Hero MotoCorp continued to be one of the leaders of the two-wheeler market in India for almost 20 years even after the breakup with Honda. After the breakup, the existing Honda products were kept but a few new products were included so as to enhance their overall product portfolio. But somehow the dealership across the country was not comfortable and started leaving the dealerships. One of the main reasons behind it was the issue of viability. It is quite surprising to know that in spite of being at the top of the sales volume, the dealers are finding the difficulty to keep service revenue at a high rate.

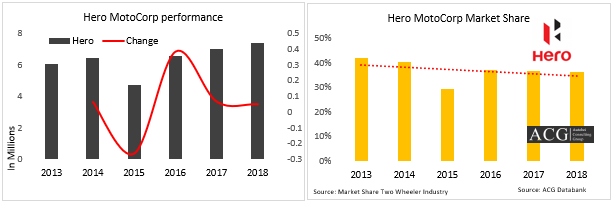

Hero registered 5 percent growth in CY 2018 compared to CY 2017 with 37 percent market share.

It is true that after the breakup with Honda, the company has tightened the supply of materials directly to the dealerships from the vendors. The engine oil is a very good example in this regard. The dealers are not allowed to procure oils from any of the local sources but they should get it only from the company. This results in the rapid downfall of the profits. In an addition to this, the workshop labor charges have also been directly monitored by solely company which eliminated the chances of any dealer to do any malpractices. This might be a very good step towards enhanced customer satisfaction but too much tightening on all petty issues brings about dissatisfaction among a number of dealerships. All of the manufacturing companies are aware of the fact that the dealerships are their first customer and Hero is well aware of the same.

After the detailed research, it is revealed that viability is not the exact issue but it is necessarily the drop in the service revenue. The dealers are actually habituated to make some money from the services offered but the sudden drop in this particular income due to the strict monitoring by the company, the dealers have started comparing themselves with other brand dealerships which made them come to a conclusion that they are being ill-treated. Hero also announced awards for the best-performing dealers based on the customer satisfaction survey, but the dealers are basically looking for a regular income by offering paid services rather than the one time award.

If we have a detailed look at the service centers or the sub dealerships, they perform much better as compared to most of the main dealerships since they need not block the money on new vehicles. They take vehicles from the main dealerships and settle the payment once the vehicle sold. Even if the margin of sales is on the lower side which is ranging somewhere between 1,000 INR to 1,500 INR per vehicle sold, no risks are involved here. Similarly, the revenue on the spare parts, the service volume considerably increases at the service centers and the sub dealerships at the time when the main dealerships nearby quit. Now, these sub-dealers are en-cashing the situations at their best.

As far as products are concerned, Splendour, Passion, HF Deluxe and Glamour still lie within the top product range which is being sold across the country. As long as the consumers are getting the same quality product, it is just immaterial for consumers, whether the product is from “Hero” or from “Hero Honda”. At the time of interaction with a number of customers, it can be clearly understood that they are still buying Hero products because of good mileage and service network. Even a very few of the customers feel that their Scooter (Pleasure, Maestro) is giving more mileage as compared to nearest competitors. But some of the high-end product like Extreme-200 have disappointed the customers a bit because of the quality of the product. Excessive vibration of the engine is another of the issue which the customers have noted and thus by doing necessary corrections.

Hero MotoCorp needs to make its effective presence in the Premium segment.

Please contact us for full report.