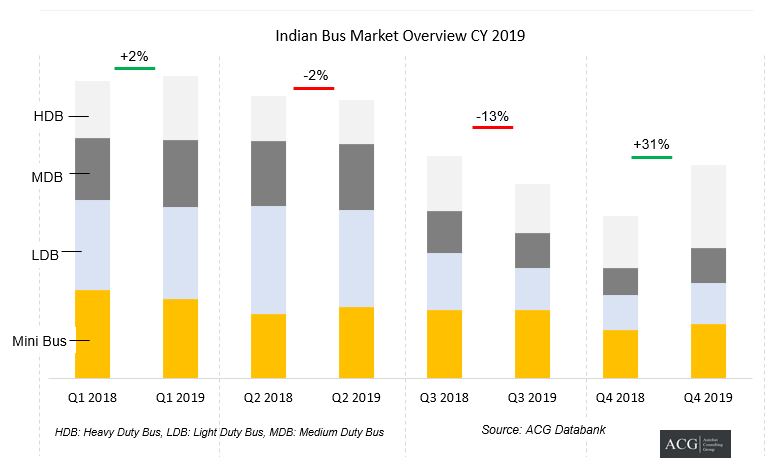

ACG released Indian Bus Market Analysis 2020 and Outlook report. It covers all critical areas of the Indian Bus Industry. While the Commercial Vehicle, Two Wheler, and Truck segments reported significant degrowth in CY 2019, the Indian Bus market holds a 2% growth in CY 2019 compared to CY 2018.

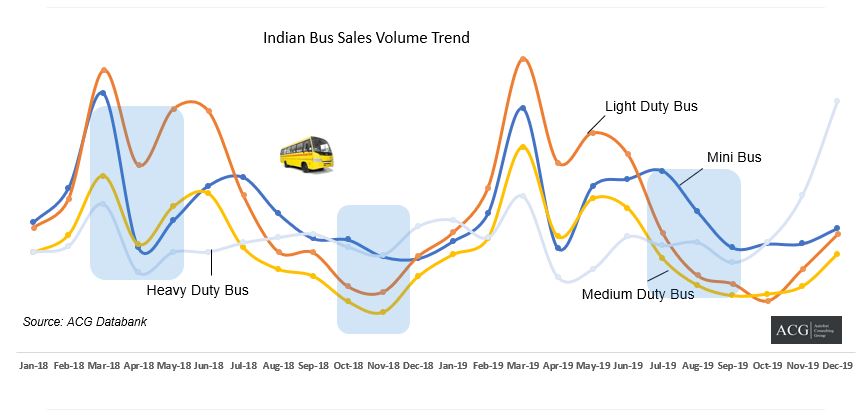

The Indian Bus market size grew to 94,000 units in CY 2019 and it’s observed that Q3 CY 2019 was the worst quarter of 2019. In Q1 CY 2019, only the Minibus division registered degrowth and in Q2 CY 2019, light-duty and heavy-duty bus segments recorded substantial degrowth.

In Q3 CY 2019, all segments attained a downfall but, somehow, in the last quarter of CY 2019, all bus segments showed growth compared to Q3 2018.

Segment Analysis:

The Bus Industry registered a 2% growth in CY 2019 compared to CY 2018. There are no variations in Mini and Medium Duty Bus segment share, however, Light duty Bus lost a 2% share, and the Heavy Duty Bus segment gained a 3% segment share in CY 2019.

OEMs Market Share Analysis:

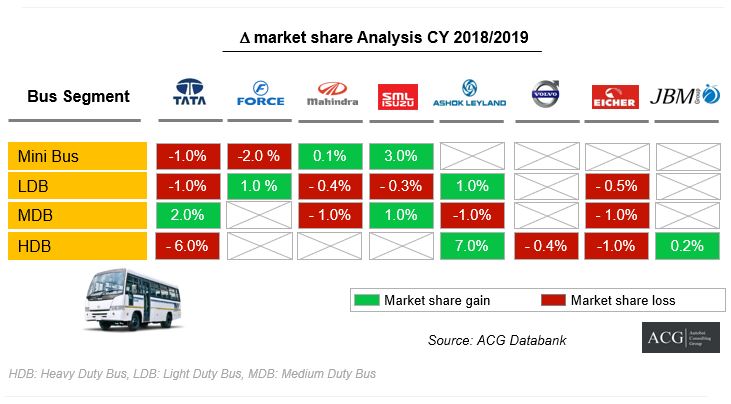

Under Heavy Duty Bus segment, Ashok Leyland gained a 7% market share, Tata Motors lost a 6% Market share, Eicher and Volvo lost insignificant market share in CY 2019. Ashok Leyland registered a 29% growth in CY 2018 compared to CY 2018.

Under the Medium Duty Bus segment, Ashok Leyland, Mahindra, and Eicher lost a 1% market share, but SML Isuzu and Tata Motors gained a 1% and 2% market share in CY 2019.

Under Light Duty Bus Segment, Ashok Leyland, and Force Motors gained a 1% market share; whereas Tata Motors lost 1% share, Mahindra, SML, and Eicher as well lost some insignificant market share. And, Ashok Leyland registered an 11% growth in CY 2019 comparted to CY 2018.

Coming to the Mini Bus segment, Market leader Force Motors lost a 2% market share, whereas SML Isuzu gained a 3% market share.

Market Dynamics:

The bus segment works on different market dynamics. Due to inflation rise, Traffic conjunction, upgraded Buses, many commuters began to use public transport for their daily use. STU like BEST, UPSRTC, and State Govt added Bus fleet in their portfolio. E-buses are also proposed by many organizations in densely populated cities like Surat, Bhopal, Delhi, Tamilnadu, and Agra.

Implementation of FASTag plays an important role in the bus preference for Intercity. Companies like Eicher, Ashok Leyland, and Tata Motors launched new bus models with new features & BS-VI emission norms. Now, it’s perceived as the most comfortable mode of transportation by passengers and Drivers.

Regulation:

New motor vehicles following Emission Standard Bharat Stage-IV norms, manufactured before the 1st April 2020 shall not be registered after the 30th June 2020: Provided that the new motor vehicles of categories M and N comply with Emission Standard Bharat Stage-IV norms, manufactured before the 1st April 2020 and sold in the form of drive away chassis, shall not be registered after the 30th September 2020.

There are new announcements declared by the Ministry of Road Transport And Highways on Self certification for Bus body code, Fully built bus, vehicle location tracking, and tourist buses.

Case Study: BharatBenz

Though BharatBenz has launched buses with superior comfort for Drivers and passengers with good pickup. The Bus is most suitable for the School and Staff bus application. However, there are certain issues concerning the growth of this bus. For instance, in case of breakdown, an electronics diagnosis system installed on the bus will detect the problem. However, only limited workers are available on the roadside, and the maintenance cost is high as well.

Key Highlights of the report:

- Indian Bus Market Size in Volume and Value

- OEM Strategy Analysis and Market share

- Top Selling Bus Models and their USP

- Budget, Premium, and Luxury Bus market Analysis

- Product Analysis – Product portfolio

- Fleet operators survey, Driver Survey, and, Passenger Survey

- Segment – School, Intercity, Intracity, School, Tourist, Govt, STU, Private, Defence etc

- Bus market Competitive analysis

- Segment-wise presence analysis

- Last 10 years trend and Forecast 2025

- Lengthwise Bus market Analysis, Size, Market Share

- State-wise Bus Market Assessment

- Engine Power, AC, Non AC bus Sales volume

- Most popular route

- TCO Analysis of different application

- Seating capacity wise wise Analysis

- Manual, Automatic, and Semi-Automatic Transmission market Analysis

- Bus Business Model