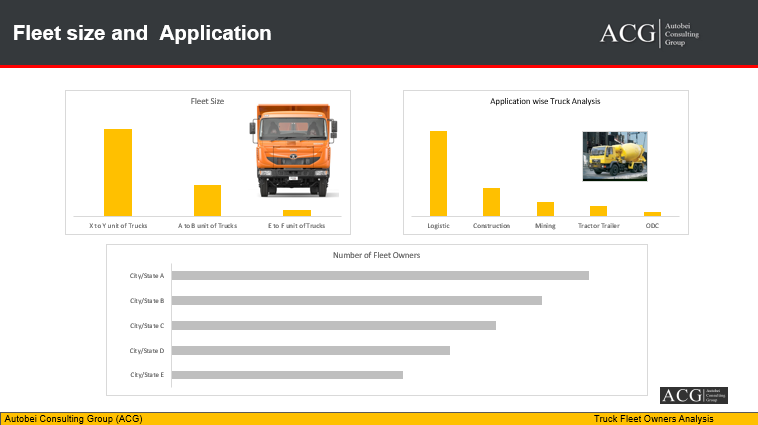

The Fleet Owner Analysis Report is the master key and backbone of the Indian Truck Industry. This is the exclusive primary data collection of Transporters in India. 1 to 5 trucks fleet size is the largest segment in India.

After the implementation of GST, Improvement in infrastructure, New regulations and policy will reshape Indian Commercial Vehicles. Post GST, Efficiency and payload capacity utilization of trucks increased after-tax reforms. Border check post has been removed and it helps to the travel time of haulage trucks at least four to five times. This also has a positive impact on TCO and the running economy of the trucks. Logistic costs were reduced from 20 to 25 percent after July 1st. The government is also introducing digital technology to make an easy trip for transporters and truck drivers.

The replacement demand is mainly driven by the advanced technology of the vehicle like Safety features, Fuel efficiency, better Payload, Connected trucks, Better speed options and low running costs of the trucks. It is expected that overall the profitability of transporters will increase 2 to 3 times in the next 3 years. This is the right time to upgrade the fleet portfolio and go for heavy truck models to increase income. After the Bharatmala project, there will be a drastic improvement in the transportation industry.

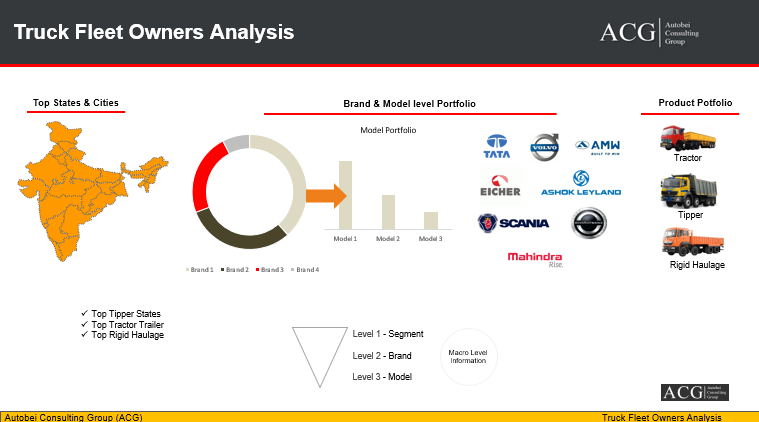

This exclusive data is the pulse of the Truck Industry at your fingertip. This will be helpful in diagnosing the Fleet Owners Current challenges, Trends, Expectations, Survey, Fleet size, Fleet Mix Portfolio, Brand mix, Product combination, Popular brand, Relation between Product, Application, and Brand portfolio with Truck Application, State-wise Brand position, Key markets for Tipper, Tractor Trailer, and Haulage.

The database has unlimited advantages for Existing OEMs, those planning to enter into Indian Market, Component manufacturers like Axle, Breaks, Lights, GPRS systems, Truck Body manufacturers, Oil, Air and fuel Filters, Tyres, Bearing, Clutch plates, Suspension, Aftermarket products, etc.

It could also be a game-changer for other stakeholders of the Industry like Financiers, Truck Insurance, Branding companies, Fuel cards, and other service providers.

Our Fleet Owner database includes the following key information:

- Name of the Fleet Company -Small | Medium and Large Fleet owners

- Address

- Phone /Mobile Number

- Key Contact person

- HCV & LCV Segment

- Truck Service available – Geography/ route

- Age of Fleet Company

- Email Address

- Website

- Personal vehicle Portfolio

- Number of Trucks/Fleet size – Small | Medium and Large

- Type of Trucks – Trailer, ODC, Tipper, Haulage

- Vehicle Manufacturer: Tata, Ashok Leyland, Mahindra, AMW, BharatBenz, MAN, Volvo, Eicher, Scania, Mercedes

- We provide information on Top Markets (Locations/ States/ City) for Tipper, Tractor, ODC, Rigid Haulage segment.

- Application of Vehicle: Machinery goods, Cotton box, Wooden box, Household and Commercial shifting, Iron, Steel, Cement, Paint, Parcel, Cartons, Vegetables and General goods, Electronic items, Medicine, Food goods, Garment items, Pharma Chemical, Earth moving machinery, Tyres, Horlicks, Biscuits, Aluminium sheets, Containers goods, Open Trailers goods, Machinery goods, Parcel, Pharma, Rice, Cleaner machines, Raw Materials, Plywood, Cotton box, Empty Bottles, Tanker, Electronic items.

- Survey for launching new product, current product feedback and make changes

- What features are expected by fleet owners

- Top Trucking center

Following States and Cities are covered: South, North, East and West Zone

Andhra Pradesh, Assam, Bihar, Chhattisgarh, Delhi, Goa, Gujarat, Haryana, Himachal Pradesh, Jammu Kashmir, Jharkhand, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Orissa, Punjab, Rajasthan, Tamilnadu, Uttar Pradesh, Uttaranchal, Vidharbha, and West Bengal

60 plus Cities: Delhi, Gurgaon, Noida, Ghaziabad, Faridabad, Mumbai, Bangalore, Ahmadabad, Agra, Amritsar, Udaipur, Ajmer, Jaipur, Ambala, Bhilai, Bilaspur, Calcutta, Chandigarh, Chennai, Aurangabad, Ambala, Amritsar, Bangalore, Bokaro, Ghaziabad, Faridabad, Gandidham, Gurgaon, Goa, Hissar, Hospet Bellary, Hosur, Gobindgarh, Indore, Jalandhar, Hyderabad, Jalgaon, Korba, Kolhapur, Jalna, Jalandhar, Kolhapur, Meerut, Mumbai, Lucknow, Mysore, Nagpur, Nashik, Noida, Panipat, Patna, Mumbai, Muzaffarnagar, Kanpur, Jamshedpur, Jalgaon, Jalna, Korba, Pune, Raigarh, Raipur, Rajkot, Ranchi, Rudrapur, Valsad, Vapi, Jaipur, Jodhpur, Udaipur, Ajmer, Alwar, Beawar, Behror, Kotputli, Nasirabad, Neemrana, Bhiwadi, Bikaner, Bhilwara, Kota, Pali Bundi, Abu Road, Daosa, Tonk ,Baran, and Nagaur, Sirohi, and others.

Advantages:

- Dealer & Service Network Strategy

- Optimum Marketing Campaign and strategy

- Drafting Sales Strategy

- Customer Target & Segment

- Easy and Fast to reach transporters in India

- Helpful for demand and Forecast Analysis

We also provide complete Market solution along with Fleet owner data. Our solution includes Detail Analysis of Indian Truck Industry, State wise Analysis, Truck Pricing Strategy, Product Analysis, Model wise sales and Production Trend and forecast, Brand perception, Digital Technology role in Indian Truck Industry, and Spare parts price Analysis.

This database also gives you the option to target by type of Truck, Geography and Application type.

ACG provides the Primary survey of fleet owners and Drivers of the truck. On request, we provide After Sales fleet owners practice also like the In-house facility of Truck Maintenance & Repair, Educational information of mechanics, Language skills – Local, Hindi or multi-language, Planning to buy new trucks, Buying process of Trucks.

Bus Fleet owner data is also available with their fleet detail.