At present, the Indian Car Industry is experiencing a headwind and showing a high level of degrowth. The new product launches are trying their best to support the boosting up of the sales and help in the establishment of positive sentiments in the overall car market.

In the past six months, XUV 300, MG Hector, Hyundai Venue, Seltos, Kicks, i10 NIOS, and Harrier are launched in India for the purpose of pushing up the sales to some extent. Renault also has launched the Triber which is basically a compact multi-purpose vehicle that comes at a starting price of Rs 0.48 million near about two years after the launch of Captur SUV in the year 2017.

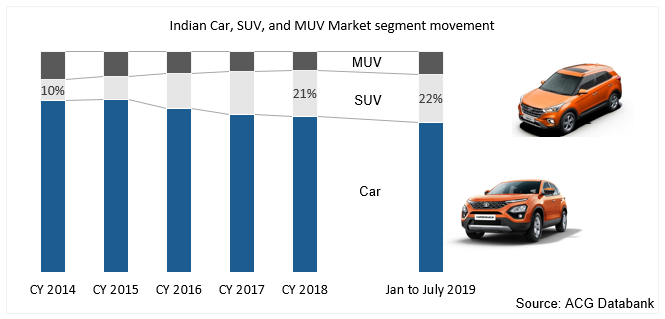

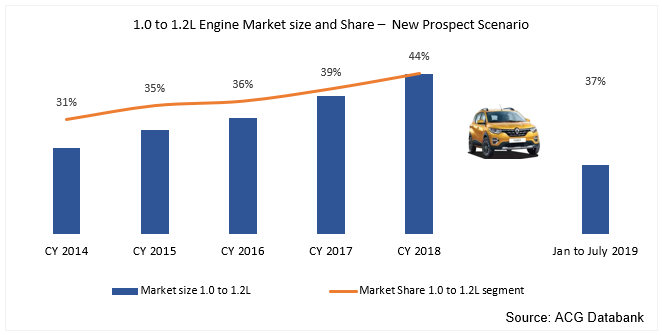

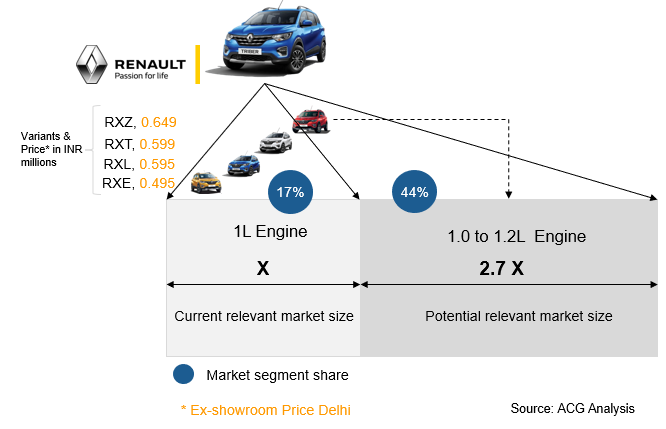

On the other hand, the Indian SUV market has doubled its size in the last five years of time and it is growing continuously. Triber from Renault is actually targeting the car market of the category of 1.0L engine. This is the market that is showing continuous degrowth of 1 % every year since the CY 2014 and it is about 17 % of the total car market size in India. This particular segment is shifting from 1.0 L engine to 1.2 L engine car segment which has shown a growth from about 31 % in the year 2014 to about 44 % of the market share of the overall car industry in the CY 2018.

At present, Renault occupies almost about 3% of the total car market. Now, if the Renault launches one more variant of Triber with 1.2L engine, it will presence in about 43 % market share and this market size is more than double the present market size occupancy of Triber.

The Triber comes in four different variants. The RXL is priced at Rs 0.54 million, RXT at Rs 0.59 million and top-end RXZ at Rs 0.64 million. The high-end variant of Triber could fall in the category of 1.2L engine. If we consider this segment based on ACG definition of the car segment, still then its present position would be falling under the ‘low cost’ segment which is squeezing every year and the category of 1.2L comes under the ‘budget segment’ as per ACG definition which is continuously growing every year.

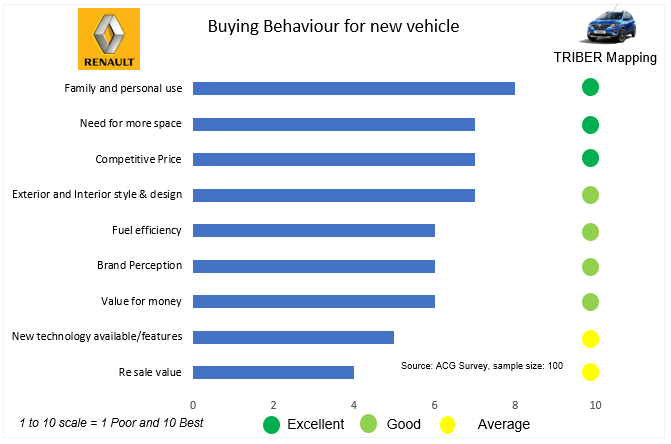

Triber likely to satisfy most of the top criteria of car purchasers for first-time buyers in India. Multi-purpose uses cars with more space are rated as the top criteria in buying decision in India. Better brand perception also plays important role to select the vehicle.

The customers readily prefer the vehicles that have a much better pick up and they are even ready to spend 0.1 million more for a better performance as well as driving experience. The customers will actually have more confidence that the vehicle would be able to carry people easily and conveniently.

Key highlights of the report:

- The market size of the Indian car Industry

- Renault Product, Marketing, Sales, and Brand Strategy

- Product life cycle

- Brand Perception

- Segment-wise Sales and Market share

- Price-wise Renault Market assessment

- Dealer network

- Product planning

- Advertising Strategy – TVC, Print, Digital, and another medium

- Customer experience and expectations

- Customer engagement

- Key Competitors Analysis

- Upcoming new product

- Technology Analysis