Indian Auto Consumer Insights Report is a special report with primary and secondary data analytics. The Indian automobile space offers a level playing field for various brands to perform to their potential and enable them to be triumph in the market. The automobile brands need to have a clear knowledge in regards to the economic and cultural mindset of the consumers before embarking on any product conceptualization. The above mention points act as a strong underpinning for the cost and product models. The production planning however remains to be the pivotal point in forecasting the overall success ratio in a country like India.

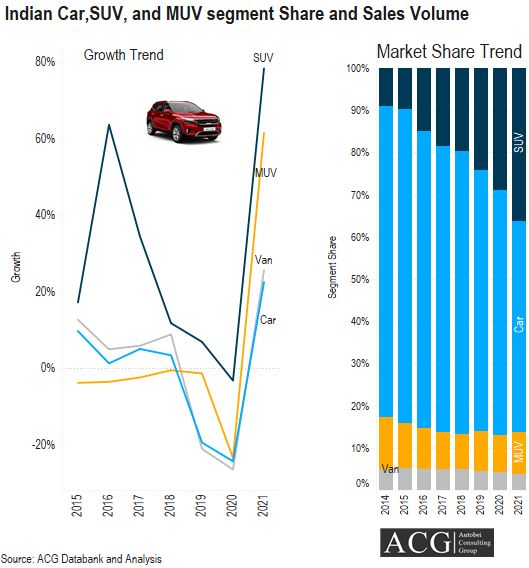

Looking at the year 2021, we observe that the Indian car segment was able to amass a sales volume of little more than 33 lakhs. The Indian PV industry had a fantastic outing in the market as the Industry registered 44% growth compared with 2020. This value equates to the sales volume recorded prior to the COVID times.

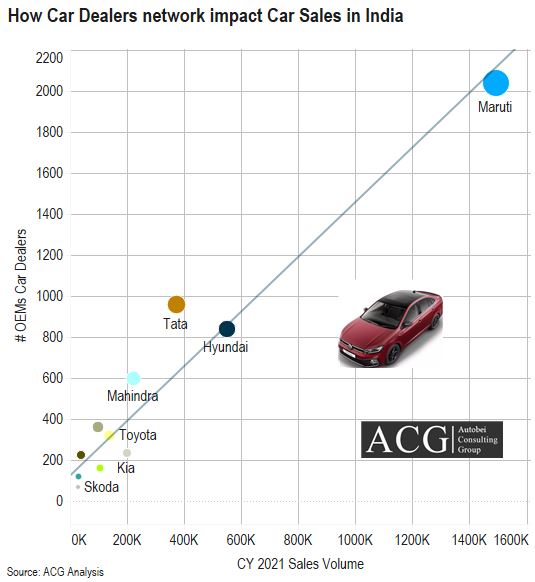

The Dealer network plays a major role in OEM’s success in India to reach the target segment. There is a direct positive correlation between the number of dealers and sales volume of Car OEMs:

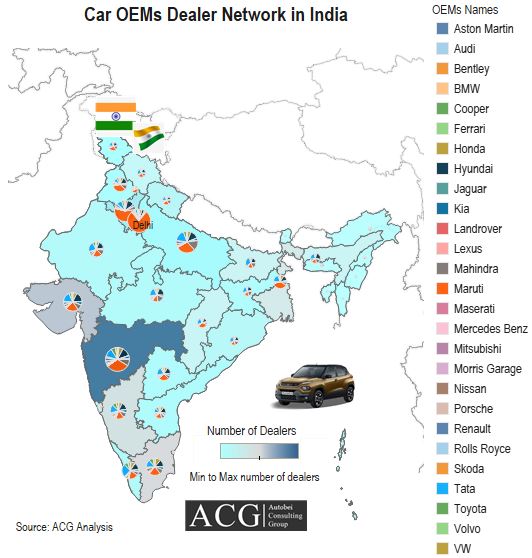

Maharashtra, Gujarat, Delhi. Karnataka and Tamilnadu are top states in terms of the number of car dealers:

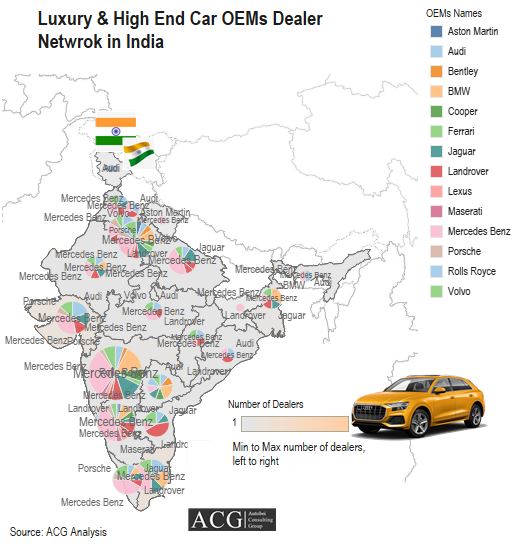

Luxury and High Car OEMs is having different dealer network strategies due to their target market and buyers segment Most of them have 1 or 2 dealers in one state-owned by a single firm.

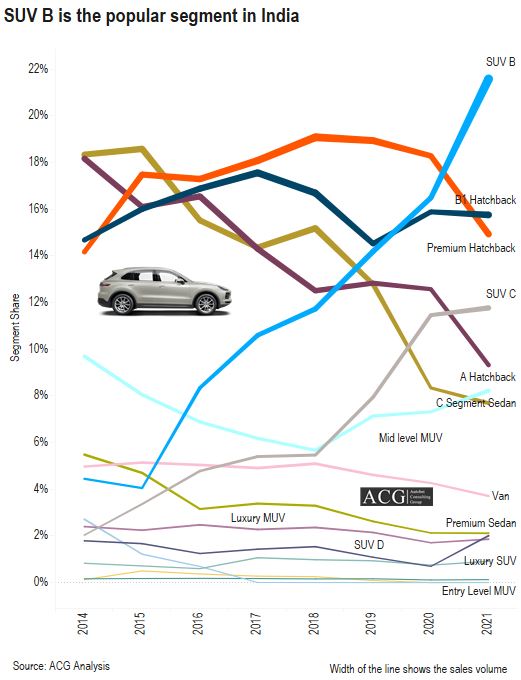

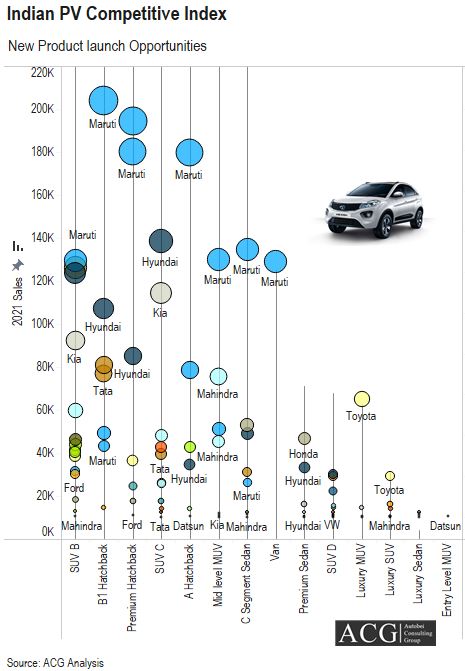

The SUV segment seems to have no stopping at the moment as it has emerged as the first choice for consumers. The same is evident from the sales figure and notably, the volume sold in the year 2021 is more than twice what was recorded in the previous year.

There was a gradual rise in the overall market share of SUV, the share was at a meager 9% in the year 2014 and that rose to a value of 37% in the year 2021. This had an adverse impact on the overall car segment, as its hold in the market dipped to 50% in the last year from 74% which was the case in 2014.

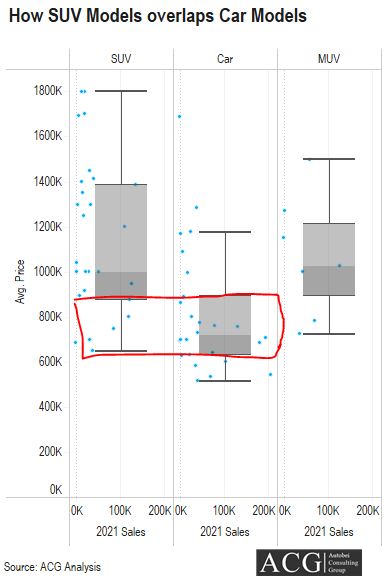

The key factor in the rise of SUVs in the contemporary market is because of the advent of new models alongside a very affordable price range which caught the buyer’s eye.

The SUV B has an almost 60% hold in the SUV market presently, and this value is proportionately 4% higher than what was seen in the year 2020.

Experts had anticipated a boom in the economic uprise post the COVID period. It’s absolutely true that the Indian PV industry has rejuvenated itself over the last few years and has become more oriented towards buyers and product choices. Since the COVID scare is still present across the nation in bits and pieces, so 1/3rd of the potential buyers are in the process of making up their minds to go ahead with the buying choice.

Amidst all the problems being faced by the automobile sector of our country, the future of the industry still seems to have a fair chance to excel in the market and it indeed has a supreme capacity to grow further. The Indian automobile market is one of the widely acclaimed market spaces across the world and has always performed exceedingly well as the demand in this particular market has never fallen behind the threshold. Indeed, even the used vehicles are attracting buyers in the same way as the brand new car model does.

In recent days, the automobile industry has been plagued by numerous problems with formidable hurdles in its path to grow big. They are facing it tough to get aligned to the digitalization, the advent of electric vehicles and the innovative vehicle connected features, pricing factor and most importantly it’s a challenge for them to build a sustainable product that would last for almost half a decade from now. The ongoing tussle between Russia and Ukraine has had its impact on the global fuel price and this would definitely raise the prices of the fuel significantly, and this, in turn, will have its adverse effect on the pricing of an ICE vehicle, and overall operations at large. The advent of electric cars from the OEM would address the issue to an extent but it can only be a damage control method and never a permanent solution for the problem.

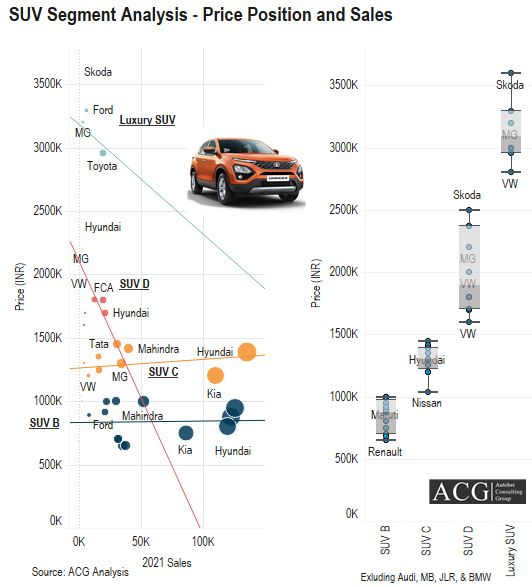

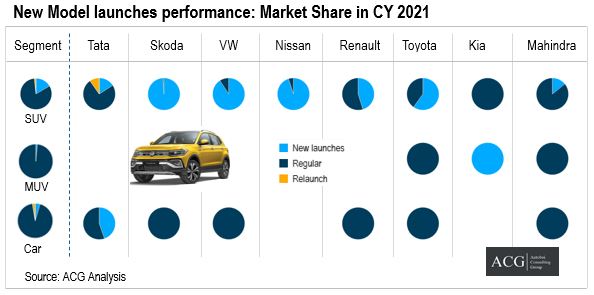

The OEMs have presented new entrants to the market, the count stands at 14 brand new and 3 reintroduced models, and these new launches have been brought in with a strategy of offering a model as an alternative to the existing market giants, it also aims at bridging the space that exists between the market and also in placing the available products in the key position.

Tata motors have given an enormous contribution by launching new products at regular intervals. This has set up rigorous competition in the Indian PV industry. Notably, there have been a lot of new entrants in the SUV segment and the brands like Kia and Tata have shown their potential to capture the market at large they even can attract new buyers and cause a dip in the sales of other existing brands in the market. The growth recorded in the year 2021 is immense, the SUV sub-segment recorded an overall growth of 90%, while the mid-level MUV stood at 43% and the B1 hatchback at 43%. However, SUV D had an amazing outing in the market as they saw a magnificent rise in their growth which went up by 318% in 2021.

The COVID 19 impact has posed a major threat to the economy and this has resulted in the buyers drifting away from their purchase decisions, especially in the budget range. The manufacturers should continue to focus on the two prime segments, the one being the value plus and the other the premium segment, as they own altogether a market hold of about 85% in the present market scenario.

The rise in digitization has had a great influence in the auto sector as the customers are now willing to shell some extra money to accommodate the new features in the variant they are buying.

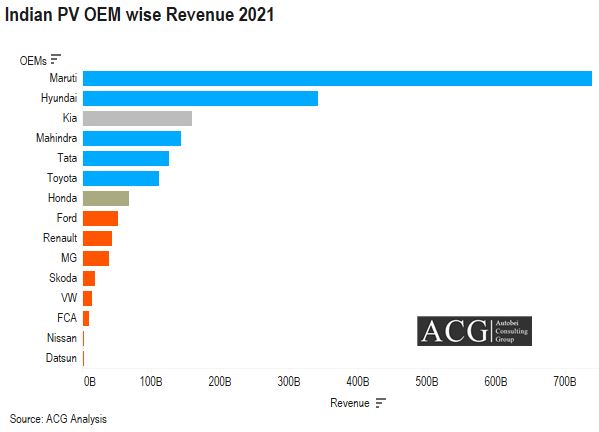

XUV 700 can be looked at as a perfect example for the same as the buyers are ready to pay a premium price for acquiring top-end features. Also, we have observed an interconnection between the number of sales that take place to the dealership that is present across the country. Even the VW Taigun has been the most sought after by the customers because of its solid looks and unparalleled interiors. The Korean brand, Kia has evolved to be a pivotal contributor in the Indian market and it currently ranks 5th in the PV industry as far as volume is concerned but it’s well placed at position 3rd in terms of revenue generation.

The study which was just concluded by ACG has shown that the buyers are considering even the minute aspect in making their buying decisions. The study involved almost 5,500 respondents coming from various diversities and age groups. The study focused on evaluating the vehicle purchase experience of the buyers in the top 25 cities in India comprising of cities, towns as well as villages. The survey also aimed at taking note of the attitude of the buyers, their preference of channels in acquiring the information, choice of product, cost-effectiveness of the brands, and most importantly the service rendered to the customers after the sales cycle has ended.

The study has unraveled various key points that would render the needed help to the potential buyers, as we take a leap into the upcoming developmental period in the Indian automobile market.

- The SUV segment has eyed to conquer the market by rendering the debut car buyers with an opportunity to buy the different variants at an attractive price offering.

- There have been various innovative strategies to influence the customers buying decisions, the best of them has been the venture of Offering the “Next best vehicle option”.

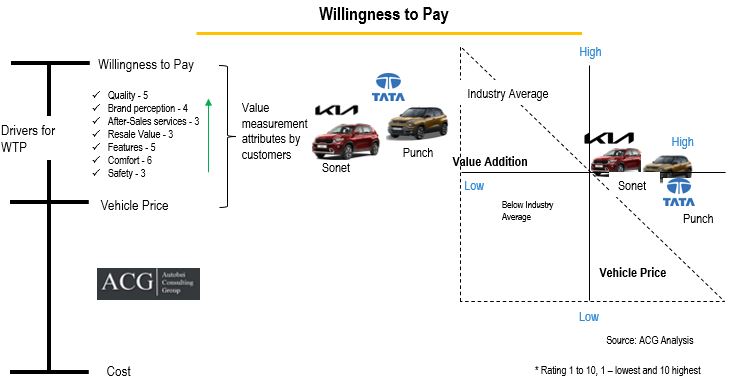

- Potential buyers are now shifting their focus on the product they plan to own than just going with the brand reputation.

- The premiums of the car are also valued on the number of best digital features they get. So the presence of digital features in the care is extremely paramount at this time.

- The rapidly changing market has demanded a change in the used market space. So, the employees now need to understand what the customer really expects and then need to deliver it accordingly in order to ensure a high level of user satisfaction.

The way ahead:

At the moment the ongoing war between Russia and Ukraine has had its impact on various businesses globally. Once the normalcy is restored, there will be a fall in the oil prices and it would be at the level it was before. This would render a very good breakthrough for the Indian car market. The increasing oil prices will enable a sharp rise in the overall sales of electric cars. The study concluded also revealed that there would be an intense demand for personal cars and this would take the market a long way ahead. It is also believed that there wouldn’t be any slowdown in the business and even if there’s any then that would be tackled easily.

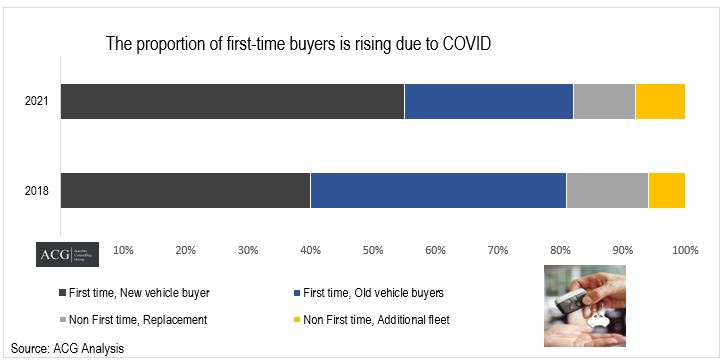

- Debut buyers – new vehicle buyer

- Maiden buyers – Old vehicle buyers

- Non-debut buyers, Replacement

- Non-Maiden buyers, Additional fleet

Increasing demand for the car, SUV, and MUV and buyer’s eagerness to own a product:

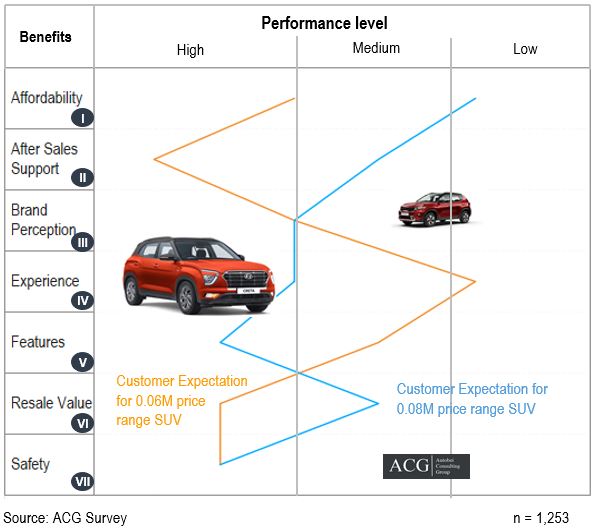

The Indian automobile customers have shown a greater affinity towards owning an SUV and for this reason, the SUV has become the most sought-after product in the segment. The buyers are looking to own one between the price tag of Rs. 770,000 to 870,700 INR. The study concluded also revealed that almost 22 percent of people mentioned that they are ready even to trade up in order to own a car in the near future. While many even had a wish to slightly go beyond their budget in order to make a purchase. There were instances, where the customers have claimed that if their existing car is priced between 500,000 to 600,000 INR then they would never mind going up by a lakh or two in making the purchase of a car with full-fledged features.

The results from the study further stated that the SUV models priced between 110,000 INR to 130,000 INR have set up an incredible platform for the OEM and they are indeed making the best use of it. The buyers are looking out for vehicles that offer superior performance and render the best cabin and driveability experience.

The overall Market held by the SUV B, B1 hatchback, and premium hatchback constitutes almost half of the market presence with just 27 models that are available in the market.

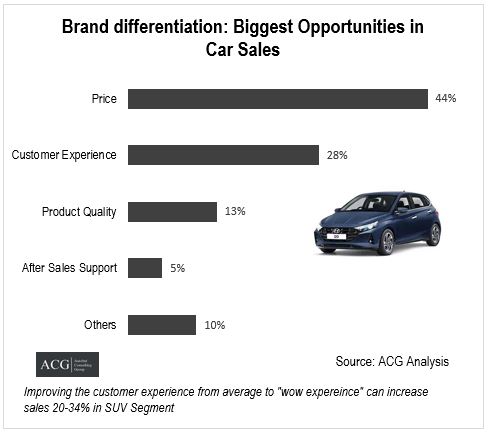

Impact of the brand on customers buying preferences:

The new launches in the market are doing good, and the influence of the brand reputation is enormous in keeping up the sales performance of these new entrants in the market. It is to be noted that the acceptance rate of new entrants is way higher than the existing models in the market.

Sheer competition in the market space:

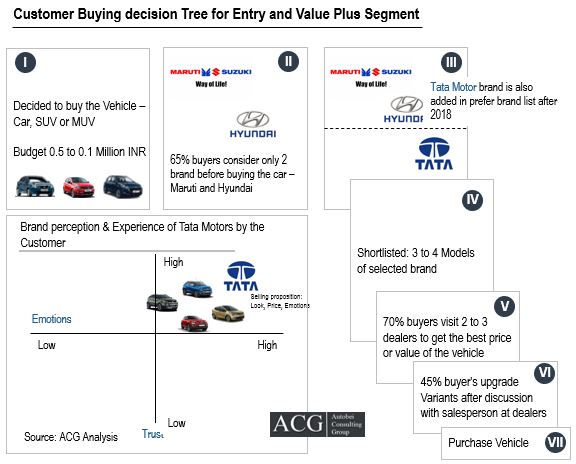

The last 3 decades have been really challenging for automobile brands. The existing domestic brands and the reputed foreign brands are all trying their best to create their hold in the market. The contemporary market dynamics are extremely different than what it was before, now there has been an increasing demand by the debut buyers. The not-so-reputed brands were able to create a small space for themselves amidst the presence of globally reputed brands and top-notch domestic brands. But now, such a kind of mutual presence would not last long and only the brands which are able to strike the customer’s aspirations are the ones that continue to exist.

In this domestic brand space, the top-performing brands enhanced their value from 13% in 2014 to a massive 18% in 2021. This growth rate of 5% in a span of less than a decade is a significant performance factor.

The key point that needs to be observed from the study is that the retention rates particularly in the Indian automobile market are all-time low. The reason for it needs to be ascertained but it is clear that the buyers are not returning in favor of the brand for which they had made an earlier purchase. The people who responded that they would go become and purchase a vehicle from the same brand stood at a very poor turnout of just 10%, this number slightly grew by 11% and raised to 21% in 2021. Astonishingly, the owners of the car which is priced at 500,000 INR and above clearly stated that they are not in favor of making the same brand purchase the next time they plan to upgrade. The people with this opinion stood at 32%. During the period from 2014 to 2021, 53 percent of the people have not turned up to the previous brand they had already owned.

Tata Motors, however, brought about a revolution in the Indian market space by coupling their top-notch innovation alongside the premium touch to their new SUV and car models. This made the customers prioritize Tata motors as the first choice when thinking about budget-friendly and premium feel cars. Tata Motors has now become synonymous with affordability and the brand that caters to every need of the customer.

Indian automobile market holds the credit of being one among the largest market space for vehicles. The performance of various brands in the Indian automobile market is dependent on various factors like customer buying preference, safety, comfort, and many more. Almost 65 percent of the participants in the survey prefer the brands that had their roots in Germany, while others went with the renowned brand JLR (Tata). The study has further revealed that the JLR brand would be very well received from the Indian audience in the future and they would gradually evolve to be the pioneers in the luxury vehicle segment. The other foreign brands hailing from South Korea and Germany have caught the customer’s eye and have been successful in creating a prominent name for themselves in the Indian market. If we make a comparison of the Indian market with that of Chinese, then we get to see that there is a lack of presence of a domestic brand to cater to the demand of the Luxury vehicle, and this is what has led the foreign brand to rule this particular segment. The study further depicts the customers are ready to go an extra mile by shelling some extra bucks to get the cars from the reputed brands.

There is an entirely different buying behavior and decision tree of Rural and Urban Indian customers. In India, the market dynamics in regards to impacting the buyer’s choice is dependent on numerous factors. Many buyers would rely on the words of their fellow colleagues or the people around them when they want to go ahead and buy an automobile for personal use. Apart from this, people also choose to fetch the relevant data from the available channels on the internet and segregate the brands and product that suits them the most.

There has been a sharp rise in the percentage of people who throng YouTube and other well-known automobile expert channels and web handles to get to know the best brand and models in the market. The obtained information will thus be used by the buyer to decide on which specific brand to own. This trend is gradually getting popularised and currently, 36 percent of people have utilized such e-services available on the net. Potential buyers will squeeze in all the relevant information from the sites and then reach out to the sales executive and would then finalize their choice. Whereas the other group of people who constitute about 27 percent are not that tech-savvy and won’t really rely on the abundant information available on the internet to get any details about the product.

The information obtained from the online and offline modes plays an integral role in influencing the buyer’s mindset. The potential customers avail all the details pertaining to the overall performance of the vehicle, reliability, technical features and moreover, the buyers tend to go through the blogs and reviews written by the existing owners. All these layers together give an initial perception to the potential customer about the choice they would make.

Currently, the market trend is getting revised every day after Covid 19. The most sought option by the buyers has still been the one where the customer directly visits the showroom and interacts with the executives to finalize their purchase. Apart from this, customers are trying to get as much first-hand information by referring to the genuine and popular web pages and other handles on the Internet. The customers have already had their expectations set prior to getting their hands on any model. The prime factors for which the customer looks while making their buying decision are positioning of the brand in the market, exterior aesthetics, premium seating, best in class features and most importantly the formidable trust a brand has created over the years which is also known as the degree of customer-centricity.

The key factor to be noted here is that more than 50 percent of the people were of the opinion that the internet plays a pivotal role in rendering the needed basic overview for the most probable buyers. It is also to be noted that why some buyers don’t rely on the internet is the lack of accurate price mention on various portals and this itself is a major hindrance. As the pricing of automobiles especially in the Indian market varies from state to state depending on the tax slabs and various other parameters. And this has made the flow of customers towards the online platform drift towards the offline showrooms so that they can get to know the actual price and plan on owning it as per their financial feasibility. The male population between the ages of 18 to 40 are the ones who prefer to visit the showroom in person than surfing the details online. In the current scenario, even the female audience is also shifting towards online portals for getting the details of the automobile prior to making a purchase. They mostly prefer to go with automobile websites and phone applications because of their detailed information and transparency. Even the offline setups are not much behind in this run, as there has also been an increase in visiting the car dealers in person, availing test drives and getting valuable insights from relatives, friends, and many more such offline engagements have evolved as the top choice for the potential buyers.