ACG let out the Indian Automotive Industry’s Analysis report Dec 2019. The year 2019 was one of the worst years, particularly to the automobile Industry. Besides 2007 which was then considered, one of the worst years for the Global Auto Industry. Since, in the past year, the Indian Auto Industry has registered 1.4% degrowth. Only SUV/MUV and Three- Wheeler segments showed stable growth. The GDP growth decline, negative impact of the market, negative results of the Macro Economy are all the reasons why the industry witnessed a sudden drop. Due to the implementation of BS-VI emission norms, 2020 is believed to witness an inevitable loss.

Govt has announced that it will put money of 100 lakhs crore into the developing infrastructure/construction projects. This would set us free momentarily whilst the worst hit of the commercial vehicle segment. The Dec month is normally perceived as the moderate month for most of the Automotive segments that don’t hit the sales sector. Eventually, OEMs give enormous discounts and run campaigns to fabricate the demand.

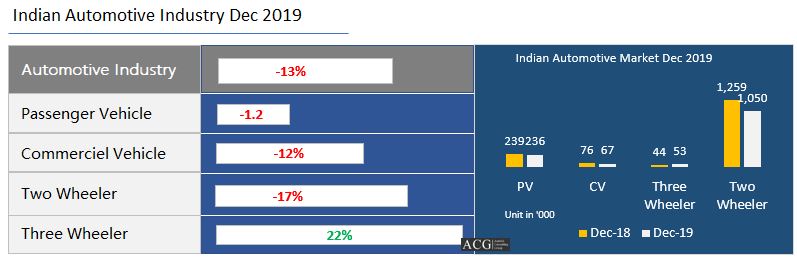

Sales: In Dec 2019, Indian Automobile Industry registered 13%, Commercial Vehicle 12%, Passenger vehicle 1%, Two-Wheeler 17% degrowth whereas Three-Wheeler registered 22% growth.

Production: In Dec 2019, Indian Automobile Industry registered 14%, Commercial Vehicle 27%, Two- Wheeler 13% degrowth, Passenger vehicle 4%, and Three-Wheeler 6% degrowth compared to Dec 2018.

Export: In Dec 2019, Indian Automobile Industry registered 9%, Passenger vehicle 10%, Two-Wheeler 22%, and Three-Wheeler 5% growth but, Commercial vehicle accounted for 27% degrowth.

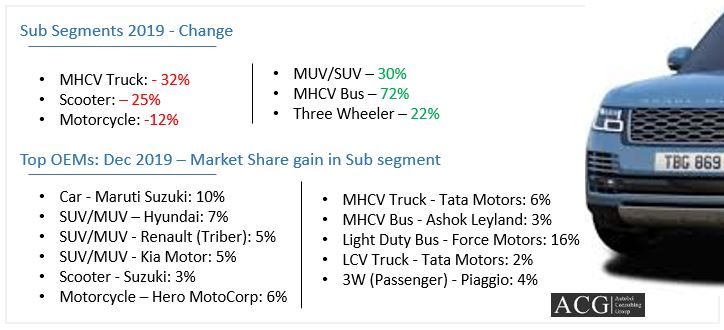

In the Passenger vehicle segment, the car segment showed 8% and Van showed 53% degrowth; on the other hand, the SUV/MUV segment showed excellent performance for it has raised its growth by 30%. This crystal clearly reveals customer preference in the changing pattern.

In the Passenger car segment, Maruti gained a 10% market share, Hyundai lost 7%, Honda cars also lost 2%, Tata & Toyota lost 1% market share in Dec 2019 within a period of one year. Ford and Mahindra topped the losers list in terms of degrowth in Dec 19 month comparatively to the same month of the previous year. Suzuki, Skoda, and Volkswagen are the only three players who registered growth in Dec 2019. In the SUV/UV segment, Renault Triber outperformed with its aggressive pricing strategy and grabbed a 5% market share in Dec 2019. In other OEMs, Hyundai, Kia, and MG Motor also accounted for their sales with a positive market share. On the whole, Renault registered the highest growth in its segment of 34.9% growth in Dec 2019. In the MHCV Bus segment, Ashok Leyland increased its segment share from 45% to 48% and Tata Motors lost 2% market share in Dec 2019.

The Medium and Heavy Bus segment registered 72% growth in Dec 2019 compared to that of the Dec 2018 report, which is a good sign for the automobile industry. In the LCV Bus segment, the segment leader, Force Motors regained their fame with 51% market share for growth raised around 86% in Dec 2019 which actually had only 34% segment share in Dec 2018. Unfortunately, Tata Motors lost 12% of its market share. LCV Bus segment showed a 28% growth in Dec 2019 compared to Dec 2018 report. Medium and Heavy Duty truck segments registered 43% degrowth in Dec 2019 compared to that of Dec 2018. In this segment, Tata Motors increased its segment share from 50% to 56%, whereas Ashok Leyland lost a 9% market share in Dec 2019. But Eicher is showed steady growth and gained 3% of the market share in the MHCV truck segment.

Key Highlights of the Annual Subscription report:

- Monthly Indian Automotive Market Analysis

- Market Driver and Challenges

- Key finding

- Market Share – segment and OEM wise

- Govt policies

- Electric vehicle Analysis

- All major segment Included like passenger Vehicle, Commercial vehicle, Three Wheeler, and Two Wheeler

- Sales, Production, and Export