The primary obstacle to electric vehicle adoption among the general public is the high price tag. Reducing costs is an ongoing process in the electric vehicle manufacturing industry, and ACG has been actively involved in this effort. Our goal is to examine how original equipment manufacturers (OEMs) and Tier 1 suppliers can achieve substantial cost savings, amounting to millions of Euros, by simply adjusting their purchasing approach for semiconductor components used in power modules.

![]()

At the moment, Power Module (Which does not have its own Semiconductor ) companies acquire SiC Semiconductor chips from semiconductor manufacturers like Wolfspeed, Renesas, and others. They then use these chips as the heart of their Power Modules in terms of technology, and these chips also account for a substantial part of the module’s production cost.

- Direct Deal with Semiconductor Suppliers:

![]()

In this straightforward process, a pricing competition is at play. Power Module companies purchase chips and then resell them to OEMs or Tier 1 Suppliers through Power Module Packaging, making substantial profits solely through semiconductor trading. Consider this: there is a possibility for OEMs or Tier 1 Suppliers could save up to remarkable 500 million Euros depend on 2 Wheel Drive or 4 Wheel Drive/High performance Electric Vehicle. Exceptionally, The number of power modules used in a 2-wheel drive (2WD) or 4-wheel drive (4WD) vehicle can vary depending on the specific design of the electric powertrain and the vehicle’s power requirements

Consequently, Electric Vehicle startups, often find themselves negotiating terms set by these Power Module companies.

There are additional advantages to this approach. Payment terms can be more easily negotiated with direct chip suppliers. Moreover, OEMs and Tier 1 Suppliers gain direct control over chip quality, stay informed about new developments, and can discuss changes in technical requirements, such as chip size or power density.

Benefits of Direct Deal with Semiconductor Suppliers:

![]()

Another avenue to save an extra million Euros in the realm of Power Modules is by abstaining from investing in Power Module production lines. Some Power Module manufacturers might face financial limitations, prompting them to seek investments from Tier 1 or OEMs, which typically involve a substantial sum, around 7 to 10 million Euros. However, it’s crucial for any business to avoid venturing into a risk-sharing business model, as customers should not be exposed to such risks. The decision about how much risk to undertake should rest with the Power Module companies.

2. Do not invest in Power Module Production line on the basis of risk sharing Business Model:

However, OEMs and Tier 1 companies can extend their support to Tier II Power Module companies seeking investment for establishing production lines or preferring to buy semiconductors directly from Power Module companies. OEMs and Tier 1 companies can facilitate the direct procurement of semiconductors from semiconductor manufacturers by Power Module companies, thus easing their financial burdens.

A considerable number of semiconductor suppliers have already ventured into the power module sector, while others are actively exploring opportunities to enter this industry. This has led to competition between semiconductor suppliers and power module manufacturers. Consequently, there’s a possibility that power module companies may not receive the most advantageous price offers from semiconductor suppliers. Although some power module companies claim to get the best semiconductor prices, it may not always be accurate. Therefore, it’s a better idea for OEMs and Tier 1 suppliers to directly negotiate with semiconductor suppliers to ensure they obtain the most favorable pricing.

Another crucial factor that companies should give serious thought to before engaging with Power Module manufacturers is the necessity of signing a Non-Disclosure Agreement (NDA) with a stringent and robust clause. An illustrative case is One of the leading OEM interaction with a Power Module manufacturer in Europe. This leading OEM shared its distinct design and advantages with the Power Module manufacturer, but ultimately, no agreement was reached on closing the deal. Subsequently, the Power Module manufacturer made some minor alterations to OEM’s design and began selling it to other OEMs and Tier 1 suppliers. This situation resulted in significant losses this OEM.

3. Use Si Semiconductor:

The third cost-saving method involves not using Silicon Carbide (SiC) in the power module device and opting for Silicon (Si) IGBT semiconductor technology instead. While SiC is an excellent semiconductor with unique benefits, it tends to be more expensive.

![]()

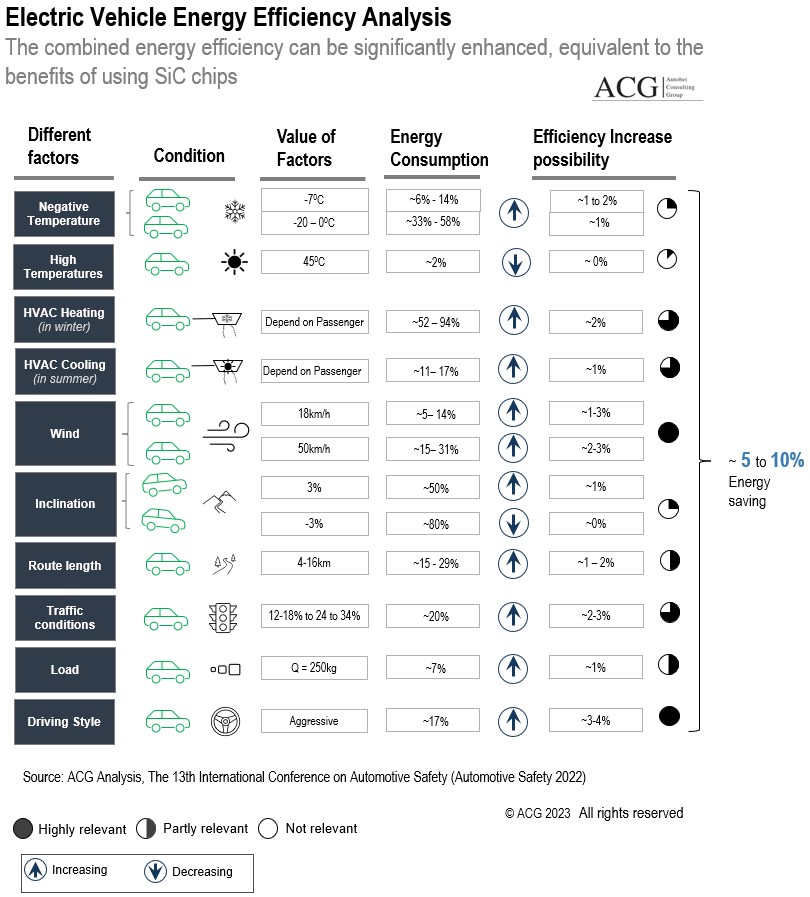

The choice between SiC and Si can be determined by OEMs based on factors like the vehicle’s driving patterns or powertrain needs. There are ten critical areas where efficiency improvements are possible with Si semiconductors. By utilizing SiC, overall vehicle efficiency can be boosted by 5 to 10%, resulting in cost savings across fifteen vehicle components, as outlined below:

Even a modest 1% improvement in energy conservation across the listed factors could lead to significant energy savings for electric vehicle (EV) manufacturers, equivalent to SiC Semiconductors’ consumption in EVs. The factors affecting EV efficiency encompass a broad research domain, considering the numerous variables that influence energy usage. Weather conditions, for instance, play a substantial role in energy consumption. Extremely cold temperatures can reduce energy usage by up to 37%, while a temperature of 40°C can extend the vehicle’s range by approximately 2%. Similarly, the presence of headwinds significantly impacts energy consumption, requiring more energy to overcome resistance during motion. Weather conditions also interact with auxiliary systems, with research indicating that heating a vehicle consumes more energy than cooling its interior.

Additionally, factors like vehicle load, battery weight, and driving style all exert an influence on energy consumption. Heavier loads and increased battery weight contribute to higher energy consumption, while aggressive driving, including sudden and frequent acceleration, can lead to faster battery depletion. It’s vital to recognize that optimizing energy efficiency necessitates considering a multitude of variables, as electric vehicles often operate under less-than-ideal conditions, such as varying temperatures, wind, passenger loads, and traffic conditions.

Key Highlights of the Full Report:

- Procurement Strategy Analysis with use case of SiC and Si

- How OEMs and Tier 1 can save millions of Euro by adopting right strategy

- Power Module Manufacturing Strategy and making profit by just trading semiconductor chips

- How make the vehicle equivalent energy efficient without using SiC chip

- Power Module Cost Structure

- Long term benefits Analysis with Power Module buying Strategy

- Power Module Business Model

- Benefits Analysis of Direct dealing with Semiconductor Suppliers