When Automotive markets like India, China, Russia registered negative growth in 2019, Brazil gave a positive sign and successful Outlook. The Brazil Govt launched a new overarching policy in 2018 for the automobile industry and called the same as the “Route 2030” Program. This served as a roadmap for producing the technological and energy-efficient vehicles in the Brazilian automotive sector. The government is willing to grant up to R$ 1.5 billion per year in tax credits to companies that invest at least R$ 5 billion in the research and development sector.

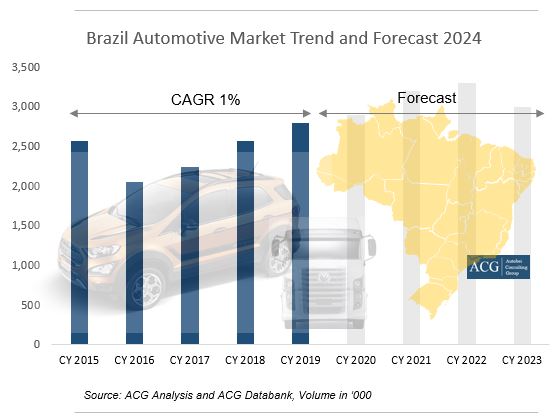

The Brazil Auto output rose from 2.3% to 2.94 million units in CY 2019. Hence they registered a 9% growth in CY 2019. From the year 2016, it’s evident that they constantly exhibit steady growth which is presumed to remain till 2020. The outlook for Brazil’s automobile industry this year is believed to go beyond fortune. Since inflation in Brazil is below target, it’s reckoned that this will create clear financial conditions. Furthermore, this will aid to increase the spending power of buyers.

However, there lies a determining factor -unemployment which shall influence the economic elements of a country. The Brazil Automotive market dominates other Premium Brands and product varieties. Thus Chinese players find it difficult to infiltrate among the Brazilian Auto markets like Russia and Africa. Geely is grabbing a better spot in the SUV segment.

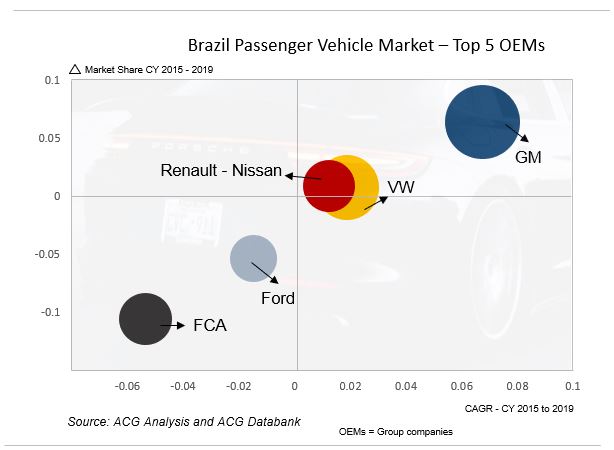

On the other hand, the passenger vehicle segment registered a 2% growth in CY 2019. The CAGR from 2015 to 2019 reached 8%. However, the Brazil Car segment registered a 5% growth in CY 2019. The CAGR from 2015 to 2019 dropped to 2% adverse. Like every other major market, SUV in Brazil grew by 17%. General Motors and Volkswagen increased their market share by 7 and 2% respectively in the last few years due to the conventional product position.

Lately, in 2018, VW added a 4 percent market share thus taking the economy from 15 to 19%. FCA lost 5 percent segment share in the last 5 years. Similarly, other German OEMs like BMW and Mercedes could not improve their performance in the last 3 years in the SUV segment. Top 5 Automotive Groups viz., FCA, Renault-Nissan, Hyundai – Kia, Honda, and VW yielded a 74% market share. The CAGR for the last 5 years of FCA, Renault, Nissan, Hyundai Kia is 30, 34, and 18% respectively. Economists at U.S. bank Citi on Wednesday lowered their 2020 Brazilian economic growth forecast from 1.6% from 2.0%. The outbreak of coronavirus is perceived as the cause that lowered the Brazilian economic growth.

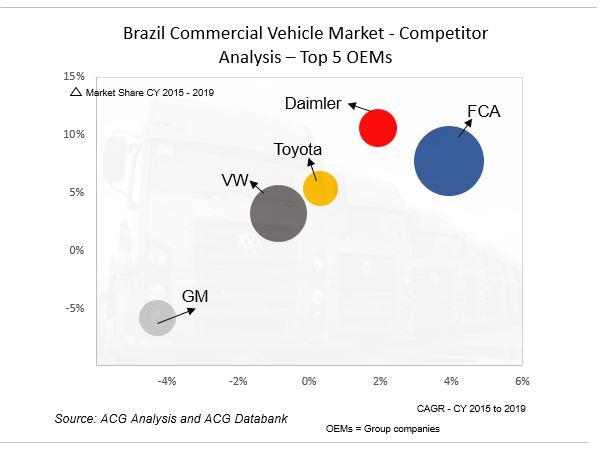

The report reveals that Brazil Truck market grew by 33%, Light Truck market by 8%, Bus market by 42% and overall Brazil Commercial vehicle market rose to 13% in 2019. The popular driveline in the Heavy Truck segment is 6X2, 6X4 and 4X2. Above 350hp, Volvo and Mercedes are popular in the respective segments. However, the Volkswagen Group remained the market leader for a prolonged period in Brazil. On the other hand, in Heavy and Extra Heavy Truck segment MAN, Scania, Volvo, and Daimler ruled the OEMs sector.

New Opportunities in Brazil’s Automotive Market Report Highlights:

- Brazil Automotive Market Trend and Forecast – Sales, Production, and Export

- Car, Commercial Vehicle Model wise Sales, and Production Forecast

- Market Gap analysis

- OEM and Model wise Competitor Analysis

- Pricing Analysis of Car, SUV, Truck, and Bus

- TCO analysis

- Customer Insight

- Brazil Auto market Product Analysis, Strategy, Top vehicle

- Entry Strategy

- Case Study – MAN – VW acquisition

- Key Macro Economy Indicators

- Customer buying behavior and expected changes in the next 5 years

- Doing Business Guide in Brazil

- Market Dynamics

- Brand Position and Perception

- Dealer network

- Customize Consulting Option is also Available