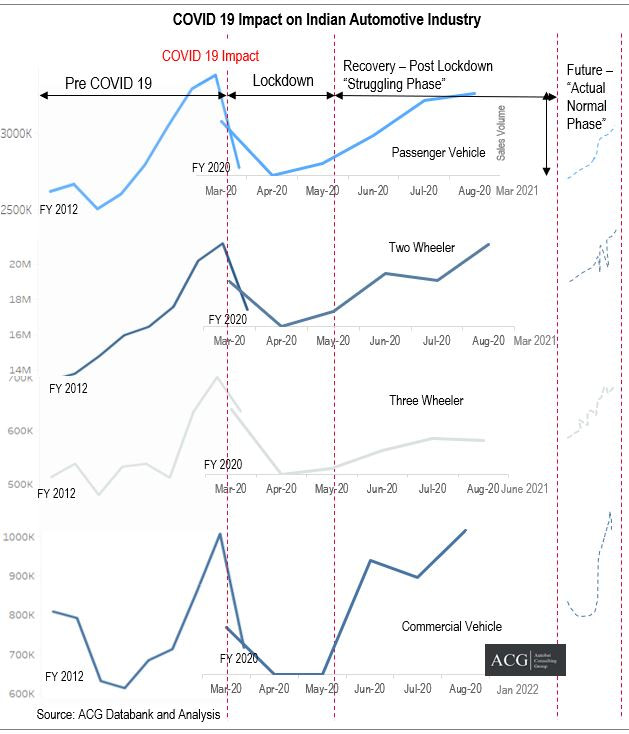

The coronavirus pandemic has wrought an unprecedented downfall in the entire Indian Automotive industry. This industry, which accounts for more than 7% of the nation’s Gross Domestic Product (GDP), was already grappling with a drawn-out decline when the nation-wide lockdown brought the industry to a standstill. Production of vehicles, the supply chain of parts, dealers’ channels, advertising, customer sentiments, and after-sales services were adversely affected.

Our Monthly subscription gives a key insight into the market movement.

In March month of this year, domestic automotive sales fell by 45% compared to the previous year of the same month, Two Wheeler sales declined by 40%, and Three Wheeler sales declined by 58%. Commercial vehicle’s year-over-year (YoY) sales dropped at a steep 88%. The month of April was a complete washout for the industry.

According to official data released by the government, in June 2020, the Index of Industrial Production shrunk by 15.7% from last year’s figures. In July, the index had fallen by a 15.7%, ever so slight progress from the previous month. India’s industrial output suffered a major contraction for the fifth consecutive month in July, impacting the production of consumer durables and capital goods.

However, as the country brought relaxations of restrictions on industries, sales revived in the subsequent months. August, the month of Onam and Ganesh Chaturthi, has been the most productive since 2018.

The industry was already wrangling since the third quarter of FY 2018 due to liquidity crunch, higher acquisition cost, and weaker customer sentiment. Sale of Passenger vehicles and Two-wheelers contracted by 18% in 2020 from the previous year, while Commercial vehicle sales fell by an even greater 29%.

Judging from the trend in the industry so far, automotive sales for the fiscal year 2021 could decline by 20-25% from the previous year across all segments – Passenger Vehicles (PVs), Commercial Vehicles (CVs), Two-wheelers (2Ws), and Three-wheelers (3Ws).

The 2W and 3W industries, however, have seen some exciting developments in May and August 2020 with a bounce-back of entry-level scooters and motorcycle sales. The increase in sales could be accounted to the small-format mobility and higher levels of comfort that 2Ws and 3Ws have. Furthermore, 2W manufacturers reported a fourfold increase in this time. 2Ws and 3Ws are the best alternatives for those who do not wish to or are not able to use Public Transport. 3Ws are a safer option as they provide affordable mobility. The demand for this segment also comes from migrants who fled the cities to move back to their hometowns in the countryside. On the other hand, 2W production surged due to the rising demand in last-mile delivery.

The CV industry however has been the worst impacted with almost 1% to negative GDP growth. Hard times await this industry which is considered the backbone of the country’s economy. Demand for this segment could be increased by accelerating infrastructure expenditure in rural and urban areas and supporting the real estate sector.

OEMs have managed to handle the situation owing to their affluence. Hyundai, Maruti, and Kia have invested a lot to promote new products like Venue, Sonet, and S Cross. Mercedes, BMW, MG Motor, Honda, Hyundai, Maruti Suzuki, Toyota have transitioned into the digital arena and have started selling their vehicles online. With the hesitation to go to physical stores and avoid contact, online demonstrations, door-step test drives, digital launches, and online financing options have provided a unified seamless virtual experience to customers. However, the dealers face viability issues and expect support and liquidity from OEMs to run the business.

The Auto components manufacturers have also faced a serious setback due to the pandemic-effected lockdown, affecting thousands of component suppliers and tens of thousands of employers in central Europe. The negative sentiments against China have to lead to the unveiling of ‘vocal for local’ initiative by the government. This will open some more opportunities in the market.

With an increase in the number of loan defaulters, financial institutions are hesitant to give out new loan applications.

Customer Sentiments:

Though basic models are still in demand, customer buying has reduced for the luxury vehicle segment. This sector will be seeing a significant drop in sales in the coming months. The confidence index of the Logistics Industry is at an all-time low. Transporters face capacity utilization issues and demand for vehicles for goods transportation.

Outlook:

The effects of the pandemic and consequent lockdown are seen across all industries. The impact on the economy and the automotive industry, depending on the intensity, duration, and spread of the outbreak. Customer spending has reduced a lot due to the psychological and financial situation. Gauging by the current scenario, the market will take another 1 to 2 years to revive from the setback. Reduction in GST will protect the industry against the economic ramifications of the pandemic. A scrapping policy should be introduced to boost the CV segment.