The commercial vehicle segment is dictated by a compilation of many sub – segments which form the foundation for the economy of the CV segment. One of the main lead indicators of the economy of this segment is the Medium and Heavy commercial vehicle segments. They form a cyclic progression across the globe. This sub-segment also contributes to a major part of the business, mainly due to the long distance travelers and tippers. The past seven to eight quarters has seen mainly the HCV segment growing.

One of the major reasons for the elongated periods of recession can be owed to fluctuation of diesel prices. The freight rates have failed to keep at par with the hike in diesel prices causing demand to not be translated onto increase in sales due to this price hike.

Being one of the industries with most investment by the government has seen various actions taking place here, leading to positive sentiments being created due to their infrastructure investments. Land acquisition conflicts have been solved, which has resulted in many projects being stopped midway. This also led to the coal mining sector being re-opened and this will result in many opportunities opening up by 2015 as the economy is improving The government is expected to take a lot of steps in order to increase the productivity of the country and an optimistic mindset currently prevails the CV segment. With interest rates falling, an improving economy, low inflation and falling oil prices, the industries indeed have very high hopes in terms of productivity.

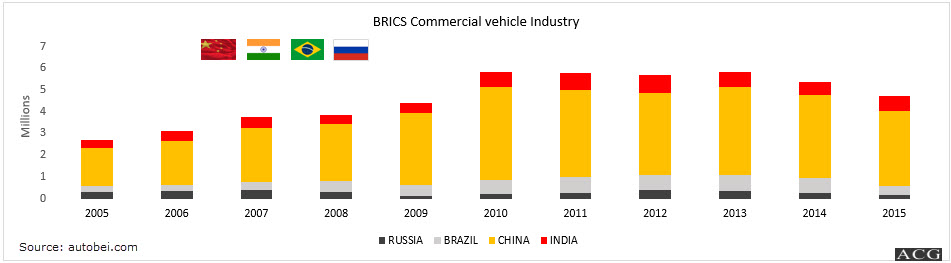

The Future is here, and with it, has brought unprecedented change and disruption. The Global Automotive industry has sped up the cogs of change by introducing Autonomous driving, connected vehicles, the rise of e-commerce and the sharing economy, surely changing the way that consumers view mobility and logistics. OEMs and suppliers need to learn to bear with the highly volatile market coupled with the huge competition and increased regulations of safety emissions. This list of competencies seem to only be growing every day.

Commercial Industry Overview:

There is a clear drop in the cargo sales of M & HCV segment in the last quarter of 11-12 whose cyclic nature took another 18 months to impact a full scale blow on the LCV and HCV segments too. This cyclic recession took almost two and a half years and it hit the SCV segment hard on the financial front. Though the situation is not as stark as before, it has still made a complete recovery from the recession. The years 2011- 2014 was the period the M & HCV segments were worst hit, the worst time of all being the January of 2012. During the year 2008-09, the global liquidity crisis created an exponential slump in sales, but however the effect on the M & HCV segments did not last long, and was able to revert back to normality in 8 to 9 months. Though the CV segment fell through by 25 – 30%, the Passenger vehicle segment remained unaffected. The problem, more than being the problem of the segment can be due to the failure to plan, as a country. The unstructured industry fell through due to lack of better planning strategies. Consequently, as the economy decline so do the industries that have not thought emergencies properly through. The country's planning is as bad as to give only an 80-85% utilization of trucks' capacity utilization. In the slump of 2012 – 2014, these utilization figures went down to an all-time low of 20 – 25%. Buses, being a minority of the segment fell by a small 10 – 15%.The cargo section of this segment suffered the wrath of fundamentally weak economics during the period from FY12 to FY2014. This breakdown was exceptionally bleak as it occurred from a height of 299000 units in FY12 and plummeted down to 162000 units in FY14.

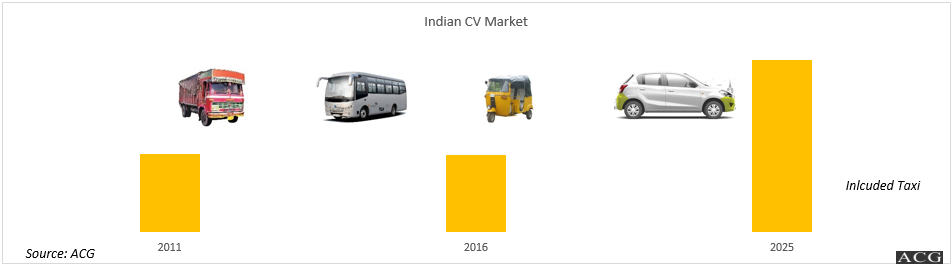

The CV sales in terms of value in US$ million figures for the commercial vehicle segment in the years 2011 and 2016 and also analyses the predictions for the year 2025. From the year 2011 to 2016, there has been a dip in sales of about 10%. However, these figures are predicted to multiply manifold by the year 2025. There can be seen more than 3 times the growth by this time. By 2025 the market size will be touched to 2,156 US$ million.

The influence of technological and business model distractions have had a profound impact on Indian OEMs which have been under pressure for several years now. Domestic overall CV segment sales saw a drastic drop from 12, 59,785 units to 12,41,699 units(including Truck,Bus, Three Wheeler and Taxis) in FY16 owing to a 0.3% drop in CAGR. This environment which has seen such a vast change in the little time can be due to both domestic as well as the negative global environment.

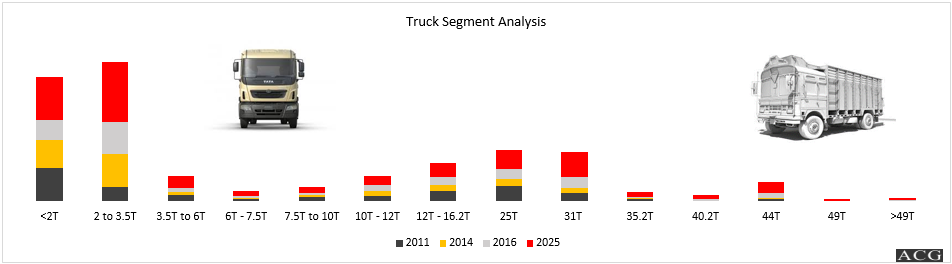

The success in sales varies across the different segments. The SCV passenger segment increased from 19% segment share in FY 2011 to 21% in FY16. There is a tough competition to SCV three wheeler passenger segment to four wheeler SCV segment, the Three Wheeler products are cheaper, less heavy, cost of ownership and operating cost. Sales was limited in the SCV segment also due to lack of finance. Parallel, the cargo section of the SCV segment also saw a major crunch in their sales from 0.27 million units in FY11 to 0.3 million units in FY16. It lost around 4% market share in 2016. In this segment, the 2 – 3.5T increased its segment share from 14% in 2011 to 31% in 2016. Sub – 2T mini trucks have lost in the market from a mere 32% in 2011 to an astounding 20% by FY16. This shift in the market scenario arose as a result of combining aggressive pricing and higher utility value of the larger vehicles. Mahindra dictates 68% of the market share, the remaining balanced out by Tata Motors and Ashok Leyland.

In stark contrast however, the last two years have led to an overall growth in sales owing to the optimistic economic impetus. This has led to the growth of more than 6% in GDP from FY2015 to FY2016. Boasting the highest growth rate among emerging nations, India has seen fluctuation in inflation and strong FDI inflows sum up to the optimistic business and consumer confidence. However, they still face the dire challenge of inflation in oil prices and elevated pressure on freight rates. "Make in India", a pro-investment initiative ensures 100% investment on defence and has also helped increase FDI limits in insurance and business sectors. These have help transition to a positive environment from a slow economy. This positive growth prevails in Q1FY2016 with a 12%YoY growth in domestic sales.

In terms of the LCV passenger segment, market size is stable at around 20,000 units since FY 2011. This segment's volumes can be reasoned due to urbanization and the increasing need for inter-city and semi-urban transport. Their cargo segment, in contrast went down by 45,000 units to 35,000 units from FY11 to FY16. CAGR in FY 2016 was -8% between 2011 to 2016 of 3.5T to 6T segment and expected to reach at 14% by 2025. Other sub segment of 6 to 7.5T CAGR 4.8% between FY 2011 to FY 2016 and expedted to reach 11% by 2025. The submerged sales could be owed to their overloading and restricted financial situation.

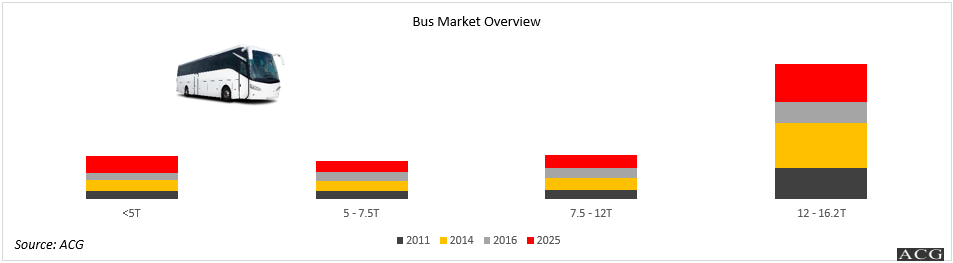

The MHCV Bus segment however underwent an 8.3% reduction in volume with only 43,000 units being sold between FY16. The 7.5 – 12T bus in this segment owed to 20% of total volume, showcasing a gradual increase from their 14% figure in FY11. The pioneers of this market are Ashok Leyland, with a market share of 45% and Tata motors with a market share of 34%, followed by Volvo Eicher.

The cargo section of this segment suffered the wrath of fundamentally weak economics during the period from FY 2012 to FY 2014. This breakdown was exceptionally bleak as it occurred from a height of 0.29 million units in FY 2011 and plummeted down to 0.16 million units in FY 2014. The situation has been improving since then, economically, owing to the growth in both GDP as well as infrastructure.

In a nutshell, it is clearly visible that there exists an inclination towards higher tonnage vehicles and tractor-trailers. On the other hand, the CAGR of Heavy segment 0.7% and expected to reach 9% by 2025. Tractor Trailer segment showed 11.27% CAGR from 2011 to 2016.

MCV cargo segment showed a -4.4% CAGR whereas LCV cargo segment's de growth was only a meagre 4.8%. The continued period of recession have led to the reduction of robustness of the segment. The LCV segment had seen continuous periods of growth since 2005 till in 2008-09 for a brief period of time. The M & HCV segments however began to affect the performance of LCV from 2014. This can be attributed to lower job opportunities and refusal of banks to provide more than 80% of the vehicle's value as loan. Though the scenario is a lot better for the M & HCV segment, the LCV segment still suffers and is slowly recovering from the slump. Inspite of all the downfalls, the segment did see significant changes in their market share. Ashok Leyland showed a 11% growth from FY12 to FY16 and is the current holder of 31% of the entire volume. Ashok Leyland's strong foothold in the market can be owed to a delicate balance struck between strong economic activities in South India and a major increase in the dealer network in North India. The 35.2 – 40T and > 49T segment vehicles also added to strong market share gains. In contrast, Tata Motors saw a stark dip in market share from 62% to 55% in this period. These figures however do not strengthen the fact that their strength of the duopoly rose from 82% to 86% between FY 2012 and FY 2016.

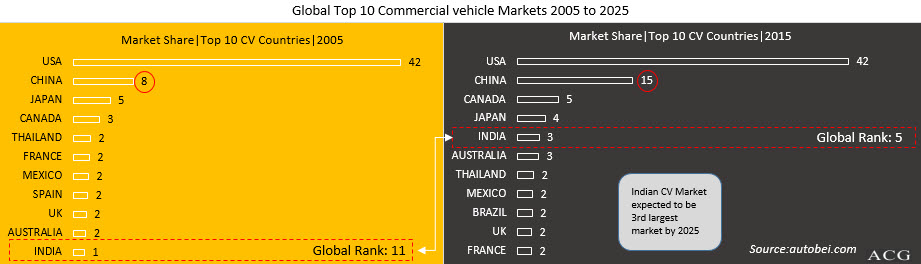

Overall, the CV segment volume is predicted to shoot by 2.7 million units by the year 2025 included Truck, Bus, Three Wheeler and Taxi segment. This is expected to be brought about by various significant factors determining the segment's growth. Most of this above mentioned growth is expected to be the contribution of the SCV segment which will grow by 10% CAGR by 2025. LCVs however will only grow moderately to about 13% CAGR by 2025 and buses are expected to show an even lesser rate of growth reaching only 0.26 million units by 2025. The HCV segment on the other hand is predicted to grow by 10% in CAGR by 2025. The end result is the inevitable placement of India as the world's third largest MHCV market.

Growth Drivers:

Some of the main drivers for the CV market include economy, availability of load , low cost finance and freight rate – diesel price equilibrium. Currently, fuel prices are low, freight rates are at comfortable levels and customers are seeing profits. This leads to an improvement of the general economy consequently leading to the betterment of the industry. Increased road construction and mining activities have also contributed to the economy development. Now, customers are looking for a way to make the situation even better with modernization of operations that require better equipped trucks for the purpose. The huge that occurred is the replacement of the fleet that hadn’t happened in the last three years. As economy keeps growing, the size of the fleet also increases linearly. With new e-commerce companies entering the field, this process has been escalated. The National Green Tribunal is also one of the factors that caused growth in the segment.

The Heavy duty segment is also showing refreshing sales figures with earlier peak touching 215,000 units in FY 2016. If this growth prevails, we will cross the peak in the year 2017, however we have noticed some de growth in this segment sales in July & August month. The Tipper and Rigid segments have shown a 90% growth compared to their peak values with 175,000 units in 2011 and 165,000 units in 2016. The replacement demand has been struck to give rise to large fleet operations. With the GST being approved by the Parliament, makes logistics and tax processing very easy. The present distribution process in inefficient, however the advent of GST will change all that and reduce the number of barriers one has to go through to reach the depots, leading to a very efficient distribution system. The GST will also lead to escalation of revenue as this involves taking credit and paying tax only on the value of portion added. Short term effects may be infinitesimal, but long term effects may be a profitable solution.

Apart from road construction and mining activities, we also see other infrastructure based projects kicking into place such as transportation of cement, steel, etc. The tippers that were used for construction and mining saw a major decline in the market in 2014. In 2011, 66,000 units accounted for the peak which is likely to plummet to 45,000 trucks in 2015. Though there has been a refreshing growth in the coal – mining industry, the demand for iron ore mining and construction tippers are at a standstill. Though there is an expectation for new projects to be launched, the future was bleak and unsure but we have seen attarctive growth in Tipper segment in 2016 due to latest development in Infra and mining sectors..

Truck Segment:

The above graph shows the growth or decline of sales of the vehicles from the 2T – 15T segments in 2011, 2014 and 2016. The less than 2T segment has seen a steady downfall from the year 2011 and the situation has still not stabilized with this segment. One can see a drop by almost 40% in this segment.

On the other hand, the 2T to 3.5T segment has seen more than doubling of sales from 2011 to 2016. The other components of the segment have seen either very little or no growth in their sales during this time and also account for a very tiny share of the overall market share.

The 5 – 15 tonne segment which has shown the least growth is still resuming its downward growth though the crisis has been averted. This segment which peaked at 100,000 units per annum has dropped to less than 70,000 units in 2014 and managed to reach 80,000 units in FY 2016. August however saw a 20% hike in sales of the LMD segment, but these were mostly due to small operators who still find it hard to receive funding. The recovery process of the LMD truck segment is taking longer than expected, with normal recovery lag period oscillating between 6 to 9 months.

Passenger Vehicle Segment:

A similar pattern is followed with the bus segment as the commercial vehicle segment. A major difference however is that it does not follow a cyclic pattern as it does with trucks. The recovery process is faster and the fall is much less drastic and cyclic. As trucks are recovering, there is an exemplar growth in the revenue generated by trucks. During a five year period, the cost incurred by the operator is merely 20% whereas fuel accounts for 50-55% of the cost. Bus requirements vary as per the state they run in. This market however, is very significant, especially in rural areas to impact development. State transport undertakings take the biggest push as they form the largest number of big buses catering to intercity transport for passengers. Though last year, lack of funds prevented them from replacing their fleet, this year they have been doing the same diligently. So, state transport undertaking has already seen many orders being placed for the course of this year. Another attractive option is the school bus segment. Tata Motors and Ashok Leyland sold only chassis to both truck as well as bus segment in the year 2001-02. But, the scenario has changed multi fold in the past couple of years. Buses now have switched to BSIV from BSIII due to their extensive use, along with their use of radial tires. With passenger transportation in mind, OEMs need to build an even more specialized network to cater to the metropolitan cities it services. The southern part of India, particularly Tamil Nadu is one of the most advanced bus markets in the country. The concept of 5-7 hour long bus journey started here and then spread. North India, on the other hand limited itself to this thought. Hence, Tamilnadu has been a major trendsetter in terms of bus travel and service.

With great power comes great responsibility, a great man once said. Hence, bus codes and regulations need to be charted in the interest of customers. It covers not only the driver and the conductor but also the 55 odd people who travel in the vestibule every day. The code made the Anti-lock braking system mandatory, and directs bus drivers to follow uniformity in seating arrangements to ensure a comfortable journey for the passengers. Luxury buses have a very minimal level of visibility, and even lower, in the case of foreign players. The Indian OEMs have captured the budget segment, and these OEMs concentrate more on inter-city transport and are interested only in lower price brands. These have much less powerful engines than the luxury buses.

The bus market is driven by the IT and the BPO markets, which have enabled more fleet operators and stage carriers.

Investment by OEMs:

VECV plans to invest Rs.400 crores for capital investments added to the Rs.2700 crore already invested in the past four years. This proves that OEMs are interested in further investment on technology, product capacity and business. With the launch of new products, this has also allocated new emission norms. From 2020, Euro VI norms are expected to be allocated to increase the capacity of this segment further.

Competitor Analysis and Product Strategy:

The strategy of OEMs need to be varied to include concept of engineering in order to decrease weight, save fuel, increase payload and reach top speed better. The space for the driver needs to be made comfortable with an air conditioned cabin and bunk beds for the co-driver to rest. This is to increase efficiency by having two or three drivers to take turns during a 20 hour bus journey. Other key features like ABS and telemetry are added to increase the safety of the vehicle. BharatBenz's entry into the mid segment truck portfolio with already existing VECV, Tata, Ashok Leyland are others plan to give an equivalent range of products to the customers.

With VECV's new range of PRO series, the cabin and the exterior are attractive but electronic malfunctions have led to after sales issues.

The current strategy focuses on the heavy duty segment and questions how to gain maximum growth from the segment. Parallel, the SCV segment is also placed in the loop, although the market share is more pronounced in the Light and Medium duty CV segment. VECV has emerged as a strong power in all segments and has added 2 percent to its market share this year. Buses have increased their share every year and is expected to hike beyond 14.9%. With exports, the bus segment looks to increase its value by 2%. The heavy duty industry, governed by the CV segment has the highest opportunity for growth and has planned to launch five new models in the 25 – 49 T range.

The company expects new products launched as a part of Eicher's portfolio, namely Eicher Pro 1000, Eicher Pro 3000, Eicher Pro 6000 series, Eicher Pro 8000 series and Eicher skyline Pro buses. The launch of these products will help to increase the volume as well as the market of the bus segment in the next 5 years. A new generation of heavy duty trucks, tippers with high power and torque and a great deal of requirement fulfilment and sophistication are going to be released from 25T to 49T GVW. The segment promises to take care of all customers' concerns during the entire life cycle of the vehicle, regarding anything from productivity to efficiency. The LCV segment, not being the spotlight, its focus is shifted to the M & HCV segment.

The medium and Heavy Commercial vehicle segment of Tata Motors grew by 14.9% and its domestic market share showcases a spectacular 54.4% This exceptional figures rise from the export of Prima and Ultra trucks in the year 2015. These vehicles were seen to outshine in developed markets as well. It has been working wonders in the Middle East, ASEAN and the South African markets. Due to this, the exports market share has increased from 10% to 20%.

Ashok Leyland, on the other hand has raced past the growth og the industry. This budget brand has Boss, which is the market leader and Captain, also a budget vehicle. It has a huge advantage over its competitors.

Customers Portfolio:

The varied customer description of the Passenger vehicle and commercial vehicle segments pushes for a proper understanding of what each customer wants from either market and cater to that specific need. For example, the customers of the Passenger vehicle segment will be attracted by a jazzy exterior, and will not mind increased costs due to the same. However, the Commercial vehicle customer will worry about cost, load, carrying capacity, fuel, durability, service, upfront acquisition costs, uptime, productivity, turnaround time, overload capacity and overall return on their investment. Unless the product is able to fulfill all these requirements, the commercial vehicle customer will not think twice to say No and walk out.

Challenges:

– Much better infrastructure is required and needs a lot of tweaking and improvements.

– Emission standard: Euro 4 's implementation needs to be changed to Euro 6 to get a better performance

– Sulphur concentration – The present concentration of sulphur in fuels is alarming. Euro – 6 will bring a change to this too.

– CV industry capacity utilization is greater than 50 – 55% as a lot of new capacity has been introduced in the past years. Due to this, many new companies have not been able to reach their projected figures.

– Other challenges include discount, Product mix, cost, competition, etc.

Key Highlights of the report: Full customize option is also available

– Historical & Outlook volume in terms of units and Value

– State and Region wise – (North, South, West and East)

– Segment Analysis

– Bus Application dynamics analysis

– Replacement Demand cycle, Buying criterea segment wise

– Technology updates and its impact on future of CV Industry

– Pricing & Discount Analysis

– After Sales

– Network Analysis

– Export Strategy and Market

– Vehicle Tracking & Fleet Management

– Company Result update:

Tata Motors

– Ashok Leyland

– Eicher

– SMl Isuzu