Indian Truck market Analysis and Outlook 2020 comes under standard reports and available at 1,500 USD.

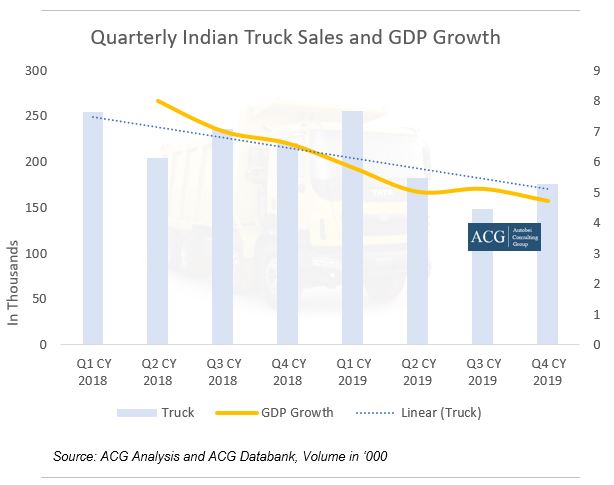

This study aims to explain the Indian Market’s scope of the Truck Industry from 2020 to 2025 after the consolidating multiple Market dynamics. The factors include regulations norms, Slowdown in demand, customer sentiments and their preferences, fluctuating vehicle prices, freight rates, new product launches, GDP drop, price inflation, China’s Coronavirus impact, segment & sub-segment shifts, investment on infrastructure, overall manufacturing growth/degrowth, mining, and logistic Industry’s impact are the factors taken into consideration. These factors are highly affecting Indian CV Industry.

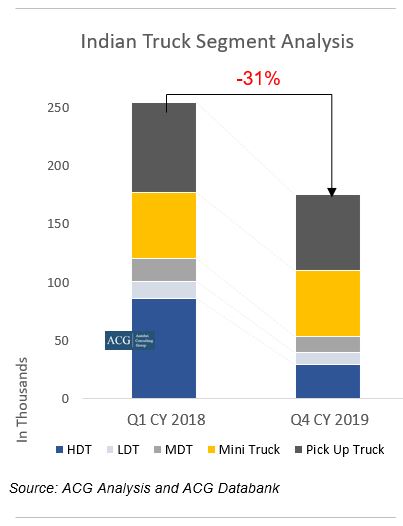

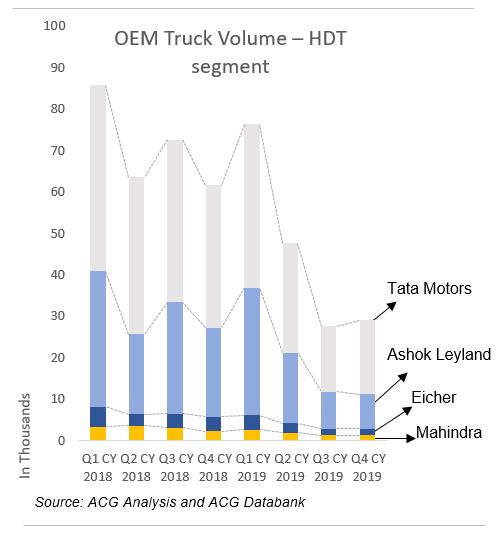

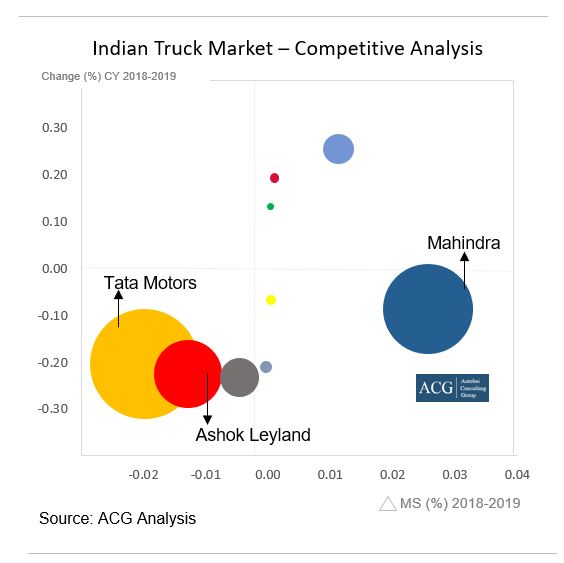

Indian Truck Industry growth was declined by 17% in CY 2019 compared to that of CY 2018. Similarly, the HDT segment registered a 36%, MDT segment 13%, LDT 11%, Pick Up 7%, and Mini Truck 7% degrowth in CY 2019 compared to that of CY 2018. In the Heavy-duty segment, Tata Motors, Ashok Leyland, Mahindra, Eicher sales revenue was declined by more than 35% in just one year span. Whereas, in the LDT segment, Tata, Mahindra, Eicher, SML Isuzu faced a steep fall and witnessed double-digit degrowth in CY 2019.

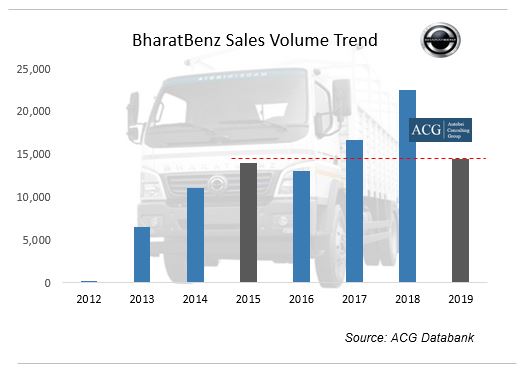

Daimler India is in a contrary spot; it’s rolling back to 2015:

BharatBenz volume declined by 36% in CY 2019 compared to CY 2018.

In the Heavy Duty truck segment, Tata Motors, Ashok Leyland, Mahindra, Eicher deals declined by over 35% in only a solitary year. In the LDT fragment, Tata, Mahindra, Eicher, SML Isuzu chose twofold digit degrowth in CY 2019.

Due to the coronavirus, the oil costs plunged. This could decrease the working expense of the Vehicle and would additionally have a serious effect on the unequivocal truck region and a bit like compartment transport is rising to organize sway on the Indian Truck deal.

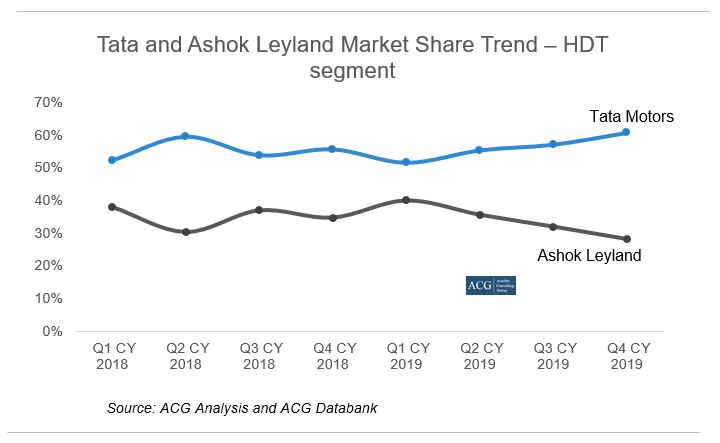

Among the HDT segments, in the last 4 Quarters of 2019, Tata Motors increased a 9% market share and Ashok Leyland remained losing 12% of its market share. Construction and Mining sectors showed slightly better growth in Q4 2019 compared to Q3 2019.

The manufacturing sector recorded degrowth invariably. Every week the retail inflation increased and weak customer sentiments made a huge impact on the market’s growth.

Due to coronavirus, the oil prices dropped. This could reduce the operating cost of any Vehicle. The Indian economy forecast for the year 2020 is expected to reach around 5.8%, which is a 0.9 percent drop from the previous estimate.

For 2021, the economy might reach 6.5% to 7%. This clearly depicts that the Indian economy will reach the worst possible point. However, there are a few growth signs evident in some sectors. Coronavirus would also have an indirect impact on the truck segments and other segments like a container where the conveyors will face a direct impact on Indian Truck sales.

India Automotive Industry’s emission norms are shifting from BS-IV to BS-VI and are effective from April 2020. The BS-VI norms demand innovations and new vehicle diagnostics (OBD). Furthermore, implementation of the BS-VI norm might raise the cost of all segment Small Commercial Vehicle, Light Commercial Vehicle, Medium Commercial Vehicle, and Heavy Commercial Vehicle segment. Depending on the type of vehicle, OEMs, and their advancement, the cost of a vehicle will vary. Some of the OEMs had already implemented BS-VI technology in their practice. It is expected that the price increase of those OEMs who had already implemented BS-VI technology in their practice, will be utterly less as compared to that of other OEMs. There will be some modifications in the design architecture of the vehicle which will make the investment horizon (ROI) longer and that will incidentally affect TCO.

The revised axle load norm that was declared in July 2018, had an immediate effect and increased the vehicles’ permissible GVW and payload capacity by approximately up to 16%. This regulation brought some challenges for fleet owners. The maintenance cost has increased without affecting the freight rate, thus dropping the profit. It eventually increased the demand for high GVW vehicles. Truck body code significantly improves the quality of a vehicle among OEMs and other local bodybuilders. Vehicle scrappage policy, which aims to promote the replacement of old vehicles under the incentive scheme, is quite questionable. The Ministry of Road Transports and Highways has a clear set of a regulatory roadmap emphasizing quality, safety, efficiency, and environment.

Awareness of technology, and realization of long-term “TCO benefits” will drive a customer to invest in value-added features, switching from the traditional price-based buying approach to the cost-value approach but this is limited with specific customers group. Indian OEMs are profoundly investing their money in product up-gradation to enhance performance and features to shall endure the tough competition and to meet customers’ expectations.

To withstand such a turmoil situation of the industry, the Indian Commercial Vehicle OEMs will have to focus on value trucks targeting the right set of customers and business models. The rising conflux of technologies in the automobile industry provides a platform for various stakeholders to offer a solution-based operating model

Advancement of purchases owing to BS-VI norms will partially be balanced by the liquidation of BS-IV inventory in fiscal 2020; Dealers rising fiscal 2020 at elevated levels of inventory are expected to reach lower levels, as dealers liquidate BS-IV inventory and thus leading to lower wholesale offtake compared to that of retail sales.

Please contact Info@autobei.com to purchase Detailed Report.