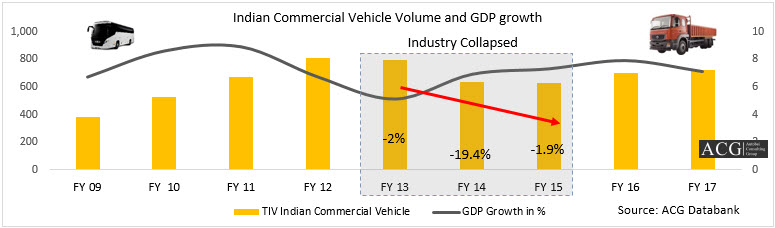

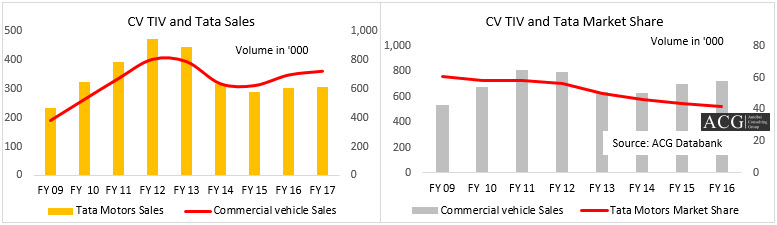

The Indian commercial vehicle (CV) industry registered volume growth of 4.5 percent in the financial year 2017 over the previous year. CV Industry growth was driven by favorable economic condition and positive business sentiments. The Industry registered double-digit growth in FY 2016.

Buyers are still waiting for clarity on GST that may bring down Vehicle prices to some extent. During FY 13 to FY 15, the CV industry was going thru difficult time due to slow demand by fleet owners, and weak replacement demand.Currently, issues like GST, emission norms, Bus code for safer and comfortable journey, Truck body code is also being considered by Govt., Mandatory Fitment of Speed Governors on Transport Vehicles to avoid over speeding, Model Automated Centers for checking the fitness of the vehicles, AC cabin and other regulations are impacting on Industry.Ministry of Road Transport & Highways also taken the initiative to offer an incentive to replace more than 11 years old vehicles.

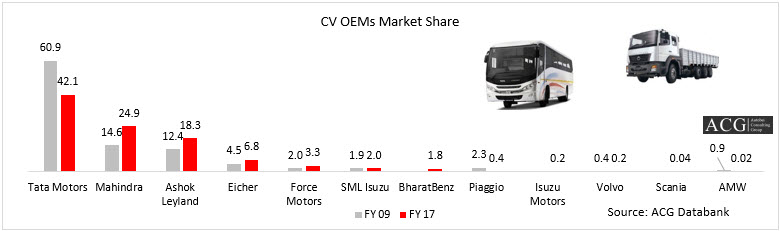

In FY 2009, the Commercial Vehicle volume was 383 thousand units and it touched 727 thousand units in FY 17. If we check the market share of Tata Motors in FY 2009 to FY 2017, company lost around 18 percent market share. On the other hand, Ashok Leyland, Mahindra (Overall CV segment), Eicher, Force Motors gained market share.

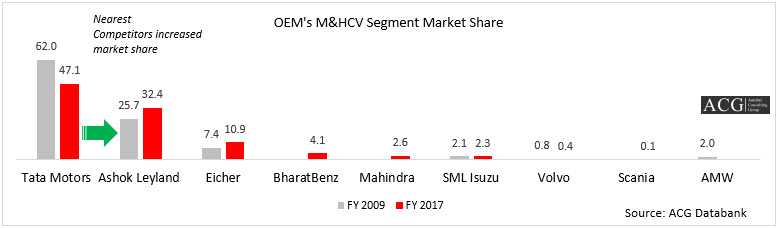

OEMs Market Share Analysis:

Tata Motors lost around 19 percent market share since FY 2009 to FY 2017. There are several factors are responsible for continues losing the company's grip on the market.Mahindra gained around 10 percent, Ashok Leyland 6 percent, Eicher 2.3 percent, Force Motors 1.3 percent market share during the same period.

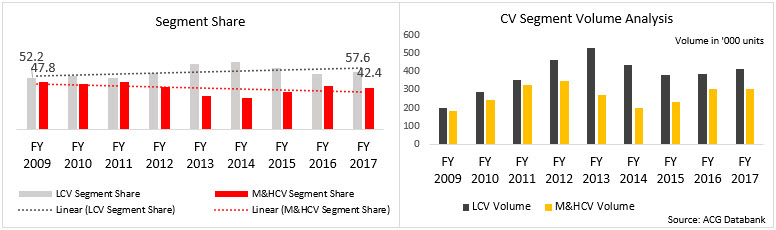

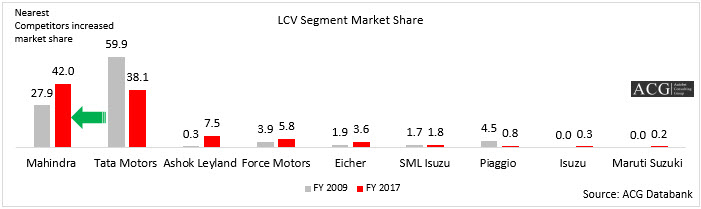

M&HCV and LCV Segment Analysis:

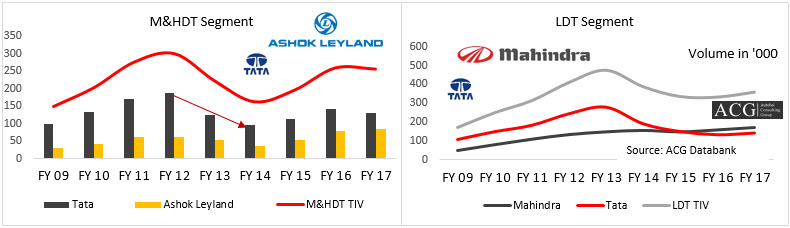

European players are more interested in the Medium & Heavy segment due to favorable market dynamics and competitive position. Foreign OEMs are focusing not only just selling the vehicle but selling the complete solution along with Telematics, Digital Technology etc. Since FY 2014, the M&HCV segment is showing positive moments from FY 14 to FY 16. Due to unexpected market dynamics, this segment lost around 2% share.

LCV segment share decline from FY 2014 to FY 2016.There is a minor improvement in FY 2017.

The Commercial Vehicle Industry outlook for FY 2018:

We expect that commercial vehicle to grow by 5 -6% in FY 18 due to normal Monsoon and GST bill. The sales growth should be visible after July 2017 after implementation of GST. It could reduce vehicle price by 3 to 4 percent.

(In our detail report, we have covered all market dynamics and their impacts on each OEM and Commercial Vehicle segment (SCV, LCV.MCV, and HCV) along with percentage impact on Commercial Vehicle Industry.)

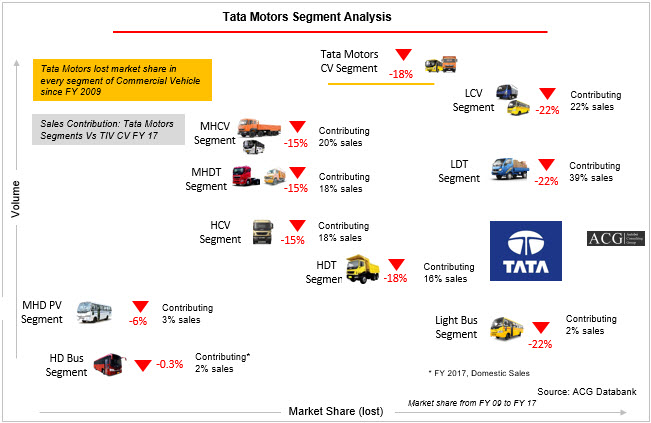

OEM strategy Analysis: Tata Motors Segment Overview:

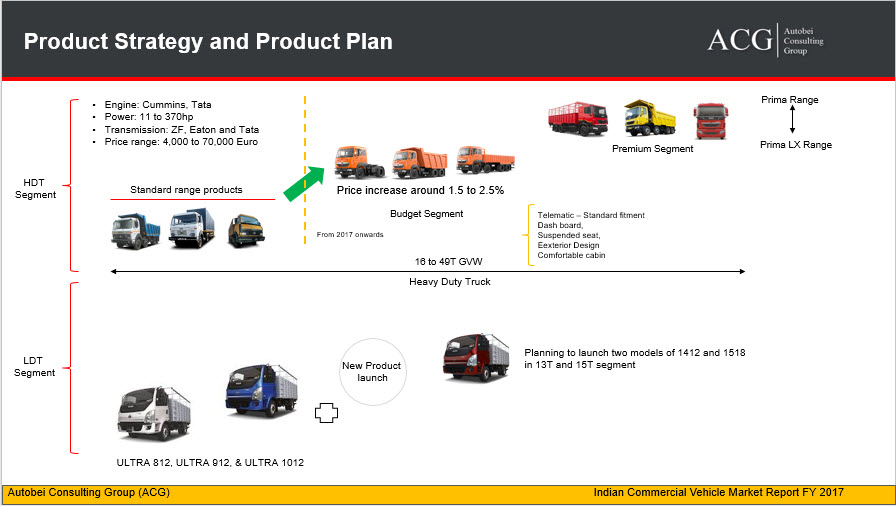

Tata Motors Product Strategy:

Tata Motors introduced new product range of Signa and upgrading the products like Pick Up Xenon and Tata ACE by modifying their body.The company is offering 4 years warranty on its heavy truck range and extended warranty.

Indian Commercial Vehicle showed continues growth since FY 15 but Tata Motors market share is declining.

Tata Motors lost its market share in every segment of Commercial vehicle. Overall it lost around 18 percent market share in its CV segment.The LDT segment which contributes around 51 percent of sales lost 22 percent market share in FY 2017.

Tata Motors is the biggest loser in this segment which lost around 15% market share. Ashok Leyland increased its market share from 25.7% to 32.4%, Eicher increased from 7.4% to 10.9%, BharatBenz showed excellent performance by achieving 4.1% market within 5 years of its operation.

LCV segment is dominating by local players. European players like Daimler, MAN are not planning to enter into this segment due to price position of vehicles. The LCV product would be more expensive with European technology. It also requires good after-sales network in rural and semi-urban areas. Mahindra Maxximo vehicle equipped with electronics parts. This was the major reason that this vehicle struggling in the market.Vehicle architecture must match the market dynamics, Application and Customer expectations.

Newly launched vehicle JEETO performance is excellent in mileage and Payload capacity.

Mahindra had just 27.9 percent market share in FY 2009 and Tata Motors had around 60 percent market share in Light Commercial Vehicle Segment. In 9 years, Mahindra became a market leader with 42 percent market share and Tata Motors hold only 38 percent market share in FY 2017. Bolero, Jeeto are flagship products of this segment.

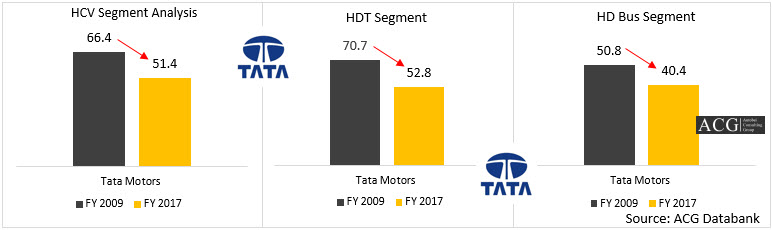

Tata Motors Heavy Commercial Vehicle Market Share Analysis:

In Heavy Commercial Vehicle Segment, Tata Motors lost market share in every segment of HCV. On the other hand, Mahindra, Eicher, Ashok Leyland and other players increased market share from FY 2009 to FY 2017.

Tata Motors, Industry and Competitors performance Analysis:

In M&HDT Truck segment, Tata Motors Volume declined by around 8% against Ashok Leyland 6.7 percent and Industry de-growth of 1.25 percent in FY 17.

In LDT segment, Tata Motors, Mahindra and Industry are in the same position by registering around 7 percent growth in FY 17 compared to FY 16.

Bus Segment:

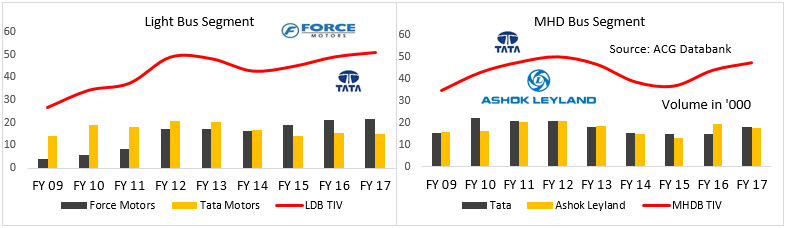

In Bus Tata Motors, given the excellent growth of 22 percent against Ashok Layland de-growth of 9.5 percent and industry growth of 7.6 percent.

In Light Bus segment, Force Motors is dominating the segment for a long time. Tata Motors showed de-growth of 0.95% against Force Motors 2.24 percent and Industry growth of 3.9 percent.

Promotion Strategy:

Tata Motors, recently started TV commercial with Akshay Kumar to promote its CV sales. Mahindra is also running TV commercial with Ajay Devgan for a long time but company registered only 17 percent growth in FY 17 compared to last year.

It is better to invest in product development, improvement and gain the confidence of the customers by giving world-class product. Ashok Leyland is a good example of this strategy. Company diverts the fund to invest in technology and also improved its balance sheet. We have not seen the exceptional impact of celebrities on Commercial vehicle business in any part of the world. Sometimes, it could only have a minor impact on branding.

It is better to invest in product development, improvement and gain the confidence of the customers by giving world-class product. Ashok Leyland is a good example of this strategy. Company diverts the fund to invest in technology and also improved its balance sheet. We have not seen the exceptional impact of celebrities on Commercial vehicle business in any part of the world. Sometimes, it could only have a minor impact on branding.

(In our detail report, we have covered Ashok Leyland, AMW, Force Motors, Mahindra, Piaggio Vehicle, Tata Motors, Maruti Suzuki, SML Isuzu, Eicher, Volvo, Scania, and MAN)

Report Highlights:

- Sales, Production and Export Trend and Forecast

- Segment Analysis: Truck & Bus

- Heavy Commercial Vehicle

- Medium-Heavy Commercial Vehicle

- Light Commercial Vehicle

- Small Commercial Vehicle

- Drive Line Analysis

- GST, Emission norms and other regulation changes

- Price Strategy

- Product portfolio and strategy

- Network Analysis

- Organization Structure

- Soft offering by OEMs

- Customer perception

- Economy Analysis

- Infrastructure

For customized Report please contact to Nidhi.Singh@autobei.com