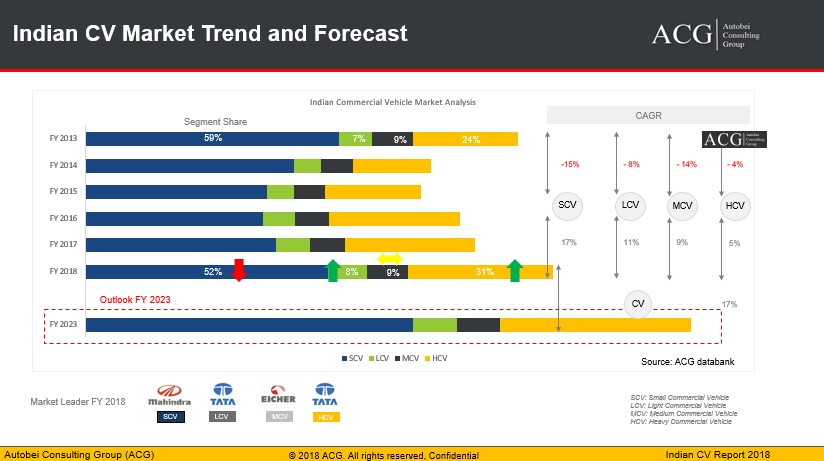

This is a detailed report on Indian commercial vehicle industry’s the on-going trends and the outlook for the year 2018. The ultimate aim of this report is to find out the reasons why and how the segment share and growth has changed in previous five years. This report also details on what and how the industry will like look like in upcoming five years. The main reasons for the changes in OEMs market share in the main segment and their every sub-segment will also be signified in this report. The Indian Commercial Vehicle has registered a growth rate of twenty percentages in the domestic sales segment. The Indian Commercial Vehicle Industry has shown a de-growth of 10 percent in export for the year 2018 compared to the previous year 2017. The current market size of the Indian CV is approximately 8.7 lakhs units for the year 2018 included MAN, DICV, and Scania. The Industry has anticipated a double-digit growth for the year 2019 for SCV and HCV segments.

Recently ROI is also changed of Premium Truck and Bus product and fleet owner expected to reduce ROI cycle at least by one year.

ACG expected that Value proposition solution and vehicle utilization will be next game changer for the Industry.

The government has recently initiated five major steps in N and M category vehicles for safety standards. The development of infrastructure, growth of economy, replacement cycles, the new and upcoming rules and regulation, transportation of heavy goods and machinery, growth in the construction and mining segment, advancement in technology, E waybill systems, new safety norms, telematics, high demands are expected in the rural economy due to normal monsoon, overloading ban, hub and spoke model started to work on the ground are the major initiative and the key drivers for development and growth of industry. The Ministry of road transport was successful in building 9829 kilometers of National Highways during the year 2018 which is approximately twenty percent of growth compared to the previous financial year.

New systems like the emergency button and GPS tracking devices will be made mandatory accessories for selected vehicles. The OEMs will have to pass the changes to initiate the technical changes which will cost a good amount. The year 2018 registered a huge growth for the tractor-trailer, Tipper, and 31T plus rigid haulage. ACG expected that value proposition solution and utilization of vehicle can be considered as the next game changer for the industry. The report included Product/ Make presence in every segment, its position, Specs, Features, Application, and other key information.

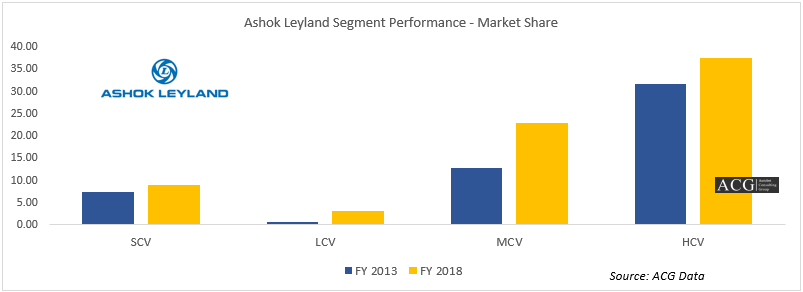

Ashok Leyland has been successful in narrowing the gap against its competitors and improve their market share in all major segments. Tata Motors has lost a valuable 12.5 percentage of market share in CV segment. Ashok Leyland, Mahindra, and Eicher have increased their market share compared to their competitors. The OEMs are mainly focusing on the introduction of new product and their up gradation. In the year 2018 Tata Motors have successfully narrowed the gap with Mahindra and now it is just a mere 7.5 percentage difference in market share in SCV segment. Tata Motors made a change in market share value from a range of 26 percentage to 28 percentage with Eicher Motors in the LCV segment. In MCV segment, Tata Motors has also made a change of market share value of two percentage with Eicher in the MCV segment whereas they have made an improvisation in the HCV segment by increasing the market share value from 33 percent to 36 percent in highly registered HCV segment. Ashok Leyland is taking up the huge initiative to narrow the gap with Tata Motors since the year 2013. The detailed analysis covers and mentions each segment and their sub-segment of the Indian Commercial Vehicle Industry.

There has been a detailed discussion and various meeting with the fleet owners, established professionals, market dealers, financiers, and experienced drivers to have their opinions about the product and expectations and details of large medium and the small fleet owners.

Report Highlights:

- Market size and growth

- Market outlook

- Expected segment shifts and the current trend

- OEMs performance in terms Product, Sales volume, and Market share

- SCV, LCV, MCV, and HCV segment Analysis, Major products, Price range, Market dynamics, Market drivers, challenges, Sub Segment movement, Product USP, Product life, Operating cost, After-sales business practice, Products specs and features, Competitor Analysis and Application

- Product lifecycle

- Key products

- Soft offering

- Network Analysis

- New Product launches and upcoming products

- The starting point for Electric Commercial Vehicle

- Product and market size mapping of each OEMs

- Low cost, Value plus and Premium CV segment

- Product portfolio

- Horsepower wise Vehicle sales analysis

- Nest 5 years sales forecast

- Macroeconomy Analysis

- Primary Survey of Fleet owners of Truck and Bus – Product Issues and USP

- Gap Analysis

- Brand promotion activities

- Brand perception – category wise

- Model-wise and Application wise TCO is available on request