Electric and Hybrid Car Market Analysis is our exclusive report. In the current trend, there is a general view regarding the electric vehicle that these models of vehicles are becoming very relevant in the global context. But in a pragmatic manner, India is a long way off from seeing any wide-spread adoption of electric vehicles. This might be true regarding the passenger car segment where most of the global focus is concentrated. There is a certain belief among the consumer that all other vehicle segments will see the electric vehicle to be adopted in a much faster manner than expected. The economics regarding the electric vehicles is working out to be far better than the internal combustion engines and that too even without any incentives.

We expect the diffusion of electric vehicles into the market will increase significantly in the next few years. The benefit of owning an electric vehicle compared to an internal combustion engine vehicle is increasing significantly. ACG forecast that the Indian electric car market will have an improved market share of 30 to 35 percent in the passenger vehicle segment. The Indian electric car market is expected to reach a sale rate of USD 11.8 billion by the year 2030. The electric car industry is expected to register 87 percent CAGR from the year 2019 to the year 2030.

There are development and innovation in every step of vehicle segment development. The hydrogen fuel cell car is the next technology that has been developed and which will replace the BEV in the coming years. The hydrogen fuel cell technology is having many advantages when compared to BEV. The competitiveness and market establishment of hydrogen fuel cell cars will totally depend on fuel cell costs and refueling stations.

In the case of BEV, there are 4 stages to reach 30 percent of electric car volume by the year 2030. The stages are mentioned below:

- How to create demand

- Make a supply chain network in India

- Produce cars and export to other countries and expand the market

Maharashtra, Gujarat, and Delhi are the top states for electric car implementation; it contributes around 45% sales volume.

Chinese OEM’s are targeting the electric vehicle segment due to their experience with electric vehicle technology. The available product portfolio and consumer purchase behavior will depend on the product and it will change based on the electric car. In the year 2008, the segment share of an electric car was a mere 0.02% and it touched only 0.4% in the year 2019.

The Indian car market size is more than 3.2 million and it is mainly dominated by small and sedan car segments where the price range of the cars is between three to ten lakhs depending totally on the product. The Indian per capita car is at a ratio of .02(20:1000).

On the basis of the product, the Indian electric car market has been classified into different segments such as hatchback, sedan, SUV, MUV, van, sports car segment, luxury, mini, micro, and other models. The majority of the passenger cars which are sold in India belong to the small or mid-size segment.

The electric car is just not a product or mobility solution. It is considered as the combination of technology, social responsibility, style, and experience.

Depending on the technology, the Indian electric car market has been categorized into battery electric vehicle (BEV), Plug-in hybrid electric vehicle (PHEV), and hybrid electric vehicle (HEV) which is again divided into mild and strong hybrid models.

Out of the three categories (battery electric vehicle (BEV), Plug-in hybrid electric vehicle (PHEV), and hybrid electric vehicle (HEV), the BEV category dominated the market during the historical years and is expected to continue doing so in the coming years. Much of this domination in the market can be attributed to the highest subsidies offered by the Indian government on the purchase of battery electric vehicles as compared to PHVE and HEV models.

The limited mileage logged which is considered to be 30 to 50 KMS per day, by the PVS category vehicles electric vehicles are considered useless even for eight years of the ownership period. In case the battery cost comes down to 60 USD/KWH the above-mentioned statement will hold true.

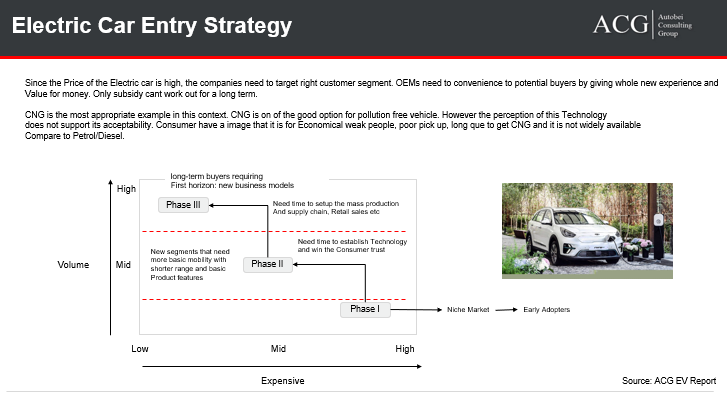

The major factor to consider is to understand the consumer’s need, outlook, and concerns regarding the product as to why the growth of the market for electric vehicles has been slow. In the upcoming sections, we will detail the reasons stating the drawbacks in the current trends and products concerning electric vehicles when compared to conventional vehicles.

The change in economics will be driven by a few factors such as

- Price of the battery

- Economies regarding the scale for electric vehicles

- Charging station at locations

- Range of travel in a single charge

- Availability of battery of product life cycle

- After-sales support and resale value of the vehicle.

Price of the Battery:

This industry is price sensitive at the upfront and operating costs. The single major factor for slow penetration of electric vehicles is the high price of the product which is around 2 to 2.5 times more when compared to the conventional vehicle. The operating cost which will include the running, as well as the maintenance cost, could be as low as 1/4th of that of a conventional vehicle. The price of the electric car segment is expected to reduce in the upcoming ten years.

In the case of the personal transport segment the cost dynamics will not work out as profit periods for the products will currently exceed a time period of five years. There is a feeling that the profit period has to be less than three years for a transition to happen smoothly and efficiently. This transition will happen by the year 2021. The transition will happen smoothly depending on the factors such as battery prices get lower and internal combustion engine cost gets higher post-BS-VI.

On cars, market infiltration will be driven totally by the type of fleet segment where electric vehicles already make sense based on the type and geographical requirement. The vehicles fleets will have to spend on their own charging network. As such this dependency on technology development and requirements will limit the market infiltration of electric vehicles to less than 10 percent of the total PV volumes even by the year 2025.

Range:

The other important concern regarding electric vehicles is their range per charge. To offer a higher range the higher battery capacity in the vehicle is needed which will lead to an increase in the electric vehicle price which will be roughly proportionately to the battery capacity and this increases the price gap of the product.

Product portfolio:

In the current trends, there are limited numbers of electric vehicle models available in the market which can be counted on a finger. In the ICE segment, the consumer has more than thirty models in each segment with a minimum of three variants in each segment. In the case of an electric car, there is no option to choose different products. The consumer also cannot choose different types of battery based on the requirements it will be prefixed based on the model.

Charging infrastructure:

The consumer needs a fast-charging infrastructure every 10 km distance. This is one of the major issues to take off the electric car sales. Most of the stakeholders ask or think that it is the question of “egg” or “hen”. It cannot be considered as an egg or hen. There must be charging infrastructure installed at a different location before selling the electric vehicle to meet the count.

Today the Indian market is having around 400 charging points. The country needs more than 4 lakhs of charging point stations to meet the requirement. So there is a big gap between demand and availability. Out of the total number of charging points across the country, only 50 are fast charging points.

Around 70 to 80 percent of the cars are parked on the road. In this case, only charging points are not enough to meet the consumer requirement. The consumer will need a longer cable to charge the vehicle, which is not viable, even in case of the rainy season it would be difficult to charge the vehicle. This can be a drawback for the product sale.

The govt or private investors or OEM will have to first build the charging infrastructure. ACG has done detail cost and ROI analysis of the charging station. The charging station cannot build be hand to hand. In the ACG survey, 55 percent of the consumers expect to have a charging station at or near to their home and 25 percent at a public charging station. The consumer does not want to be part of the trial process. They want some concrete solution instead of being a part of the trial and error method. This also cannot be compared with mobile tower development since there was no other mobile technology existing during the initial stages. It was a step by step process first and then improve slowly since the consumer did not have the second choice.

In the case of the electric vehicle segment, the scenario is different. There are more than 200 years old tested and trusted ICE technology that still exists. Replacing this ICE technology is a difficult task with new electric vehicle technology. To replace the ICE technology, OEMs will have to offer a not different product but a much better product and technically high-level products. There are mainly 3 types of charging station:

- Slow charger,

- Medium charger, and

- Fast charger.

When compared to the personal vehicle segment the commercial vehicles like taxi fleets, bus fleets, three-wheelers are capable to run five times more the distance throughout the day. Due to the higher mileage levels, the initial cost, as well as the operating cost, will be higher when compared to the low mileage vehicles. For the higher mileage vehicles, the profit returns will be slow and less when compared to the low mileage vehicles.

As per the ACG survey in 20 cities (2000 sample size), most of the personal vehicle buyers consider the initial purchase price, fuel efficiency, maintenance and service cost, comfort features as the major buying criteria. The commercial vehicle buyers will take into consideration the CAPEX along with the OPEX cost economics as the most important purchase factor.

Automotive component suppliers:

The introduction of e vehicle has put the auto components manufacturer companies to face serious survival issues if they are not ready for this transition. The companies like BOSCH and Mothersun Summy have already started solving the issues and trying to save their place in this market dynamics. There will be a high thread to lose employment.

The unorganized sector is also having a strong presence in this segment. They will also face a difficult situation due to the transition. From the last 5 years, this industry showed around 10 percent CAGR. Radiator, oil filters, engine, and transmission manufacturers will also face a survival issue due to the change in the trends. On the other hand, companies like software development, hardware providers, electronics will get reap enough benefits.

The traditional component manufacturers will have to expand or change their product hand-outs by collaborating with makers of the electric vehicles. This collaboration will act as leverage for their technological expertise. To develop specialized parts for the hybrid as well as the electric vehicle for domestic and export markets this tie-up will act as a catalyst for growth and development as well as expansion. India has a relatively strong base for electrical and electronic components of automobiles. This market can be used as a leverage to tap into the currently trending and upcoming electric vehicle sector.

The government schemes and subsidies are the major driving factors for the growth of the electric car market in India. Central and state governments are encouraging the increase of electric car sales by introducing several schemes. The government has made some changes in FAME II compared to FAME I. One of the major change is that mild hybrid will not get any subsidy. This segment was having the largest share in getting subsidy under the FAME I scheme. In the car segment, the private vehicle owner will not get any subsidy.

The urban population has increased rapidly over the past decade, resulting in rising in pollution levels. The introduction of electric vehicles will see a decline in pollution levels.

India electric car market competitive landscape

There is no competition in the electric car segment. The only major player in the current market is Mahindra electric mobility. Tata is the second player in this segment with an E Tagor car. Volvo is entering the PHEV SUV segment. More competition and competitors will enhance the product levels which will help attract more consumers.

Hydrogen production

The fossil fuels, biomass, water, or a mixture of both compounds will help extract hydrogen gas. The natural gas is currently the major source of hydrogen production. The natural gas extraction is will account for a share of three-quarters of the annual global dedicated hydrogen production which will quantities around 70 million tonnes of hydrogen. This 70 million tonnes of hydrogen produced from natural gas will account for 6 percent of the global natural gas use. The natural gas consumption is followed by the use of coal, due to its overriding role in China, and a small fraction of energy is produced from the use of oil and electricity.

The technical and economic factors will play a major role in the production cost of hydrogen. The gas prices and capital expenditures are considered to be the two most deciding factors of the price range.

The fuel cost is considered to be the major cost component which will account for between 45 to 75 percent of the production costs. The low gas prices in the Middle East, Russia, and North America give will give rise to some of the low-cost hydrogen production. This low-cost production will act as leverage for development in the upcoming stages. Due to the higher hydrogen production costs, the gas importers like Japan, Korea, China, and India have to struggle with higher gas import prices that can backfire the development plans.

The deteriorating costs for renewable electricity such as solar power, wind power the interest is mounting in electrolytic hydrogen. There have been several demonstration projects in recent years regarding the use and development of electrolytic hydrogen.

Innovation will always come at a cost. In the case the cost is innovation when coupled with proper Technology will devise a solution for better result. This result will help us shape a better tomorrow.

Highlights of the report:

- Electric and Hybrid car Introduction

- Global Electric car Introduction

- Indian Electric Car market Introduction

- Current and future demand for Electric car

- Electric Car Product Analysis, Product portfolio, Upcoming new product, and

- Product position

- Customer segment and mapping their needs/wants

- Battery Introduction and Analysis

- Charging infrastructure availability and requirement analysis

- Setup cost and a Business case of charging station

- Key challenges

- Energy Demand Analysis

- After-sales analysis

- Expected business models

- Govt incentive, regulations, and policies analysis along with their impact

- FAME I and FAME II