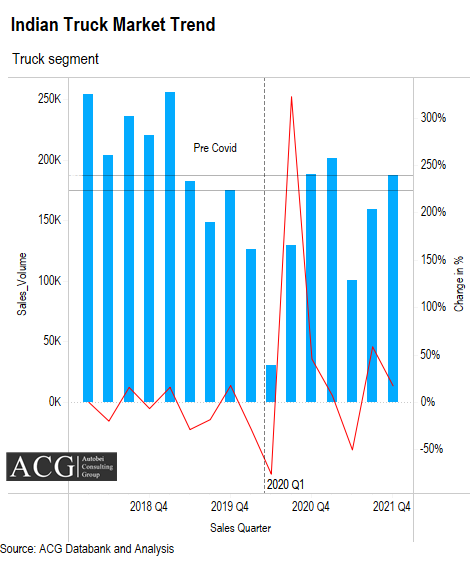

The post-pandemic period aided the automobile industry to rejuvenate itself by boosting its growth and rendering them opportunities to scale better. Taking a look at the Indian truck market, we observe that the overall performance for this sector was better as the sales figure shot to 0.64 million from 0.47 million units starting from 2020.

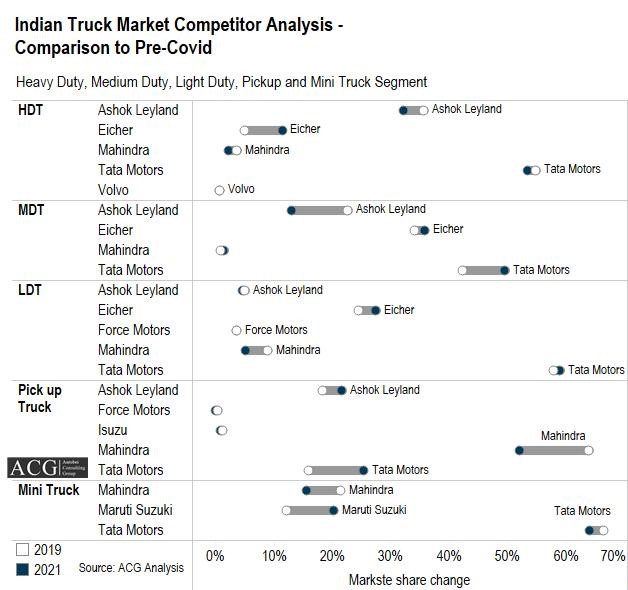

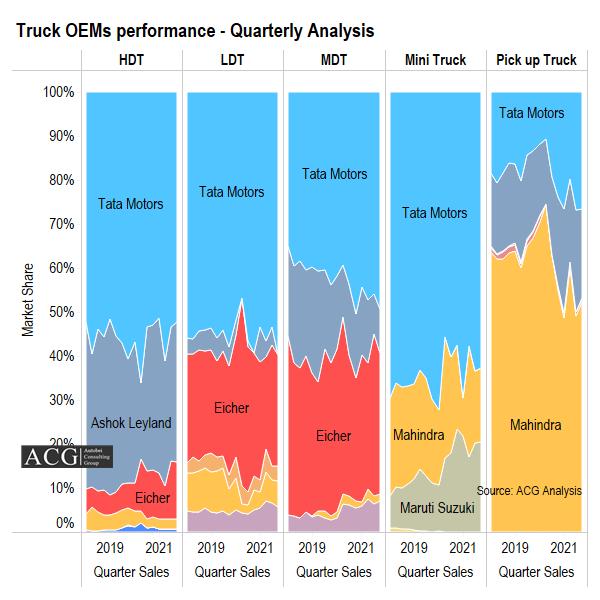

After the Covid impact, some OEMs are performing better than the Pre Covid time. Maruti Suzuki, Ashok Leyland, and Tata Motors increased their market share in the different Truck segments. Mahindra lost in almost every truck segment.

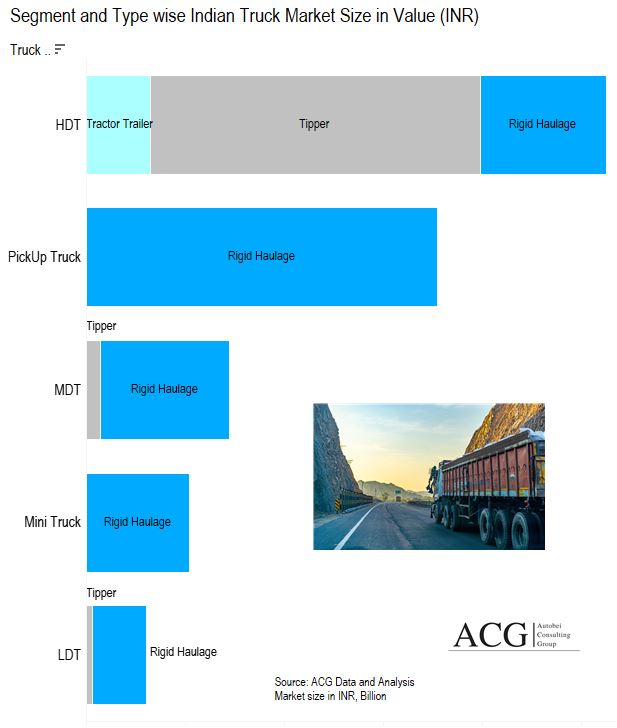

Indian Truck market size in terms of Value (INR):

The Heavy-Duty Truck segment is the largest one in terms of Value. In Tipper segment is the dominant segment with the largest market size in terms of value.

The growth rate of the Indian Truck Market recorded in 2021 stood at 37% compared to CY 2020. Also during this period, the Heavy-duty truck segment performed better in the 4th quarter, and this rate of growth is exceedingly well as compared to the pre-pandemic times.

The recent rise in the omicron cases globally has played a spoilsport by considerably bringing down the sales of Mini truck, LDT, and HDT. Many customers have pulled from their plans of owning these commercial vehicles due to the COVID scare and the unforeseen future ahead.

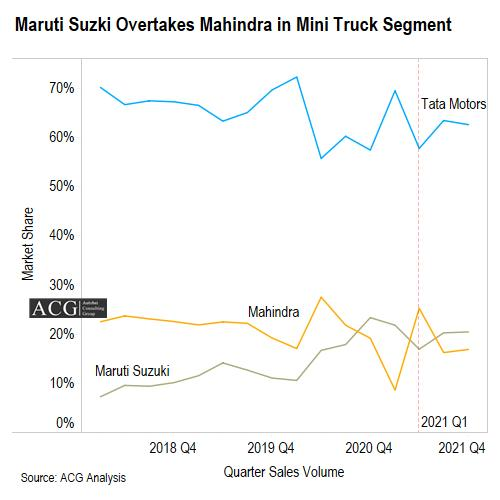

In Mini Truck Segment, Maruti Suzuki overtakes Mahindra in Q3 CY 2021.ACG published a report on how Maruti Suzuki’s strategy to become the market leader in this segment.

Also, check our exclusive Report on the Indian Electric Truck market Assessment and Forecast

As mentioned earlier the Q4 and Q3 in 2021 paved a way for some tremendous growth across segments. The Indian tipper market saw its growth climbing up by 15%, and even the Rigid Haulage and Tractor segment put up a commendable performance in bringing their sales and recording a growth of 18% and 21% respectively.

The growth rate that was witnessed in the above-mentioned segments couldn’t create magic in the Pickup Truck segment. Ever since the start of 2020, this segment is facing tough times and its market share is diminishing drastically. No considerable growth was recorded even during the Q3 and Q4 of 2021, and this period was almost standstill as far as this specific segment is concerned.

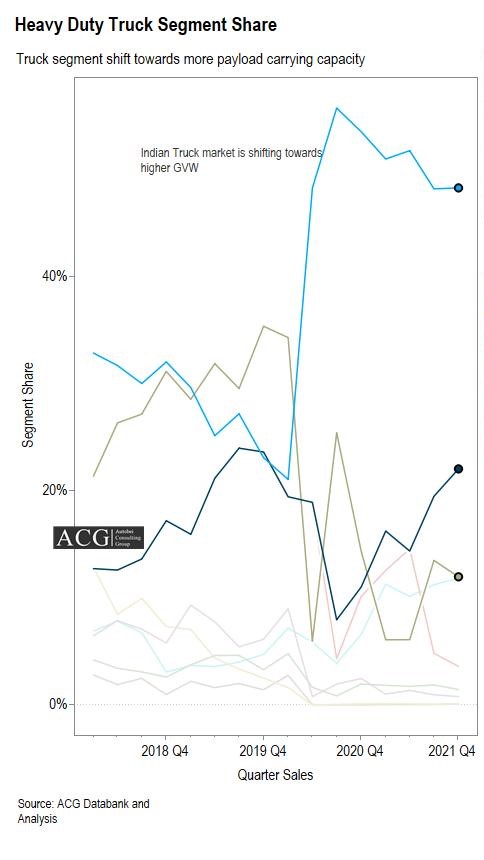

Taking a look at the Tipper segment reveals to us that the growth particularly in this segment is not linear and is oscillating from 10 % to 8% throughout the last two years i.e from 2020 to 2021. Majorly, the Tipper Market has its roots in the GVW 18.5T to 34T category and they tend to have a firm hold on its overall operations and business. The current scenario has opened new avenues for the Construction and Mining industry. Nevertheless, the demand has shot up sky-high. This has led to the creation of heavy market demands for the various Tipper models comprising even the premium segment and the MDT tipper. The construction and other activities related to Real estate would continue to excel in the future thus providing a constant growth curve for this segment.

The heavy-duty tipper segment has been backed by various formidable key performing brands in the industry. Tata Motors and Ashok Leyland are the prominent ones in the segment and have always held the top position irrespective of the market situation. Their firm hold on the market is evident from their total Market presence in this segment. Tata enjoys an overall presence of 49%, while Ashok Leyland is in 2nd position with a 40% market share. Tata’s flamboyant run in the market continued even to the 18.5 to 28T GVW segment and their dominance seems to just get stronger shortly. Eicher has also evolved to be a key contributor in the segment by being at the 2nd spot. As we move towards the 34 to 40T segment, Tata has been successful in holding a key spot in this too. And they are even more prominent in this segment as their share stands at a whopping 58%. Another premium brand Volvo is trying to get things right in this segment and has managed to get a 12% market share over the 4th quarter of the last year.

The market dynamics in the MDT segment are very different compared to the other segments we have just discussed. Tata couldn’t continue their uninterrupted streak of exceeding its market hold. Their market share of 80% in the 2nd quarter of 2019 was reduced to a meager 40% by the last quarter of 2021. This segment is now being led by Ashok Leyland as they hold a market share of about 25% currently. It is then closely followed by Eicher, which climbed to this spot by taking over about 8% from its close competitor Tata motors. Overall, Ashok Leyland continues to hold a vital position even in the 10 to 14.5T segment by being able to turn around the overall market presence of 50% and 74% respectively.

The market dynamics in the MDT segment are very different compared to the other segments we have just discussed. Tata couldn’t continue their uninterrupted streak of exceeding its market hold. Their market share of 80% in the 2nd quarter of 2019 was reduced to a meager 40% by the last quarter of 2021. This segment is now being led by Ashok Leyland as they hold a market share of about 25% currently. It is then closely followed by Eicher, which climbed to this spot by taking over about 8% from its close competitor Tata motors. Overall, Ashok Leyland continues to hold a vital position even in the 10 to 14.5T segment by being able to turn around the overall market presence of 50% and 74% respectively.

Another prominent player in this list is the Rigid Haulage. Over this segment, the 14.5 to 16.2T has garnered much attention from the customers, and by the virtue of this, it has been able to establish itself as one of the biggest and exceedingly growing segments. These models have found their extensive application in the e-commerce industry, and the growing demand for the same has opened up a new growth journey for this segment.

The credit for being the gigantic segment in the Rigid Haulage goes to the 18.5T to 28T and 45 to 49T segments. Whereas the quick growth in this truck category has been recorded by the 34 to 40T segment as they have consistently maintained their growth curve at 48% for the two consecutive quarters of the year 2021.

The sales volume of Pickup Truck has come down in 2021 Q1 and Q2 but bounced back in Q4 2021. Also, the difference seen between LDT and MDT is not that significant taking into consideration the pre-pandemic time and the last quarter of 2021.

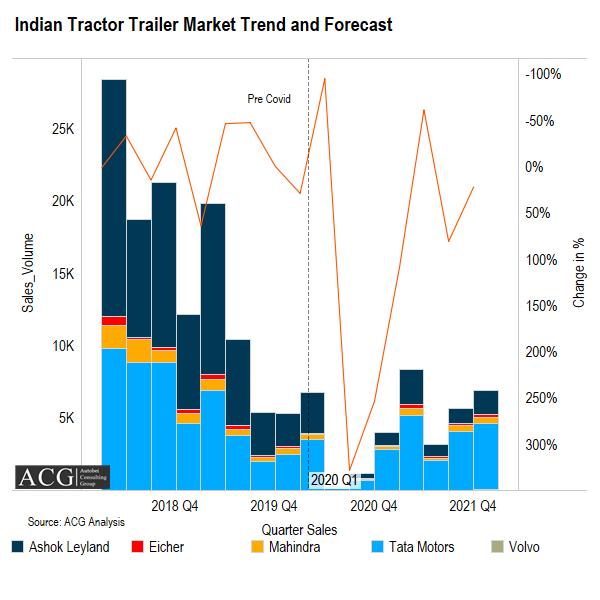

The previously discussed Rigid Haulage segment is experiencing a never-before boom in the market at the moment. And the Tractor trailer model couldn’t get the expected turnover in the present market scenario and its sales figure hasn’t seen a significant rise starting from the 1st quarter of 2018.

Other reports:

Contact info@autobei.com to buy the Full Report