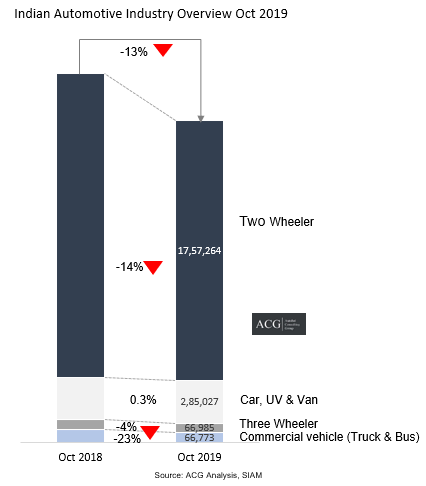

Indian Automotive Industry total sales declined by 13 percent to 21,76,136 units in October from 24,94,345 units, Production declined by 26 percent, and Export registered 2.7 percent growth during the corresponding month of the previous year.

Indian Passenger vehicle sales of 2,85,027 units in October 2019 marginal growth as compared to the same month in 2018.

Truck and Bus sales were down 25%, and 2% from last October to 61,819 and 4,954 units, while commercial vehicle sales declined 23% to 66,773 units. STU Bus order gives some space to take a breath for CV Industry in this slowdown.

Two Wheeler and Three Wheeler sales were down 14% and 4% to 17,57,264 and 66,985 units in October 2019 compared to the previous year.

In Passenger Vehicle, Maruti Suzuki increased market share from 55% to 61%, and Toyota 1%. Hyundai lost 2% market share, Honda 1%, Tata Motors 2%. Other players like Nissan, Renault, Fiat, Mahindra lost market share in October 2019 compared to October 2018.

Ford showed 56% degrowth which was highest in this segment. On the other hand, Toyota registered a maximum positive growth of 35% in Festive month in October 2019 compared to October 2018.

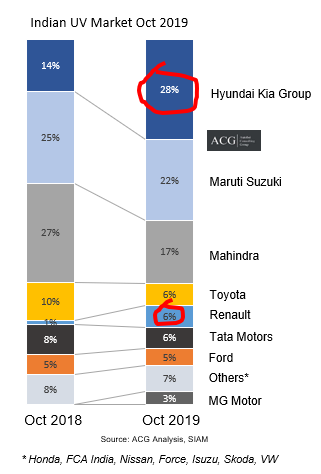

In the Utility vehicle segment, Kia and Hyundai group sales in October 2019 were up 144% and market share increased from 14% to 29%, Market leader Maruti Suzuki lost 2%, Renault Triber helped the company to add 5% market share, MG Motor also captured 4% market share in October 2019.

Our latest Customer buying behavior showed that SUVs of Kia and Hyundai target different customer groups. There is no internal competition within a group.

Get our Annual Subscription for critical monthly Indian Automotive Analysis.

Key Highlights of the Annual Subscription:

- Monthly, Quarterly, half-yearly, and yearly Automotive Market insight

- Segment Car, SUV, MUV, Van, Two Wheeler – Scooter, Motorcycle, and Moped, Commercial Vehicle – Truck (Mini, Pickup, LDT, MDT, HDT, Tipper, Tractor Trailer, Rigid haulage), Bus – Application-wise, length and GVW wise, Three Wheeler – Cargo & passenger, and Electric vehicle

- Market Forecast & Demand Analysis

- Current Market scenario

- Newly launch product impact and coming up product

- Pricing Analysis

- After Sales Analysis

- Campaign Analysis

- Customer purchase pattern

- Sales, Production, and Export

- Brand Analysis and Market share analysis

- Business and Market Strategy review

- Macro Economy indicators analysis

Customize Annual Subscription also available as per requirement.