The landscape of two-wheeler vehicles in India is undergoing a remarkable shift, primarily driven by the growing demand for electric scooters and motorcycles. This change is expected to trigger a reconfiguration of the established brands that have long dominated the industry. To remain competitive and relevant in this evolving landscape, traditional automakers need to strategically incorporate advanced technologies. This includes the seamless integration of features such as connectivity solutions, mobile apps, interactive interfaces, digital communication tools, information-rich dashboards, and predictive services, among other technological advancements, all aimed at not just meeting but exceeding customer expectations.

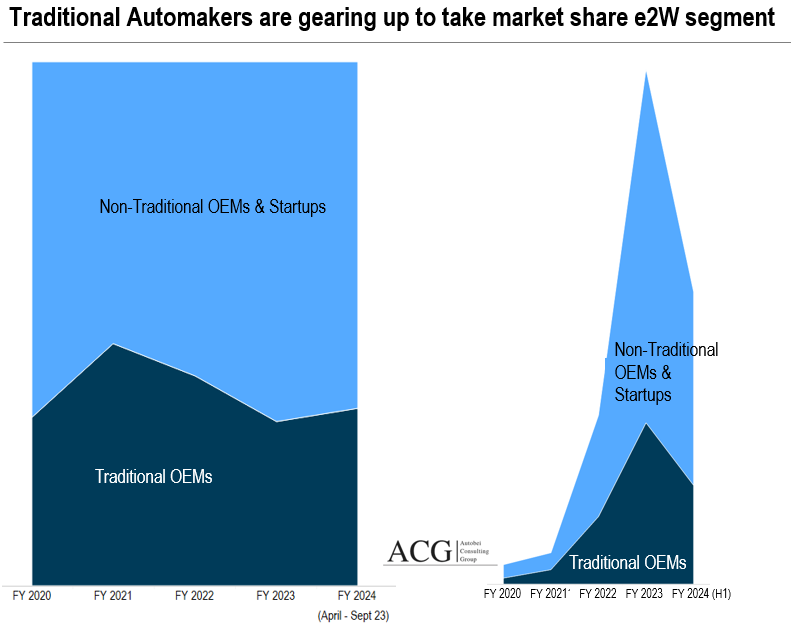

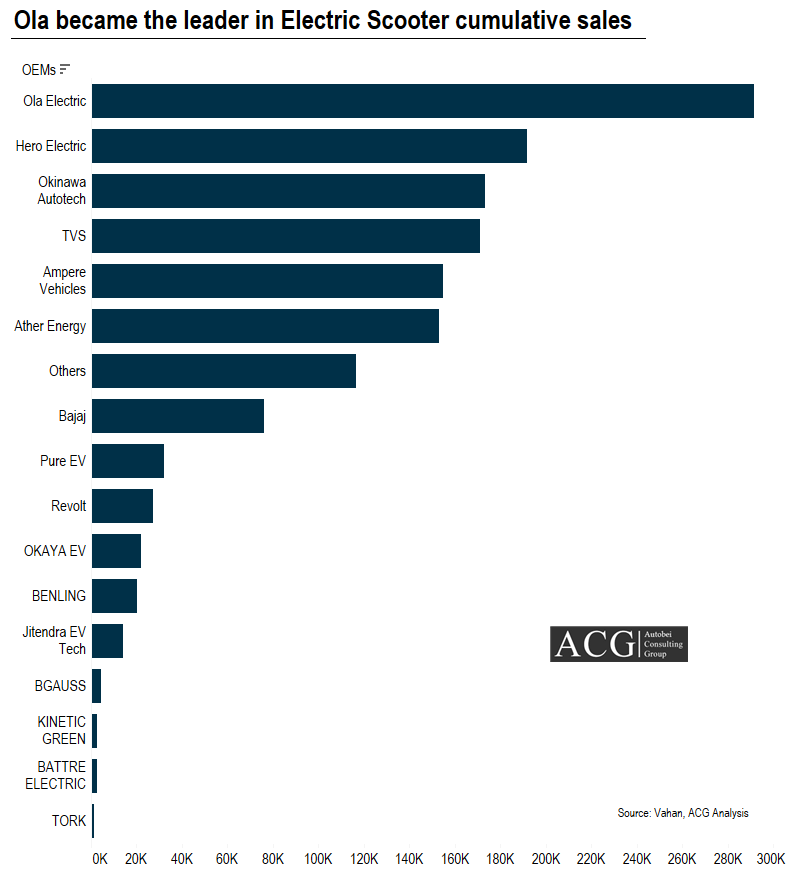

In this fast-changing environment, newer entrants in the industry, such as Ola, Okinawa, and Ather, are rapidly gaining ground, while traditional giants like Honda, Bajaj, Yamaha, and TVS are moving at a more measured pace, often operating in lower gears. Significantly, a steady stream of new brands consistently introduces an average of two to three new products in this segment, further contributing to the industry’s dynamic evolution.

The electric two-wheeler market in India has become a familiar point of interest for both established automotive players and newcomers. This rapidly evolving segment is currently in the midst of a significant transformation.

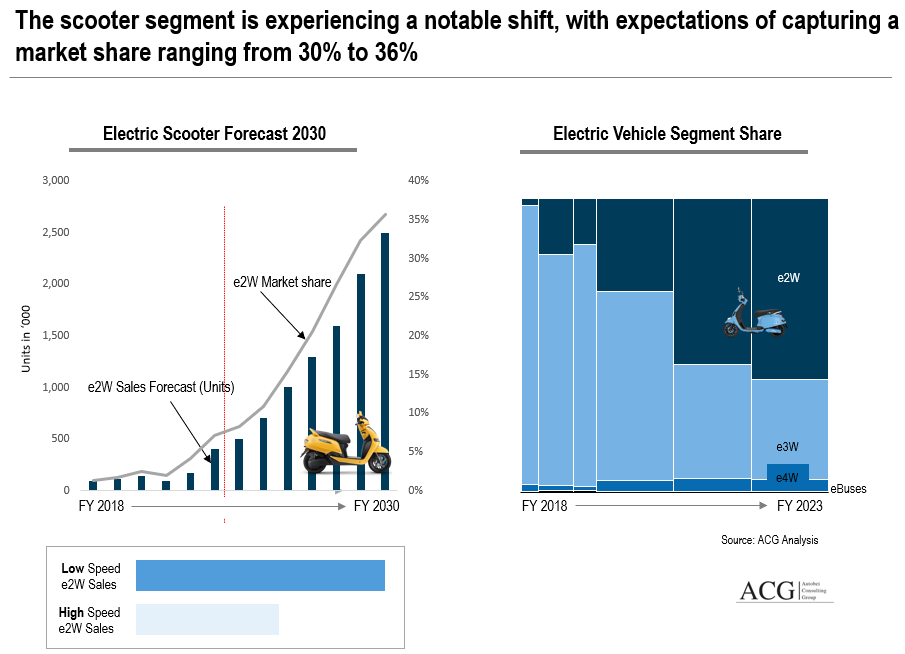

It’s anticipated that the electric two-wheeler market will reach a substantial value of approximately 2,410 million USD by the year 2030. Remarkably, the scooter segment is experiencing a notable shift, with expectations of capturing a market share ranging from 30% to 36%.

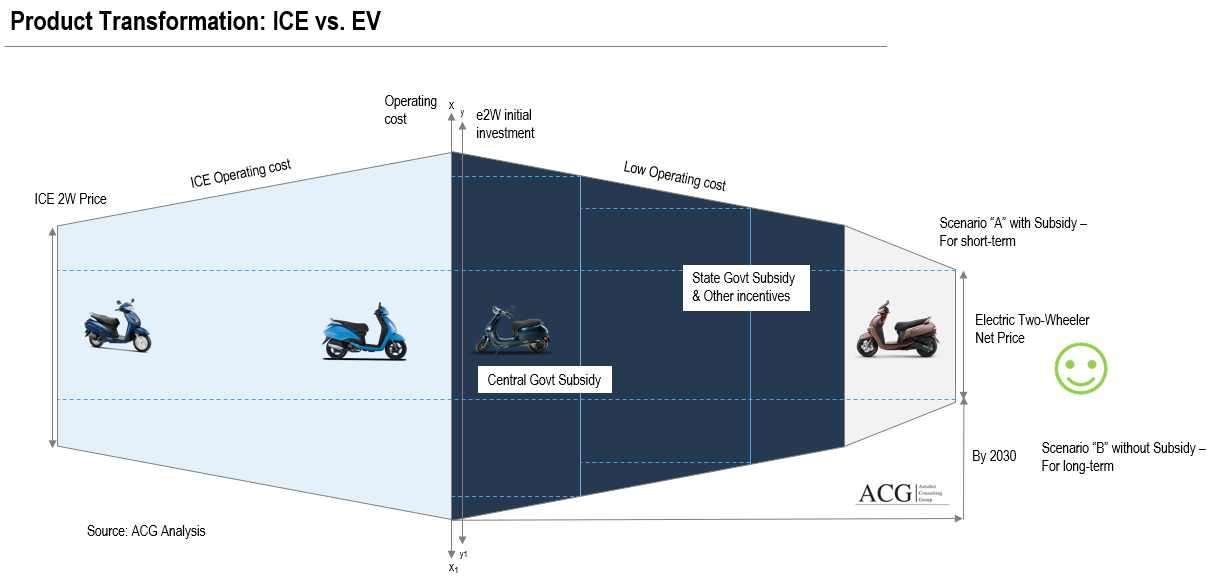

The government has put in place a series of substantial measures to encourage the adoption of electric vehicles. These include the FAME subsidy, with FAME III currently under evaluation. The Ministry of Heavy Industries has launched Phase-II of the FAME India Scheme, earmarking INR 1000 Crores for the development of charging infrastructure for electric vehicles. Additionally, the government has enhanced subsidies for electric two-wheelers, increasing the subsidy from ₹10,000 per kWh to ₹15,000 per kWh, with the maximum subsidy now set at 40% of the ex-showroom price, up from the previous 20%.

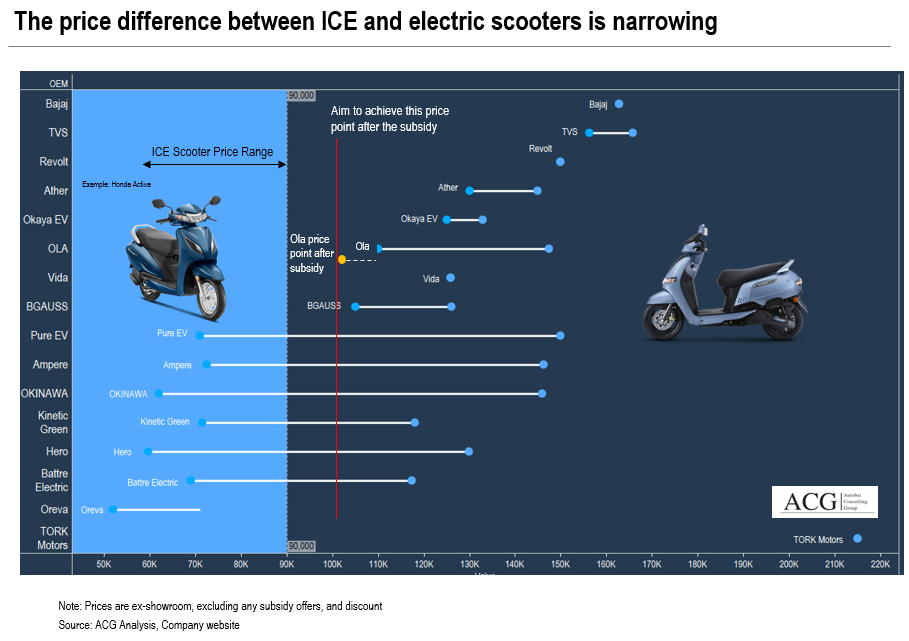

Price Point of Electric Scooter and Motorcycle:

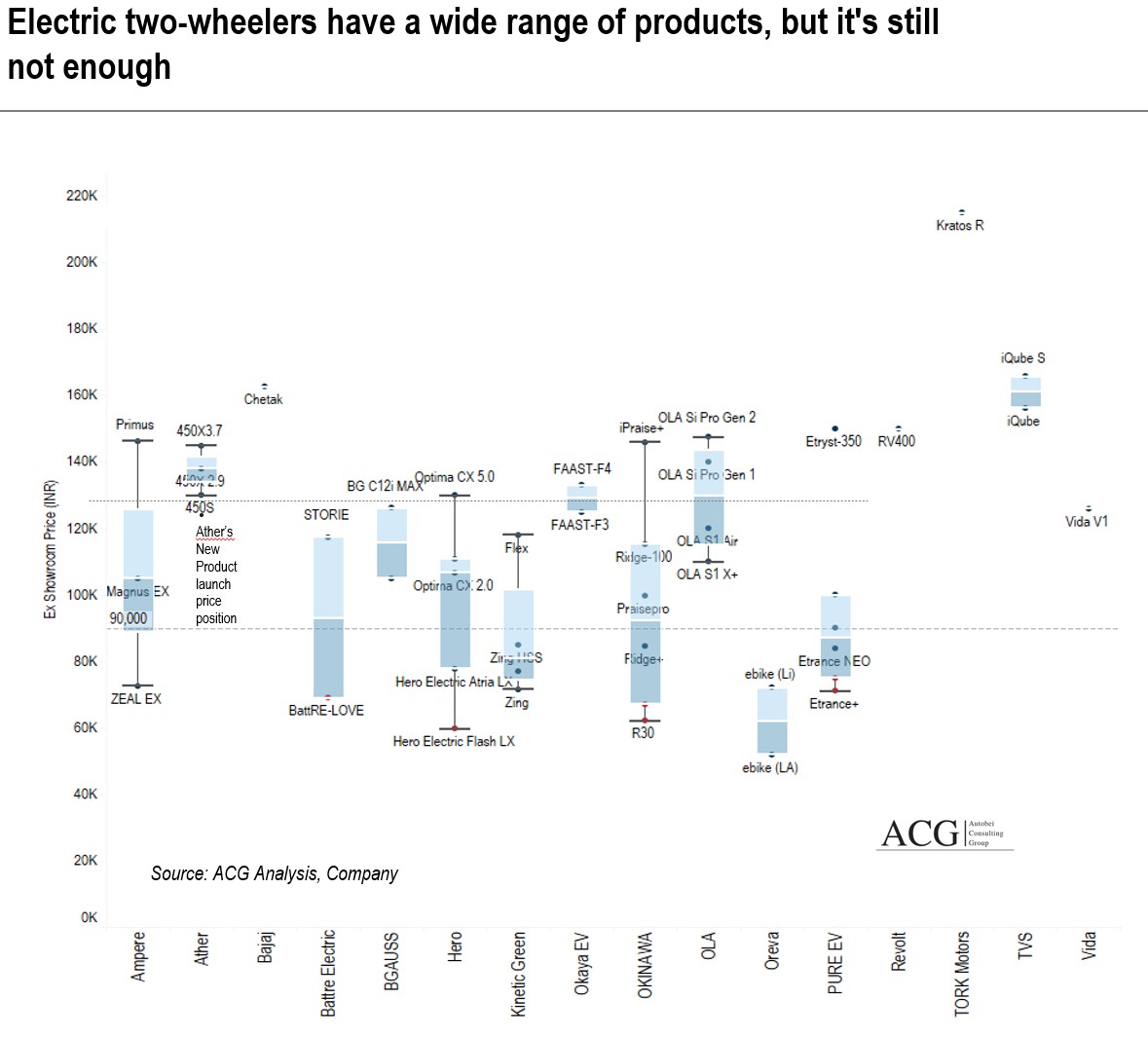

Ampere, Hero, and Okinawa offer products across a wide price range. Ola offers models within a narrow price range, targeting closely-segmented markets. Okinawa and Hero are targeting more than two segments at a time. Currently, Chetak and Tork have only single products closely segmented.

Another notable development is the approval of the Production-linked Incentive (PLI) Scheme in May 2021. This scheme is aimed at strategically incentivizing potential investors, both domestic and international, to establish large-scale ACC manufacturing facilities. The emphasis here is on maximizing value addition, ensuring high-quality output, and achieving pre-committed capacity levels within specified timeframes. It’s worth mentioning that companies like Ola are actively engaged in constructing substantial 20 GWh giga battery factories for their two-wheeler portfolios.

Another notable development is the approval of the Production-linked Incentive (PLI) Scheme in May 2021. This scheme is aimed at strategically incentivizing potential investors, both domestic and international, to establish large-scale ACC manufacturing facilities. The emphasis here is on maximizing value addition, ensuring high-quality output, and achieving pre-committed capacity levels within specified timeframes. It’s worth mentioning that companies like Ola are actively engaged in constructing substantial 20 GWh giga battery factories for their two-wheeler portfolios.

To fuel the growth, the government has initiated significant actions to decrease the Goods and Services Tax (GST) on electric vehicles, reducing it from 12% to 5%. A similar reduction has been applied to chargers and charging stations for electric vehicles, reducing the GST rate from 18% to 5%.

In a nutshell, these all-encompassing actions have not only driven the uptake of electric vehicles but have also significantly shrunk the cost disparity between conventional internal combustion engine (ICE) two-wheelers and electric scooters, marking a pivotal moment in the transition to electric mobility.

Turning our attention to a different aspect, the electric vehicle (EV) industry in India grapples with its distinct set of challenges. Most prominently, there is a notable deficiency in charging infrastructure, particularly in rural and smaller towns, despite the presence of over 600 charging stations along highways and expressways. Yet, this issue continues to persist and requires attention. Delving further, we gain a deeper understanding that the access to electricity, especially in rural areas, is a significant obstacle that requires substantial investment to meet the growing demand for electricity by 2030. Responding to this need, the government has given the green light to establish 1,576 EV charging stations spanning 16 highways and 9 expressways.

Furthermore, the concept of “range anxiety” contributes to the gradual adoption of electric two-wheelers. In specific regions, the absence of state subsidies for electric two-wheeler purchases amplifies the price difference between internal combustion engine (ICE) two-wheelers and their electric counterparts.

The Indian electric two-wheeler industry also heavily relies on imported components, including lithium-ion or LPP batteries.

Moreover, a substantial portion of potential consumers still harbors reservations about embracing electric vehicles. This is partly due to a lack of awareness concerning EV technology, further compounded by sporadic incidents of electric vehicles catching fire. To foster greater EV adoption, India must craft a manufacturing-friendly policy framework. This strategic endeavour holds the promise of mutual benefit, benefiting not only the domestic market but also positioning India as a potential exporter of electric two-wheelers to countries like Vietnam, Africa, Sri Lanka, several European nations, and beyond.

Analysing Product Portfolio, Product USP, and Competitive Landscape:

In the Electric Two-Wheeler Industry, we identify three distinct categories: High-Speed Electric Scooters, Low-Speed Electric Scooters, and Motorcycles.

While the Scooter segment garners high market appeal, the presence of Motorcycles in the Electric Segment is notably limited. Several primary constraints hinder the adoption of Motorcycles in this segment. Firstly, the speed does not align with the expectations of traditional Motorcycle users. Secondly, the range offered falls short of necessary requirements. Lastly, even after accounting for subsidies, a substantial price gap persists between ICE 2-Wheeler Motorcycles and their Electric counterparts.

While the Scooter segment garners high market appeal, the presence of Motorcycles in the Electric Segment is notably limited. Several primary constraints hinder the adoption of Motorcycles in this segment. Firstly, the speed does not align with the expectations of traditional Motorcycle users. Secondly, the range offered falls short of necessary requirements. Lastly, even after accounting for subsidies, a substantial price gap persists between ICE 2-Wheeler Motorcycles and their Electric counterparts.

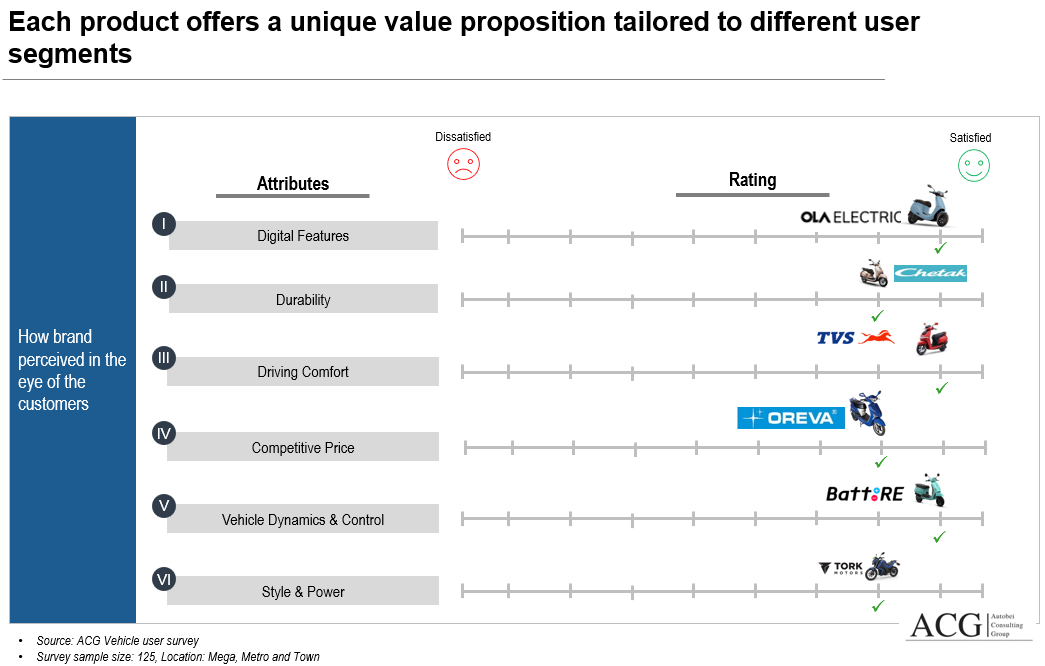

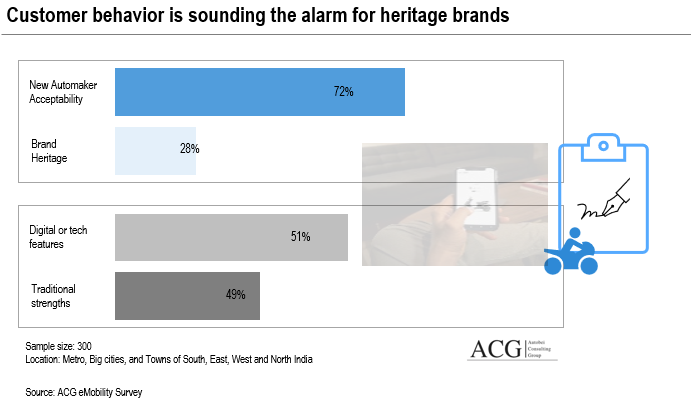

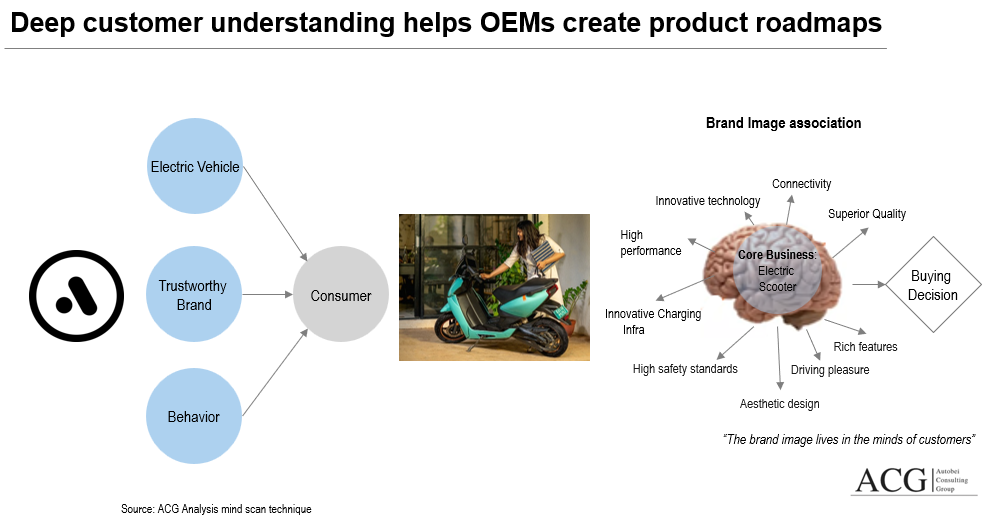

Unpacking the Influence of Brand Recognition on Consumer Behaviour:

Brand recognition plays a pivotal role in shaping customer perceptions, preferences, and interactions with products and services. However, understanding the intricate dynamics of how brand recognition precisely influences consumer behaviour merits closer scrutiny.

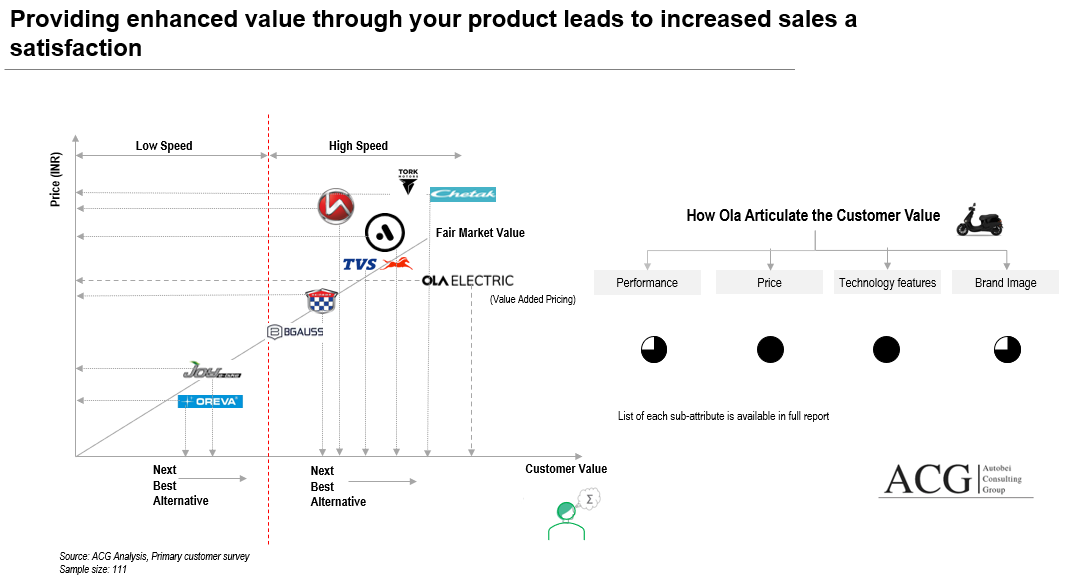

Value-driven Electric Two Wheeler result in higher sales:

In the EV Segment, prominent contenders include Ather, Bajaj, Ola, and TVS. Notably, Chetak has witnessed a remarkable doubling of its market share within just one year, reflecting significant growth.

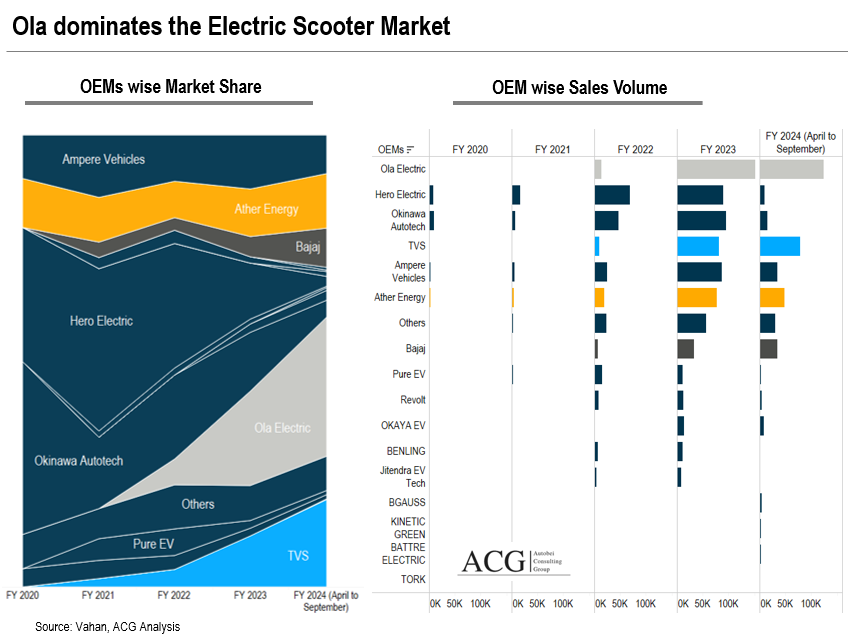

Particularly, Ola stands out as the fastest-growing OEM in the EV segment, commanding an impressive 30% market share during the initial half of FY 2023.

Traditional Automakers Paving the Way:

On the traditional automaker front, TVS has displayed commendable growth, securing a 19% market share in H1 FY 2024, a substantial increase from 11% in FY 2023.

Challenges and Downturns:

Conversely, Hero Electric is gradually ceding its market leadership position, experiencing a significant 27% decline in market share from FY 2020 to H1 FY 2024, marking a substantial setback for the company. Additionally, Okinawa is another OEM witnessing a decline in market share, plummeting from 38% in FY 2020 to 3.6% in H1 FY 2024. Notably, two dealerships of the company in Ahmedabad have ceased operations.

New Entrants Shaping the Market:

When juxtaposed with traditional automakers, new entrants in the EV sector exhibit a stronger foothold in the Electric Two-Wheeler market, drawing parallels with the narrative of Tesla.

Exploring Sales Trends:

Now, let’s delve into the factors that underlie these sales trends. We have meticulously studied consumer behaviour within this purchasing pattern and correlated it with market dynamics. By delving into the minds of existing and potential consumers, we unveil the driving forces behind these trends.

Cracking the Code of Consumer Decision-Making:

In the world of Electric Two-Wheelers, understanding how consumers make choices is crucial. When people are asked about the first brand that pops into their minds in the Electric Two-Wheeler category, a whopping 75% swiftly name Ola.

Among this 75%, 30% attribute their choice to an emotional connection with the brand. This emotional bond is forged through Ola’s consistent storytelling, especially its impressive tale of having the largest manufacturing facility in India and the grand launch of the Ola S1 Electric Scooter. Ola also effectively leverages social media and extensive media coverage to cement itself as the go-to brand for tech-savvy, youthful, and creative individuals. Ola’s ability to influence consumer behaviour is a testament to its brand strength, highlighting the idea that buying an Ola Electric Scooter transforms you into a hero, not just a purchaser.

When consumers have to choose between brands like Ola, TVS, Chetak, Okinawa, Ather, and others, their choice often reflects their personal identity and the image associated with the Electric Scooter they want to own.

Interestingly, Ather users respond very positively, while users of some other brands express a more neutral sentiment. If this pattern continues, consumers might unconsciously lean toward specific brands, drawn by the self-expression they find within them. This poses a significant challenge to traditional two-wheeler manufacturers.

For traditional Scooter Original Equipment Manufacturers (OEMs), the challenge is to shift from being seen solely as providers of Internal Combustion Engine (ICE) and Electric Two-Wheelers. This shift might involve introducing new brands that strongly emphasize Electric Technology, a move that significantly shapes consumer perceptions.

Product Transformation: ICE vs. EV:

Traditionally, Two-Wheeler buyers sought high performance, safety, and mechanical reliability. But in the digital age, riders demand a more comprehensive experience – a smart, connected ride that enhances safety, provides information, and entertains.

The coming years are expected to witness a significant rise in Electric Two-Wheelers equipped with large LCD dashboards and augmented reality head-up displays.

Sales and Marketing: Dealership vs. Online:

Customers usually start their journey online to gather information about Electric Two-Wheelers, but the final decision often hinges on a test drive. Research reveals that Electric Two-Wheeler buyers interact with an average of 5 touchpoints during the purchase process, with 3 of them happening online. These touchpoints significantly influence the buying decision, even though the actual purchase usually takes place offline.

Enhancing the Showroom Experience for Customers:

The quality of a customer’s experience in an Electric Two-Wheeler dealership is crucial. Unfortunately, the current scenario leaves much to be desired, with 95% of customers reporting subpar experiences upon entering such showrooms. Prospective Electric Vehicle buyers deserve a showroom visit that exceeds traditional standards. It’s not just about the dealership’s size; it’s about creating a welcoming atmosphere, providing in-depth product knowledge, offering informative test drives, sharing technological insights, and showing an unwavering commitment to understanding each customer’s unique needs. Currently, Electric Two-Wheeler showrooms often fail to deliver an experience that matches the importance of the purchase, making it feel more like buying everyday products like soap or vegetables.

Dealerships must aim to exceed customer expectations, with the ultimate goal of boosting customer satisfaction. This ultimately leads to more sales and helps build strong, lasting customer loyalty. Achieving this requires punctuality, personalized attention, and making every customer feel like they are the dealership’s top priority.

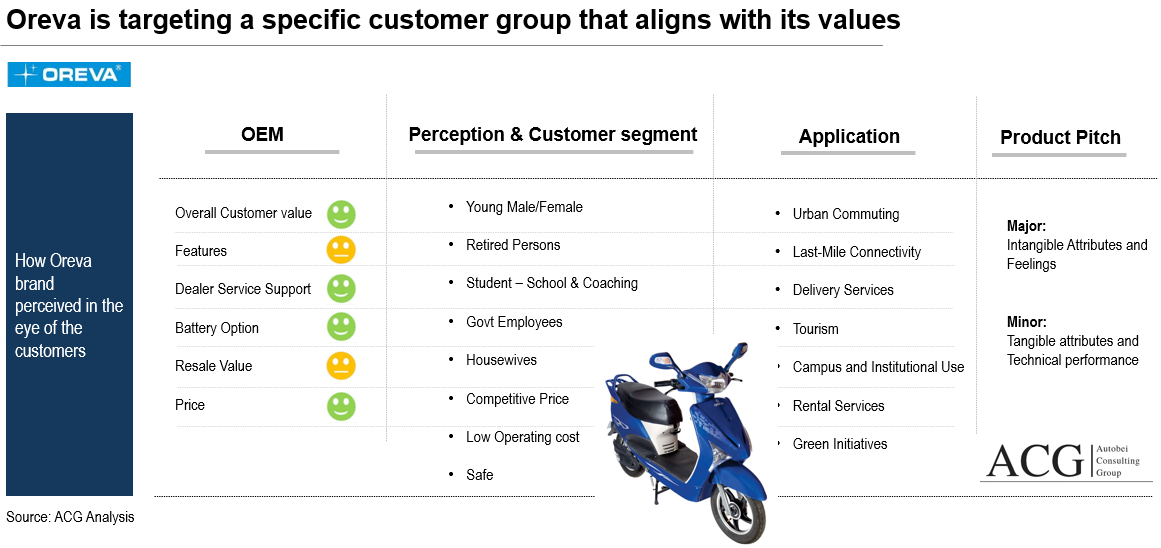

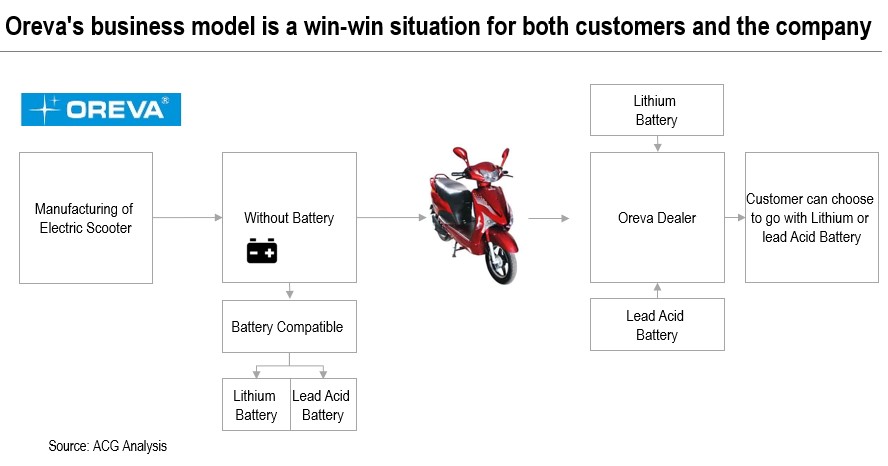

Oreva sets an example of understanding customer needs through a unique business model. Oreva manufactures Electric Scooters without batteries and actively involves dealers in the process.

Key Highlights of the Indian Electric Two-Wheeler Product and Customer Analytics Report:

- Indian Two Wheeler Market Size, Challenges, and Opportunities

- Indian Electric Two-Wheeler Market size in terms of Volume (units) and Value (USD)

- OEMs Market Share Trend and Forecast

- Market size and trend of South, North, West and East India

- Indian Electric Two Wheeler competitor landscape

- Penetration of Electric Scooter and Electric Motorcycle till 2030

- Electric Two-Wheeler Price Trend Forecast Analysis

- Electric Scooter and Electric Motorcycle Market Assessment

- Low-Speed and High-Speed Segment Analysis

- Market category based on battery type: Lithium & Acid lead

- Electric Two-Wheeler Model-wise Technology Analysis

- Market Drivers and Restraints for Electric Two-Wheeler

- Market dynamics in Rural and Urban areas

- Expected Market Development for the next 10 years

- Central & State Government Policy and Subsidy support Analysis and its impact on the Electric Two Wheeler market

- Electric Two-Wheeler Product Roadmap

- Market Segmentation based on Volt 48-59V, 60V-72V and above 72V

- Market Segmentation based on Battery size, Actual Range, and Charging time

- How OEMs target customer segments and map with their product portfolio

- What is the brand image and brand position in the eyes of the customers?

- How to improve the brand position of Traditional and Non Traditional OEMs

- Customer decision process – Electric Vs ICE Two-wheeler

- Customer Groups for Electric Two-Wheeler

- Customer journey touchpoints

- What are the key points customers consider to buying an Electric two-wheeler?

- Why Motorcycle customer is not taking an interest in replacing their ICE Motorcycle

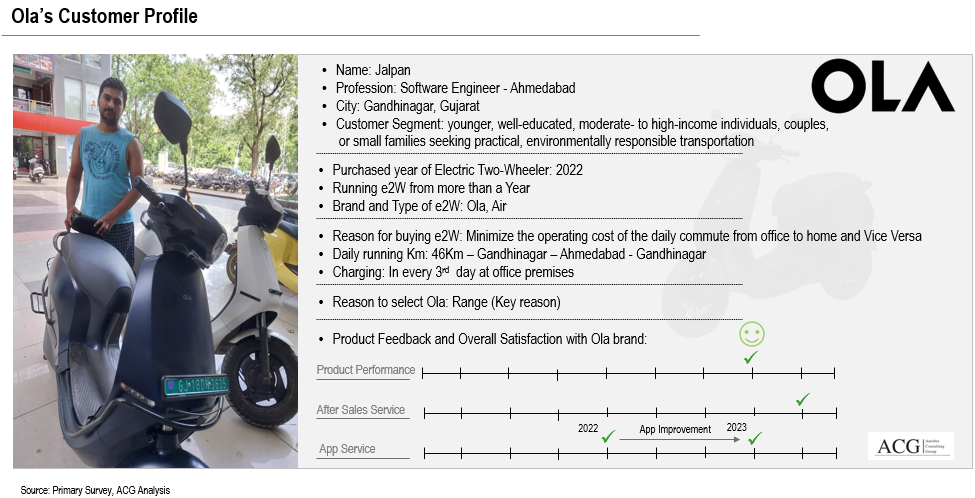

- Customer profile of existing and potential users of e2W

- Customer groups based on their income

- Customer willingness to pay for different Brands and Models

- Company Strategy Analysis, Investment, and company profile: Hero Electric, Ather, Ola, Crompton Greeves, Bajaj, TVS, Battre, Okinawa, Pure EV, Tork, Revolt, Oreva, White Carbon, BGAUSS, Kinetic, and others

- OEMs Pricing Strategy

- Price position or price difference of all Electric two Wheeler models

- Segmentation based on the Price group of the Electric two-wheeler

- Market and Product Gap Analysis

- New coming-up launches

- How Models deliver value to its customers

- Product Life Cycle Analysis of Electric Two-Wheeler

- Financial challenges during each phase of the Product life cycle

- How to Develop the Electric Vehicle (2W) – balance between market attractiveness, Product attributes (MVP), and customer expectation

- Design an effective Marketing Strategy

- Sales Strategy Analysis

- Digital Marketing Strategy Analysis

- Customer experience analysis during Dealer visits, and After-sales

- How to Go-To-Market

- Effective communication strategy since Electric Two Wheeler is the new technology

- Dealer Staff training requirement

- Refurbished market size and opportunity for all stakeholders

- Refurbished feasibility study