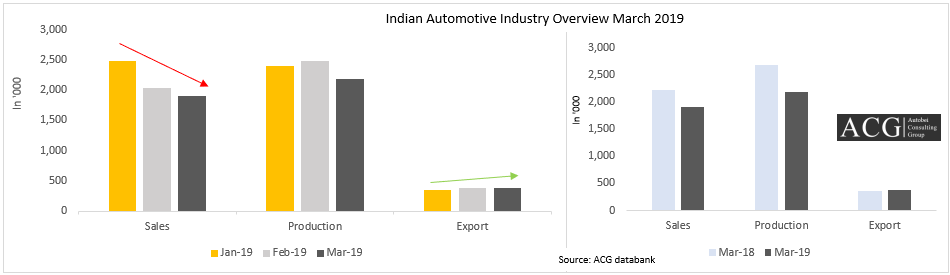

The industry of Indian automobiles came down by 14 percent in the month of March 2019 as compared to the same month of last year that March 2018. The rate of production also saw a downfall by about 18 percent but the good thing is that the export rose up by 4 percent.

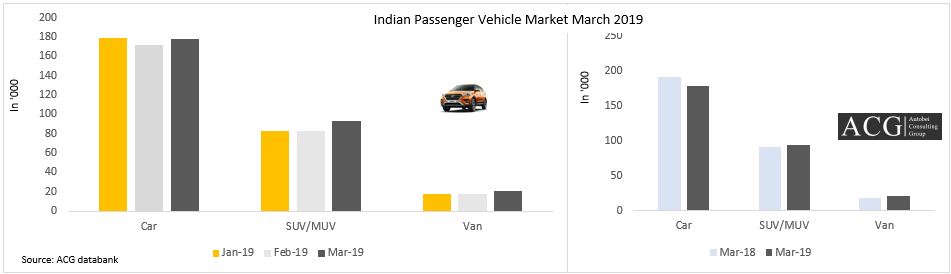

Passenger Vehicle Market:

A downfall of 3 percent in domestic sales and 6 percent in export was seen by the industry of Indian passenger vehicle in the month of March 2019 as compared to March 2018. The sales of cars were down by 7 percent. The segment of SUV and MUV came down by 2 percent. But on the other hand, the segment of van rose up by 14 percent. In the export of PV, all saw a downfall except the segment of the van.

The sales of cars were down by 7 percent. The segment of SUV and MUV grew by 2 percent. The segment of van rose up by 14 percent. In the export of PV, all saw a downfall except the segment of the van.

In the month of March 2017, a total of 174 units of Tata Nano was sold, but in March 2018, a total of 29 units was sold and in March 2019, there is no production at all.

The segment of mini car size reduced by more than about 50 percent in the previous month of the financial year of FY 19. In this segment, Maruti is the market leader with about 74 percent of the market share. On the other hand, Renault also increased its market share from 12 percent to 26 percent.

The segment of the compact car rose up by 10 percent in the month of March 2019. The total combined market share of Maruti and Hyundai is about 81 percent. This is certainly one of the largest and most competitive segments in the Indian car market. The market share of Maruti rose up by 5 percent and that of Hyundai came down by 2 percent in the same segment. The second-best performer in the same segment is Honda who increased its market share from 2.7% to 6.2%.

To make its presence quite effective in the compact car portfolio, Tata necessarily needs to add more products. In the month of March 2019, Tata lost more than about 3 percent of its market share.

Coming to the segment of super compact, it experienced a downfall of about 44 percent in the month of March 2019 as compared to March 2017. In this segment, Toyota is certainly the ultimate leader with 91 percent of the total market share.

The segment of the mid-size car saw a downfall by 17 percent in the month of March 2019. Volkswagen seems to be struggling a lot in this segment where it's market share remained constant at 3.7 percent exactly the same as compared to March 2018. Toyota in the same segment had about 2.8 percent of share. The top players of this segment other than Hyundai, Maruti as well as Honda, lost more than about 2 percent share of the market.

Talking about the segment of an executive car, it saw a massive growth by about 280 percent which is just phenomenal. The top performer in this segment is Hyundai which is in clear control of 80 percent share of the market in this particular segment. Both Volkswagen, as well as Toyota, lost its grip in this segment of an executive car.

The segment of the premium car increased by 19 percent in the month of March 2019. The previous leader in this segment was Skoda who lost 10 percent of share in this segment whereas Volkswagen has increased its market share in this segment by 10 percent with its popular Passat model.

The segment of affordable SUV and MUV saw a downfall of 13 percent in the month of March 2019 as compared to the same month in the previous year that is March 2018. Maruti, Tata Motors, Hyundai and Mahindra are top gainers in this market segment because of the fact of their strong product portfolio as well as their position.

The segment of premium SUV came down by 8 percent in the month of March 2019. Jeep emerged to be the leader of the market in March 2018 with about 43% percent share of the market share but as per the present results that are in the month of March 2019, Jeep lost about 12 percent of its market share. The one to replace Jeep from the position of the leader of the market was Toyota Fortuner who had about 42 percent share of the market. Both Ford, as well as Mahindra, also increased their share in the market in the respective segment.

Coming to the segment of sports SUV, Skoda increased about 22 percent of market share where it came up from 55 percent to 77 percent. Both Volkswagen and Toyota lost 25 percent and 1 percent market share in the segment respectively.

The market segment of van including both mainstream and personal transportation was on the rise at the time of turbulence of car and SUV/MUV segment in the month of March 2019 where it saw a registration of about 27 percent of segment share.

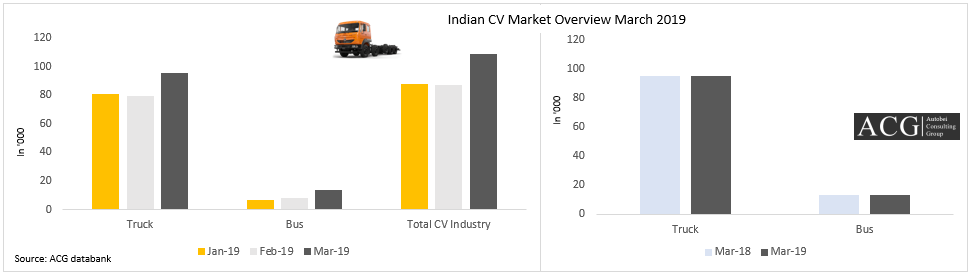

Commercial Vehicle Market:

No significant changes are noted in the segment of Indian commercial vehicle in the month of March 2019 when compared with the same month of the previous year that is March 2018. The segment of the bus saw a growth of 4 percent but in the segment of the truck, the changes are hardly noticeable. To a great surprise, the segment of tractor trailer witnessed a downfall of 28 percent. Similarly, the rigid truck segment also witnessed a downfall of 5 percent in FY 2019 year-end month.

The segment of the mini truck increased by a very good 83 percent in the month of March 2019. Tata Motors increased 2 percent share of the market, but on the other hand, Mahindra saw a loss of 5 percent share in the segment of a mini truck. Moreover, Maruti also increased the market share in the segment from 7 percent to 11 percent.

Again, no changes are recorded in OEMs position in the segment of a pickup truck. The segment of LDT saw a downfall of 5 percent in the month of March 2019.

In the segment of LDT, Mahindra, Eicher and Tata Motors lost market share. The gainer in this particular segment is Ashok Leyland. The performance of SML Isuzu is neutral which kept its position constant as compared to March 2018.

In the segment of MDT, Eicher saw a downfall in their market share which was not expected since Eicher has a very strong & attractive portfolio in segment of MDT. In addition to this, it is considered as one of the strong players in some of the specific sub-segments of MDT. Moreover, the company also introduced a specific vehicle for the purpose of an E-commerce application.

The segment of the heavy-duty truck witnessed a downfall of 13 percent in the month of March 2019. In this segment, the 16.2 GVW Eicher lost 3 percent share of the market. The Industry segment overall increased by 10 percent.

In the segment of the 25T truck, a gain of 12 percent was registered and the sole gainer is Tata Motors who increased the share of market share in the category of 31T and above but registered a downfall of 24percent in the month of March 2019.

In the segment of the tractor-trailer, only the category of 40.2T to 44T registered growth in the month of March 2019.

The segment of the bus of 5T saw a downfall of 6 percent in the month of March 2019. The performance of the OEMs is mixed in this segment. Force Motors saw a gain in its market share.

The segment of medium-duty bus rose up by 4 percent and Eicher increased its market share from 21 percent to 24 percent in the month of March 2019.

The segment of heavy duty bus saw a growth of 8 percent. JBM gained about 3 percent market share whereas Tata Motors lost 4 percent.

About 16 units of buses were sold by Volvo in the month of March 2019.

Thus, it is evident from the above results that the performance is mixed in this particular segment.

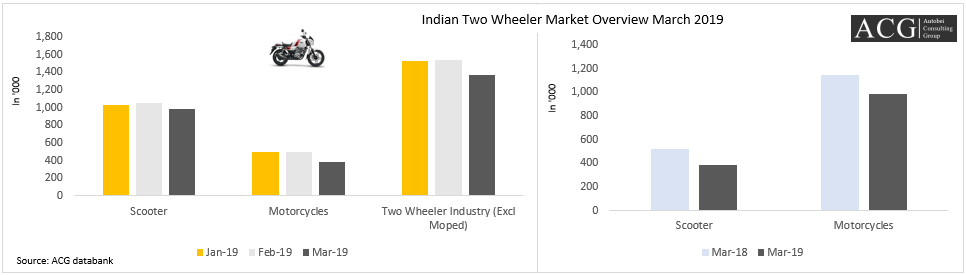

Two Wheeler Market:

The two-wheeler industry of India saw a downfall of 18 percent in the month of March 2019. The segment of scooter witnessed 25 percent downfall and the segment of motorcycle witnessed 14% percent downfall as compared to the same month of the previous year that is March 2018.

In the segment of the scooter, all of the brand's excerpt Suzuki saw degrowth. Suzuki saw a steady growth of 56 percent in the month of March 2019. The two of the major players in this particular segment Hero and Honda saw a downfall of more than about 40 percent.

After negative growth, TVS grew its market share from 7 percent to 16 percent in the category of 90 to 125 cc.

The segment of the basic motorcycle of 75 to 110 cc, Bajaj increased 6 percent market share and rose up by 31 percent. However, the de growth of the segment is 13 percent. In this segment, TVS also rose up by 21 percent and increased 2 percent market.

In the category of 110 to 125 cc, which is the largest segment of a motorcycle in terms of volume, witnessed a heavy downfall of about 43 percent in the month of March 2019. But Hero and Yamaha increased their market share in this segment.

The segment of 125 to 150 cc rose up by 48 percent in the month of March 2019 with Bajaj as the key gainer in this category which increased its market share from 41 percent to 64 percent in the month of March 2019 as compared to the same month of the previous year that is March 2018.

The segment of 150 to 200 cc witnessed a downfall of 22 percent. The best performer in this segment is TVS Apace which increased its market share from 54 percent to 64 percent.

The segment of 200 to 250 cc witnessed a downfall of 25 percent in the month of March 2019. There are some major changes in the market share of the OEMs.

The segment of 250 to 350 cc saw a downfall of 22 percent in the month of March 2019. Royal Enfield made its grip quite stronger by increasing their market share in this particular segment from 97 percent to 99 percent which is just great.

The segment of 350 to 500 cc also noted a downfall of 63 percent in the month of March 2019. The two of the most important players in this segment that is Bajaj and Royal Enfield showed clear domination with 29 percent and 70 percent of the overall market share in this particular segment.

The segment of 500 to 800 cc showed an extremely good performance by registering a total growth of about 350 percent which is quite phenomenal. The market share of Royal Enfield rose from 21 percent to 89 percent which is a jump of about 68 percent in the market share.

The segment of 800 to 1000 cc rose up by 6 percent but this segment actually very small. In this segment, Kawasaki increased its market share from 38 percent to 60 percent.

The segment of 1000 to 1600 cc witnessed a downfall of 9 percent. But the segment of more than 1600 cc registered a growth of 66 percent in the month of March 2019. Honda and Harley Davidson are the two vital players in this segment.

Coming to the export data, the segment of 110 to 125 cc motorcycles rose up by 25 percent, the segment of 200 to 250 cc witnessed a downfall of 62 percent and the segment of 500 to 800 cc also rose up by 118 percent in the month of March 2019 which is quite good.

Contact to Info@autobei.com to get Monthly Subscription Plan. This is the most detail subscription package of Quantitive and Qualitative Automotive Analysis.