Many organizations are increasingly making use of the term “Market size” and developing product strategies based on the market size. Our novel study revealed that the meaning of “Market Size” is significant only if has been defined in a specific dimension of product, market, and Customer attribute. Fortunately, the strategy works unquestionably if evaluated, used, and employed in relevance to the Market Size.

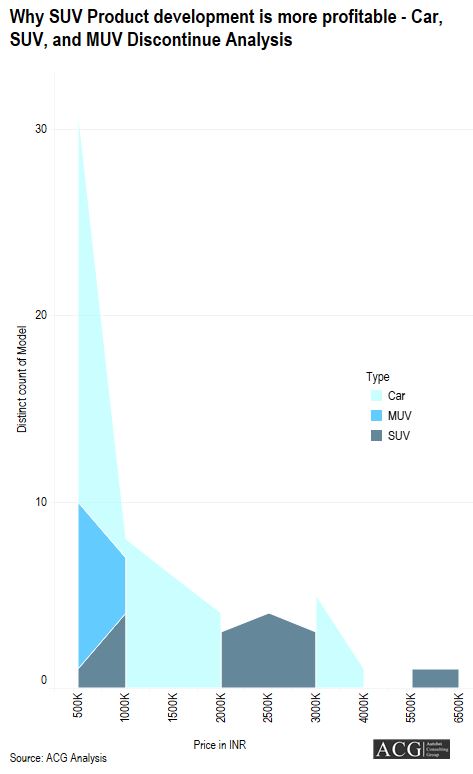

We have conducted our experiments on more than 100 Car that including SUV and MUV models which have been launched in the last 10 years. In addition, we have also built a sub-segment based on Features, Customer income, Technical specs, Brand Position, Market Share, Product Portfolio, Product Gap, Product Price, Sub segment Market competition/competitors, and other 20 more parameters.

Analysis of the Different car Segments: The study is divided into 3 components on the basis of vehicle Type i.e. – SUV, MUV, Car, and VAN.

Most of the Cars in the segment SUVs (sports-utility-vehicle) and MUVs (multi-utility-vehicles) has been launched in India owing to – Product gap Analysis and Customer purchase power. That is to say: Because of not standing superlative on the aforementioned parameters, a good number of Low-Cost Car Segment models have been discontinued in these segments over the past 3 years. These cars include models from big brands like Tata, Hyundai, Maruti like Nano, Eon, Alto 800, etc. In recent times, only one car model has been introduced by Maruti in this segment. This segment lost its charm even before COVID-19 but could only cash in minor growth post the lockdown period due to weaker consumer sentiments and declined income.

City wise Innova Sales Analysis: Major Market for MUV Segment

Budget Segment has become all the more popular in the lockdown period and so far most of the Top-selling models belong to this segment.

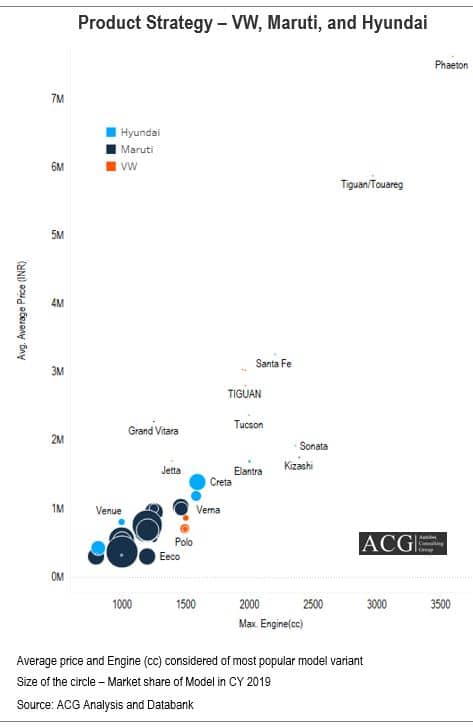

Hyundai’s Venue is currently positioned strategically to get maximum benefits. Our Product Analysis gives a clear picture of how this segment looks and where is the opportunity to launch a new model.

For New launches, the SUB B segment is emerging to be an attractive segment in India. The chances of increasing market share are more than 3 times as compared to the fiscal year 2019.

Under the Budget & Premium segment, SUV dominates the domain. Maximum new models of SUV have been launched in these two segments like Tata Harrier, MG Motor Hector, Kia Seltos, Renault Captur etc. All Models are strategically positioned in a different portfolio canvas, thus enjoying the monopoly somewhat. Even after launching multiple models in this segment, there is still a lucrative space to accommodate new models at the appropriate position.

In the Luxury segment, many models have been discontinued, just one model launched in this segment. This segment is gradually losing its shine among the upper-middle and rich class for the past 2 years. We if analyze the second level of sub-segment, there is possibly a good chance to launch new models.

In the High-End segment, only selected models are available for the high-income customer groups.

Case Study: Volkswagen India, Maruti, and Hyundai

Report Highlights:

- Indian Car Market Size, Market Share, and Growth Analysis

- Indian Car Market Entry Strategy

- Detail Product Analysis

- Map Models to Customer segments

- Car, SUV, MUV, and Van Pricing and Specs Analysis

- COVID 19 impact Analysis

- Variant Level Product Analysis

- Customer buying Journey Analysis

- OEM, Type, and Segment wise Market share analysis

- Statewise Market share and Sales Analysis

- Brand Analysis and perception Analysis

- Outlook for the next 5 years

- Segment-wise Product Portfolio

- Product Strategy and Product Gap Analysis

- Competitor Analysis of Indian Passenger Vehicle Market Analysis