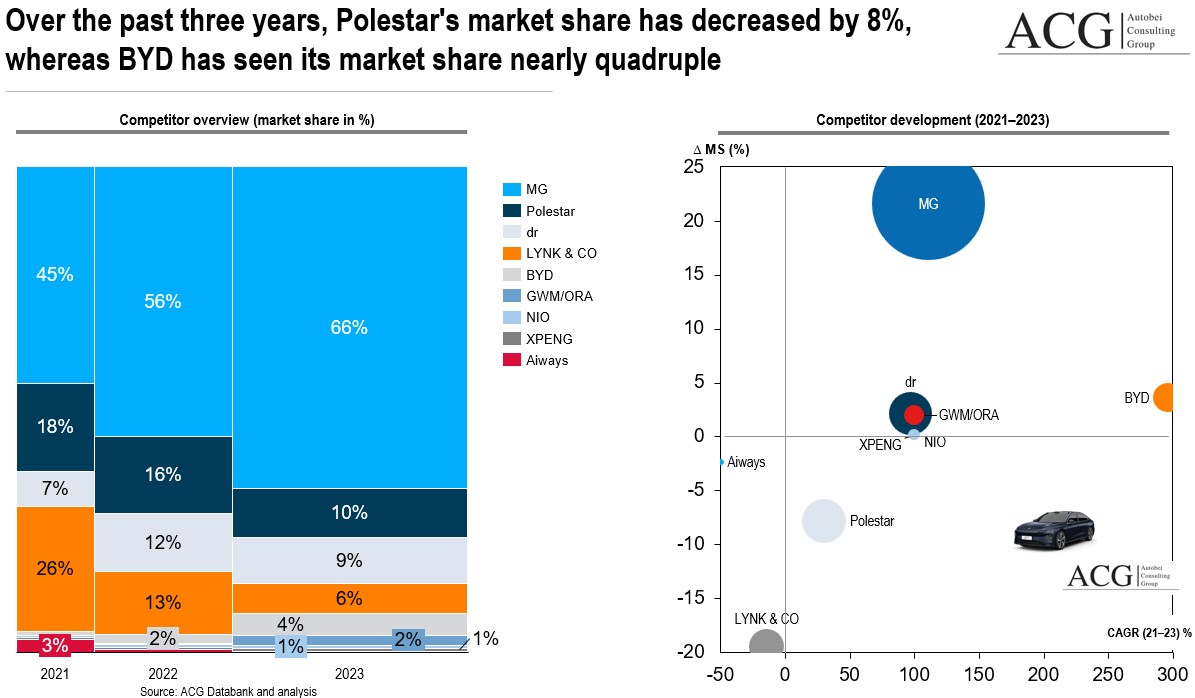

Over the past three years, Polestar’s market share has decreased by 8%, whereas BYD has seen its market share nearly quadruple. BYD currently offers 6 models, Volvo has 12 EV models with plans for 4 more, while Polestar, facing challenges in the European market, currently offers 4 models. It is expected that all OEMs are going to add additional models in their portfolio in next 2 years.

BYD became number 1 in Electric car sales in 2023. Company overtook Tesla in last quarter of 2023. Even BYD is running commercial ads on mainstream TV channels in a prime time slot. BYD is Strong in China market and the company is looking at one of the largest car markets, Europe. The company is planning to launch more than 5 new models including Dolphin and Seal in Germany. Most OEMs moving to online sales but BYD is taking the traditional root of sale its cars. Tesla was ranked 12th with 1.8 million sales. It is expected that Tesla could be in the top 10 OEMs by 2025.

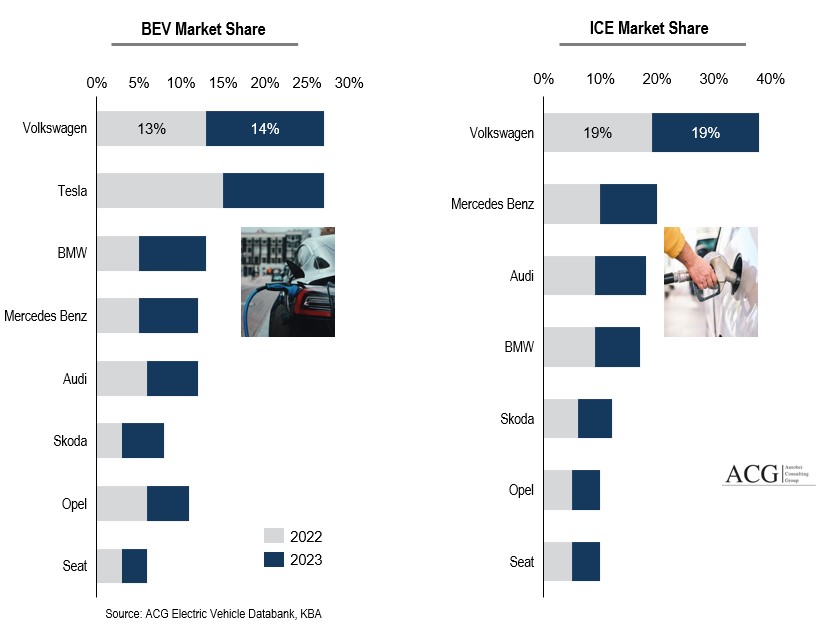

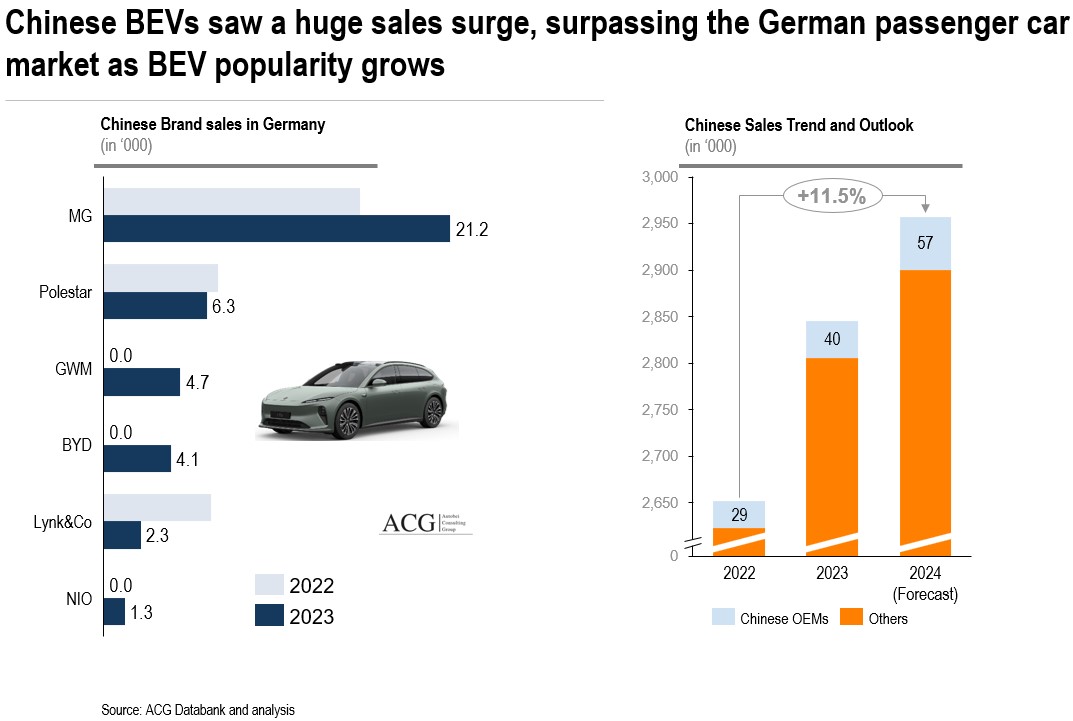

The German BEV car market grew by 11.4 per cent in 2023. German Brand Volkswagen registered 11 per cent growth with 14 per cent market share. By the end of 2023, VW will be the leading brand in Germany. Volkswagen is aggressive in the electrification of its Electric car portfolio. The supply chain is the most critical issue for the company, specially getting the Topside closed cooler power module. If Volkswagen gets the power Module as per its production plan, the company can keep its leadership position in Europe. The company is also trying to acquire some power module manufacturing firms to secure the supply. Alternatively, the company needs to manufacture its power module. The business case is positive for high-volume BEV vehicle production. The best part of VW strategy that they are directly buying the semiconductor from semiconductor suppliers.

Tesla slipped to second position but is still the leader in the premium segment. The Tesla Model 3 poor performance was the key reason that Tesla ranked number 2 in Germany.

BMW, Audi and Mercedes-Benz are growing fast in the high-end car segment. The market share of Audi, Mercedes, and BMW is 6,7, and 8 per cent in the year 2023. BMW is starting to get an eMPacK power module, which is a closed Top side component from 2024, however, it is heavier compared to other power modules. This component helps to increase the production volume.

BYD is the Top Brand in China in NEV sales with a 35% market share in 2023. BYD’s margin is squeezed due to tough competition from brands like Geely and other local brands.

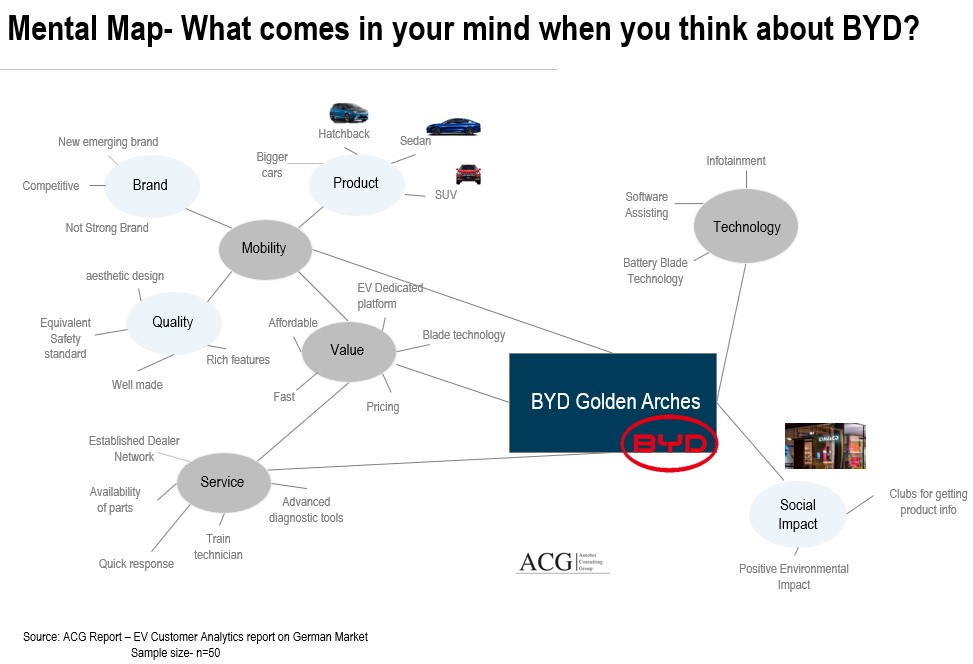

We have created the mental map of BYD based on Customer feedback. We have selected some cities in Germany to draw the mental map of BYD. We asked: What comes to your mind when you think about BYD? The key components are Product, Value, Technology, Service, Brand, Social Impact, and others. Below is the BYD Golden Arches:

Qualitative and quantitative Research is always part of our study which give much better understanding and connect the dots of Product, Strategy, Sales, and other part of the business.

We interact with potential customers, Current customers, and rigid to replace ICE vehicle.

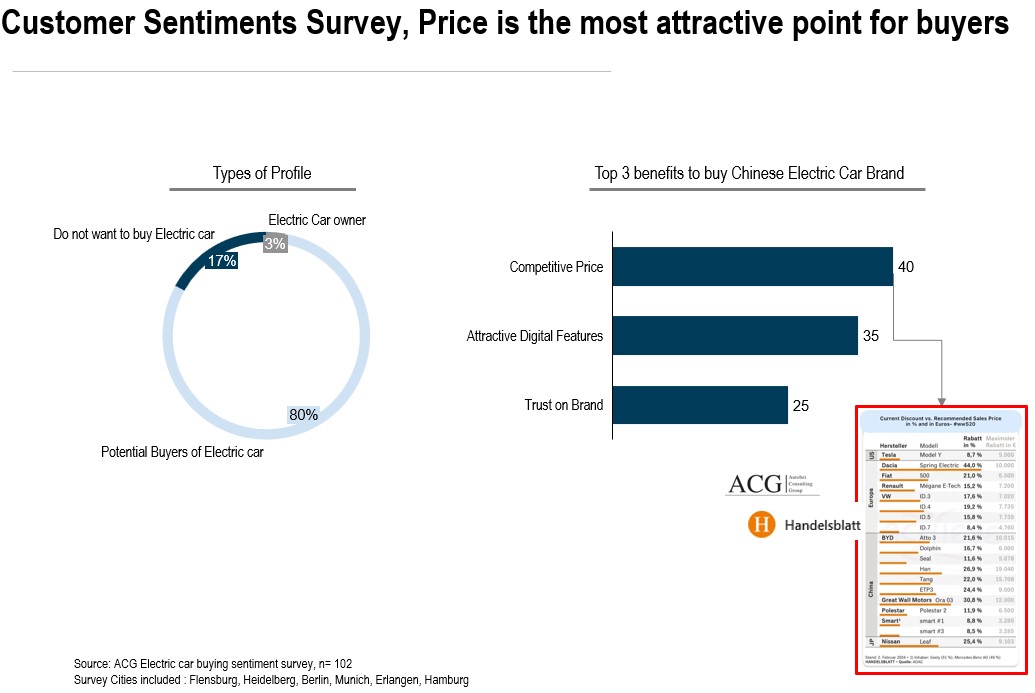

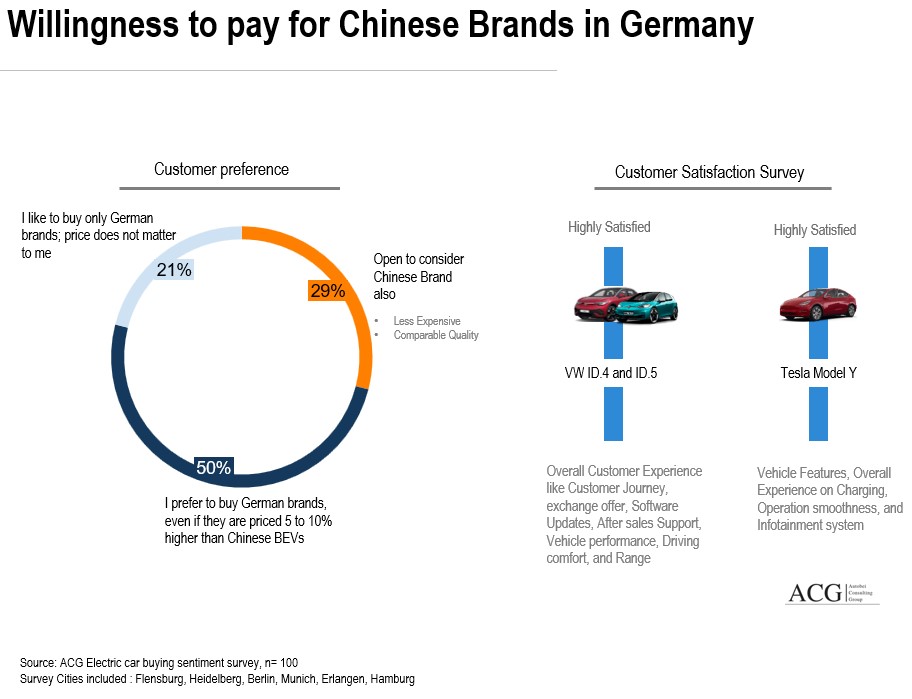

In our survey, 80 per cent of buyers give meaningful insight into their expectations, challenges, and key drivers, and touch on other points of the customer journey. Some Germans are very open to adopting the Chinese Car, and some still do not like to even consider the Chinese brand. The low price is not the only reason to buy a Chinese Electric car, but the combination of low price and comparable quality of the vehicle give value to the German customers.

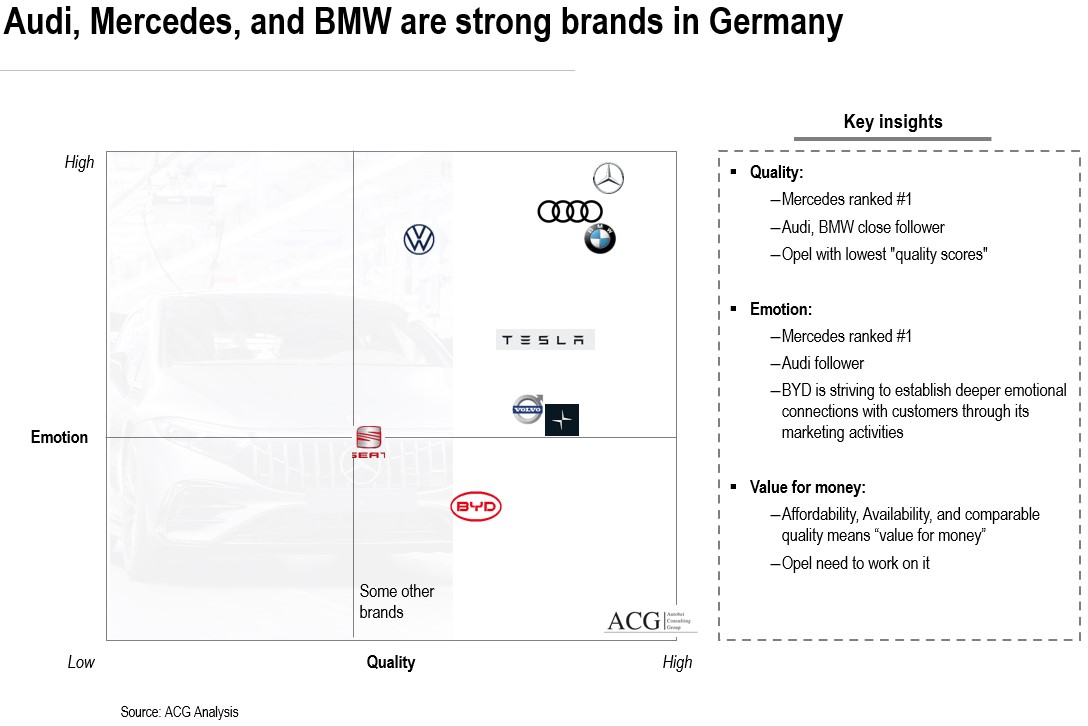

In 2023, 29 per cent of potential buyers are ready to accept the Chinese brand in their next purchase. This is the target segment of brands like BYD, MG, NIO, and Polestar. Large population 71 percent like to associate with German brands only. This is expected to change after a year time.

Most of the existing customers of VW ID.4 and ID.% are satisfied with their car performance. Similarly, Tesla Model Y is also successful in fulfilling the expectations of its customers on premium parameters.

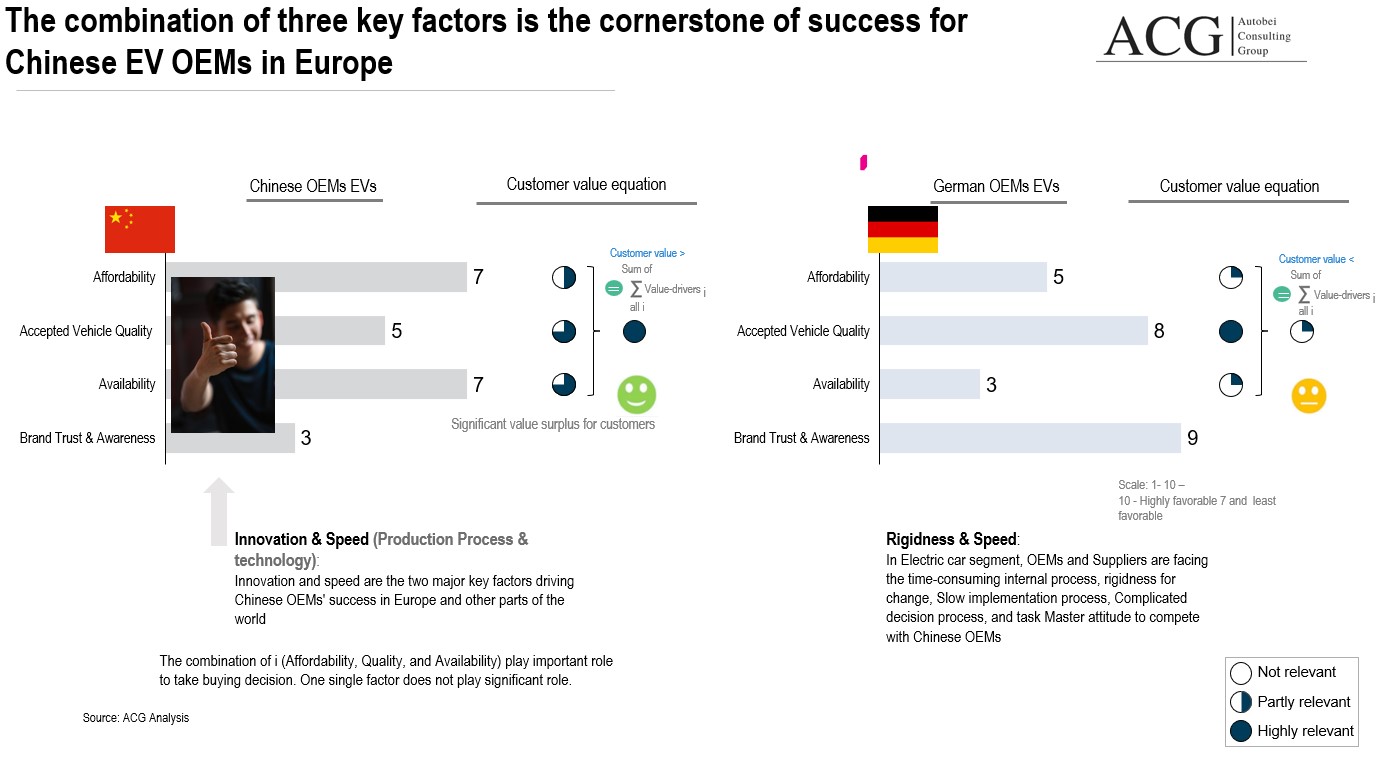

The two factors play the most important role in the success of Chinese brands. Innovation, speed of development of new technology and its implementation are key strengths of the Chinese OEMs. Affordability accepted quality level and Availability are the key drivers of Chinese brands.

Align all major stakeholders to win the market. Such an approach gives a new edge to German OEMs. This is a complex task, but this is the most effective way to compete with the Chinese and Tesla brands.

BYD, NIO, Geely, and Huawei are entering with diversified strategies. BYD has entered 11 European new markets in just a few months. Adopting or aligning with German culture is a challenging task for OEMs. German and Chinese corporate culture is very different. Communication styles (Direct and Indirect) are also opposite to each other. For example, Huawei is offering to work for them on a contract basis for 2 years.

Huawei is doing groundwork to establish a charging network in Europe.

Emotion and Quality are two parameters that customers consider when positioning the brands. Mercedes Benz ranked top in Emotion and Quality, followed by Audi, and BMW. Volkswagen is also coming in top rank on emotion parameters.

We have worked on costing and pricing strategy of Chinese OEMs. The Chinese subsidy also help to sale the vehicle at winning price bracket.

The interesting fact about the survey is that BYD became popular in Germany in just 12-18 months time frame. After announcing sponsoring the Euro2024 Cup, the brand will be known to almost every house. This will also help to build a trusted brand in Europe. Chinese brands know that if they are successful in the European market, they can write the success based on their acceptability in European markets.

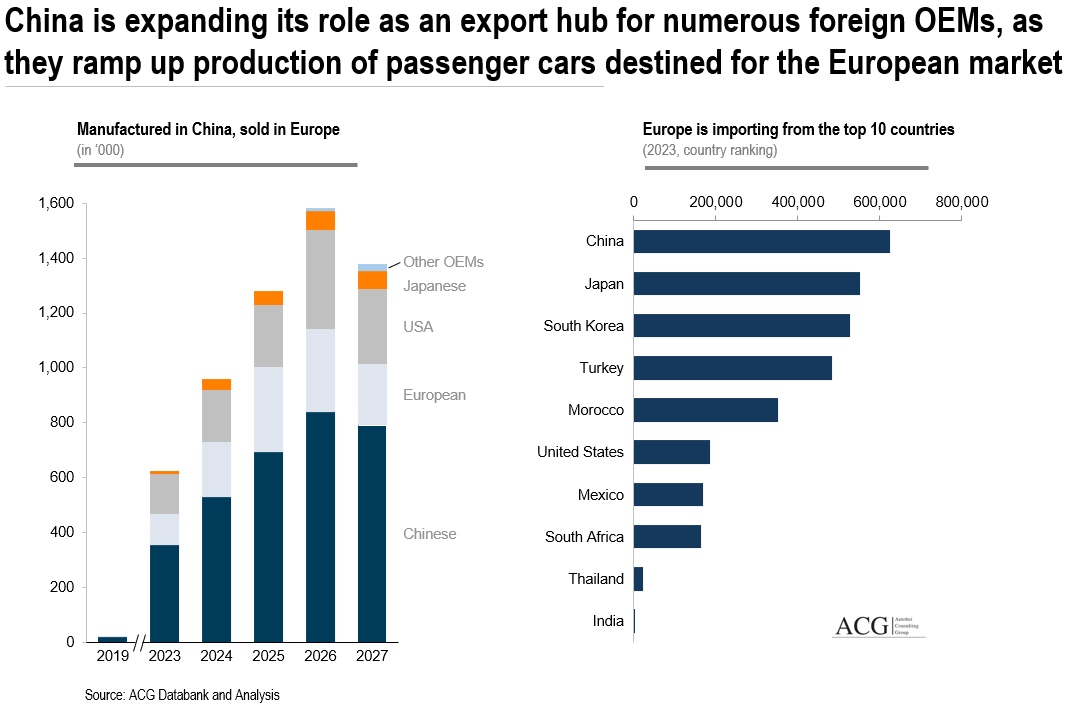

BEV sales from China in Germany noted impressive growth in 2023. Chinese OEMs increased their export to Europe by 123% between 2019 and 2023. It is expected that next year it will exceed 1.2 million cars. India also becomes the top choice for European OEMs to build in India and export to Europe.

The European Union is working on protecting its market from importing vehicles by putting regulations. However, it is much better business practice to support European OEMs to compete with Chinese Cars rather than creating a fence for Chinese cars. Around 24% of cars sold in Europe were imported from other countries.

MG was the biggest gainer and grew by 34 per cent in 2023. Great Wall Motor, NIO, and BYD have effective presence in just one year. NIO has introduced LiDAR technology in its car which is one of the safest cars in its segment.

Key Highlights of the full report:

- Global BEV Production and Sales Forecast

- How German OEMs can maintain the leadership position?

- Model and Brand wise Production forecast

- Brand Strategy Adopting by Chinese Car Brands

- OEMs wise Strategy Analysis of Electric Car Portfolio

- Chinese Car Pricing Strategy of Electric Car

- What kind of steps need to be considered by EV stakeholders to support local players like Mercedes, BMW, Audi, VW etc?

- Brand-wise market share analysis in Germany and China

- Product Portfolio of Chinese OEMs and Germany