Indian Two Wheeler Industry Analysis 2022 is the combination of the Electric Two Wheeler and ICE Two Wheeler Segment.

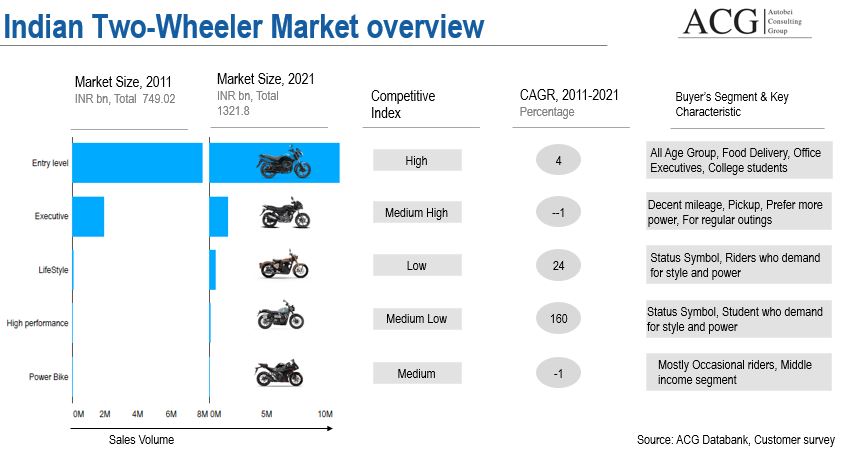

The Indian Two Wheeler unit in 2021 stands at about 13.7 million units which is equivalent to the sales volume of 2013 and is expected to register a 5 per cent CAGR over the next 5 years.

The year 2021 wasn’t a cakewalk for the Indian two-wheeler industry as it had to navigate across various hurdles to keep up the pace with its sales volume. However, the growth was a meager 3.5% up from the year CY 2020 which proved to be fatal for the two-wheeler industry. The two-wheeler industry has always had a significant foothold across the nation and the cumulative market value stood at 1321.8 billion INR during this year.

ACG has put forth various reasons that led to the disastrous outing for the two-wheeler industry, and the most prominent of them is the rapid and incessant shot up in customer preference to buy Electric Two Wheeler, fuel prices, massive inflation, and also the exorbitant interest rates. All these factors continued to trouble the already plagued two-wheeler industry and led to its downfall.

When we take a look at the market dynamics post-2018, we notice an astonishing fact that the scooter and motorcycle segment are mostly in tandem with the growth curve and the overall performance in the market.

The two-wheeler segment in India has enjoyed a flawless run in the market, thanks to the wide variety of product choices it offers to its customer base.

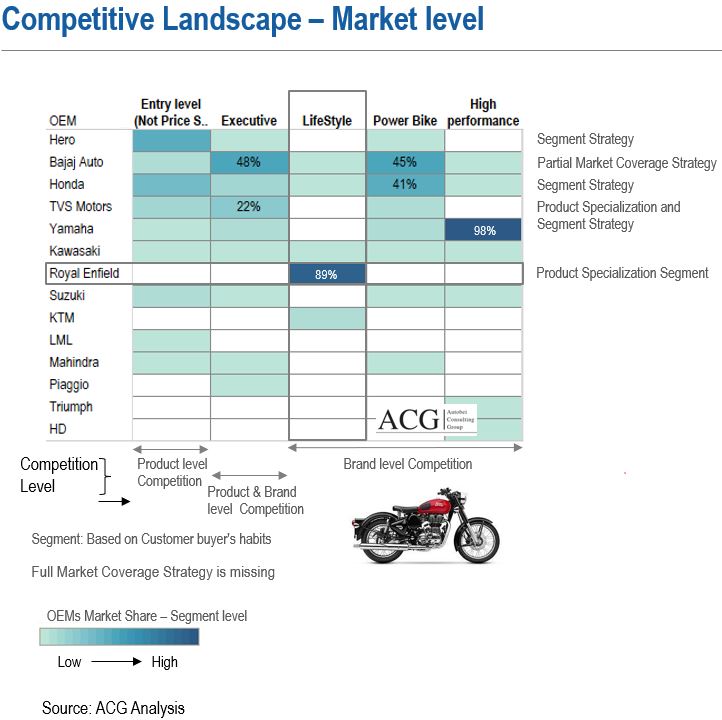

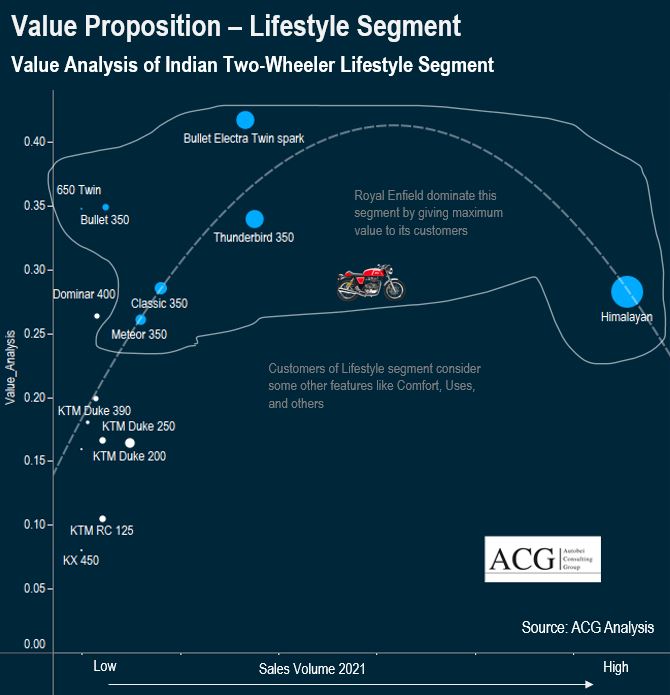

The two-wheeler segment can be broadly classified under 5 categories i.e Economy, Executive, High performance, Lifestyle, and Power Bike. Out of all the categories listed above, the economy and the executive category have established a firm hold in the market by amassing a record number of sales in the past. Their market presence stands at a whopping 93% as far as the year 2021 is considered. While the other categories have not been able to get big in the market but have decently performed as they all witnessed good growth in the yesteryear.

Taking a look at the growth curve of the various bike categories reveals an interesting insight that the overall growth rate has been encouraging. The entry-level segment has been able to record a CAGR of 4%, while its close competitor Executive faced a slash in its sales volume, which brought its growth to -1%. However, the lifestyle, high performance, and the power bike have made the most of the market opportunity and have amassed a growth of 24%, 160%, and -1% respectively during the last decade starting from the year 2011.

Road to owning a two-wheeler:

Procuring a two-wheeler to facilitating commuting needs has been the top priority for the Indian community at the moment. The buyers take into consideration various factors before zeroing in on their purchase call.

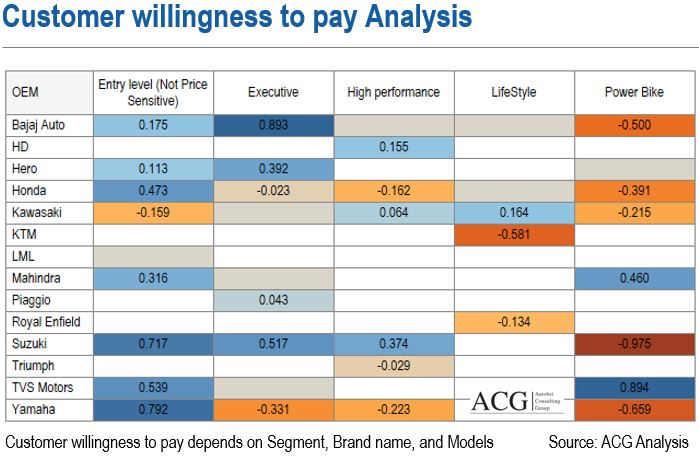

The key areas of consideration are price range, ergonomics and style, economy, status and prestige symbol, emotions, ease of comfort and convenience, and most importantly maintenance cost and safety. The weightage of these factors depends on the type of segment. Ultimately, the customer makes the final call in regards to procuring a two-wheeler.

The hierarchy of the factors that influence the purchase decision will vary from person to person, and the key areas like age and income of the buyer, gender, and most critically the geographical base play a critical role in influencing the buyer.

The report formulated from our end depicts the fine relation between the purchase decision of the buyer and the influence it has on the OEM’s market dynamics. The report also highlights the corrective action that needs to be inculcated for being able to build on the trust of the potential buyers.

Key factors contributing to the Purchase decision:

The marketing and the advertisement channels do constitute a major part in getting the traction from the customer base and thereby enhance the sales volume. The brands have started focusing on unravelling the various standout features of their product in a visual mode and this in turn has enabled them to reach a wide range of audiences. For instance, two-wheeler products like Pulsar and Apache have been periodically making the headlines by coming up with advertisements to showcase the product’s best-in-class power ability, seamless ride experience, and the confidence it instils in the rider.

Altogether, these advertisements have emerged as a strong medium to directly engage with the potential customer base. Taking a look at the ad conceptualized by Pulsar and Apache reveals that the brands are trying their best to attract customers to get their hands on the product and we will soon get to know whether the brands would be able to reap the best with this tactical Move.

The recently concluded study has revealed a scintillating insight that the Word of Mouth(WOM) stands tall in influencing the mindset of the buyers to make purchase-related decisions, it is then closely followed by the product visibility attributes which also attract the customers to own a brand. Both these factors cumulatively sum up to almost 75% of the influencing medium, out of which 40% is by the WOM and the rest is from the product attributes.

The key insights of this analysis are briefly listed below:

Sentiment Analysis:

It is one of the prime factors that have a good impact on the buyer, this analysis helps the brand to formulate a product strategy and a sales plan. Over the last half a decade the TVS brand has done commendably well in hitting the positive sentiment well.

Impact induced by the culture:

The profile of the person making the purchase decision: the two-wheeler industry has always been customer-driven. The industry has been able to quickly adapt itself to deliver to the needs of the customers, which has been a prominent reason for its flawless run in the market. Getting to understand the customer’s mindset is one of the keys to success.

The different ways in which the communication is sent across:

Communication amounts to the overall rise in the sales volume, as it strikes the right chord of the customer and influences them to buy a product. Communication across the two-wheeler industry is divided into 3 types i.e Points of Parity (POPs), Points of Difference (PODs), and Points of irrelevance ( POIs). All these 3 types of communication come together and render a good experience to the customer thereby contributing to the success of this two-wheeler segment. However, the influence of this communication factor is purely dependent on the customer’s mindset.

Impact by the surrounding culture:

Let’s take a look at the most luxurious two-wheeler brand i.e the Harley Davidson in the Indian context. We get to know that Harley Davidson has evolved to be one of the key prestige and status indications in the Indian scenario. The buyers usually get their hands on this product to enhance its popularity and traction in society rather than using it as a mainstream commuting option.

Taking a further keen look in regards to how the competition has turned out be in the two-wheeler industry for the last few years reveals an astounding point that the dominance of the two-wheeler segment is segment-specific, and even the segment leaders have been able to make the most of the market by maintaining a popular product chunk of not more than 2 to 3 two-wheeler models.

Case study analysis:

- Ola Impact, Market share, Customer experience, and its impact on the Electric Two Wheeler Industry and Overall Indian Two Wheeler segment

- The study conducted on a customer who previously owned a Bajaj Pulsar and went on to purchase a TVS Apache has revealed the various factors that influenced the owner to make his buying preference.

Key Highlights of the report: Electric Two Wheeler and IC Segment

- Indian Two-Wheeler Market Trend and Forecast 2030 – Electric Two-Wheeler and IC Two-Wheeler

- Used Two Wheeler Market Analysis

- Comparison of Electric Two Wheeler Products, Markets, Price, Product life cycle, Maintenance cost, Resale value, Getting a loan from Banks to buy a vehicle, Challenges, Opportunities, Forecast, OEM profile, Customer Acceptance, Customer expectations, Customer experience, Dealership difference, Selling Strategy, Technology, Key Features, and Design

- How buying and selling process is different for EV and IC Two-wheeler

- Customer willingness to pay for each brand and Model

- The average life of a Motorcycle, Scooter, and Electric Two Wheeler

- Demand Analysis – Long, Medium, and Short term

- Scenario Analysis of Changing Price, Specs, and Key Features

- Establish OEMs strategy to invest in Electric Two Wheeler Start-ups

- Product improvement Analysis – Engineering, Design, Quality, Reliability, Features

- How Honda and Yamaha are leading the innovation to win the trust of the buyers

- Market Fit and Go-To-Market Strategy Analysis

- How to develop a Product roadmap for an Electric Two Wheeler

- Indian Two Wheeler Segment Analysis – Market Share, Volume, Growth, Price bracket, Number of Models, Model Distribution Analysis

- Motorcycle and Scooter Customer profile and map with purchase criteria

- Income and Age group and their buying pattern

- Uses of Motorcycle and Scooter

- Maintenance Cost Analysis of Major Models

- Brand Perception of Bajaj Auto, Hero, Honda, TVS, Harley Davidson, Royal Enfield, Yamaha, Piaggio, Ola, and others

- Two Wheeler Market Dynamics of Rural and Urban India

- State wise EV Policy and Penetration Forecast

- Key growth drivers of Electric Two Wheeler and IC two-wheeler

- Customer preference to select the specific Models

- Market Attractiveness for each Two Wheeler Segment

- Top Selling Models and Why Customers Prefer Those Top Models

- Indian Two Wheeler Competitive Assessment tool

- Communication Style of Major OEMs and Marketing Strategy

- Opportunity Analysis based on Low growth, Low Market Share, and Product life cycle

- How some models are replacing segment leader Models