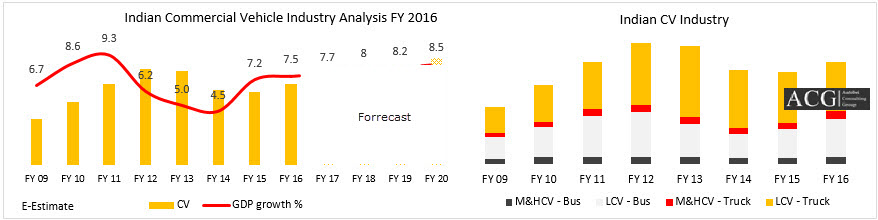

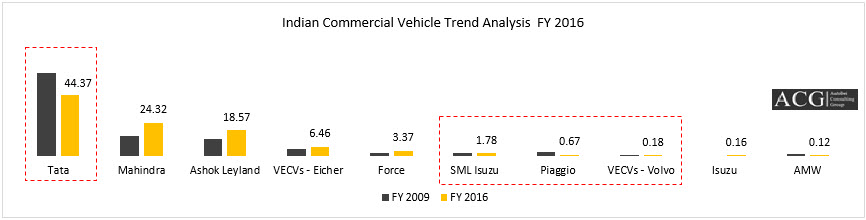

Indian Commercial Vehicle Strategy Analysis FY 2016 is the latest report give in-depth Technical and Market information. M&HCV Industry seeing strong demand conditions powered by constant replacement demand and initial fleet expansion due to positive market sentiments. Growth was driven by volume expansion across all application segment. In FY 2016, CV Industry grew by 12%, M&HCV segment grew in the double-digit of 30%, LCV segment is almost flat by registering 0.30% growth.

On the other hand, LCV segment continues to weaken. Some segment showed mix response of positive and negative growth. Tata Motors is the market leader in Commercial vehicle segment with more than 44% in FY 2016.

Report Highlights:

- Macro, Microeconomic trend and demographic profile of these countries and its impact on

- Market overview and segmentation based on GVW, Usage segments and geographic distribution of volumes

- Evolution of Market size and competition market share

- Brand-wise, model wise domestic production and numbers for import and export volumes

- GVW wise competition sales data for last 5 years and forecast for next 10 years along with cabin type (Bonneted, COE sales) bifurcation.

- Current and future demand drivers and projections for installed production capacities

- Competition: Players and their product offerings, dealer, after sales service, warranties, financing options, buyback arrangements and any other customer strategies adopted

- Top selling Competition models SWOT

- Sales and service footprint for competitors

- Price positioning and current freebies/discount practices

- Duty cycle & operation model for similar kind of vehicles, Variant wise competition prices, and Specification

- Segment wise Altitude/Climatic boundaries, loading/Overloading patterns

- Segment wise preferred features (Current and future)

- Typical Applications usage (Tipper, Cargo, Vans etc) by percentage

- Segment Wise – Understanding of loading patterns, road conditions, service practices , maintainability, durability and reliability expectations

- Policy, Regulations, and Duties

- CKD CBU, Duty Structure, Value stream mapping

- Homologation requirement

- New technologies/Preferred Features /Expectations to be mapped for the mentioned key markets

- Network Analysis

- After Sales and parts analysis