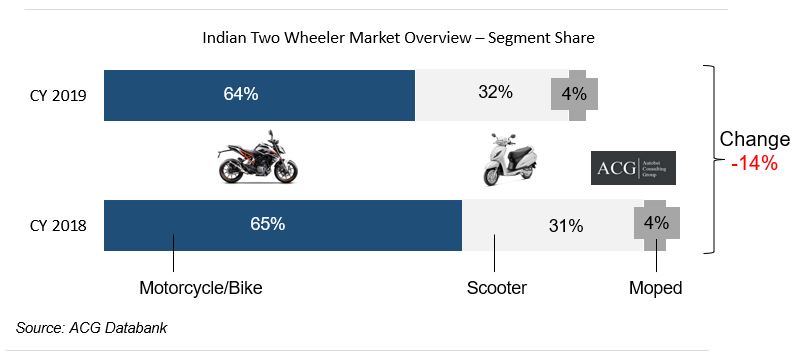

ACG proclaimed the Indian Two-Wheeler Market report 2020 and Forecast. Unquestionably, the Indian Two Wheeler Industry registered 14% degrowth in CY 2019 compared to that of CY 2018. The Motorcycle segment became an underachiever and dropped to 13%, while the Scooter segment to 16%.

The Rural demand was put under pressure in 2019. Suzuki and TVs Brands grew popular among the Rural market in the Motorcycle segment. The main reason behind the degrowth shall be blamed on the economy’s sluggish growth employment issue and other negative predilections of the market.

Implementation of Bharat Stage VI norms in FY 2021 would shoot the price up to 20%. But, if the OEMs try to implement the same to 2W customers, then eventually, the sales of Two-Wheeler vehicles will land in the slow lane in 2020.

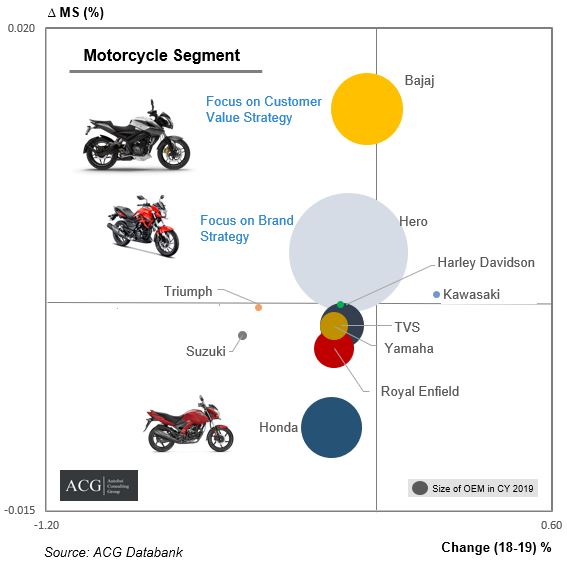

Motorcycle Segment:

HeroMoto Corp rules around 51% market share of the Indian Motorcycle market. Bajaj, being the second-largest player, increased its market share from 17% to 19% in CY 2019. On the other hand, Bajaj Auto registered the lowest possible degrowth in the Two-Wheeler segment. The Bajaj Auto seems to follow a better Customer value, for the company is giving better features and specs at a given price. Premium Brand Kawasaki registered a 30% growth in CY 2019 compared to CY 2018.

Indian Premium Motorcycle Brand Royal Enfield sales were declined by 18% in CY 2019. Triumph Motorcycle sales were perceived as a 44% fall in CY 2019.

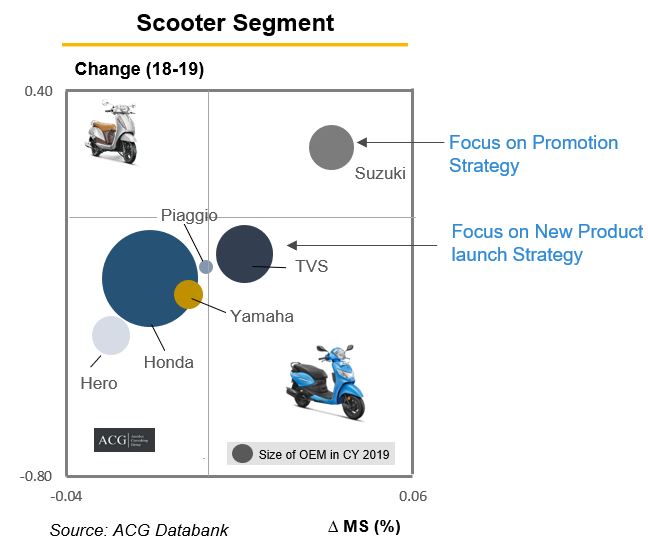

Scooter segment:

Suzuki and TVS achieved their desired result by the end of CY 2019 with a gain of 4% and 1% market share. Except for Suzuki, all other scooter OEMs recorded negative growth.

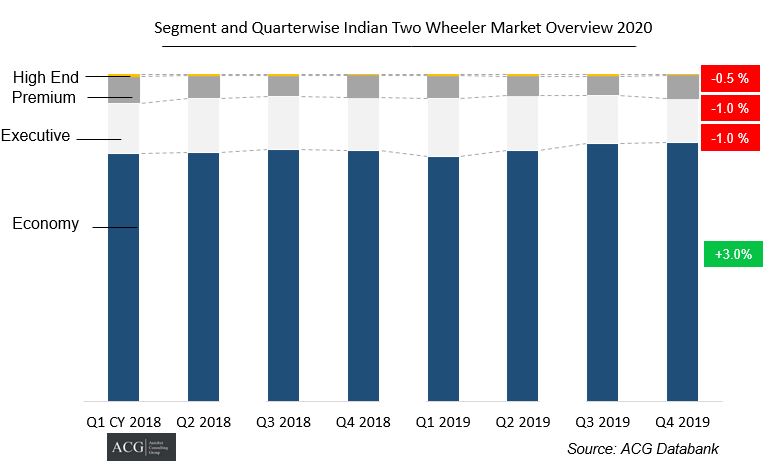

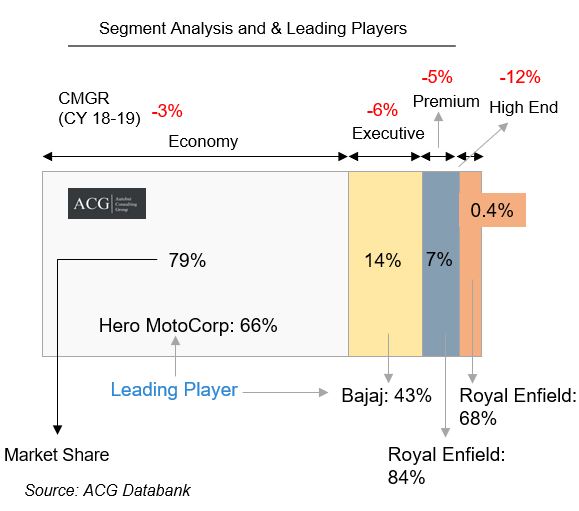

Compound Monthly Growth Rate Analysis:

The CMGR of Economy, Executive, Premium, and High-End segment recorded a 3, 6, 5, and 12 percent degrowth respectively. In the last quarter of CY 2019, sales of the Economy segment increased. This segment gained a 3% share in Q4 CY 2019 compared to Q1 CY 2018.

HeroMoto Corp, being the leading OEM manufacturer gained a 66% market share. The executive segment was fluctuating in a zigzag manner. Hence, this segment lost a 1% market share. Bajaj Auto turned to be the segment leader with 43% market share. But, on the Premium Segment, they lost a 1% market share. Royal Enfield became the leading manufacturer with 84% market share whereas its high-end segment is almost stagnant.

Key highlights of the report:

- Indian Two Wheeler market size in Volume and Value

- Indian Two Wheeler Segment Analysis and Market Share

- Motorcycle and Scooter Markert Analysis, Sales, Production, and Export Analysis

- Model wise Specs, Price Analysis, and Features

- Customer Mapping mapping with Models and Group

- Middle class, Low income, and Upper-income class customer analysis

- Top Cities and Key models Sales