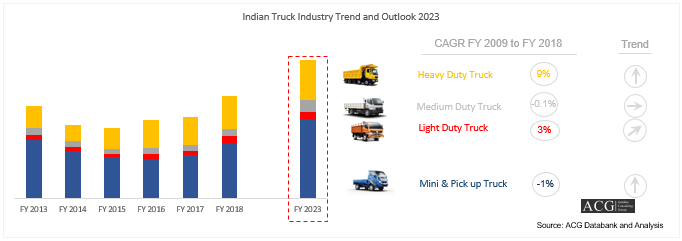

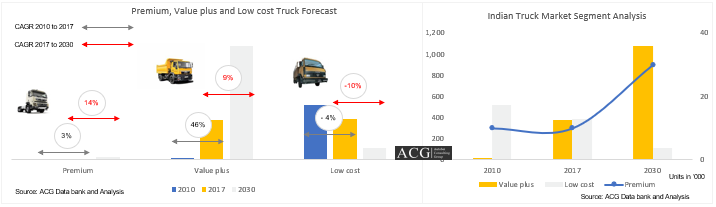

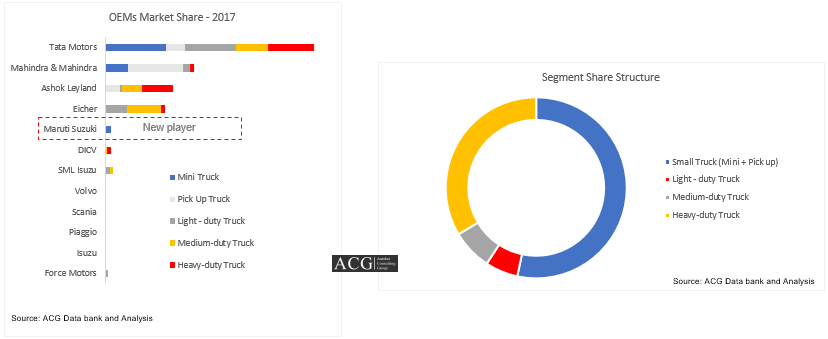

Indian Truck Market is witnessing many major changes in the last 3 years and it is expected to see some more major changes in the next 10 years. The market size of Indian Truck in 2018 is around 0.79 million units. The combined segment share of the Small & Heavy Duty truck segment is more than 85 percent in the current fiscal year. The market is expected to reach 1.2 million units by 2030. Most of the product up-gradation and new launches belong to the Value plus segment which makes it the largest market segment. Even Daimler and MAN Truck decided to enter into this segment in India.

Indian recent economic reforms and expected GDP growth create positive market sentiments. Govt is implementing some new safety norms which will be implemented in the next 2 to 3 years.

The industry is shifting towards a heavy segment due to better TCO and ROI. This year 31T plus segment overtake 25T segment. Tractor Trailer showed a 60 percent growth in FY 2018 compares to last year.

In 2010, the industry was dominated by a low-cost truck with low horsepower and Cabin Chassis Truck models. By the end of 2017, the low-cost segment moved to the Value plus segment. The premium segment is still struggling to get good sales volume due to its low ROI.

Tata Motors is a market leader in the Truck segment. The company is having a double-digit segment share in all sub-segments. Ashok Leyland, Mahindra, VECV Eicher are strong in some specific segments.

Report Highlights:

- Indian Truck Industry Market size and Outlook 2030

- Definition of Premium, Value plus and Low-cost segment – Market Dynamics, Market Driver, Price, Segment size and Outlook, Key Models

- Mini Truck Segment Analysis

- Pick up Truck Segment Analysis

- Light Duty Truck Segment Analysis

- Medium-Duty Truck Segment Analysis

- Heavy Duty Truck Segment Analysis

- Special Truck Segment Analysis

- Rigid Truck Segment Analysis

- Tractor Trailer Segment Analysis

- OEMs Product mapping and its presence in segment and Sub Segments

- OEMs Product Strategy Analysis

- Model-level product position, Specs and Features

- Application wise Market Analysis

- Brand Analysis

- Competitor Analysis

- OEMs Market Share fluctuation

- Product Lifecycle Analysis

- Product USP

- Customer pain area

- Customer Satisfaction Analysis

- Customer, Application and Product mapping

Fleet owner Survey:

- Types of Transport companies (Low Budget Segment, Value plus Segment, Premium Segment), Influencer, Decision-making – Company size, Fleet & Company profile, Application, Portfolio, Truck type, Fleet size, Make

- Purchase Criteria for each segment – All factors included

- After Sales Survey: Maintenance, Repair, Response time, Warranty, On road assistance, Spare parts etc.

- Brand Perception: Pricer & QUality and Segment comparison based on perception of brand