Here are the results of our latest reports on the Product Analysis of Indian Trucks. The Indian Truck Industry has thrived in the market and variants exist to cater to the different needs of the customer. Hence, an extensive analysis of the different variants is essential. Based on GVW, the Indian Truck Industry is categorized into four variants: Heavy Duty trucks, Small Duty Trucks, Medium and Light Duty Trucks. The maximum number of variants as shown, is displayed by the heavy duty trucks segment. Being a majorly application-oriented segment, the heavy duty trucks comprises of a multitude of combinations.

On the other hand, the Small Truck Industry though the largest segment of the Truck Industry suffer from significantly fewer variants. Customer needs shuttle to and fro in accordance to the dynamic market.

Medium and Light Duty Trucks are characterized by their small market size. The Small Duty Trucks have seen a significant increase during the period of the report in market size percentage. It has seen the market size double during this period. Medium and Light Duty Trucks on the contrary have shown only a minute increase in market size. The heavy duty trucks have captured most of the market, but their increase in market size is smaller in percentage as compared to its small truck industry counterpart.

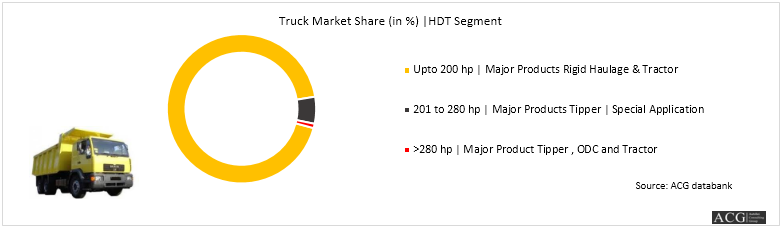

Horse Power wise Analysis:

In previous years, Indian trucks were horse powered only to a maximum of 180hp, which is not much. Low horse power translated to lower speeds and hence, increased transportation time. This resulted in the increase in number of trips to transport the goods. There was too much effort, time and money being wasted all because steps were'nt made for trucks to run with a higher horse power. One of the first companies to identify and correct this mistake was Volvo, being one of the first European OEMs to introduce high horse powered trucks. This gave them the ticket to enter the premium and budget segments.

Analysis of the horse powers of the vehicles in the truck segment show that a majority 75% trucks run with average horse power of 200hp. Vehicles like Rigid Haulage and tractors form the constituents of this section. On the other hand, an alarming minority of only 5% run with a high horse powered 280hp. Tippers and various ODC's run at such high power. Around 10% of this segment are horse powered in the range of 201 to 280hp, including certain special application tippers.

Axle Configuration wise analysis:

Another major criteria for customer choice and OEM strategy is the Axle configuration. The tipper portfolio made it's way into the Indian market in the year 2010 while previously being a foreign truck OEM. They extensively researched the market and concluded with the launch of a 31T, 8X4 drive system heavy duty tipper. At the time, Volvo was thriving with success in the market. The foreign market's research and analysis went to no waste when they came up with the 8X4 drive system which was highly suitable for mining applications. It's major advantage lay in the fact that Volvo products was almost as costly as 3 times their own. The foreign company were fooled by their feasibility, while turning a blind eye to other major contributing factors such as Overload, Gradeability, Payload, Chassis strength and TCO. The product lasted for barely a year when customers and the company likewise decided that this product was unsuitable for the Indian heavy duty segment.

This being said, a majority of vehicles in the truck segment run with an axle configuration of 4X2, while a minority run with a 10X2 configuration.

Wheelebase Analysis:

Added to the list of parameters to be considered during the purchase of a truck is the wheelbase analysis. This forms the base for using the truck for a plethora of applications. Truck modifications used for different applications vary by changing merely the wheelbase. Majority of the trucks in this segment are equipped with a 4,001mm to 5,000mm wheelbase. They have a 50% share of the segment. A 10% minority have a wheelbase more than 6,000mm. Even fewer have a 2,000mm.