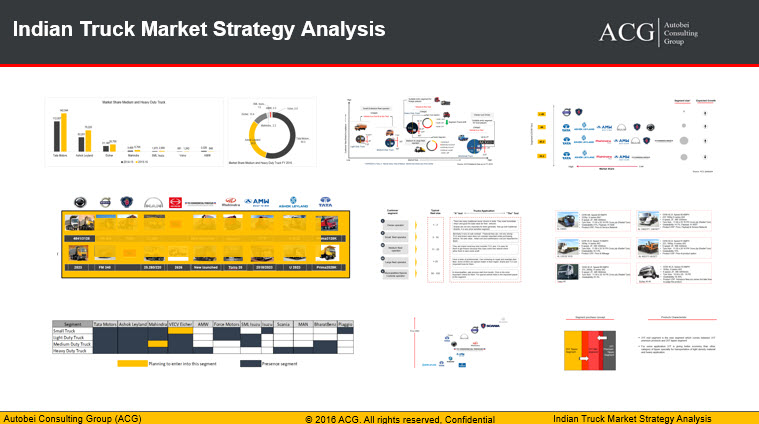

Indian Truck Industry Strategy Analysis Report is our most detailed Market Intelligence report on Indian Truck Market. A comprehensive view of India’s different truck segments and analyses the various brands in each against their presence in the market. In the small truck segment, the major players like Tata Motors, Ashok Leyland, Mahindra, Force Motors, Isuzu, and Piaggio have already stamped their presence into this segment.

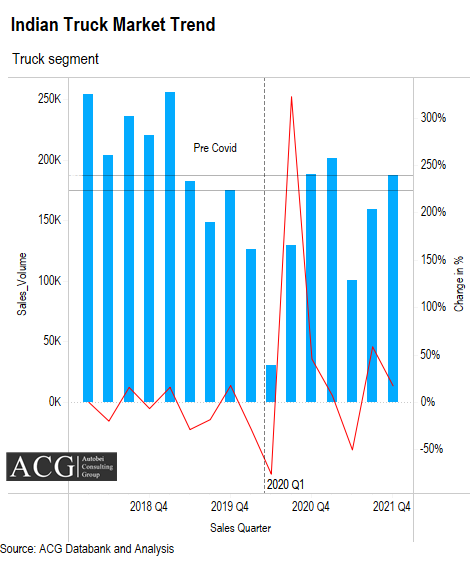

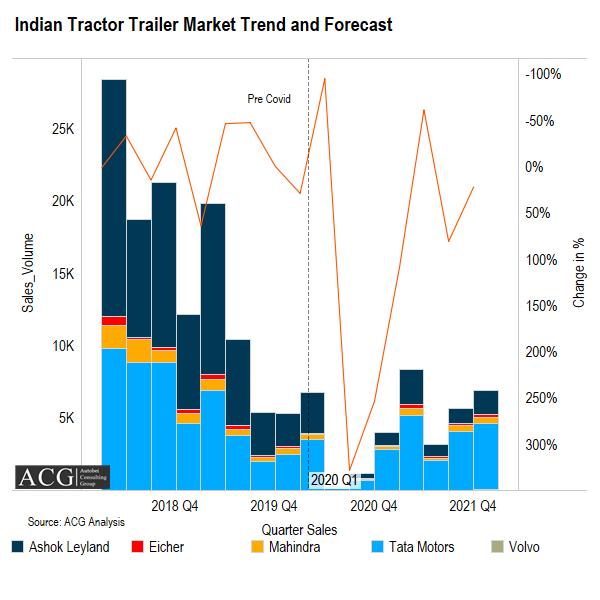

COVID 19 has impacted Truck Sales volume heavily after March 2020.

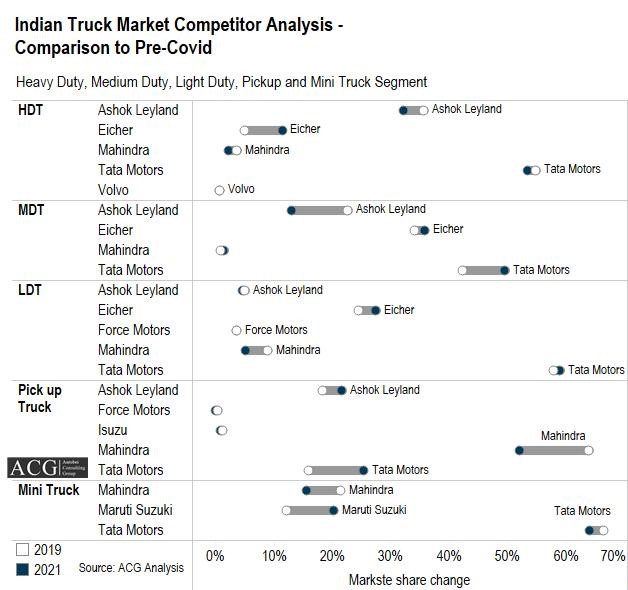

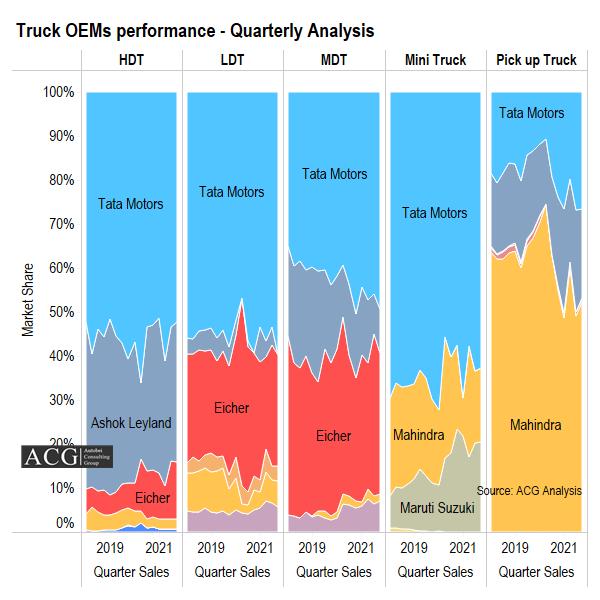

In the Light Duty Truck segment, Most of the key players in the truck industry are already present in this segment, while sadly none of the remaining brands (European) are planning to enter into this segment. This scenario is almost opposite to the Heavy and Medium duty truck segment.

In terms of their success stories, the small truck segment has reached gold with its extremely pleasing, skyrocketing figures. This success can be attributed to having offered price-sensitive solutions to customers concerning both pricing of local parts and support after-sales. Presently, this segment looks forward to upping its stakes to the more ludicrous Medium Budget segment by the year 2024. By this year, the entire dynamics of this segment are expected to change and undergo a major makeover. This segment is dictated entirely by the Indian OEMs. Isuzu is a company, clearly defined by the quality of both the vehicles and parts.

A recent study conducted by ACG revealed that this company was in all the customer’s good books as they are highly satisfied with its performance. This highly recommended trait of it is one of the main reasons it has escalated to where it is now, powered by a multitude of awareness campaigns and people’s support. One of the only drawbacks we at ACG had realized with regards to this company is that they would highly benefit from a more focused and widespread PR campaign specializing in the arenas of showcasing and advertising. This segment’s customers are main drivers who are mandated to run the business on a daily basis, which also owes to the great success of this segment. The pioneers of this segment are Mahindra, closely followed in popularity by Tata Motors and Ashok Leyland.

Though their figures show a tumultuous behavior over the years individually, with respect to the other segments, their growth has been spectacular. The Light Duty Truck segment, however, has seen a fairly constant behavior over the years. Following the profitable scenario of the small truck segment, the Heavy Duty Truck segment has shown the next considerable growth growing linearly and almost equalling their small truck counterpart in the year 2017-18. The Medium Duty Trucks however as their name suggests have shown mediocre behavior over the years and have managed to maintain their state homeostasis. Individually, this happens to be the situation here concerning the Indian market scene. Small trucks have seen an incredibly doubled acceleration in their figures. The Light Duty and Medium Duty Truck segments have seen constant numbers at this time.

The Heavy Duty Truck segment, on the other hand, have also shown considerable degrowth amounting to almost 14% in FY 2021.

Check here Model wise Sales Data also

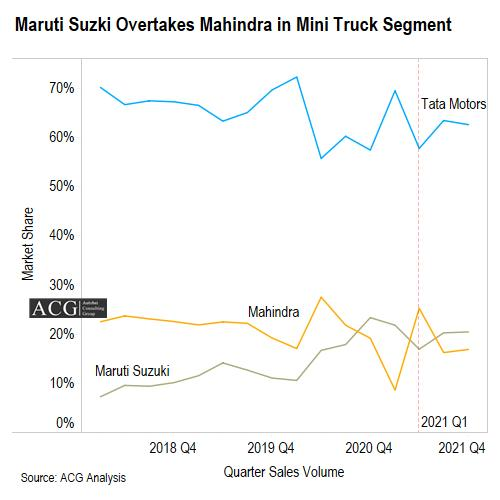

Mini/Pick up Truck Segment Analysis:

The small truck segment is an extremely price-sensitive one and this is one segment where customers expect to receive local parts and support after-sales. It needs to make the transition from being a low budget segment to a medium budget one and this is attempted to be done by the year 2024, considering the ever-changing market dynamics scenario. Currently, this segment is being dominated mainly by Indian OEMs. According to a study conducted by ACG, most of its consumers are satisfied by the performance and quality of Isuzu, Tata, and Mahindra vehicles. Based on the recommendation, sales are driven and it has seen some flourishing business. Though they are receiving commendation for their products, Isuzu needs to buckle up their awareness campaign and move forward attempting to spread the news of their new launches and features.

The pioneers of this segment are Mahindra. The runner-ups are Tata Motors and Ashok Leyland.

Light Duty Truck segment:

The major dictator of this segment is Tata Motors who have seen a degrowth of almost 16% and market share moved from 55% in FY 2020 to 56% market share in the year FY 2021. In second place with a huge gap in between is VECVs- Eicher which has also seen a slight growth accounting for 29 percent market share. All the other companies namely, SML Isuzu, Mahindra, Force Motors and Ashok Leyland have very minimal shares.

The Light-duty truck segment is run by the Indian OEMs, like Tata Motors as the pioneer of this segment. Other top players include Eicher and SML Isuzu. With better after-sales support, TCO, and a better life cycle this could move from its status of being low budget into a medium budget model. Those who use these vehicles range from truck owners and drivers. The usage as such is mainly on a short-term basis.

Medium-Duty Truck:

From being a predominantly low budget segment, this is forecast to move to the status of the medium budget by the year 2024. The market is led by Tata Motors which grasp a major 41% of it, with Eicher Motors closely following with a similar 31% market share. The remaining share is distributed among two major players, namely, Ashok Leyland and SML Isuzu. Pioneers like Eicher Motors and Tata Motors have seen a notable change in their share. However, Ashok Leyland has lost by more than 7% in market share. The major characteristic of this segment is that the fleet size is comparatively bigger, coupled with better vehicle handling and usage. However, they have very little consideration for TCO, product lifecycle, payload, etc.

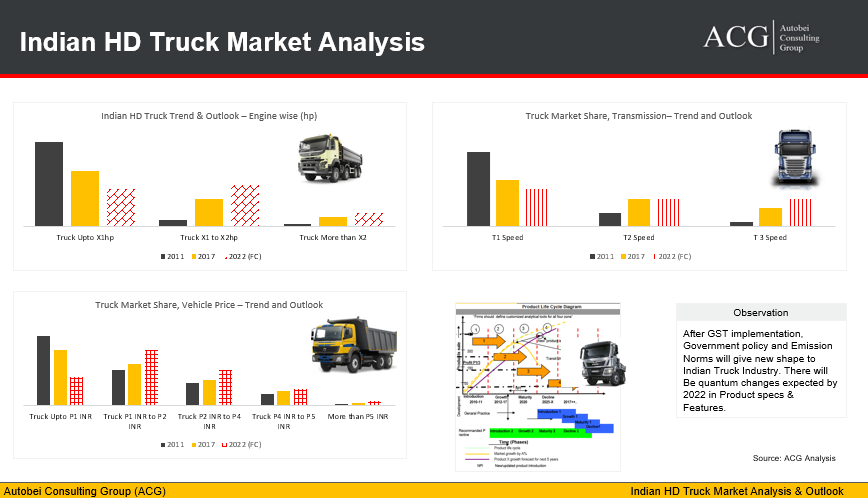

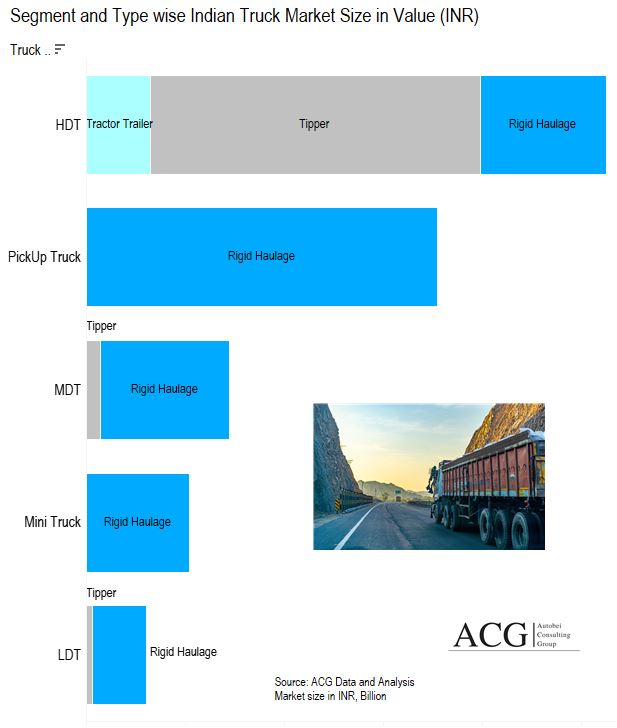

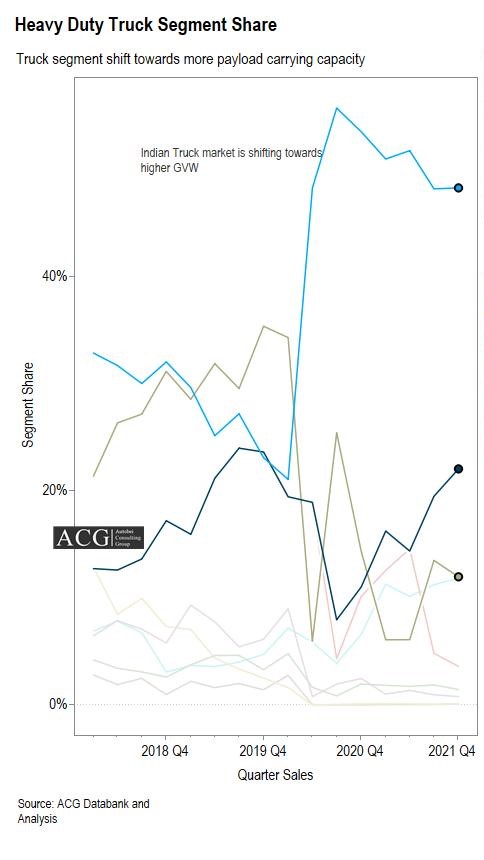

Heavy Duty Truck:

This was a predominantly Medium budget segment, which is expected to move onto being a High Budget segment by 2024. The key dictators of this segment are Tata Motors which capture an astounding 58% of the market, going down in the market share by almost 2% in FY 2021 compared to FY 2021. Ashok Leyland comes in a close second with a market share of 31% has lost in the market by almost 5% over the past year. Companies like Mahindra & Mahindra, Volvo, and VECV capture the minuscule shares of the truck market.

Above all this, the segment is a highly competitive one with the presence of a multitude of European players like BharatBenz, Scania, and Volvo. The segment is divided into Tippers, Rigid Haulage, Tractors, and Special Vehicles. However, a major proportion of the European players happens to be tippers owing to reasons of application, TCO and performance of a vehicle. BharatBenz, on the other hand, has made an impressive stand in the Haulage segment also. Customers of this segment are open-minded about considering new brands and their business propositions are also open on a long-term basis, which adds to the success of this segment. Haulage falls in between low and medium-budget segments concerning budget positioning while the tipper positions itself between the medium and high-budget segments. Companies like Scania and Volvo are in the premium segment. Volvo leads ODCs and the mining application segments.

Table of Content:

1. Indian Truck Market Overview

– Economy

– Market Size

– Segment overview

– Major players

– Key Market Dynamics

2. Segment Analysis:

– Small/Mini Truck

o By Units

o by Worth

o Segment growth

o Segment Share

o Segment Drive-line analysis

o Price range

o Product Application analysis

o After sales and product support analysis

o Used vehicle Analysis

o Trend Analysis

o Buyers profile

o Segment Dynamics

o Forecast

– Light Duty Truck

o By Units

o by Worth

o Segment growth

o Segment Share

o Segment Drive-line analysis

o Price range

o Product Application analysis

o After sales and product support analysis

o Used vehicle Analysis

o Trend Analysis

o Buyers profile

o Segment Dynamics

o Forecast

– Medium-Duty Truck

o By Units

o by Worth

o Segment growth

o Segment Share

o Segment Drive-line analysis

o Price range

o Product Application analysis

o After sales and product support analysis

o Used vehicle Analysis

o Trend Analysis

o Buyers profile

o Segment Dynamics

o Forecast

– Heavy Duty Truck

o By Units

o by Worth

o Segment growth

o Segment Share

o Segment Drive-line analysis

o Price range

o Product Application analysis

o After sales and product support analysis

o Used vehicle Analysis

o Trend Analysis

o Buyers profile

o Segment Dynamics

o Forecast

3. Product Analysis

– Product segment

– Application wise

– Price-wise

– Type-wise

– Category wise

– Engine-wise

– Transmission wise

– Fully built

– Chassis

– Cabin & Chassis

– Product Gap analysis

– Product USP

– Product Age

– Product Life Cycle Analysis

– Market acceptance Analysis

– Customer Survey and Feedback Analysis

– Mapping of application and model

– Vehicle Type:

o Tipper

Product portfolio

Key Models

Technical Analysis

Price range

Application

Sales and Market share analysis

Competitive Analysis

After Sales Analysis

Customer profile

Buyers pattern

o Rigid Haulage

Product portfolio

Key Models

Technical Analysis

Price range

Application

Sales and Market share analysis

Competitive Analysis

After Sales Analysis

Customer profile

Buyers pattern

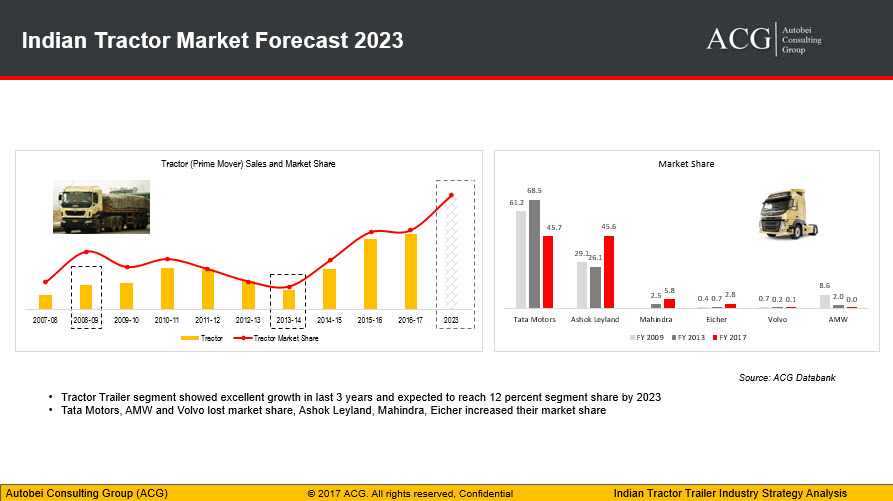

o Tractor – Long Haulage

Product portfolio

Key Models

Technical Analysis

Price range

Application

Sales and Market share analysis

Competitive Analysis

After Sales Analysis

Customer profile

Buyers pattern

o Special or Customized Application

Product portfolio

Key Models

Technical Analysis

Price range

Application

Sales and Market share analysis

Competitive Analysis

After Sales Analysis

Customer profile

Buyers pattern

4. Customer Behavior

– Psychology

– Behavior parameter forecast

– Trend Analysis

– Customer profile

– Truck buying factors

– Segment and Application Wise Brand Recall

5. Product Segment Analysis:

– Low Budget

o Definition

o Price bracket

o Major Models

o Application suitability

o Customer segment

o Segment Trend

o Segment dynamics

– Medium Budget

o Definition

o Price bracket

o Major Models

o Application suitability

o Customer segment

o Segment Trend

o Segment dynamics

– High Budget

o Definition

o Price bracket

o Major Models

o Application suitability

o Customer segment

o Segment Trend

o Segment dynamics

– Premium

o Definition

o Price bracket

o Major Models

o Application suitability

o Customer segment

o Segment Trend

o Segment dynamics

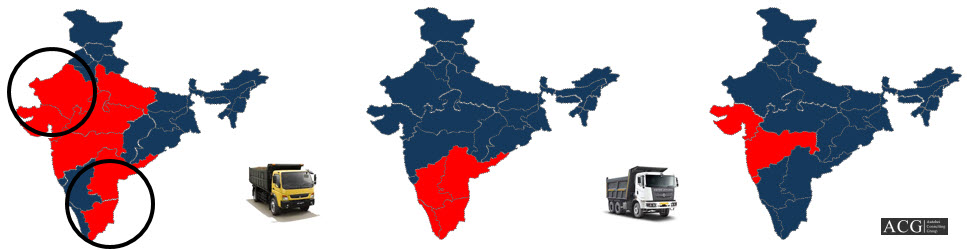

6. Zone wise Truck Market Analysis

– North zone

o Market size

o Market trend

o Market forecast

o Market dynamics

o Market share

o OEMs wise analysis

o Major Application

o Demand Analysis

o The Major States for Truck sales

o Customer behavior

– South zone

o Market size

o Market trend

o Market forecast

o Market dynamics

o Market share

– East zone

o Market size

o Market trend

o Market forecast

o Market dynamics

o Market share

o OEMs wise analysis

o Major Application

o Demand Analysis

o The Major States for Truck sales

o Customer behavior

– West zone

o Market size

o Market trend

o Market forecast

o Market dynamics

o Market share

o OEMs wise analysis

o Major Application

o Demand Analysis

o The Major States for Truck sales

o Customer behavior

7. State-wise Analysis

Karnataka

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

Andhra Pradesh

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

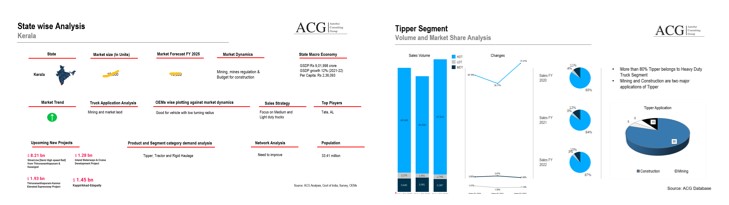

Kerala

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

Tamil Nadu

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

Uttar Pradesh

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

Himachal Pradesh

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

Delhi

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

Madhya Pradesh

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

Chhattisgarh

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

Rajasthan

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

Uttaranchal Pradesh

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

Jammu & Kashmir

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

Gujarat

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

Maharashtra

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

o

Orissa

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

West Bengal

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

Bihar

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

Jharkhand

o Market size

o Market Forecast

o Market Dynamics

o State Macro Economy

o Market Trend

o Truck Application analysis

o OEMs wise plotting against market dynamics

o Sales Strategy

o Top Players

o Upcoming New Projects

o Product and Segment category demand analysis

o Network Analysis

8. Pricing Trend Analysis: MRP & Discount Trend

– Small Truck

– Light Duty Truck

– Medium-Duty Truck

– Heavy Duty Truck

Competitive price position of Tata, Ashok Leyland, BharatBenz, AMW, MAN, Piaggio, Force Motors, Mahindra, Volvo, Scania, SML Isuzu, Isuzu, Eicher

o Tipper

o Rigid Haulage

o Tractor

9. Business Environment:

– Major challenges

– Opportunities

– Global Impact

– Business Sentiments

– Political & Economy

– FDI and Exchange rate

10. Major Export Market:

– OEM Analysis

– Key Export Markets

11. Application Industry Analysis

– Construction

– Road

– Real Estate Development

– Port

– Mining

– Logistics

– E-Commerce Industry and its impact on Truck Industry

– Cement Industry

– ODC

– Light & Heavy Machinery

– Manufacturing Industry

– Local Transport

12. Used Truck Analysis

– Market size

– Commercial and Technical challenges

– Buying pattern

– Trend Analysis

– Business practice

– Advantages

– Disadvantages

– Finance challenges

13. Advertising

– Truck Industry traditional way

– Most effective ad strategy

– Competitor Ad strategy

– Print

– Electronic

– TV Commercial

– Digital

14. Company Analysis

– Tata Motors

o Latest Developments

o Product portfolio

o Product age

o Product lifecycle

o Application analysis

o Strategy

o Segment Analysis

o Customer profile

o Brand perception

o USP

o Key persons

– Ashok Leyland

o Latest Developments

o Product portfolio

o Product age

o Product lifecycle

o Application analysis

o Strategy

o Segment Analysis

o Customer profile

o Brand perception

o USP

o Key persons

– VECV Eicher

o Latest Developments

o Product portfolio

o Product age

o Product lifecycle

o Application analysis

o Strategy

o Segment Analysis

o Customer profile

o Brand perception

o USP

– VECV Volvo

o Latest Developments

o Product portfolio

o Product age

o Product lifecycle

o Application analysis

o Strategy

o Segment Analysis

o Customer profile

o Brand perception

o USP

– Scania Commercial Vehicles India Private Limited

o Product portfolio

o Latest Developments

o Product age

o Product lifecycle

o Application analysis

o Strategy

o Segment Analysis

o Customer profile

o Brand perception

o USP

– MAN Trucks India

o Product portfolio

o Product age

o Product lifecycle

o Application analysis

o Strategy

o Segment Analysis

o Customer profile

o Brand perception

o USP

– AMW Motors

o Product portfolio

o Latest Developments

o Product age

o Product lifecycle

o Application analysis

o Strategy

o Segment Analysis

o Customer profile

o Brand perception

o USP

– Force Motors

o Product portfolio

o Latest Developments

o Product age

o Product lifecycle

o Application analysis

o Strategy

o Segment Analysis

o Customer profile

o Brand perception

o USP

– Piaggio

o Product portfolio

o Latest Developments

o Product age

o Product lifecycle

o Application analysis

o Strategy

o Segment Analysis

o Customer profile

o Brand perception

o USP

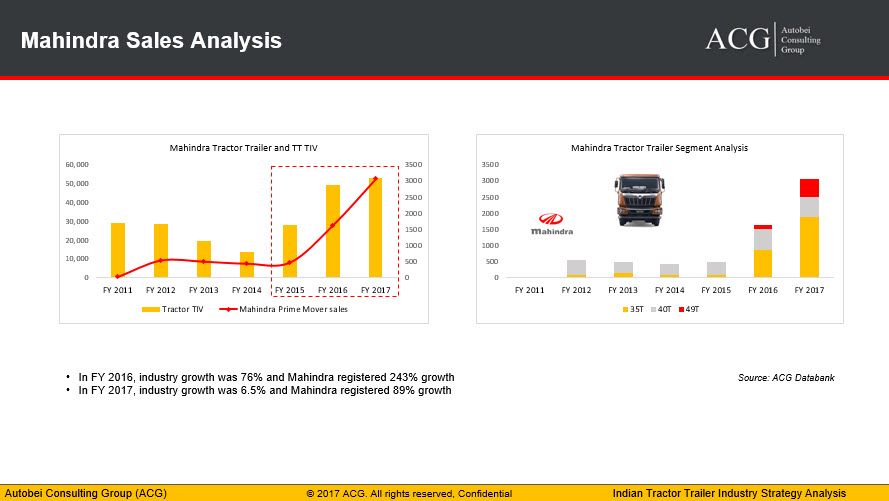

– Mahindra Truck & Bus

o Product portfolio

o Product age

o Product lifecycle

o Application analysis

o Strategy

o Segment Analysis

o Customer profile

o Brand perception

o USP

The market dynamics in the MDT segment are very different compared to the other segments we have just discussed. Tata couldn’t continue their uninterrupted streak of exceeding its market hold. Their market share of 80% in the 2nd quarter of 2019 was reduced to a meager 40% by the last quarter of 2021. This segment is now being led by Ashok Leyland as they hold a market share of about 25% currently. It is then closely followed by Eicher, which climbed to this spot by taking over about 8% from its close competitor Tata motors. Overall, Ashok Leyland continues to hold a vital position even in the 10 to 14.5T segment by being able to turn around the overall market presence of 50% and 74% respectively.

The market dynamics in the MDT segment are very different compared to the other segments we have just discussed. Tata couldn’t continue their uninterrupted streak of exceeding its market hold. Their market share of 80% in the 2nd quarter of 2019 was reduced to a meager 40% by the last quarter of 2021. This segment is now being led by Ashok Leyland as they hold a market share of about 25% currently. It is then closely followed by Eicher, which climbed to this spot by taking over about 8% from its close competitor Tata motors. Overall, Ashok Leyland continues to hold a vital position even in the 10 to 14.5T segment by being able to turn around the overall market presence of 50% and 74% respectively.