The “Indian Automotive Industry Yearbook 2015” is published every year with the aim of tracking the multitude of the developmental aspects of India’s auto industry 2015. This publication contains within it a comprehensive account of motor vehicles, historicity of industrial development, continuity, comprehensive and large-scale books for the national automotive industry planning, research, production, marketing and new product development to provide better guidance and services, welcomed by readers.

This Automobile year book 2015 and Outlook will give a complete update on the Indian Automobile Industry. This book can be used by Passenger vehicles, Commercial Vehicles –Truck & Bus, Two Wheeler as well as Three wheeler.

The report can be obtained as the standard version or a customized-on-demand version, enabling the user to choose their best fit on the basis of specific organizational benefits. Focussing on providing valuable information to OEM, Vendors, Manufacturing Industry, Financial institutions, Stock market, Dealers and Fleet owners, this report provides a significant insight into OEMs, Market, Price trend, Macro Economy, Latest update, buying criteria, buying parameters Brand name, Look, performance, Style, New product launches and its position etc.Additionally, the report also covers the impact of advertising on company sales and their brand image. Also, the report fixates on brand and segment wise Monthly sales, production and export analysis and its linearity based on market share fluctuation.

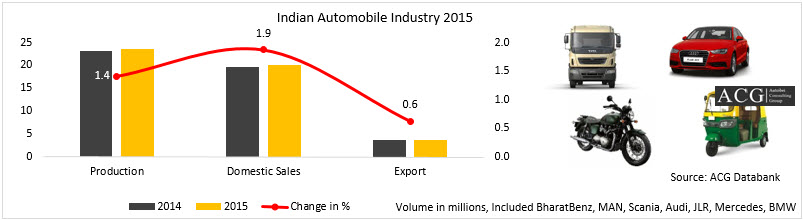

In the previous year 2014, automobile production, sales and export figures flourished with an increase of 1.4%, 1.9% and 0.6% owing to a total of 24, 20 and 3.6 million respectively. The growth of passenger car sales, however is plummeting down slowly to a minimal 7.8%. Commercial vehicles on the other hand, majorly driven by the M & HCV segment registered a 7.6% growth. The two wheeler segment showed a positive growth of 0.86% while the three wheeler segment faced a decline of 3.28% in sales.

However, from a bird’s eye view we see that that the new initiatives which are taken by the Indian Government benefit the entire industry with key enterprises running smoothly, leading to gradual optimization of the industrial structure and continued improvement in market concentration. These initiatives have greatly benefitted the country owing to new launches of a series of supportive policies, increased energy vehicle sales and growth explosion.

The “Indian Automotive Industry Yearbook 2015” has undergone several changes to adapt to the changing scenario and development of automotive industry characteristics. Some of them include re-arrangement sorting of columns for different column designs, providing a distinctive framework and easier access. Also, the Reader’s comparative analysis focus on the text’s content has been refined and concentrated.

In the 2014 review article which talks of the overview of the development of the automobile industry, there lay a significant concern for the industry on the topic “ Key segment of each category and key model of each brand” guiding the development of the automotive industry The "policies and regulations", "car standardization". The development of the regional and major automotive groups was reflected in the “Regional auto industry: the basic situation”.

Passenger Vehicle Segment:

The passenger vehicle segment has included Small car, Sedan car, Hatch back, Notchback, Cross over, SUV, Compact SUV, MUV, Van, Premium cars, Luxury cars which are analysed Length wise, Engine wise, Price wise with added emphasis on customer mapping, competitor analysis, Segment Analysis and its trend, major Models and their position, Product USP, Customers feedback and expectations, After sales support, Advertising Strategy, Branding strategy and Brand position. Also, Business review and strategy analysis of Tata Motors, Maruti Suzuki, Hyundai, Honda, Toyota, Audi, Mercedes, Renault, Nissan, GM, Ford, Mahindra, BMW, Volvo, Skoda, Volkswagen are specified.

Commercial Vehicle Industry Analysis:

The Commercial vehicle industry has seen exports rise from 85,683 units in 2014 to 96,814 units in 2015, signifying a pleasant ascent. The Medium and Heavy duty vehicle segment has seen a 28% growth in domestic sales as opposed to the decline of Light commercial vehicle sales by 5% over the duration of the one year.

Two Wheeler Industry Analysis:

The scooter industry has thrived even under pressure and succeeded in ascending by a 13% in sales in the past year. In stark contrast, bike and moped sales have faced a plummeting decline in sales by 4% and 7% respectively. Overall, the sales of scooters have thrived much better than that of bikes and mopeds.

Three Wheeler Analysis:

The three wheeler segment is facing a serious problem of decline in sales as both passenger and goods vehicles have seen similar plummeting decline in sales.