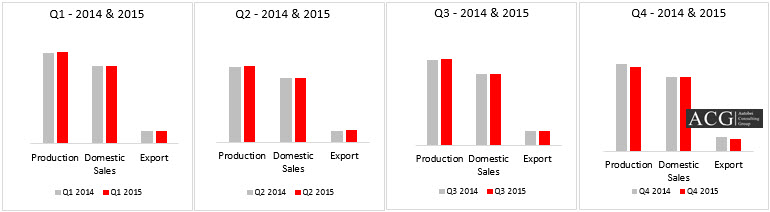

The above graphs compare the production, domestic sales and export of the automobile industry of each quarter in 2014 and 2015. When the first quarter of 2014 and 2015 was compared, it was evident that both production and domestic sales took a small hike while exports declined over the year. The production of the first quarter rose from 56,01,197 units sold in 2014 to 56,98,020 units in 2015. The sales of the first quarter also rose from 48,21,372 in the year 2014 to 48,51,939 units sold in 2015.

When the same was analysed with respect to the second quarter, production, domestic sales and exports increased over the duration from 2014 to 2015.In the comparison graphs of quarter 3, production and exports shot up whereas domestic sales dwindled down during the course of the year in the corresponding quarters.In quarter 4, the production figures saw an escalated number through the year, however domestic sales and exports took a hit and down-sized over the same period. Production was very low during the fourth quarter due to the floods that devastated Chennai, affecting

most of the OEMs and Auto suppliers which are mainly located in Chennai. The company incurred huge losses during this time on account of the floods. Production dipped by 3.3%in 2015 as compared to 2014. The demand was affected on a global level.

The passenger vehicle segment saw a 7% increase in domestic sales from 2014 to 2015. Parallel to this, they also saw a minor increase in market share over the same time to own 13.8% of the market.

Commercial vehicles have also seen a minor increase in sales however, their segment share is insignificantly minimal to denote any major change in the industry.

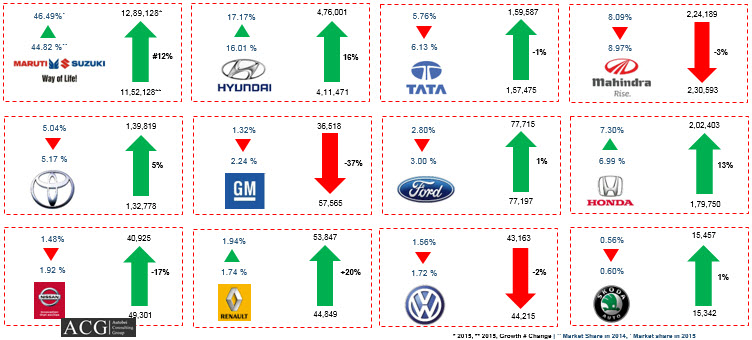

The key player of this industry is Maruti Suzuki bagging nearly half the industry's share. It has also seen a 12% increase in sales from 2014 to 2015. Close runner up is Hyundai with close to 17% of market share. Brands like Honda, Tata and Toyota have also owned close to 6% share of the market with equally signifying contributions in terms of sales numbers.

Fiat India Quarter 1 saw nearly 50% reduction in sales during the years corresponding to the first quarter. On the other hand, the market share went down from 0.62 to 0.31% during this year. Quarter 2 saw nearly 5%decrease in sales. This decrease in sales was linearly translated into market share too. Quarter 3 and Quarter 4 witnessed similar decrease in sales which were correspondingly translated into their individual market shares too.

When an even more extensive analysis is made month wise, the results yielded the above graph. The months of March, July, August and December have shown the most growth in terms of sales. However, in February, September and November sales have dropped low drastically.

Force Motors Quarter 1 showed a spectacular decrease in sales corresponding to 10%. The dip in market share was similar to the sales figure. Quarter 2 saw an alarming dip in sales as well as market share from 2014 to 2015 by a stunning 30%. Quarter 3's numbers both in sales and market share remained relatively constant. Quarter 4 saw the maximum elevation in sales and share.

The months of April to June saw plummeting sales with sales going as low as 100 units sold. October showed great promise with sales striking through the roof. October saw maximum growth of about 41% from the previous month.

Ford first quarter showed a slight decrease in sales and so does the market share. Quarter 2 also showed a decrease in sales, which was pronounced than that in quarter 1. This was translated on to the market share figures also. The third quarter however saw a period of relatively constant sales as well as market share The fourth quarter was characterized by an astounding increase in sales and market share. Overall, the sales rose by almost 25% and the market share also rose by close to 1%.

The months leading up until August have seen fairly low and constant sales while the month of August saw a nearly 90% increase in sales from the previous month. October saw the period of maximum sales for the company.

General Motors quarter corresponding with the years 2014 and 2015 have seen some sort of decline in both sales as well as market share. Sales have plummeted down by an alarming amount. Each quarter sae more than 20% decrease in sales, sometimes as high as a 50% downfall too. In terms of market share, each corresponding quarter has seen more than a 1% dip in sales, leading to an overall dip from 2.63 to 1.05% over the course of the year. Overall, sales have plummeted down by an exorbitant percentage from 17,765 units sold in the first quarter of 2014 to 7728 units sold in the last quarter of 2015.

Honda quarter saw a relatively refreshing growth in the sales figures, owing to almost a 10% increase. The same was translated to a 1% addition in the market share to the previous figure. The second quarter saw a very slight increase in sales corresponding to an insignificant increase in market share too. During the transition to the third quarter, there was a decline in sales. But during this quarter, sales rose up by a similar percentage again. The fourth quarter also exhibited similar statistics. Overall sales dipped by a minor percentage over the duration of this year. Overall market share also dipped from 7.20 to 6.42 over the same time.

The months of April and December have recorded lowest growth recording less than 12,000 units sold. Similarly, the month of March witnessed maximum growth in sale corresponding to almost 20,000 units sold in that month.

Hyundai Quarter 1 has seen a slight increase in sales over the year of about 5%. Quarter 2 has been relatively constant with sales. On the other hand, quarters 3 and 4 have shown rising sales figures. Market share has taken huge leaps in these two quarters. Quarter 3 saw an additional 2% increase and so did quarter 4. Overall sale has definitely risen by more than 10%. Overall market share has also skyrocketed from 15% to 18%.

The monthly wise sales of Hyundai has been analysed in the above graph. It seems to paint a pretty stable picture with not much dips and escalations with sales oscillating about the 40,000 units’ mark. The month of October saw close to 50,000 units sold.

Isuzu motors owes very minimally to the overall figures. In terms of market share, though there were several ups and downs in each quarter, it constantly oscillated between a mere 0.01% and 0.02% of the market share. In terms of sales, quarter 1 saw sales rising from nothing to 94 units sold in the successive year. Quarter 2 remained constant with sales as well as market share. Quarter 3 saw a steep increase in sales with the sales figure almost tripling itself. Quarter 4 saw a doubling of sales resulting in a 0.02% of market share finally. The months from March to June have seen very low sales figures with the months of August and December shining a spotlight with their impressive sales figures.

Mahindra & Mahindra curve shows a bowl like characteristics with sales reducing till about the second quarter of 2015 and then since then, increased on to reach a maximum in the fourth quarter. Quarters 1 and 2 showed reductions and fairly constant yet decreasing behaviour respectively, whereas quarters 3 and 4 showed increasing behaviour in their graphs. In terms of market share, quarter 1, 2 and 3 showed decline in their market shares however quarter 4 remained constant with its share. Overall sales dipped by 5% and market share reduced by more than 1%. Due to the launching of many more improved new products, this market is turning out to be a cutthroat, highly competitive one. The periods of maximum growth are March and October, seeing nearly 25,000 units being sold. The periods of low business namely June, July and August saw less than 15,000 units being sold.

Maruti Suzuki quarter as observed from the graphs above showed a slight increase in sales. However, the transition period has been one of slight decline. Overall sales however escalated from 2,98,596 units sold in the first quarter of 2014 by more than 15% over the course of the year. Market share as seen has remained fairly constant with no erratic dips and escalations in it. As evident from the above graphs, Maruti Suzuki is clearly the ruler of this industry with almost 50% of the market owned by it. Overall market share has actually increased from 44% to 46% over this period. One of the strategies used by the company to gain more popularity was to reduce prices of its products. The Nexa strategy adopted by the company was successful in the launch of Balena but the S Cross' sales are struggling. The monthly sales of Maruti through 2015 are analysed are plotted. Not surprisingly, sales have remained constant through each month. No erratic dips are identified in the plot with the period of maximum growth, October accounting for more than 1,20,000 units being sold.

Nissan Gradually as the years and quarters passed, this company has seen a step wise reduction in sales to reach a new low in the last quarter of 2015. Overall sales took a hit of almost 50%. Apart from a momentary increase in market share in the second quarter of 2014, market share has also plummeted below the threshold and has seen a reduction of market share of 1% in the overall view.

Nissan portrays a rather weird scenario in terms of sales and market share. The first and second quarters saw almost homoeostatic behaviour in terms of sales and market share. However, sales and market share took a giant hit in the third quarter when sales dropped by more than 50% and market share reduced by 75%. This was more than made up for by the figures of the fourth quarter when sales hit through the roof as it almost tripled during the corresponding years of the final quarter. Market share on the other doubled itself over the same time.

In the small car segment of this company, Renault introduced KWID which proved to be a game changer for this company. Similar to Renault Duster, this was able to modify the market dynamics and re-name the whole scenario. Recent times have seen that this brand's image is lessening and becoming more stark and hence they need to be focussing on brand recognition by launching more and more products in the market. The months until October have seen constant periods of low sales some months going below the 2,000 unit’s threshold. On the other hand, the months of October and December have seen sales rise like never before. The change is extraordinary as sales rose by a mind boggling 315% from September to October.

Skoda occupies a very insignificant part of the industry. However, it has managed to be consistent with their shares and sales which have not varied much across the year, relatively speaking. Quarter 1 has shown a slight decrease in sales. Quarter 2 has seen a slight increase in both sales as well as market share. Quarter 3 shows a more pronounced increase in both these parameters. Quarter 4 also exhibits similar increase in their sales and market share. The month of October saw maximum sale with more than 1,500 units sold.

Tata Motors Quarter 1 was the period of maximum growth for the company in both 2014 and 2015. Market share also rose to new heights during this time. Sales and market share rose by 10% during this period. The transition to quarter 2 however was not so smooth with a reduction in sales. During quarter 2 however, sales as well as market share rose by a small amount. Quarter 3 showed relatively constant behaviour. Quarter 4 on the other hand exhibited plummeting sales and market share by more than 10% over this time. Overall sales dipped by around 20%, while overall market share fell from 6.4% to 4.88% over this time. The launch of Tata Zest and Tata Bolt was expected to make an impact on the industry, but it failed to do so. The brand ambassador, Messi who is renowned worldwide was not able to kick start this company. From analysis, it becomes clear that what this company requires is more focus on the R&D department and maybe a lesser focus on glamour and advertisements with empty promises.Monthly sales analysis of Tata motors show February and March as the period of maximum sales with close to 20,000 units sold. However, December saw very low sales with less than 10,000 unit sold that month.

Toyota Quarter 1 saw a 20% increase in sales as well as market share. Quarter 2 saw minor increase in both these parameters. Quarter 3 saw slightly constant sales while market share dipped by a small amount. Quarter 4 saw a reduction in sales while a significant decrease was observed in market share. Overall however the scenario is pleasing as sales rose by 10% and so did market share too.The monthly sales graph of Toyota saw a relatively stable plot which all months oscillating about the 12,000 units sold.

Volkswagen Quarter 1 saw a very timid increase in sales which was translated on to market share too. In quarter 2 hoever the company witnessed a hige leap in both sales and market share in the year. Quarter 3 however saw a period of constant sales and market share. However, quarter 4's sales plummeted by 40% and its market share dropped from around 2% to 1% of the industry. The monthly sales have been plotted in the above graph. Until August the sales have been revolving around the 4000 units sold point, never going high above it or falling too much below this level. However, the month of November saw a huge decline in sales to a mere 2000 units sold that month.

Hindustan Motor Finance Corporation Ltd first quarter was relatively constant in terms of sales and market share. The transition to second quarter was stark as sales plummeted by nearly 40%. Quarter 2 however saw a pleasant increase in both sales and market share. The following quarters proved to be periods of decline resulting in an overall sales dip of nearly 70% and a 75% dip in market share over the year.There has been a gradual decrease in sales over the year of 2015 when considered month wise, with sales shooting down by more than 40% when the month of July struck. An all-time low in sales was reached in the month of December when a mere 50 units were sold that month. The months following June have been of constant downfall for the company.

Car segment share was 9.9 percent in 2014 and it increased in 2015 by 0.2 percent, Utility vehicles and SUV segment market share was unchanged, Van segment increased by 0.1%. Total passenger vehicle segment in Indian Automobile Industry was not changed.

Maruti's top models Alto, Dzire and Swift added more than 50 percent sales of total company sales in 2015. Mahindra's Bolero, Scorpio and XUV 500 are the company flagship models and it added around 86% of total sales of company in 2015. Since 2011 Bolero model added around 45% of total company's sales but in 2015 it declined by 2% of total Mahindra Auto sector sales. Newly launched compact SUV TUV 500 sold 16,286 vehicles in just 4 months of 2015.

Honda City, Honda Amaze and Honda Jazz added 88% of total company sales in 2015. Second largets player in India, Hyundai's i20Elite, i10Elite and Eon sales added 68% of company total sales. Hyundai change of compact SUV segment by introducing Creta which sold 40,952 units from June to December 2015. It's position is between premium and economy product portfolio range.

Nissan top model's MUV GO Plus, SUV Terrano and Economy model GO added 74% of company sales in 2015. Nissan Micra sold 7,673 units with 19% sales share of Nissan portfolio.

Japanese OEM Toyota's top model MUV Innova, mid range Etios and SUV Fortuner are the top model of company and added 77% of its total sales in 2015.

French Auto maker Renault's top model's SUV Renault Duster, Small car KWID and MUV Lodgy are the top models of the company and it added 94% of total sales. Newly launched KWID became game changer in small car segment sold 17,933 units from September to December 2015.

Indian one of the biggest Auto maker Tata Motor's top models sedan model Zest and Small car Bolt given support to maintain its position in terms of sales number, Small car Tata Nano sold around 17,542 units in 2015. All three models combined sales added 44% of company sales. Indica and Vista model contributed 25% sales of company in passenger vehicle segment.

Amercian OEM GM's Chevrolet small car brand's Beat, MUV model Tavera and Enjoy are the top models of the brands. Beat 33%, Tavera 31% and Enjoy 14% added in company's total sales of 2015.

Another German car manufacturer Ford's top models SUV EcoSport, Figo and Aspire are the top models of the company. It added 98% of total company sales in 2015.

German car manufacturer top model's Polo, Jetta and Vento added 66%, 29% and 5% sales in 2015.

Skoda is struggling in Indian market from a long time. It's top model Rapid, Octavia and Superb are driving the Skoda sales in 2015.

Segment-wise performance trends Micro, Mini, Compact, Super Compact, Mid-Size, Executive, UV, Vans segment detail analysis included.