We have released Indian Automobile Industry Report Q1 FY 2020 report. India has become an established ground space for the automotive companies for their growth and development and we are swiftly narrowing our gap over several established locations around the globe.

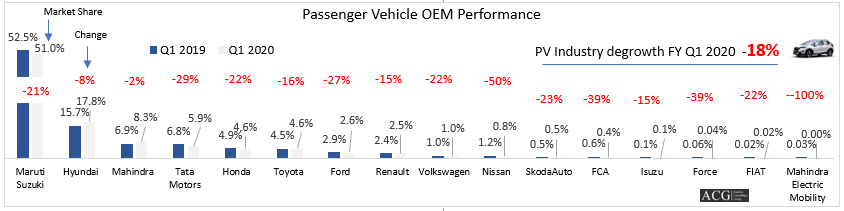

In the first quarter of the financial year 2019-20, there was a huge decline in the car sales rate which can be accounted to be 23 percent, while passenger vehicle sale rate has nosedived to a mere 18 percent. This is considered to be the worst quarterly performance since the third quarter of the year 2000-01. In the year 2000-2001 the car sale rate graph came down by 27 percent and the passenger vehicle sale rate also declined by 23 percent. This decline in sale rate brought immense financial as well as economic loss to many automotive companies.

The Indian automobile industry has started to show a deep decline in the market after a near-decade of attractive growth. However, the fundamental of the automotive industry is still strong. India is slowly but steadily emerging as the powerhouse in the automobile industry but there are still many factors which pull the string from making our country move ahead.

There are many factors which contribute to this decline the factors can be listed as below:

- Lack of consumer spending power

- Poor monsoon, and Flood situation

- Maintenance and purchase costs increase

- Lack of promotion of electric vehicle by introducing new guideline and schemes

- Distress in rural markets

- Tight liquidity and BS-VI norms

The above-mentioned factors have made an immense impact on industry growth. All the major OEMs have started to upgrade most of their product line to meet the new BS-VI emission norms and this will bring cost pressure on OEMs. Many Automotive dealerships have already closed their shop due to poor sales in the past and many companies are facing the hurdle to meet the sale target. This will also have a huge impact on the new hiring and new expansion plan.

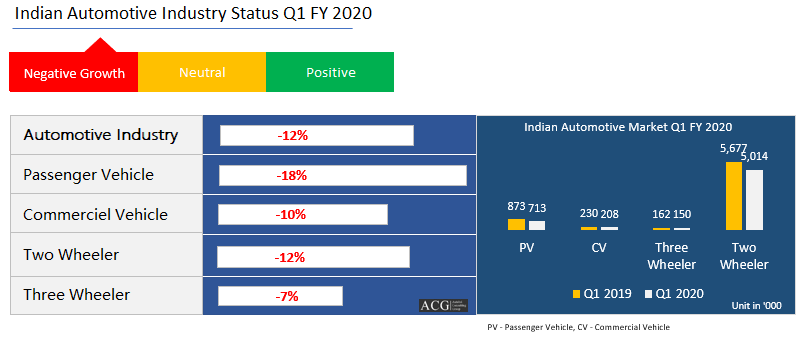

In the current scenario, the worst-hit segment is the passenger car segment that shot down by 24 percent. The passenger car segment declined by 23 percent, SUV/MUV 5 percent and Van 26 percent, for the commercial vehicles segment the decline rate was 10 percent whereas for the three-wheeler sector the decline is considered to be 7 percent. In the motorcycles segment, the decline rate is about 9 percent, whereas for the scooters segment the sale rate reduced by 17 percent and for the two-wheeler segment, the decline in sale rate was calculated as 12 percent. The Overall decline in the sale rate for automobile sales in the country is considered to be 12 percent for the month.

India is considered to be a sleeping giant in the automotive market. In the current living trend, 18 out of 1,000 Indians own a car when compared to the citizens of the United States where nearly 800 out of 1000 and the in the other European Union around 500 out of 1000 own a car.

The decline in the industry is due to the lack of facilities to maintain and run a vehicle, the cost and amount required today to expense, the lack of development of infrastructure and finally space and time to run a vehicle and reach the destination in time. When these hurdles are crossed we can India leaving behind the other automotive giants across the globe in no time.

Passenger vehicle segment has shown a decline 18 percent in the first quarter of FY 2020. The commercial vehicles sale rate in the domestic market were down by 10 percent when accounted there was a sale of around 2,08,298 units in the Q1 FY 2020 this year, as compared to 2,30,236 units in the year-ago Q1.

The major car manufacturers like the Maruti Suzuki, Hyundai, Tata Motors, Honda, and Toyota have reported a decline in the sale rate for the Q1 FY 2020. Nissan has registered 50 percent de-growth.

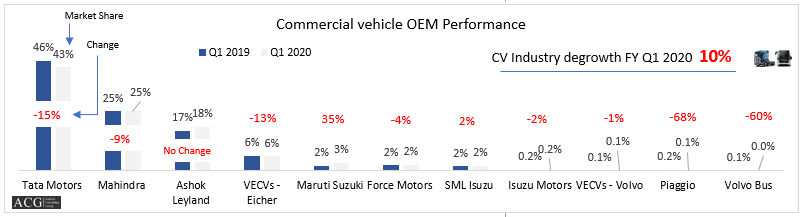

The Commercial vehicle segment sales experienced a 10 percent decline in Q1 FY 2020 when compared to the sale rate same period a year ago. Tata Motors, Ashok Leyland, Mahindra, and Eicher reported a decline in sales of products due to poor demand among the consumers.

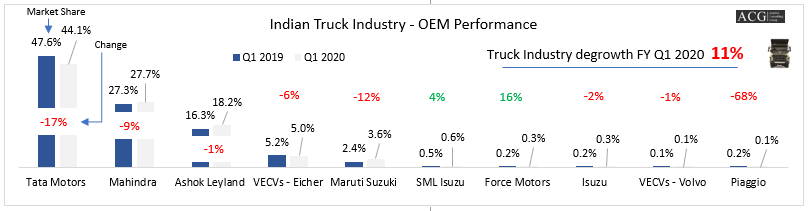

The Indian Truck Industry is also going through a tough phase. The multiple market dynamics are applying the brake on the truck sales. The sale rate of all major the players have slumped in Q1 FY 2020 when compared to Q1 FY 2019. The fleet owners are not showing any interest in immediate purchase of the truck due to low utilization of truck carrying capacity and falling freight rates after implementation of new axle norms.

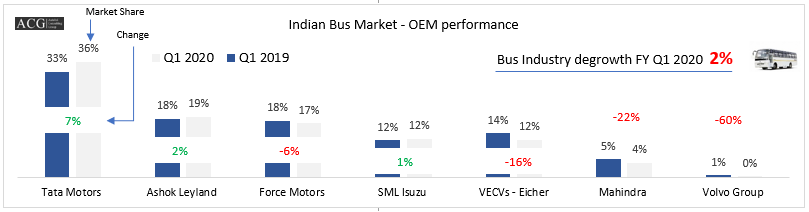

Indian Bus Industry has shown a 2 percent decline in the growth rate in Q1 FY 2020. The Two major players of the truck industry Tata Motors and Ashok Leyland have reported single-digit growth in Q1 FY 2020. Tata Motors was able to increase its market share from 33 to 36 percent whereas Ashok Leyland added were able to increase its growth rate only by 1 percent, unfortunately, Eicher lost 2 percent of its market share.

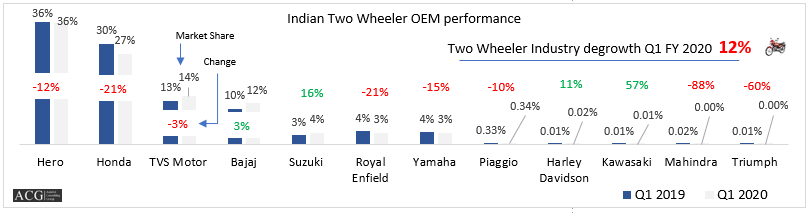

The Two-Wheeler segment reported 12 percent de-growth in Q1 FY 2020. Hero Motor, Honda, TVS, Royal Enfield, Yamaha, Piaggio. Mahindra, Triumph all the major OEMs and companies witnessed a decline in their sales. Honda market share slipped from 30 to 27 percent in Q1 FY 2020. Bajaj Auto is in good condition.

In the current budget, Govt has proposed of raising the duties on automotive parts and additional special excise duty of 1 INR per liter and road and infrastructure cess of 1 INR per liter on both petrol and diesel fuel. This increase in the fuel cess price and excise duty will drag the current scenario to the worst situation. It is evident from our research of the last ten years that increase in fuel prices impact auto sales far more than other factors.

The firms have to initiate a thought process and framework to have a better chance of finding the solution for the decline and develop a base ground for an improved sale rate. Those companies or firms who are not able to find a method or solution for success will find it difficult to keep a hold in the market. And those who have made business strategies on a strong base will stand a much greater chance of meeting a success.

Take our subscription services for Monthly Analysis

The highlight of the Indian Automobile Industry Analysis Report Q1 FY 2020:

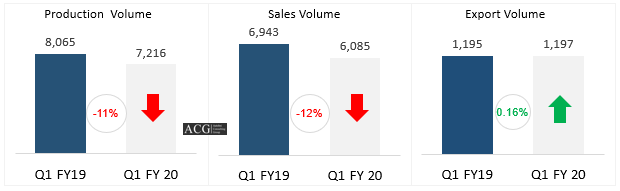

- Indian Automotive Sales, Production, and Export analysis

- Key finding

- Top reseason behind the current situation

- Forecast for the next 3 quarter

- Segment and Sub-segment analysis

- OEMs Market share movement

- Growth analysis

- New Product Launch Strategy

- Segment covers – Car, SUV, MUV, Van, Commercial Vehicle, Truck, Bus, Two Wheeler, Motorcycle, Scooter, and Three Wheeler