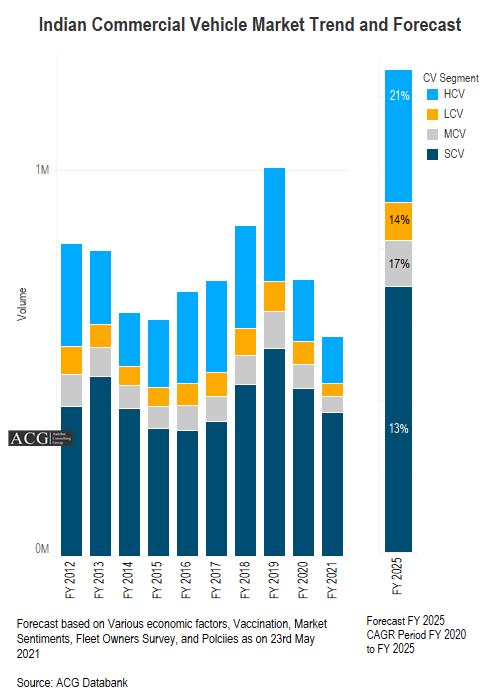

The Indian Commercial Vehicle sales done in FY 2021 is slightly above half a million, and this is the worst performance considering the entire decade. CV Export and the Production stood at 0.62 and 0.05 million units respectively in the FY 2021 and this further is the lowest figure recorded in the Recent past.

The Pandemic has proven to be the worst nightmare for business transactions across the globe. It has left the growing business stranded and the established business units clueless at the moment. It would be a herculean task for all the businesses to get back on track and get back their momentum. If we take a glance at the Automotive sector, specifically the Industry comprising of Commercial vehicles faced the wrath of this infectious virus as it witnessed getting transitioned to its worst-ever position in a significant time. The sales of the Commercial Vehicles procured in FY 2021 were able to match the statistical equivalent of just 50% in total units that were procured in FY 2019.

The sales of the Commercial Vehicle would show the economic health of the country. The Pandemic hit situation didn’t give any scope for the OEMs segment to acquire their old base of clients.

Insight: Model wise Indian Truck and Bus Sales and Production Data FY 2021 and FY 2022

The Compound Annual Growth Rate (CAGR) of the Indian commercial automotive sales stood at a negative curve of -4% during the 10 years starting from 2021. It is expected that Heavy Commercial Vehicle will register 21%, Medium Commercial Vehicle 17%, Light Commercial Vehicle 14%, and Small Commercial Vehicle Vehicle register 15% in FY 20205.

There has also been a significant decline in the overall segment share of -12% for HCV, -3% for LCV and MCV individually. Contrastingly small commercial vehicles showcased a 18% improvement in the decade.

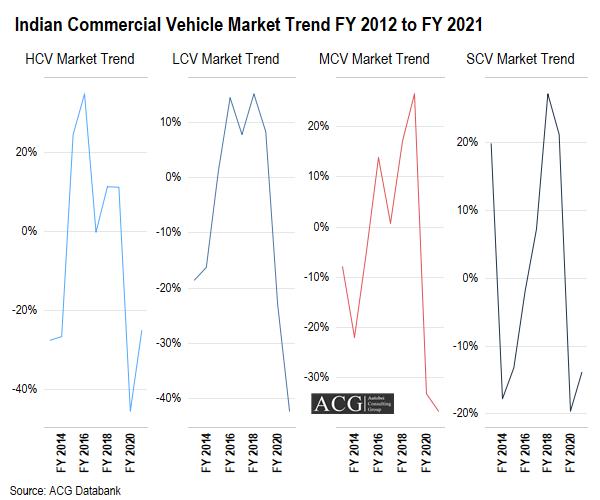

Post the Pandemic, the recovery rate looked even more worsening as we saw the Indian CV industry further dipping down on its growth potential by a negative gradient of 29 and 21 in the FY 2020 and FY 2021 respectively. Though the value diminishing has been a common phenomenon everywhere, but noticeably LCV and SCV performed slightly better than the HCV and MCV.

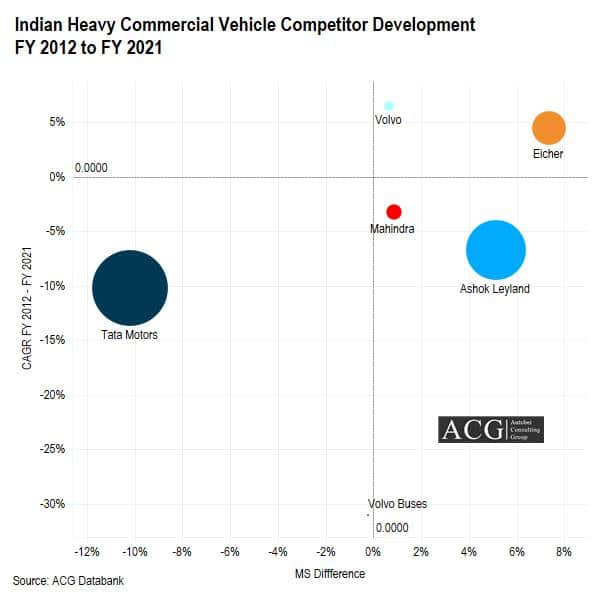

Tata Motors, which is widely acclaimed for being the Indian brand that gives utmost importance to value for money couldn’t turn its magic in the CV segment, as it put up a dismal performance in the decade by amassing a CAGR of -7.2%. Whereas the premium segment was slightly successful in getting the last laugh, as Volvo climbed up and showed up 6.5% CAGR from FY 2012 to FY 2021. Other decent performers then would be the Mahindra which showcased a growth rise of 1.2%, and Eicher was a negative growth of 3.2% taking into consideration the previous 10 years.

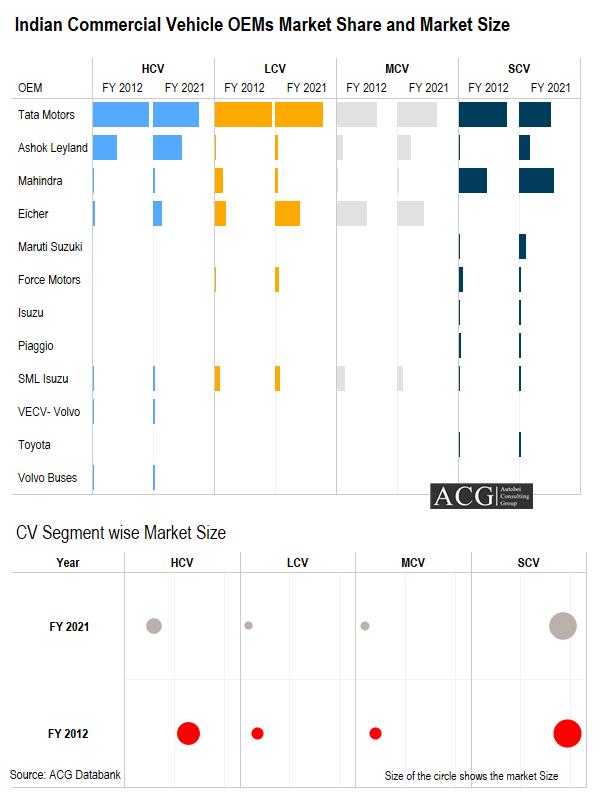

But, in the commercial vehicles industry, the Indian players continued to rule the market as we saw Tata Motors had a flawless regime by amassing 42% hold in the year 2021 and it faced a marginal drop of 16% considering the overall performance of the decade. Though they have tightened their hold on the existing market, their contemporary rivals have given it a tough time to cope with the existing situation. Despite the challenges surrounding them, they have kept the innovation at the core and have ensured to storm the market with their best-in-class products.

The established players too had a marginal rise when it comes to the enhancement of their Market share. The likes of Mahendra accelerated a market share of 10%, and the Ashok Leyland shot its growth to an additional 5% during the stint of ten years. Even these two have kept the innovation at the heart of everything and have been evolving continuously to throng the market with renowned products over various segments. Their ability to render a much-needed solution enabled them to speed up their growth strategy and tighten their market hold.

Even the Pivotal manufacturers of the Indian commercial vehicle segment loosened their overall command on the Market by close to, 20% in FY 2021 in line with FY 2020. Volvo Truck growth declined by 92% in FY 2021 compared to FY 2020. Maruti Suzuki tried to maintain its growth by amassing 36% in FY 2021 compared to the last financial year despite the worsened situation.

Heavy Commercial Vehicle Segment:

The new BSVI adoption into the existing market has brought about a transformation regarding various operation-related things. One such thing can be the measure to Curb the new axle load norms. The established players like Tata ensured their flawless operations at the place, despite seeing a dip in the overall share during this period. The annual growth rate recorded during this decade astonishingly was in the negative gradient of 10%.

The premium Vehicle manufacturers, have tried in all sorts to restore the market conditions and have even rendered an opportunity to other counterparts by uplifting them. One such example would be the growth of Eicher fuelled by Volvo which handed them a Cumulative 7% growth during the period, and its growth rate is at the constant rate of rising and recorded as 4% at the moment.

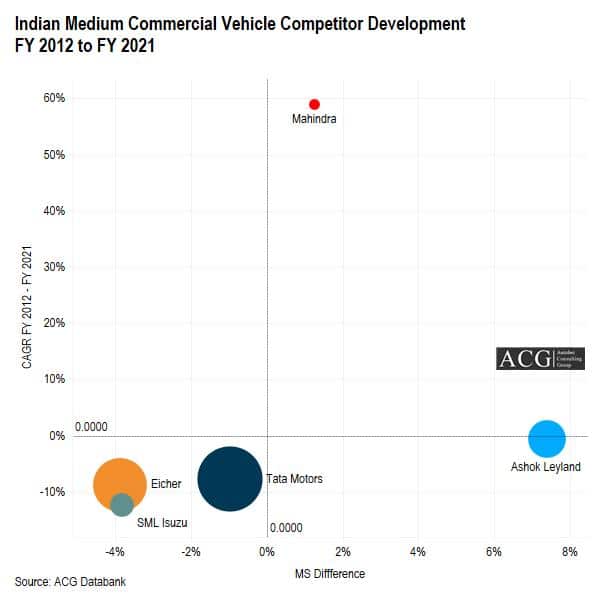

Medium Commercial Vehicle Segment:

The flag bearer of this segment would undoubtedly be the senior player in this domain i.e Tata Motors, and as already mentioned its Uniqueness in New Product launches, Price, Continuous innovation has made them get almost close to 50% of the market share.

The growth rate didn’t quite reflect the same identical growth or expansion as it was yet in the negative gradient. The other manufacturers in the leaderboard didn’t quite put up a commendable performance worth mentioning. And notably, Eicher faced a 4% fall in the existing market scenario.

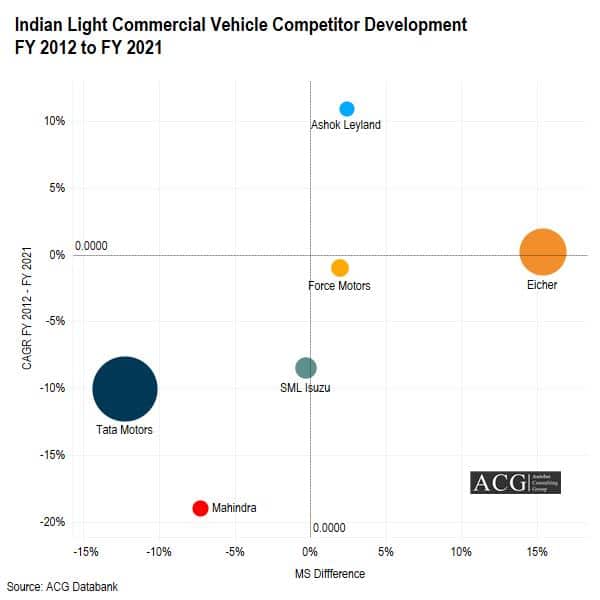

Light Commercial Vehicle Segment:

This segment too suffered more or less the same sort of disownment in the Market. Eicher was able to reap good results here, as it enhanced its overall market share which was at just 13% in 2012 to a whopping figure of 29% in a decade’s time.

Numerous factors contributed to this astounding success and TCO value can be one such. Apart from this development, Tata too conceded a sharp decline in its segment share by 12% between FY 2012 to FY 2021. This further affected the growth rate to decline to a negative curve and recorded a growth of -10% in the decade starting 2012.

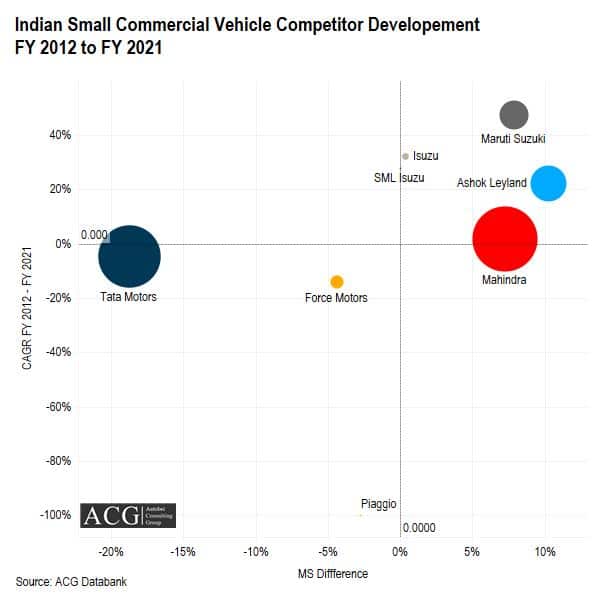

Small Commercial Vehicle Segment:

As Pandemic continued to worsen the potential of almost all the sectors in the automotive sector, but this Sector didn’t quite receive the same sought of harsh treatment from it. As the figures suggest a significant amount of value being conceded and losing up to the wave of the virus but it seems to negligible when the value is holistically compared with its other counterparts. The Mahindra continued to be the best performer by amassing a 40%+ expansion in its operative space and even shot up to its growth rate to 2% during the period.

Other potential segment leaders like Ashok Leyland tried to emulate the strategies like Innovativeness, brand positioning, presenting a whole renewed range and this, in turn, yielded them a fruitful return as they want to climb to 12% from their initial pace of 2%. During the last 10 years, they were even successful to put across a CAGR of 22%. The Household brand of the Indian Automotive sector, the Maruti Suzuki had a perennial run in the space as they again touched an appreciable growth rate and even created a record of their own by ensuring a 47% CAGR in the recently concluded decade.

Positive aspects in the current Market scenario:

- After assessing the available data, and further analysis has strongly predicted the potential of market expansion by a value greater than 9% or more in the year FY 2022

- The Present Monetary year is forecasted to witness economic growth starting from 9% to 11% in terms of GDP expansion.

Hurdles in the path ahead:

- Getting the people to the showrooms and enhancing sales will be an unattainable task at the moment, considering the rapid rise of cases.

- The Transport organization has incurred an irreparable finance crunch.

- The costing of the vehicle is yet again a tricky challenge

- A pandemic can again bring the world around to a standstill position

- The Dealer’s might rethink the Gain factor