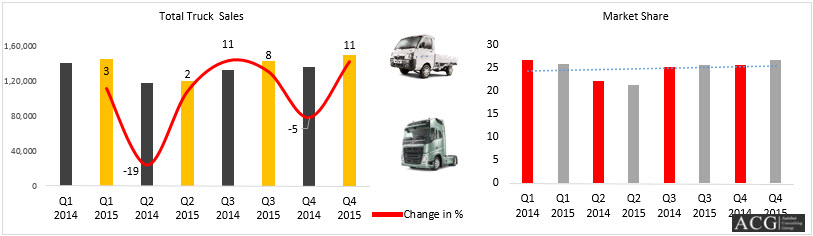

The truck industry has been analysed segment wise and divided into segments for better clarity of the sales figures. The truck segment is characterized into the SCVs, LCVs, MCVs and HCVs. The maximized growth of trucks was seen in the SCV segment which shows a varying graph of sales over the year with quarter wise witnessing the maximum growth. This was followed by the sales of the HCVs.

The least sales was observed in the LCV and MCV segments.

The market share varies in accordance with the sales figures with SCVs at the head of the table and the MCVs and LCVs at the end of the table. SCVs dictate more than half the market with segment share varying as a function of sales. HCVs on the other hand are the runners up with an average of 25% throughout the year. Through the year however, the segment share shows erratic behaviour with ups and downs which vary with every quarter.

The report also entails a detailed analysis of the sales of each brand to give us a better insight into the internal working of the industry. Tata Motors are the pioneers of the industry with an outstanding 48% market share which dipped down by 2 % in the subsequent year. However they still retain their position as the dictators of this segment. M & M are the runners up, though they constitute only about one-fourth of this segment. Their segment shares also suffered a minor loss in sales as the years progressed. In stark contrast, Ashok Leyland rose up the scales in terms of market share as well as sales. Their sales were characterised by a 39% increase, leading to a corresponding increase in market share too. Companies like Piaggio, Force Motors and AMW however were impacted by a major degradation in sales translating to a decline of more than 21% in sales. Their minimal share was also downtrodden.

Irrespective of industry, brand and segment it has come to observation that the sales and market share figures have always shown a linear change. These two are linearly proportional to each other and the graphs of each company showcase just the same. AMW has seen a stunning decrease in both market share as well as sales figures when the corresponding figures for each quarter through the year are analysed side by side. Though their market share was not much to boast about to start with, these minimal figures have also degraded ostensibly over the year through the various quarters.

To gather a better understanding of the same, the monthly sales have been analysed with the months of January, February and March showing the maximum sales and the subsequent months portraying a steady descent ending with almost negligible sales in the month of December.

One of the companies which have had a refreshing increase in sales have been Ashok Leyland. Each quarter has seen more than 20% increase in sales and atleast a 3% increase in market share over the past year.

When it’s monthly sales have been analysed, we see a varying graph with periods of increase followed by periods of decline in sales with the months of March, July, August, September and December witnessing positive growth while on the other hand the months of April, October and November have suffered a huge decline in their sales figures.

Tata Motors have maintained their position as pioneers of this segment. They dictate the truck industry bagging almost 50% of the market. Sales have seen minor decline and elevation now and then over the various quarter through the year. On the whole, this company has seen only increases in their sales figures, owing to a fruitful segment share in the market. Though each quarter has seen a decline in market share percentage, they have still managed to ensure that the sales stay at the top and does not fall below a stipulated level.

The monthly sales trends of Tata Motors mainly show growth. Few exceptions lie in the month of April and November when negative growth was seen, but this was quickly rectified with a speedy ascent in sales the subsequent month. The months of March and September showed an exceptionally elevated increase in sales.

VECV does not have more than a 5% market share to boast. Yet, each corresponding quarter of the previous year has seen atleast a slight increase in sales, owing to an increase in market share by almost 1%.

The monthly sales figures mainly show growth over the years. The exceptional months of April and November show slight decrease in sales, which spring right back up in the upcoming months. March and December however showed exceedingly elated increase in sales.

Mahindra stands at number 2 in the truck industry competition. Though its market share comes nowhere close to Tata Motors, this industry has thrived in well in the individual quarters over the year. Quarters 1 and 2 showed negative growth with plummeting figures whereas Quarters 3 and 4 have witnessed tremendous growth in terms of sales as well as market share percentage.

The monthly sales of Mahindra have majorly seen positive growth through the year with the exceptionally high sales months being October and March. On the other hand, some months have also witnessed plummeting descents of more than 21% characterized by the months of April and November.

In terms of sales, quarter 1 has seen a slight decrease in sales owing to a 0.14% decrease in market share. However, the quarters 2,3 and 4 have seen growth in both sales and market share by an exponential amount. Overall however, the market share has gone down owing to the decreased popularity of the company.

The monthly sales do not show too much of a promising picture either. Months of July and October have seen a particularly decreased trend in sales but however the month of December has managed to buck up and increase it’s sales.

Force motors also stands out as one of the companies which have seen a favourable growth, however market share for this company is low amounting to a mere 0.97% in the 4th quarter of 2015. The sales on the other hand has increased by almost three times in the past year leading up to December 2015.

The monthly Analysis points to the months of April, August and November as the months of descent in sales while month like July and September show more than 20% increase in sales.

From less than 14 units sold, SML Isuzu has amazed us all with more than 303 units produced in the following year, last quarter. Each corresponding quarter has seen a huge increase in sales translating to the increase in market share of the company from a mere 0.01% in the first quarter of 2014 to 0.20% in the last quarter of 2015.

The monthly sales graphs show an erratic graph with both periods of increase and decline. A particular mention can be given to the months of September and May which formed the foundation for the base of increased sales of vehicles.

Isuzu motors has seen a definite decline in sales over each quarter. Overall, sales have dipped by 10% and so have the market share percentage figures.

The monthly sales show an uninteresting monotonous change in sales. However notable is the fact that may saw a 108% increase in sales from April of the year 2015.

Piaggio has also seen only negative changes in each quarter succumbing to a summative loss over the entire year. Sales had dropped by almost 20%. On the other hand, the market share was also dwindling down.

The monotony of the monthly sales of Piaggio was broken by the sudden decrease of more than 50% from July to August and immediately, a 114% increase in sales by the subsequent month. Apart from this, there have been no erratic behaviour in this graph.

Interview with Atul Singh Chandel, Director Autobei Consulting Group

The Hindu Newspaper: when the demand for trucks would see some real improvement, given the fact that the M & HCV growth is majorly being driven by replacement demand. It was also pointed out that there was a real possibility of some segments of trucks vanishing from the market in terms of volume. With the inclination of fleet operators towards heavy trucks, the demand for some segments might reduce or altogether be diminished.

Atul Chandel says that this is a normal trend that is observed across segments during the business cycle. As a result of deferring the replacement of the aging fleet, the pent-up demand arises. This demand is firstly satisfied, followed shortly by fleet expansion with the improvement of freight movement and rates. Also, with the festive season paving it's way through to the spotlight, new operators have joined the fray as business sentiments, clearing the path for new fleet addition. Though heavy trucks are becoming increasingly popular, this is a natural process. It is only natural for heavy payload trucks to be more in demand as the momentum of manufacturing and infrastructure projects increase. This is due to the easy drivability and more revenue and profit prospects of heavy payload trucks. A pattern emerges as we see the figures. First to be introduced was the 4×2, GVW 16T, the biggest truck, followed by the 6X4 25T GVW. Then 8X2 31T and 10 X4 31T were introduced keeping in mind more the payload, the better. There has been a translation from 25T to 31T gradually. This shift in segments will mostly give rise to market dynamics and segment shirt. 16T is the most effective in the M&HCV segment, but has been constantly demoting due to the preference of 25T segment. Kerala and Goa still maintain 16T as the leading segment locally. This transition to the 16T segment translated as a de-growth whereas an astounding 90% was growth was achieved by the 31T segment.

The Hindu Newspaper: The current recovery phase witnesses the company Ashok Leyland to have gained more than its counterparts in the same in ensuring the country's growth in sales and share. What might have helped the company?

Atul Chandel: Similar to all other companies, Ashok Leyland also faced a sharp de-growth in sales. Smart tactics and market corrections has helped gain more profit. One of the major reasons for this is that Ashok Leyland is a self-financing company with self-captive finance. The company was also aided by it's aggressive sales strategy. The Medium duty truck BOSS grew up to about 15% in the corresponding segment in FY 15 and played a vital role in increasing its sales and market share. It grew to almost a double digit market shares within 3 months of it being launched in the respective states.

The Hindu Newspaper: Although BharatBenz had reported positive growth in the September quarter, their share in the M & HCV market dwindled down. In the following quarters, was it challenging to bring it's share and sales back up?

Atul Chandel: In spite of being a newcomer in the market, BharatBenz is one of the major performers in the Indian market. It has recorded a significant growth once in a month on it's truck sales. It is also a fact that volume wise, Bharat Benz is smaller than key players such as Tata and Ashok Leyland. Only the pioneers and the big players can impact this setup. Market share of Bharat Benz is not visible as the volume does not count much for the market share.

The Hindu Newspaper: Will this have a real challenge in boosting sales and shares in the coming years?

Atul Chandel: Only when BharatBenz's sales touch a limit, the market share becomes a parameter to the company. Once it reaches that level, Bharatbenz scales would be able to use market share to be a strong enough competitor.

The Hindu Newspaper: With new regulations and stress on profitability, how is the truck landscape changing the country? Do we see technologically-superior products getting accepted among the truckers?

Atul Chandel:Regulations are costly, and with the advent of a price truck, safety was improved and helped reduce the number of road accidents. Technologically superior products are bought on a daily basis, however paced slowly. India is a price sensitive market. The key question to ask here is at what price do we want to adapt technologically advanced product. Not only India, this is true for almost all country. The only difference with India is that it is more significant among the developed countries. Technologically superior products are accepted easily compared to other segments for applications like mining, Tunnel operation, Oil industry, port and big infrastructure projects. Attractive ROI figures should be adapted to include latest technology in the certain time frame. However, it is still hard to sell trucks like Daimler Actros or MAN TGX series in India. These products are technologically advanced but the price tag is too high. Countries like Russia and China face the same problems too.