ACG released The Rise and Fall of Indian Bus Market during the Pandemic report.

If there’s any year in the books of history that brought the entire world to a standstill position, then that era can be undoubtedly labeled as the COVID hit the year of 2020. This grueling period had its Ill effect on each and every various sector across the globe, and the Automobile sector tops the list.

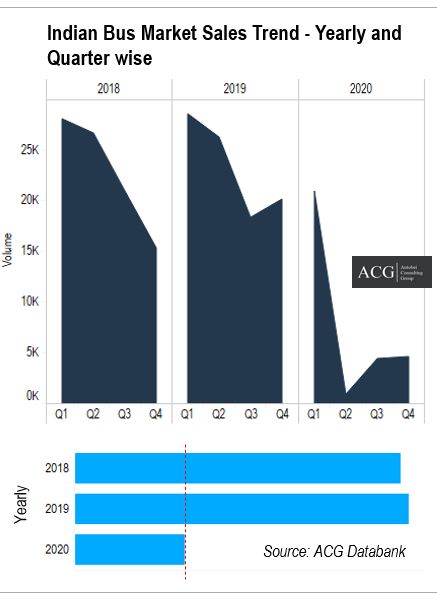

Coming to the Indian scenario, the bus division was absolutely one of the most affected categories in the automobile market. Indeed, it witnessed a humongous downfall in the total marketed units for CY 2020. The corona factor can be termed as the major game spoiler for the Bus sector of India, as it scaled down the percentile share of the sector by 67% from the previous year.

Despite all these adversities, there was a sharp rise of a marginal percentage in regards to the market expansion from 2018 to 2020. The market positioning was in a respectable place by amassing close to 94,000 sales in the previous year, but soon during the pandemic, this number came down heavily to a mere value of 31,000.

Autobei Consulting Group has presented a prediction model which depicts the rise in total sale units to 12,00,000 in the next 5 years.

The compound annual growth rate, for the last 2 years is not at all encouraging as the value is now in the negative scale and stands at -42%, but the future market scenario, increasing demands, and expansion of the market will all togetherly culminate to boost the CAGR at 80% in the next half a decade.

Also read: Indian Bus Market Report 2019

The present scenario has given a very little scope for travel, as the people have developed various apprehensions owing to the widespread of virus and thus this has restricted the movement of people. The schools have been closed down, offices have resorted to working from home, traveling to districts, cities, and states are limited only to emergency situations, Tourism Industry is still in a stagnant position. So all these Business activities in the past were aiding the operation of Bus, but now as they seem to diverge no function hence Bus industry has been immensely affected by this.

The government’s decision to ease lockdown and lift restrictions enforced on the movement of the people came as a boon to the Bus market, and the two succeeding quarters of the second half of 2020 rendered the much-needed breakthrough for its growth. The figures achieved as a result of this will speak for itself, the growth rate of 400+% was seen in Q3 and Q4 saw a booster by another 6%.

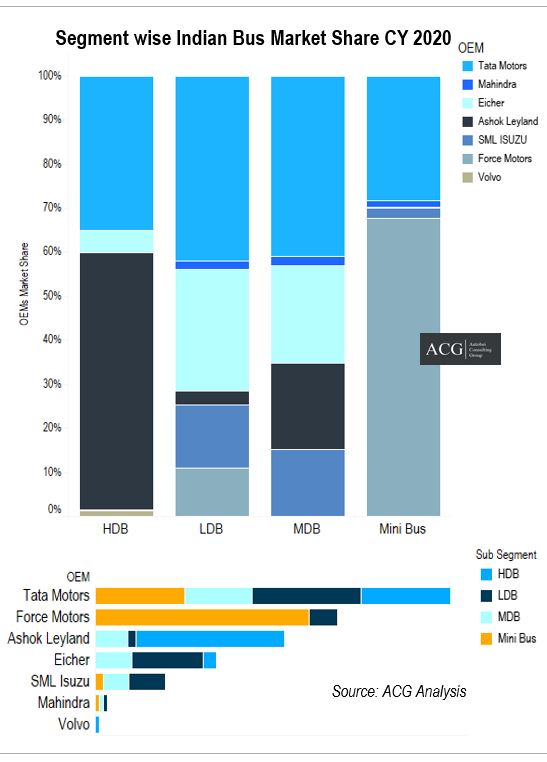

The Indigenous Automobile giant Tata has had a consistent run in the Bus market scenario for three consecutive years, and it has even garnered a whopping share of 35%.

Yet another Budget Bus manufacturer, Force, has shot up to its sales and managed to enhance its market prevalence by 4%. Astonishingly, Ashok Leyland which flaunts the best in class efficiency and build quality saw its presence in the market gripping down by 3%, on the other hand, its counterparts Eicher and Volvo bus managed a decent upgrowth amidst the pandemic. Mahendra didn’t quite manage to replicate the success it tasted in the car segment, as it witnessed a downfall by 3% over the last couple of years.

The smaller variant in the Bus sector, the Minibus also saw its market dynamics suffering a sharp change, as their market presence came down drastically and the growth factor stood at null and negative for a major period. The figures say it all, the HDB, LDB, MDB had no buyers in the market and their hold in the market vanished at the rate of 62%, 69%, and 74% respectively.

The relaxations that were given after the decline in COVID cases resulted in bringing some fascinating results for the Indian Bus market and the same was evident in the 3rd and 4th Quarters, but the LDM sector failed to capitalize during this time.

The HDB sector has different market dynamics and Ashok Leyland is the Market leader of this category by managing an overall hold of 56%, but even they faced the wrath of pandemic and saw their market presence dipping down by 9% in the COVID dominated the year of 2020. Tata and Ashok Leyland continue to be the market leaders of the HDB category, Eicher a dominant player of the same category managed to climb the ranking list by adding up a percentage growth rate to its name.

Get Exclusive Data Electric Bus Product Planning Data

Time and again, the Indian origin manufacturers have reaped fruitful results in the MDB segment, with Tata yet again managing a top podium finish by tightening its Market hold which currently stands at 42%. Despite the fact that Tata’s growth seems no stopping at the moment, but yet the hardcore approach by Ashok Leyland and Eicher to rise to the top has foevedy Tata to be on its toes always.