Every year there will be growth and decline in any industry. The automobile industry is one such industry where there is a significant development as well as new technology being implemented. Owing to the new initiatives and norms there has been an improvement in the sector and on the other hand there have been few hiccups also. The following section will detail the key factors affecting the industry.

Jan 2019 Major Influencing Factors of Indian Automotive Industry:

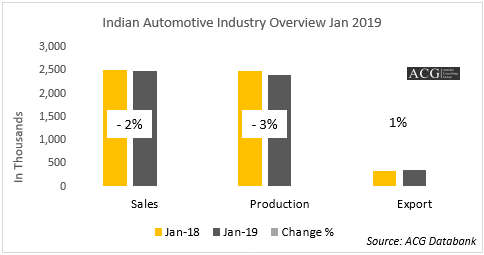

The Indian Automotive segment showed a 5 percent decline in the growth rate in the sales sector and a 3 percent decline in the production sector. The export segment could register only one percent growth.

There are indications for improvement in the industry and many populists’ believe that the budget for the year 2019 will strengthen consumer sentiments in the country, thus enabling a significant development of the Automobile Industry. The increased focus on the initiation and implementation of rural Industrialization and infrastructure development will further drive the development of rural markets across the country. We can expect enhanced customer demand with this initiative which will uplift the market share value for the products. The increased tax exemptions norms will generate more disposable income; this will further uplift the buying sentiments in the upcoming months. A key focus on the improvement in the highway developments and railways sector will be an additional impetus for the commercial vehicle industry. This change will prove to be a significant factor of hope for a positive sales momentum with these growth-oriented schemes.

The highly influencing factors like subdued market sentiments from the consumers, high-interest rates, lag in the implementation of revised axle load norms have impacted the industry development and growth.

Passenger Vehicle segment:

The passenger vehicle segment, car, and SUV/MUV segment registered a decline in the growth in the sales segment and export with an exception of the van segment. Van segment showed 17 percent growth in Jan 2018 compare to the same duration of the previous year.

The executive segment showed the highest decline in growth with 44 percent. The mid-size, mini, super compact and the executive segment also registered a double-digit decline in growth.

The compact segment and the premium segment showed signs of improvement with 4 and 28 percent growth respectively.

The declined customer sentiment towards the segment is caused due to the non-availability of retail finance schemes and liquidity crunch of the product in the market have also impacted the Passenger Vehicle (PV) Business in the market. The Car sector is and always will be about the consumer sentiments. The consumer will always have a lot of emotions, dreams and sensitive sentimental factor regarding their vehicle. The client will have to satisfy their needs to be successful in the market.

There is buoyancy in the rural growth, commodity costs are leveling and fuel prices are coming down which in turn will improve customer sentiment towards the Passenger vehicle segment.

Skoda launched their upgraded models like the Skoda Rapid Monte Carlo and in luxury segment, Lamborghini launched Huracan Evo in the market.

Honda and Ford showcased excellent performance in the market and these models were able to register 73 percent and 54 percent growth in the compact car segment.

In this segment, Nissan had a declined growth rate of 58 percent in the month in Jan 2018. Maruti too had a declined growth rate of 4 percent market share when compared to the 3 percent decline in growth against 4 percent segment growth in the month of January 2018.

Maruti Suzuki showcased 42 percent decline in the growth in the mid-size segment which comprises of the CIAZ model also. Maruti Suzuki also lost 10 percent of their total market share. On the other hand, Honda had an incline in its growth rate with a 12 percent market share with an improved growth rate of 38 percent in the mid-size segment market share.

Creta continued to show good performance in the market. Now Market is shifting from sedan to compact SUV with more consumer opting for SUV due to its technical and luxury features.

The SUV and MUV Segment:

The successful establishment of the Marazzo and Alturas brands and with the launch of the new compact SUV models which were based on the SsangYong Tivoli's X100 platform, the XUV300 was developed. This SUV launched in this segment is made with less than 4m length.

The difference in the price range between the diesel and the petrol version is just around 50k, normally it will range from 80K to 1 lakhs due to low demand for a diesel vehicle in the market. This manual comes only in the manual transmission. The company launched this SUV to regain market share in this segment. The company has already lost five percent market share in the last year in their various product bases. Maruti snatched this opportunity to grasp the market share from Mahindra and increased their market share 5 percent to go with the 8 percent total growth rate. The company faced a five percent decline of growth in the SUV segment.

The company is mainly targeting the middle-class segment by introducing this SUV.

The Tata Harrier has received a good response in the market and the company is expecting to witness a good sale rate in the coming months as the production ramps up.

Two Wheeler Industry Analysis:

The supporting factors which have improved the trend for two-wheelers are factors like more women joining workforce, faster expanding road network in rural areas and increasing demand for a unisex two-wheeler that fulfills the need of every family member. Lower maintenance cost as well lower fuel cost has also acted as a catalyst for improvement of the sector.

In the entry-level segment from 75 to 110cc the market share of Bajaj has increased from 13 to 18 percent but in the case of Hero Moto Corp, their marker share value declined 1 percent. In the 110 to 125cc segment, Hero Moto Corp lost 11 percent of the market share, but Honda gained 14 percent of the market share only in this segment. In the premium segment of 150 to 200cc, the Honda gained 5 percent market share in the month Jan 2018.

Bajaj also had an improved growth rate of 16 percent in 125 to the 150cc segment. In the upper segment of 150 to 200cc, the company had a decline of 6 percent market share. In the export segment the company registered 24 percent growth in the entry segment but in the 125 to 150cc segment, the brand registered an 18 percent decline in the sale rate in the market.

Suzuki Motorcycle lost market share in every segment with a decline in the market value in the year Jan 2019. Yamaha also had a loss in the market share in every segment except for the 110 to 125cc segment.

TVS is currently doing well specially the Apache Motorcycle and TVS gained 10 percent market share. In the entry-level segment, they were able to show improvement with 2 percent incline in the market share.

In Premium Motorcycle segment, Royal Enfield is continuously showing consistent as well as improved performance without any heavy and expensive advertising. The company has shown increased market share in every segment. In the 250 to 800 cc, the company had an increased market share of more than 80 percent sale rate. However, in the 250 to 500cc, the brand failed to showcase the growth and in turn, the company registered negative growth in sales.

Harley Davidson could not increase its market share in the month Jan 2019 when compared to the month of Jan 2018.

Triumph launched two new bikes in the premium segment. The company lost a chunk of its market share in its present segment. Triumph is expecting to gain some market share by launching new products in the market with improvised features.

In the 75 to 90cc scooter segment, Hero has done an aggressive campaign, but they still lost 3 percent of their market share. Honda also lost 3 percent market share. Suzuki gained 6 percent market share and registered 60 percent growth in the market share. TVS also showed signs of improvement with an increase in market share value to 15 percent from 14 percent.

Commercial Vehicle Segment:

The introduction of the axle load norms has led to the freight carrying capacity of MHCV parc to be increased by 20 percent. However, the freight growth has not been able to absorb this capacity resulting in lower demand for new trucks. The tipper segment, on the other hand, has continued to witness a strong growth on the stable and steady implementation of new development strategies like road construction projects, irrigation, and affordable housing projects. The increased demand in the MHCV segment has been led by the e-commerce sector, increased rural consumption, supported by new product introductions to the fleet.

The Bus segment has been hugely impacted by the slowdown in the procurement of buses by STUs and the limited permits for private hiring.

Heavy Duty truck registered 6 percent de decline in growth rate, tractor-trailer segment which was one of the fastest growing segments also faced few setbacks. The Introduction of 37 and 42T GVW trucks has led to the tractor-trailer segment to move towards rigid haulage. The segment registered a 32 percent decline in growth. Mini Truck continued to exhibit an 11 percent growth rate and the pickup segment remained stagnant. Due to the increasing number of logistic park and e-commerce business, MDT segment showed 21 percent growth in sales.

In the mini truck segment, Tata Motors lost 6 percent market share, whereas Maruti Suzuki and Mahindra gained 5 and 4 percent market share in the month Jan 2019.

In Pick up segment, Mahindra and Ashok Leyland gained 2 percent market share. This 4 percent market share moved to its competitors. The Pickup segment showed 5 percent growth.

In some sub-segment of LDT Tata Motors lost market share and they were able to gain improvement in some other segment. Ashok Leyland had an increase of 3 percent market share. The segment showed on whole showcased 8 percent decline.

In 7.5 to 10 T, Tata Motors showed excellent performance and gained 12 percent market share with 68 percent growth. One of the major competitors like Eicher lost 10 percent market share. In 10 to 12T segment Eicher lost 8 percent market share.

In the HDT segment of 16.2T, Tata Motors lost 9 percent market share. On the other hand, Ashok Leyland was able to deliver 8 percent increase in the market share. The 25T segment is always the most popular segment which grew by 36 percent in Jan 2019 when compared to the month of Jan 2018. Major competitors of this segment like Tata Motors had a 4 percent increase in their market share. In the case of Ashok Leyland, they lost 2 percent of their market share.

31T and above segments were able to overtake the sale of the 25T segment but showed a 10 percent decline in growth. Ashok Leyland increased 10 percent market share in this segment. Tata Motors and Eicher lost 11 and 2 percent market share respectively.

In most of the tractor-trailer sub-segment, Tata Motors had a decline in market share and in case of Ashok Leyland, they were able to improve their market share.

Bus Segment:

Bus Industry registered a 49 percent decline in market share value. Small Bus segment indicated a 15 percent decline in its market share value.

Tata Motors did a good performance and increased market share value. Traditional strong player Force Motors too lost a good value of their market share value.

Light Duty bus segment also showed a decline in their growth rate with a 3 percent market share value. Ashok Leyland, Mahindra, and SML Isuzu increased market share but Eicher, and Tata Motors lost 1 and 4 percent of the market share respectively. In the medium-duty bus segment, all the OEMs had to face loss in the market share. This segment registered a 2 percent decline in growth rate.

Only the heavy-duty bus segment registered 33 percent growth in the month Jan 2018. Tata Motors lost 10 percent of their market share whereas Eicher gained 2 percent market share respectively.

Tata Motors also started to supply 40 electric buses for city transportation in Lucknow. Olectra BYD also supplied 25 Electric Buses in the city of Pune.

Promotion and Advertising:

Honda started to promote its CRV SUV through a TV commercial. Bajaj also started to promote their products heavily through advertisements. Advertisements through social media, hoardings and another innovative method will improve the brand value among the consumers. The promotions through road display and another display method will allow the consumers to have a look of the product.

Every brand and their products will require improvement in its technology and features. The consumers will look at the advancement in the product. The market share improvement totally depends on the consumer. The brands will have to be smart and innovative to be in the consumer's mind. By attracting the consumer and by keeping the brands attached the emotional sentiments the brands can achieve a higher market share in the market. The consumer wish list and product features will have to be proportionate and these factors will have to be like hand and glove for the industry to grow and develop.