The U.S. Electric Car Market Forecast is a detailed Pricing analytical report that covers every aspect of the EV market. The US Market registered 1.3 million electric light-duty vehicles, including Electric Pickup Trucks. The CAGR between 2020 and 2024 is 24.6% and is expected to register 11.3% by 2030.

We have adjusted the USA Electric Vehicle market after the Trump Government imposed it. Two scenarios look possible.

If the Trump administration imposes tariffs on electric vehicles and components, this may increase production costs, reduce demand, and disrupt supply chains. While the policy may aim to fulfill the demand by increasing local manufacturing capacity, it risks slowing EV adoption, raising consumer prices, and creating uncertainty for automakers and suppliers in the short term. The US still relies on some Electric Vehicle components in the European Market, such as the Traction Power Module. Due to a supply shortage, some U.S. OEMs, such as Rivian, are buying power Modules from Germany.

Rolling Electric Vehicle in the USA:

The cumulative EV sales volume has grown significantly, from 0.41 million in 2019 to 4.80 million in 2024, indicating a strong upward trend in EV adoption in the USA after multiple new EV Models were launched. Sales growth has gained momentum since 2021, increasing rapidly each year.

The rolling sum of Electric Vehicle sales from 2019 to 2024 highlights exponential growth, strong market momentum, and increasing consumer confidence in EV adoption, but is still low compared to market expectations. The significant jump in 2023-2024 indicates that electric vehicles (EVs) are gaining popularity and have become the preferred choice for customers.

US Electric Vehicle Competitive Landscape:

Tesla maintains a Leadership position but faces tough Competition in the US Electric Car Industry. It holds its leading position by increasing sales from $499,550 in 2020 to $633,762 in 2024.

Despite its growth, traditional OEMs such as GM, Ford, Hyundai, and BMW have significantly expanded their market share in the electric vehicle (EV) market.

The Electric Vehicle industry has shifted from a Tesla-dominated market to a more competitive landscape, with traditional automakers and startups gaining traction. Rivian is gaining a firm grip on the premium SUV and Pickup Truck Market.

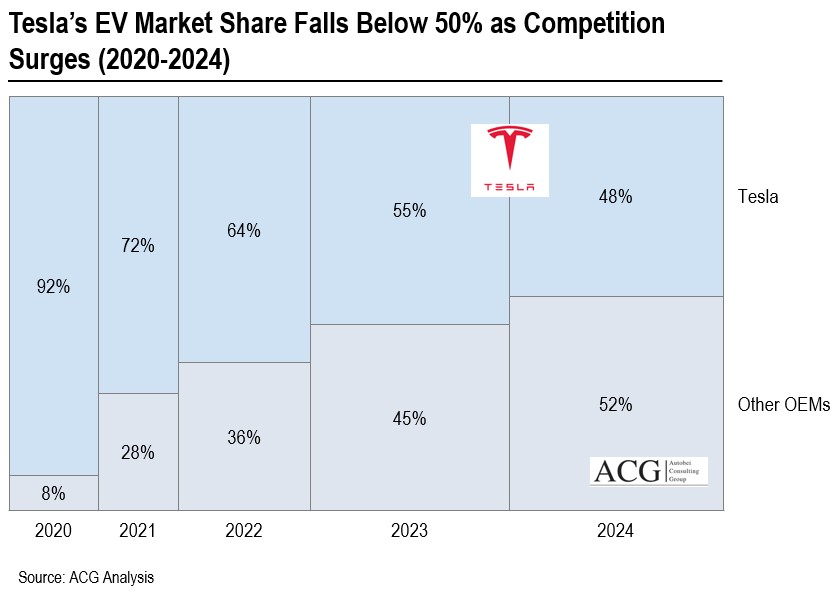

US Electric Vehicle Market Share 2020-2024:

The US Electric Vehicle market share has undergone significant changes in the last five years. In 2020, Tesla was dominating the EV market with a 92% market share. In 2024, other traditional OEMs are also expected to enter the EV segment.

Why Tesla’s Market Share Shrinks:

Tesla’s market share dropped 16% despite maintaining a 10% CAGR growth.GM is the biggest market share gainer. The Chevrolet Equinox, Cadillac Lyriq, and Chevrolet Blazer are the top models with a significant presence in the Electric small and regular SUV segments in the USA.

GM, Hyundai, BMW, and Mercedes are showing positive market share growth while maintaining a double-digit compound annual growth rate (CAGR).

Rivian, Lucid, and Nissan have positive growth trajectories but modest market share increases.

VW and Geely are struggling in terms of both market share and compound annual growth rate (CAGR).VW must launch new EV models in the USA market to gain market share.

The USA EV market is shifting from a Tesla-dominated landscape to a more diversified competitive field. Meanwhile, brands like Honda and Toyota are growing rapidly but still hold a smaller share of the total market. Volkswagen and Geely’s weak performance highlights challenges in keeping pace with the evolving Electric Vehicle market.

Tesla’s market share has significantly declined from 92% in 2020 to 48% in 2024. There are two reasons behind it. There is intense competition from other OEMs, and no new products have been launched except for the Cyber Truck in the last couple of years.

Tesla is facing two types of challenges. First, it’s product degradation, and second, to launch new Models. The external challenge is that traditional OEMs launch new EV models that customers accept well.

Every year, Tesla loses its market share in the US market. As other brands launch new EV models, Tesla loses its grip. Customers have more choices in choosing models.

Electric Vehicle Market Shift in the US: Domestic Leaders Face Growing Competition:

U.S. brands dominate the Electric Vehicle market in the USA, growing from 520K in 2020 to over 900K in 2024, driven by strong domestic demand and incentives. German and South Korean brands are gaining traction, with sales reaching 130,000 and 124,000 in 2024.

Japanese brands lag, peaking at 47K in 2023, reflecting a slower Electric Vehicle transition. Chinese brands remain primarily absent, likely due to trade restrictions and brand perception.

U.S. automakers dominate their home market, while German and Korean brands are gaining market share. Japanese and Chinese brands struggle to gain significant market share in the U.S. electric vehicle market.

The market share of U.S.-origin Electric Vehicle brands in the U.S. market has steadily declined, dropping from 95.4% in 2020 to 69.2% in 2024. Tesla is one reason for the declining market share of USA-based automakers. This indicates growing competition from European and Asian Brands.

German brands have made the most significant gains, rising from 2.6% in 2020 to 10% in 2024 and peaking at 13.5% in 2023. This suggests strong consumer adoption of premium and performance-oriented electric vehicles (EVs).

South Korean brands have experienced steady growth, reaching a 9.5% market share in 2024. Hyundai and Kia are known for offering better value against their selling price.

Japanese brands also increased their market share from 8.6% in 2022 to 9.2% in 2024.

Like the EU, the US market is difficult for Chinese Automakers due to geopolitical issues and brand acceptance.

The Rapid Growth of Electric Vehicle Models Across Automakers:

In 2019, only a few brands had Electric Vehicle models, with Tesla leading with two models, followed by Chevrolet, BMW, Audi, VW, and Nissan, each having 1 model. By 2024, the number of electric vehicle (EV) models per brand has increased significantly, with some brands now offering multiple EV models, indicating wider adoption of EVs across automakers.

By 2024, the number of Electric Vehicle models per brand has increased significantly, showing wider EV adoption across automakers.

Kia, Genesis, Ford, Rivian, Toyota, Porsche, GMC, and Cadillac now have multiple EV models, whereas most had none in 2019.

Mapping Electric Vehicle Consumer Behavior: What Drives Buyers Across Segments:

The U.S. electric vehicle market caters to a diverse range of consumers, from budget-conscious buyers focused on affordability to high-end customers seeking luxury, performance, or sustainability. The mid-tier and luxury segments remain the most competitive, while eco-conscious luxury is emerging as a niche yet growing market.

Mid-Tier Dominates Top 10 Electric Vehicle Models, Highlighting Demand for Balanced Pricing:

The Mid-Tier segment dominates the market. Currently, 18 variants of the top 10 models are available. It shows that consumers prefer EV models, which are in the middle price range. The Luxury segment also holds a strong presence, with 12 model variants, indicating that premium electric vehicles (EVs) remain in high demand, likely driven by brands such as Tesla, Mercedes, and BMW. Tesla’s New Model Y will also be in the Luxury segment. Most Luxury or high-end EVs have an 800V vehicle architecture with SiC semiconductors.

In contrast, the Entry-Level segment has only one model variant in the top 10 Models. Other models, like the Nissan Leaf, are available in this segment. The mid-tier segment has the highest number of models and variants. This is a rapidly growing segment in the electric vehicle (EV) market. OEMs are focusing on this segment since it offers better value for money.

US Electric Vehicle Pricing Strategy and Distribution: Top 10 Models and Variants

Entry-Level Segment: The Tesla Model 3 is the only leading sub-$30,000 option, making it one of the most affordable electric vehicles (EVs) on the market. The lack of competitors in this range suggests a gap in budget-friendly electric vehicle (EV) offerings. The top 10 model price points of U.S. electric vehicles are explained in the chart below.

Mid-Tier Segment: This is the most competitive electric vehicle (EV) segment, featuring models such as the Tesla Model Y, Ford Mustang Mach-E, Hyundai Ioniq 5, Honda Prologue, and Chevrolet Equinox. This segment aligns with the needs and requirements of most electric vehicle (EV) customers.

EVs below USD 30K are rare, but if more affordable options enter the market, they could create a new sweet spot.

Luxury EVs (USD 80 K+) cater to premium buyers but have a smaller target audience.

Electric Vehicle Segment Level Pricing Strategy:

The median price across all segments is approximately USD 50,000, a reference point for price comparisons.

Pickup Trucks

- The Tesla Cybertruck and Ford F-150 Lightning dominate this segment, with prices ranging from $60,000 to over $100,000.

- The Tesla Cybertruck has the highest pricing variation, with some models exceeding $100,000.

- The Ford F-150 Lightning offers a more stable price range, ranging from USD 70,000 to USD 90,000, with some lower-end variants priced closer to USD 60,000.

Sedans

- The Tesla Model 3 is the only sedan Model in the top ten EV models. Minimal

SUVs

- The Rivian R1S variant is the most expensive SUV. The highest variants cost nearly USD 100,000. The vehicle is equipped with four Power Modules.

- The Cadillac Lyriq, Mustang Mach-E, and Hyundai Ioniq models are priced above the median price.

- The Tesla Model Y is a successful model at a competitive price. The Model Y is positioned at the lowest point in the SUV segment.

Key findings:

- Pickup Trucks and SUVs have the highest price dispersion, indicating a broader price range across different trims and configurations.

- Sedans remain the most price-stable category, with prices tightly concentrated around USD 30,000 – USD 40,000.

- Luxury SUVs like Rivian R1S and Cadillac Lyriq are priced significantly higher than the median, making them the premium choices in this segment.

- Tesla dominates affordability in both the SUV and sedan segments, positioning itself as a cost-effective alternative compared to competitors.

- The Tesla Model 3 leads this category, with prices tightly clustered between USD 30,000 and USD 40,000.

This is the only sedan in the dataset, and its price is significantly below the overall median, making sedans the most affordable segment.

Luxury & Premium Segment: The Tesla Cybertruck, Ford F-150 Lightning, Rivian R1S, and Cadillac Lyriq dominate this space. These vehicles prioritize performance, technology, and larger body styles, such as pickup trucks and SUVs, targeting high-income groups.

Automakers need to develop entry-level electric vehicles (EVs) for the US Automotive market.

EV Pricing Drivers:

There are three main pricing drivers: technical, Functional, and Emotional. If the OEMs can satisfy either one or all of these drivers, then the brand can connect with the customers.

Top 10 EV Market Trends: Luxury & Mid-Tier Models Dominate, Entry-Level Options Remain Scarce:

1. Luxury and High-Performance EVs Dominate the Upper Price Range

The Rivian Ascend (USD 85,000 — USD 110,000) and Tesla Cybertruck (USD 95,000 — USD 105,000) are among the most expensive models. Both models dominate the premium SUV and pickup truck segments in the high-end EV market.

The Ford F-150 Lightning Platinum and LARIAT models (USD 75,000- USD 85,000) compete in the luxury truck segment, with pricing varying significantly.

2. Mid-Tier EVs Exhibit Price Stability

Models like the Ford GT, Honda Touring, and Hyundai SEL are priced between USD 50,000 and $60,000. This pricing strategy makes Ford and Hyundai strong brands in their respective categories. The Tesla Model 3 Performance, Model Y AWD, and Chevrolet RS are priced between USD 40,000 and $55,000. This price range strikes a balance between affordability and performance in the US market.

3. Affordable EVs Are Limited but Well-Defined The The

Tesla Model 3 Long Range RWD variant is among the most affordable EVs in this segment.

4. Ford and Tesla Show the Widest Price Range

Tesla and Ford offer electric vehicles (EVs) in a range of price points to cater to various segments.

Tesla’s price range spans from USD 30,000 (Model 3 RWD) to USD 105,000 (Cybertruck), covering a broad target segment.

The Electric Vehicle market remains polarized between premium and mid-tier models, with few affordable options. Ford and Tesla lead in price diversity, while Chevrolet provides some of the best budget segment models.

Key Price Influencers of Top 10 Electric Vehicle Models:

When the battery size of the Top 10 EV models and variants increases by 14.97 kWh, the price rises by USD 17,770. When the range decreases by 30.52 miles, the price increases by USD 5,470. Premium trims may have a shorter range but enhanced features, making them more expensive. Including trim price variants in the analysis highlights how higher trims with larger batteries cost more, while some luxury models have a lower range but premium pricing.

Competitor Landscape of Electric Vehicles in the USA:

GM’s Electric Future: Strong Sales Growth:

GM’s Electric Vehicle sales have experienced a significant CAGR of 47.4%. New Product launches are the key driver behind the company’s electric vehicle (EV) growth.

Market share has also increased year over year, rising from 4% in 2020 to 9% in 2024, reflecting GM’s ability to capture a larger portion of the competitive EV segment.

Chevrolet leads GM’s Electric Vehicle sales, consistently increasing sales volume to surpass 68,000 units in 2024 and maintaining a 5.2% market share. Cadillac exhibits rapid growth, achieving a 2.2% market share in 2024, which reflects strong demand for luxury electric vehicles. GMC has also started gaining traction, growing to a 1.2% market share in 2024, with its electric pickup truck and SUV product range. Brightdrop, GM’s commercial EV brand, has a small but emerging presence. GM is electrifying the delivery vehicle segment.

GM Market Share 2024:

Chevrolet leads GM’s Electric Vehicle lineup with a 5.2% market share. Cadillac follows with 2.2%, indicating strong demand for luxury EVs. GMC holds a 1.2% market share, primarily driven by its electric trucks and SUVs. Brightdrop remains small at 0.1%, indicating slow adoption in commercial EVs.

Chevrolet Equinox and Cadillac Lyriq are top-selling EV models. Around half of the GM’s sales are coming from these two models. Both Models have a 2.2% market share. Chevrolet Blazer follows at 1.8%, while GMC Hummer SUV/Truck holds 1.1%. Chevy Bolt (0.7%) and Chevrolet Silverado (0.6%) contribute smaller shares.

Chevrolet, Cadillac, and GMC led GM’s electric vehicle growth. The Equinox, Lyriq, and Blazer dominate sales. Brightdrop is still in its early stages.

Ford’s EV Expansion: Rising Sales Amid Market Dynamics:

/> />

/> />

Ford’s Electric Vehicle sales showed a compound annual growth rate (CAGR) of 53.2% from 2021 to 2024, which is impressive growth. The company’s market share increased from 5.5% to 7.5% between 2021 and 2025.

The electric Vehicle market share stands at 7.5%, with the Mustang Mach-E leading at 3.9%, followed by the F-150 Lightning at 2.6% and the E-Transit at 1.0%. The Mustang Mach-E remains the most substantial contributor to Ford’s Electric Vehicle presence, while the F-150 Lightning and E-Transit show steady market penetration.

Rivian’s EV Surge: Strong Growth but Facing Challenges:

Rivian’s Electric Vehicle sales have experienced remarkable growth, achieving a compound annual growth rate (CAGR) of 59.3% from 2022 to 2024. Sales volume surged significantly in 2022 and 2023, stabilizing in 2024 at around 60,000 units. Market share increased from 0.1% in 2021 to 4.0% in 2023, then declined slightly to 3.9% in 2024.

The power Module supply chain is one of the company’s major issues. Semikron Danfoss is one of Rivian’s major suppliers.

Rivian’s R1S SUV leads its sales mix with a 2.1% market share, making it the brand’s best-selling model. The price of this model starts from USD 75,900. The EDV500/700 electric delivery vans account for 1.0%, indicating Rivian’s presence in the commercial electric vehicle (EV) segment. The R1T electric pickup truck contributes 0.8%, indicating relatively lower traction compared to the SUV segment. The market share showed its substantial presence in the SUV segment compared to the commercial segment.

Tesla Faces Intensifying Competition in its home ground:

Tesla’s sales volume in the USA market grew at a CAGR of 6.1% from 2020 to 2024, which is slow compared to its competitors. However, its market share has continued to decline, dropping from 92% in 2020 to 48% in 2024. Tesla lost 44% of its market share in the last five years. New launches by other OEMs, combined with Tesla’s lack of new launches, are the primary reasons for the decline in its market share.

The Tesla Model Y is the leading model in all key electric vehicle (EV) markets, including the US, EU, and China. Model Y is the leading model in Tesla’s portfolio. Tesla is set to launch the New Model Y at $46,500. The company is capitalizing on the popularity of its Model Y. The Cybertruck has unique features and key specs in this segment. The Tesla Cybertruck has a 3.0% market share, indicating its acceptance in the USA. The Tesla Model X and Model S hold significantly smaller shares, at 1.5% and 0.9%, respectively.

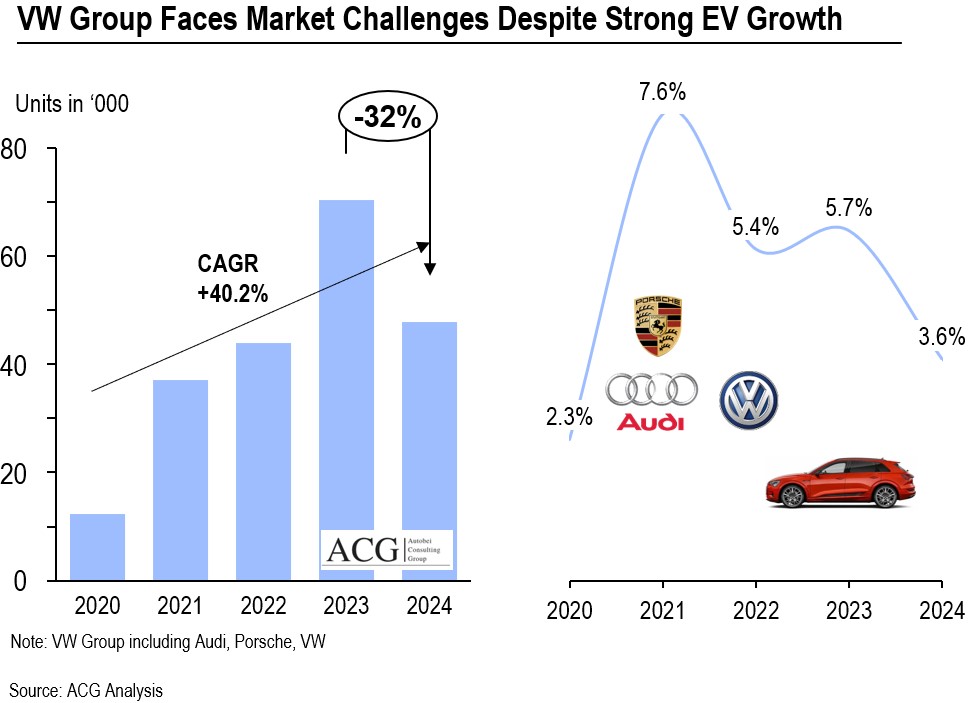

VW Group’s EV Sales Peak, Then Decline by 32% in 2024:

The Volkswagen Group, comprising Audi, Porsche, and Volkswagen, has demonstrated a strong 40.2% compound annual growth rate (CAGR) in Electric Vehicle sales from 2020 to 2024. The market share of the Volkswagen Group decreased from 2021 to 2024.

The Volkswagen Group, comprising Audi, Porsche, and Volkswagen, experienced fluctuating Electric Vehicle sales trends from 2020 to 2024. Audi had a strong initial market presence, peaking in 2023 before experiencing a slight decline in 2024. The three brands of VW Group have different product positions, Pricing, and target customer segments.

Audi leads with a 1.8% market share. Audi has the largest number of electric vehicle models, one of the key reasons Audi leads the Volkswagen Group in the US electric vehicle market. VW follows with 1.4%, while Porsche holds 0.5%. The VW ID.4 dominates with a 1.3% share, contributing the most to VW’s overall share. The price of the Volkswagen ID.4 ranges from $46,520 to $58,720, depending on the trim and variant.

Audi’s top models are the Q4 e-tron (0.9%) and Q8 e-tron (0.6%), which show strong brand performance. The Q4 e-tron price starts from USD 49,800. Porsche’s Taycan (0.4%) remains its most significant Electric Vehicle but has a smaller footprint. The price range of the Taycon lies between USD 99,400 and 149,800. Models like ID. Buzz, Q6 e-tron, and Porsche e-tron contribute to a diversified portfolio but have lower individual market penetration.

Audi’s top models are the Q4 e-tron (0.9%) and Q8 e-tron (0.6%), which show strong brand performance. The Q4 e-tron price starts from USD 49,800. Porsche’s Taycan (0.4%) remains its most significant Electric Vehicle but has a smaller footprint. The price range of the Taycon lies between USD 99,400 and 149,800. Models like ID. Buzz, Q6 e-tron, and Porsche e-tron contribute to a diversified portfolio but have lower individual market penetration.

BMW EV Growth Accelerates with 138% CAGR:

BMW’s Electric Vehicle sales have proliferated. The CAGR from 2020 to 2024 is 138%. In 2024, sales rose by 184% compared to 2022. Market share increased from 0.3% in 2020 to 4.2% in 2024. BMW’s growth is accelerating, making it a leading player in the electric vehicle market. BMW utilizes highly efficient car components, such as semiconductors, inverters, and Power modules.

BMW’s Electric Vehicle sales touched 54,647 units in 2024, while Mini’s remained stable, averaging around 3,000 units from 2022 to 2024. BMW’s rapid growth contrasts with Mini’s steady, yet lower-volume, presence in the Electric Vehicle market.

The BMW i4 leads the lineup with a 1.8% market share, followed by the BMW at 1.2% and the BMW i5 at 0.7%. The price of the BMW i4 ranges from $52,800 to $70,700. The BMWiX is more expensive than the i4.

The iX’s price ranges from USD 87,250 to USD 111,500. It is the second-largest and best-selling EV model in the BMW group. The i4 and iX models account for more than 50% of BMW’s EV sales in the US. The brand focuses on EV penetration by adopting the most advanced and reliable technology.

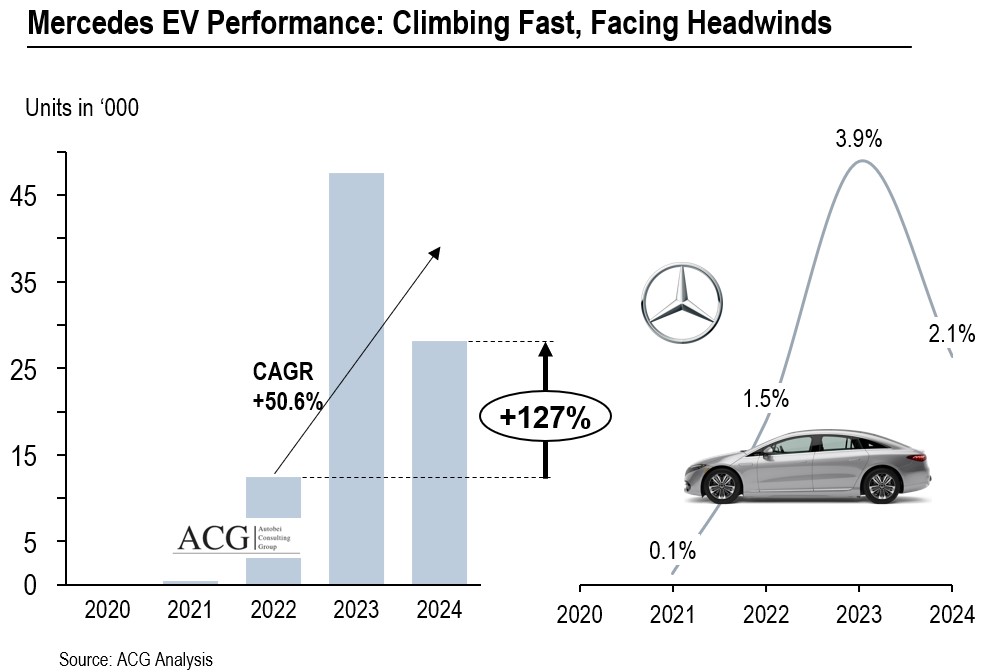

Mercedes EV Growth Slows After Peak in 2023:

Mercedes Electric Vehicle sales grew at a CAGR of 50.6% from 2022 to 2024. The sales volume in 2024 was 28,154 units. In 2024, sales declined by 127% compared to 2023. Mercedes EV’s Market share dropped from 3.9% to 2.1% in the US. Early growth was strong but slowed due to the Supply chain of components and competition. Mercedes remains a key player with a rich product portfolio in the premium EV segment, but faces challenges sustaining momentum.

The price range of Mercedes cars and SUVs lies between USD 53,000 and USD 179,000.

Mercedes Electric Vehicle sales proliferated from 2021 to 2023, reaching their peak in 2023. Sales volume declined in 2024, indicating a slowdown after a period of substantial expansion. Market share followed a similar trend, rising sharply before dropping to 2.1% in 2024. Despite this, Mercedes-Benz remains a key player in the luxury electric vehicle segment.

The Mercedes EQE holds a 0.9% market share in the US market in 2024. The EQB follows with 0.7%, showing strong demand. The EQB models are beautiful. The EQS holds 0.5%, indicating a niche presence. Mid-size and compact EVs dominate Mercedes’ electric sales. High-end models have lower market penetration. The most popular Mercedes Electric Vehicle models are priced between USD 53,000 and USD 74,900. Mercedes’ 19 EV variants are available in the USA until January 2025.

Hyundai Electric Vehicle:

Hyundai’s Electric Vehicle sales increased at a compound annual growth rate (CAGR) of 88.6% from 2021 to 2024, rising from 19,000 in 2021 to 124,000 in 2024, representing a 32% growth from the previous year. Market share increased from 3.8% in 2021 to 9.5% in 2024. Hyundai holds a strong position in the US electric vehicle market.

The Hyundai price starts at USD 32,000. This is an attractive price point and competitive with the Tesla Model 3.

Hyundai is the largest brand within the Hyundai group, holding a 4.7% market share as of 2024. Kia is the second-largest brand in this group, with a 4.3% market share in 2024. Genesis is a premium brand with a 0.5% market share. Hyundai’s EV sales reached 61,821 units in 2024, while Kia’s sales reached 56,099 units. This shows that Kia is a well-accepted EV brand at its price point and features.

Hyundai holds a 4.7% market share. The Ioniq 5 leads with a 3.4% share. Kia follows with 4.3%. EV6 and EV9 each contribute 1.7%. Genesis remains small at 0.5%. The GV70 holds 0.2%. Hyundai’s Ioniq 6 adds 0.9%, and the Kona contributes 0.4%. Kia’s Niro stands at 0.9%. Hyundai remains dominant, while Kia shows strong momentum. The Kia EV6 and EV9 are top models, with starting prices of $42,600 and $52,900, respectively. Both models belong to the Tier EV price segment. The Niro EV starts at USD 39,600, but the car lacks an attractive aesthetic.

The most attractive price point for the Hyundai Kona Electric is USD 32,875. The most successful Hyundai Electric model is the IONIQ5, which has a price range of USD 41,550 to USD 58,100. This model gives its customers value for money. The Hyundai IONIQ5 is available in eight different variants, each with distinct features.

IONIQ 9 is going to launch at the Los Angeles Auto Show. It is the first vehicle with a three-row, all-electric SUV. This vehicle is expected to be available in the USA in 2026.

JLR EV Growth Accelerates in the USA:

Tata’s EV sales grew at a CAGR of 18.8% from 2020 to 2024. Sales rebounded sharply to 3304 in 2024 after dipping in 2022 and 2023. Despite the volume growth, market share remained at 0.25% in 2024. JLR is the only electric vehicle (EV) brand under Tata Motors in this segment.

Key Highlights of the report:

- USA Electric Vehicle Market Trend and Forecast in Units and Value.

- Model-wise Electric Vehicle Pricing Analysis

- Brand-level competitive pricing Strategy

- Variant-wise pricing Analysis

- Value Drivers of every customer segment

- USA EV market share

- Government Policy impact on EV buying decision

- New EV launch strategy

- Entry Strategy Analysis in the USA Market