Tata Group is an iconic brand based out of India. The Tata brand is respected and trusted worldwide.

Tata Motor Automotive business is primarily divided into two main categories:

- Commercial Vehicle (CV)

- Passenger Vehicle (PV)

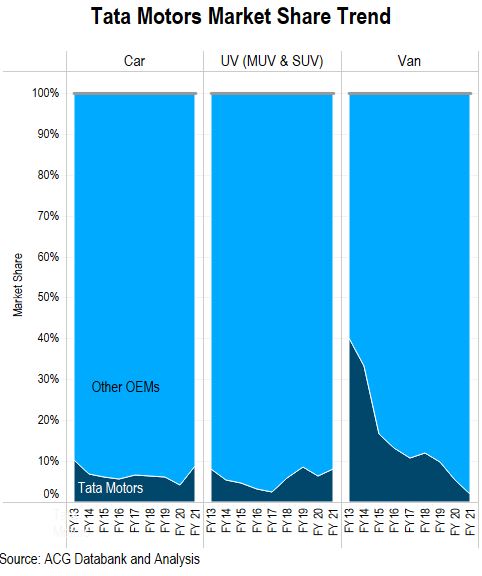

In the last few years, Tata Motors experienced losing its grip on some of the automotive segments and sub-segments of Cars, Trucks, and Buses.

Tata Motors increased its market share by launching a new product range in the SUV and Car Segment.

There are basically five main components a business relies on:

- Brand Experience, perception or image

- Customer’s consideration to Trust, like, and buy it

- Customer Satisfaction

- Rich Products portfolio,..no but the suitability of product as per customer needs, demands, and expectation

Tata Motors greatly started to focus on its Product range, Price point, Features, Design, Style, Customer segment, and Dealer involvement.

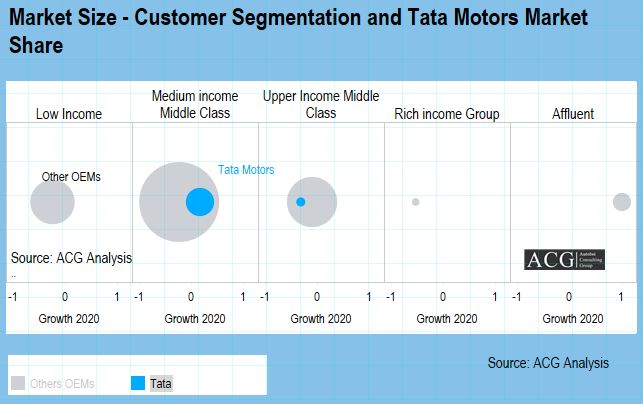

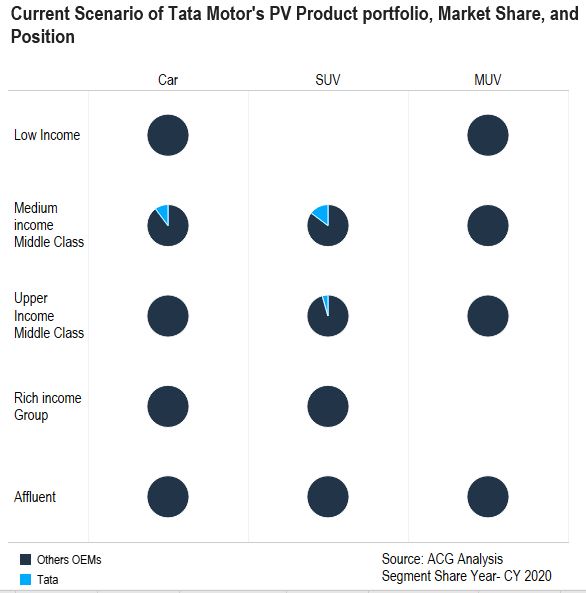

Tata Motors, a company formally known to have established an offering of affordable product range, appears to have been drifting away from that image. The company now manufactures vehicles for ValuePlus, Premium, and High-end segments in the passenger Vehicle category for medium Middle, Upper Middle Class, and Affluent income classes. There is no product available for lower and Elite class income class. Launching new models for these two income group customers could increase Tata Motor’s market share by 5 to 7%.

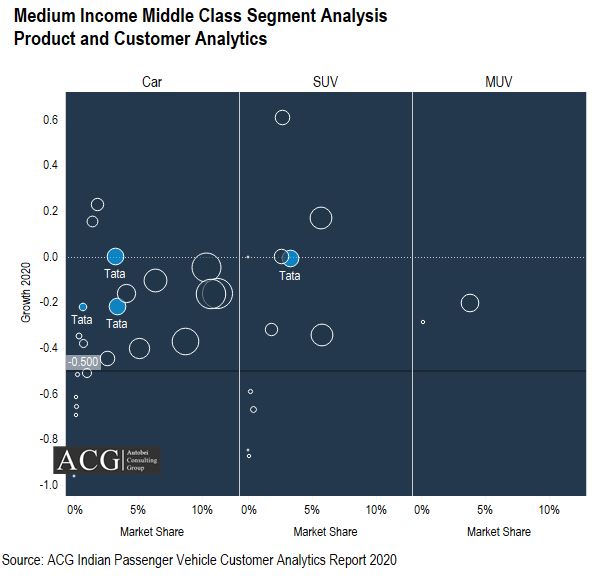

The Medium income Middle-class customer segment owns 67% of sales of cars, SUVs, and MUV shares and is one of the most significant segments in the Indian PV segment. At present, Maruti regulates this segment with 12 models while Tata has only 4 models.

In this segment, the Relative market share of Tata Motors climbed from 11 to 17.5% between 2017 to 2020. However, Tata remains the second-best performer in this segment by increasing 6% relative market share with just 4 models.

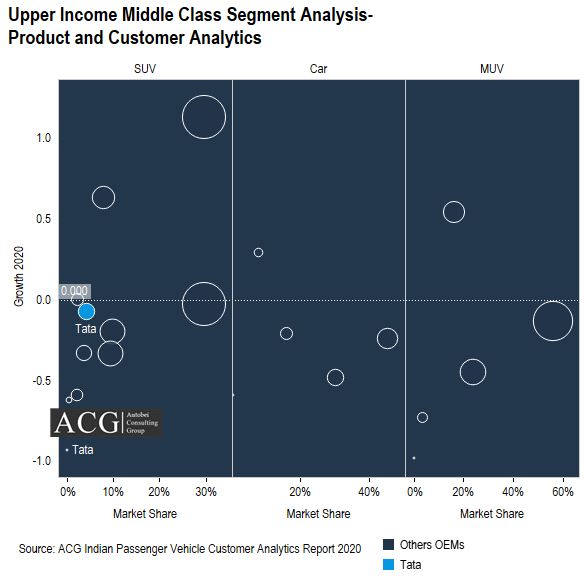

Tata Motors Segment, Product, and Market Analysis: Upper Income Middle-Class Group:

The Upper-income Middle-class group customer contributed 11% segment share in Tata Motors SUV Sales in 2020 as per ACG Customer Analytics Report 2021.

Most of the customers of this income group still prefer Hyundai and Kia SUV brands. Tata Motors dominates over 5% market share and its relative market share increased from 12.8% to 14.7%. Harrier is playing a significant role in the customer journey. It brings customers to the point where they like the vehicle design, look, and style of the Harrier or Tata’s product range (Connect with Harrier). This induces them to buy and become curious to know about the other Tata’s products also. It is creating the base for 4 customer attributes: Benefits, Capabilities, Differentiation, and Value proposition. Now it is accelerating the other model sales like Tiago, and Nexon.

Current Scenario of Tata’s Product portfolio, and Position:

Each of these newly launched cars and SUVs within these segments is targeting a different group of income Group, Lifestyle, Age, and some are focused on family, some are focused on sporty, etc.

Tata Motor’s main point of difference within this group of competitors is its commitment to functional “Made in India” design at a relatively affordable price like Tata Harrier, Tata Nexon, Tata Tigor. Another reason is the aggressive sales team from dealers.

We have surveyed to know “Why do you buy a Tata”? In most of the answers, the Model name supports the corporate brand Tata, like People, who love “Tata Harrier” design, Style, size, and features. As per our Survey, 67% of customers changed their steering from other brands to Tata Harrier.

Tata Motor was not rated specifically high on any of the attributes in 2013, this implies a possible problem within the Product quality and the brand image and we saw the major changes in some of the attributes in 2021. This upgrade helps the Tata brand to gain double-digit market share in some specific segments.

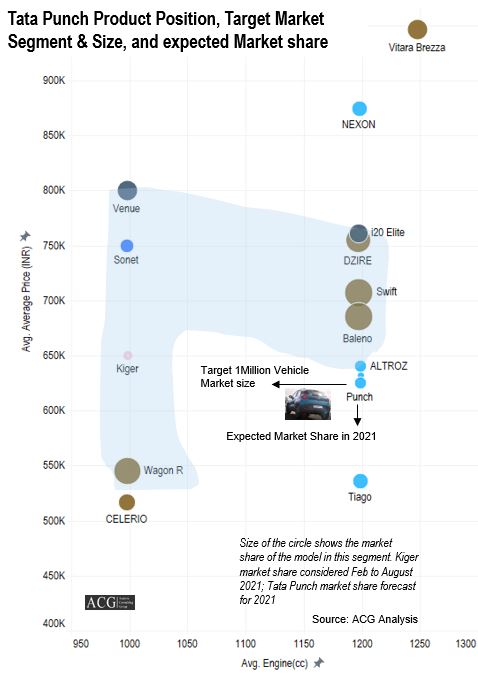

Tata Punch launched Impact Analysis:

Tata Motor’s Commercial Vehicle Business Strategy:

A commercial vehicle is a different game with a variety of different rules, and it functions on various other measurable market dimensions. Tata Motor is also undertaking different market and product strategies for its Truck and Bus Business segment.

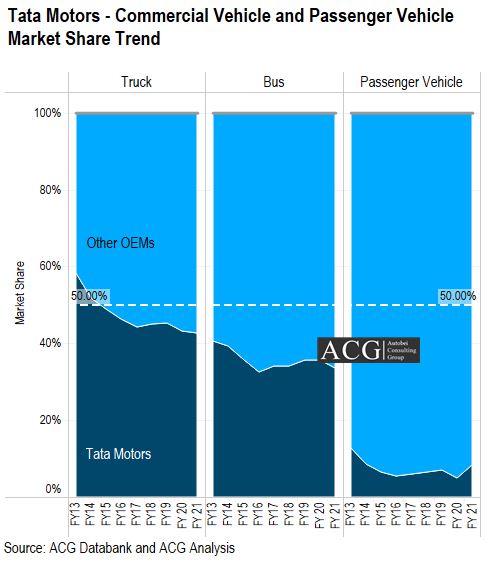

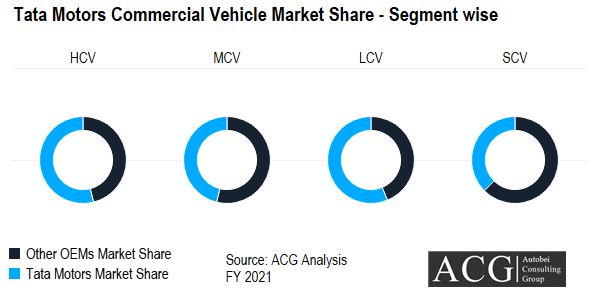

Tata Motors is a market leader in most of the Commercial Vehicle sub-segments. In the Overall CV segment, its market share is stagnant at around 42% from the last 5 years.

In the Truck Segment, Tata lost 1% market share, while in the Bus segment, its market share is almost stagnant. Under the CV segment, Tata Motors is continuously launching new products and upgrading the current product portfolio by adding new features.

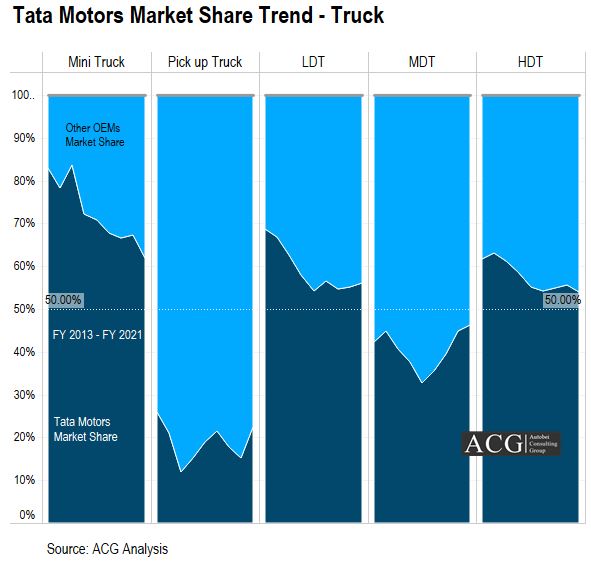

In Mini Truck, Tata ACE is one of the top-selling products from the very commencement of this segment. But now it is challenged by a new player in this segment—Maruti Suzuki’s Super carry. Due to its torque, it became the first choice for e-commerce application users.

There are two key competitors of Tata Motors in the Pickup segment, one is Mahindra and the other is Ashok Leyland which is very aggressive to gain market share in this segment. This is a growing segment in India. Customers are looking mainly for bigger vehicles for city-level applications.

LDT and MDT are smaller segments compared to Small trucks and Heavy Duty Trucks. Currently, in both segments, Tata Motors is in a dominant position. In Heavy Duty Truck Segment, Tata Motors has maintained more than 50% market share for over a decade. This is the segment where the company can upgrade the product features to increase the productivity of the drivers.

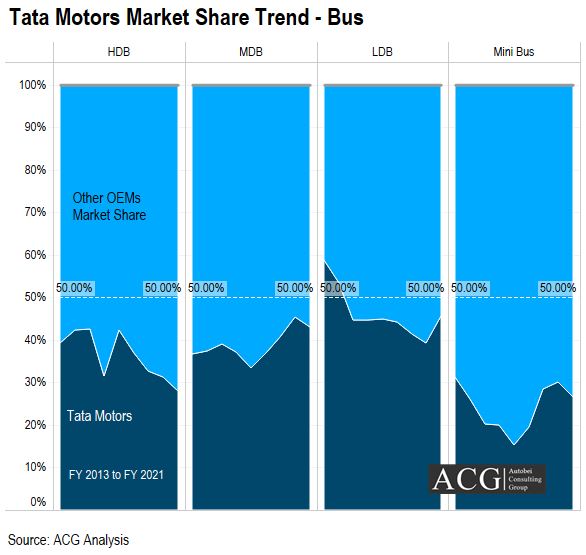

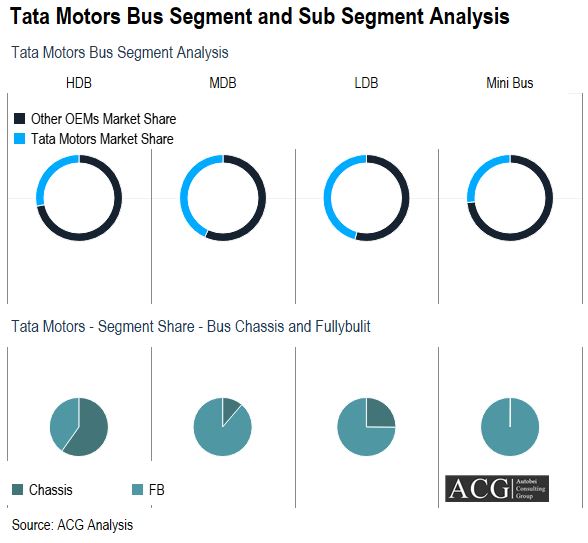

The company is the second-largest OEM in the Heavy Bus segment. Based on the different applications of the buses, Tata Motors needs to add new features to attract customers.

There are some possibilities to increase the quality at an extra price. In this segment, the company could work on Electric Buses. Eicher Motors is targeting this segment by launching new products.

The Medium Duty Bus segment is dominated by both Tata and Eicher. Both are targeting a different segment. The light-duty bus segment is also dominated by Tata and Eicher. In this segment, the purchase criteria differ from those of heavy Duty Bus segment.

The Minibus segment has only one major player which is Force Motors with a 72% market share. The Traveller’s comfort driving features, the number of variants available, and its turning radius made it exercise control over this segment. Tata Motors tried hard to acquire the segment share but still, it is struggling even after some good products.

Contact Info@autobei.com to buy a full Report.