The year 2020 brought the entire world to a stand-still position and toppled the world economy like never before. Indian Commercial Vehicle Industry Trend and Outlook 2021 report cover all aspects of the Indian CV Industry.

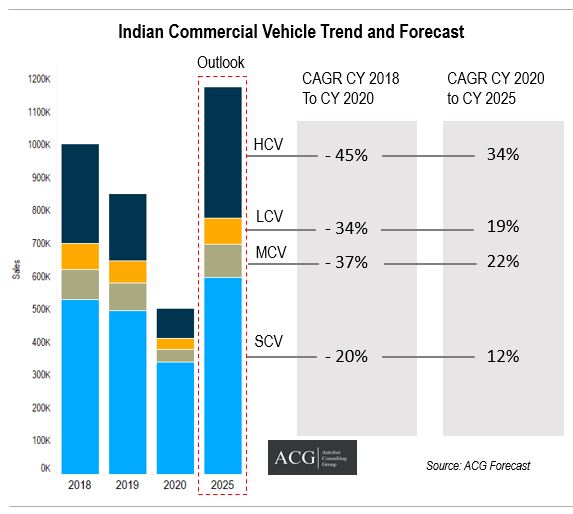

The Indian Commercial vehicle Industry is expected to reach 11,80. 000 units by 2025 with a CAGR of 18% from CY 2020 to CY 2025.

It had its adverse effects on the contemporary market scenario too, but yet the indomitable spirit of various Industries and companies have enabled them to rejuvenate and keep up the momentum amidst the global slowdown. The commercial market in India has also faced the wrath of Corona and the same can be deduced by the following statistical explanation.

Read the latest Indian CV Report 2022

Check: Model Indian Truck and Bus Data – Yearly & Quarterly

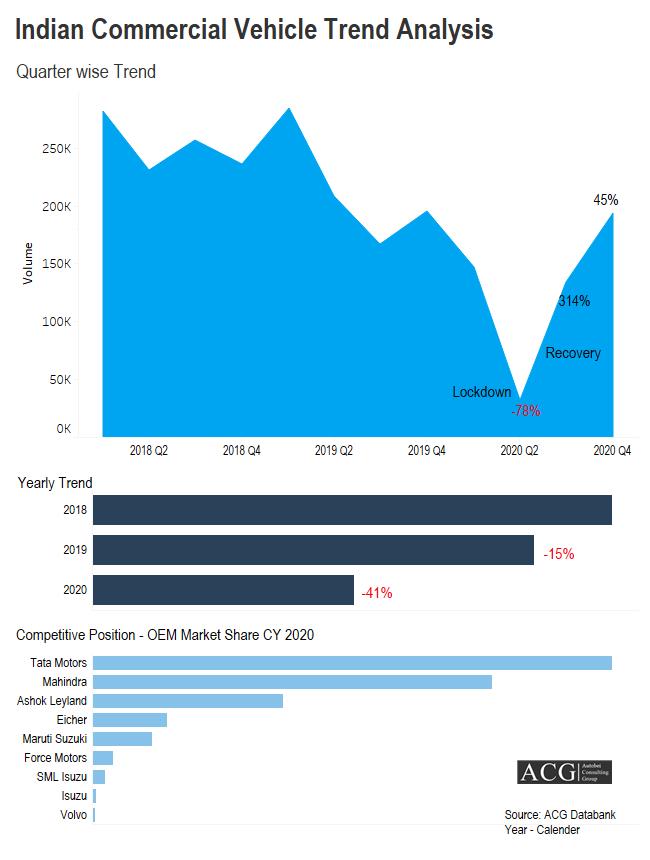

The magnitude of the Commercial Market in India clocked 50k in the year 2020, and this number is significantly 50 percent lower than the overall output that was accomplished in the CY 2018. But the CV segment unraveled a glorious performance by recording a historic recovery in the 3rd and 4th quarter post the lockdown. Nevertheless, the 2nd quarter for the last two consecutive years has turned out to be the worst nightmare for the commercial market. As the degrowth stood at 27% for the Q2 of the year 2019 and this was the lowest ever taking into consideration the last 3 years’ performance. Later in the year 2020, the degrowth further worsened to 78%, proving it to be the worst of all times.

Almost all the Industries across the nation were the victims of the year 2020, and the Automobile industry hierarchically ranks first. The Bus segment recorded whooping degrowth of 96% in the 2nd quarter of 2020 and a record high degrowth of 30% was witnessed in the 3rd quarter of 2019. Whereas, the statistics recorded by the Truck segment are no different. As the degrowth stood at 75% for the period between April-June (Q2) 2020, and the degrowth for the year 2019 was resonating at 29% during the same time as in 2020.

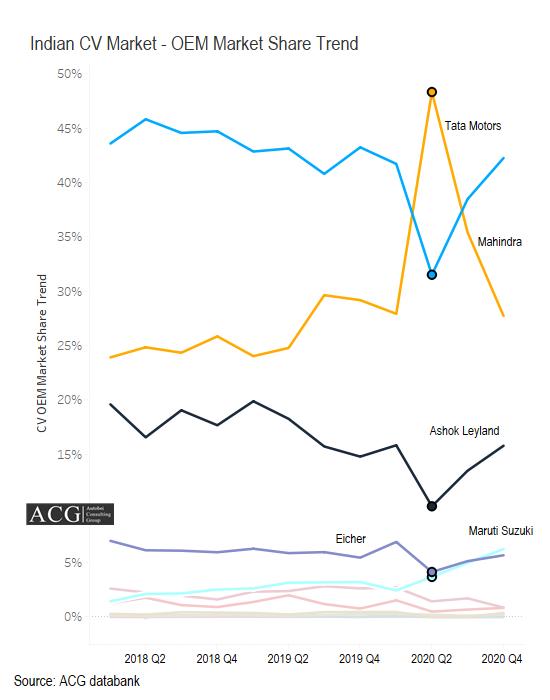

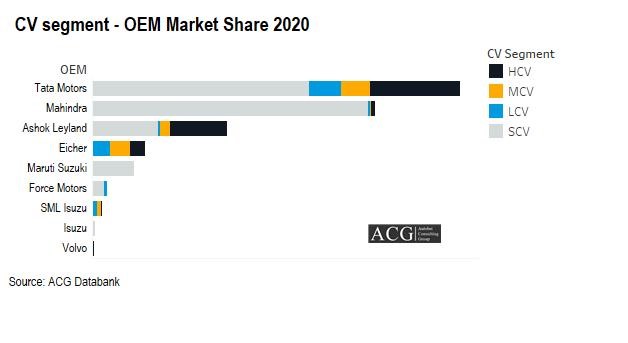

Tata Motors is marveling at the First spot in the CV segment by garnering a market hold of about 40% and the 2nd, 3rd positions are held by Mahindra and Ashok Leyland by taking a market share of 31% and 15% respectively for the year 2020. Though Eicher and Maruti failed to live up to the expectations of the masses but yet were able to get a mediocre turnover of 6% and 5% for CY 2020.

The statistical formulations also depict that the Original Equipment Manufacturer (OEM) Unit of Ashok Leyland suffered 50% degrowth in the year 2020 when compared to 2019.

Maruti Suzuki which had proven its mettle in the Indian automobile arena achieved a growth of 2% as compared to last year. Despite the year 2020 turned out to be a show spoiler for most of the Automobile manufacturers, but Maruti Suzuki seemed to have been the least affected as the statistics tells its degrowth was at 8% when compared to 2019 and the Original Equipment Manufacturer (OEM) unit of Maruti enhanced its market hold in the Quarter 4 of 2020 as compared to the previous year 2019.

Mahindra on the other suffered the most during the last 2 quarters of 2020, as it conceded a loss of 8% market share after the lockdown was lifted.

After taking all the above-mentioned statistical data into consideration, we can outline that the overall degrowth stood at 41% in CY 2020 as compared to last year. The performance of Truck and Bus sales to say have been hit drastically as it faced a backlash and rounded of the degrowth at 38% and 67% respectively in CY 2020 as compared to the CY 2019. If we further ponder light on the crisis-hit scenario then we can clearly see that the degrowth of the 2nd quarter was the worst ever recorded nationally as the degrowth scaled up to the all-time high of 78%

The sales of Bus have been mostly nullified, and its contribution to the overall market share is tending to zero as it has become a herculean task to ensure even the sale of half of the units as compared to last 5 years. All we can summarize is that Covid had the last laugh and it was more than successful indenting the entire market.

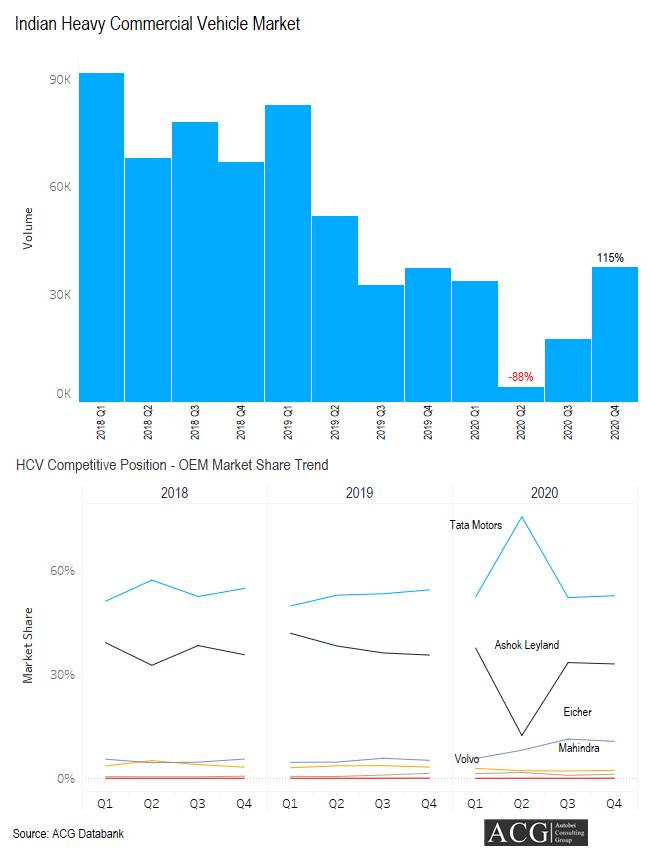

Over the CY 2020, even the HCV segment faced a 55% degrowth as compared to CY 2019, and while we go further deep into the analysis we can note that Quarter 4 was the tedious of all, as it saw a degrowth of 115%.

While the lockdown was prevalent, the same segment had a degrowth rate of 88% in 2nd Quarter and its overall contribution lasted only for 13% in this quarter, and now this period is quite infamous as it is the highest low that has been observed over the last 4 decades.

Undoubtedly, Tata Motors has climbed up to the market leader position by increasing its share to 53%. The year 2020 was very fruitful for Tata, as it fuelled its growth like anything. And the out Even outstanding achievement of Tata is that its overall market share in 2020 and the 4th Quarter of 2020 is higher than that of the market share that it had in 2019. Even, Eicher shoots up its market presence by 4% in 2020, though it had a mediocre 2nd half of the year as the growth was stagnant during this time.

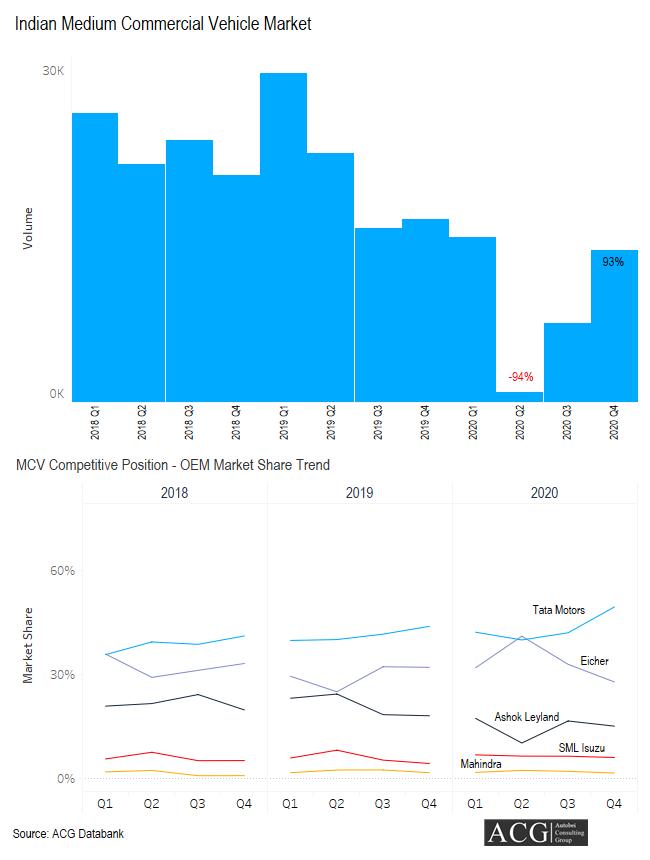

Further, as we move towards the performance of the MCV segment we can see a very nail-biting finish accomplished by Tata Motors and Eicher as they clearly outperformed Ashok Leyland in CY 2020, But Ashok Leyland retaliated and gave a neck to neck competition in the 4th quarter of 2020 and it swept their oppositions of by their feet as it rose to become the Captain of the MCV segment by amassing a clear market share of more than half.

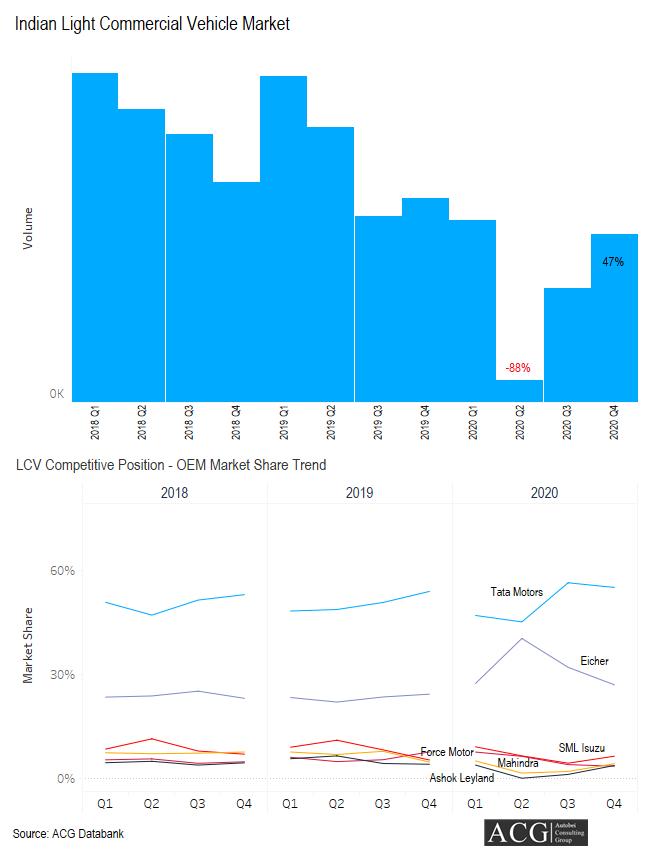

Moving on, we can shift the focus on the LCV segment and even the scenario here is no different than the rest, as it also saw decline degrowth of 51% in 2020 as compared to 2019. It registered a respectful growth of 47% and 412% in Quarter 4 and Quarter 3 respectively in comparison to the performance of Quarter 3 and Quarter 2 in 2019. And the key observation into the data tells us that the 2nd quarter registered a very sharp decline of 94% as compared to the 1st quarter of 2020.

As we have seen the rise of Tata in various segments and its performance has continued to stun even the LCV segment too. As it has taken a podium finish and even the Eicher has put up an appreciating performance by elaborating its share to 6% in 2020 as compared to 2019, but due to various factors it suffered a loss of 5% in 4th Quarter compared to 3rd Quarter in 2020.

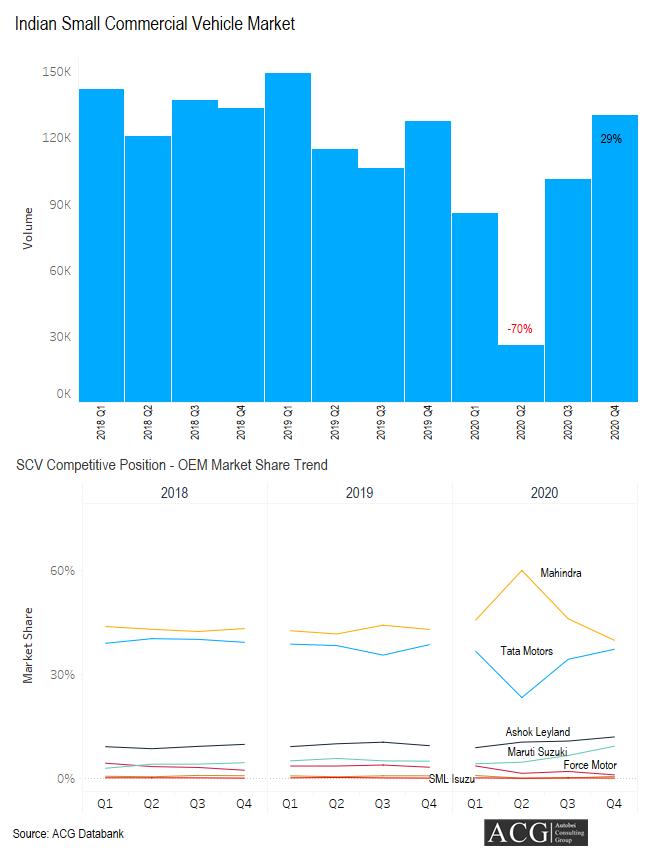

Now, Let’s try to emphasize the performance of the SCV segment, which amounts to the largest market presence of 67% in the 4th Quarter of 2020. Previously, the degrowth stood at 31% for the entire year 2020 in comparison to the year 2019. Way back in 2018, the market share was around 50% and to everyone’s surprise, the SCV segment is the one that pulled out the best ever performance after the lockdown restrictions were relaxed.

The data further speaks that Tata, despite its magnificent and stronghold on the existing market, lost 3% of its share and its close competitor Mahindra added up 2% of the market share when compared with the statistics of 2019.

While, if we get into the minutest details of the analysis we can note that from the 1st Quarter to 4th Quarter of 2020, the Mahindra and Ashok Leyland’s growth is contradictory in nature. As Mahindra loosened its market existence by 6% and the later beefed up it by 3%