Indian Electric Bus Model Variants-wise Sales Data is another database in our series of Variants-level data from 2020 to 2025. This is not just data or a report; it is a blueprint to win the market within a few weeks. It can determine whether you secure 60 crores.

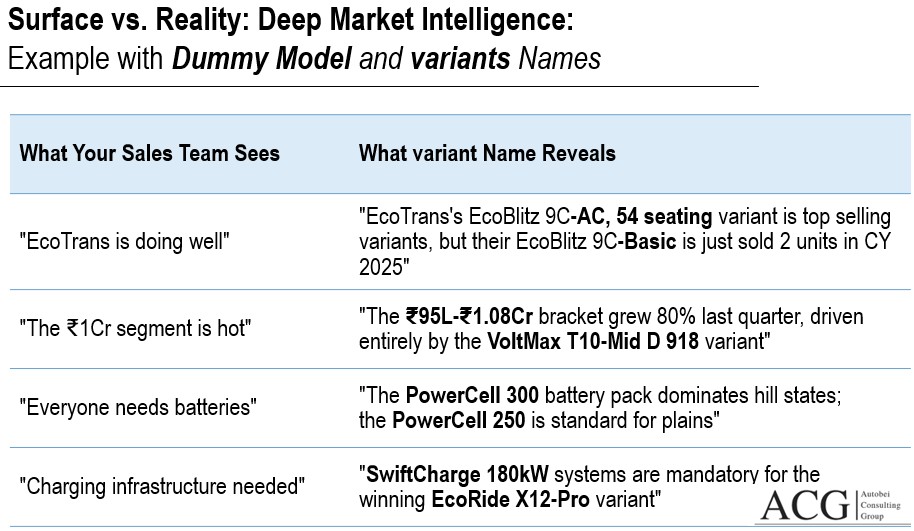

Sales of Indian electric buses are driven by specific variant names. Tracking only model-level sales, such as EcoRide X9 or VoltMax (Dummy name), yields only 30% of the market intelligence. There are various variants under a single model name. Some variants are entirely different; one accounts for 70% of sales, and another for 30%. The difference between 2 variants may be minor but highly effective in influencing customer preference.

We provide Electric Bus data on the product, customers, and market. This data can inform your brand strategy to quickly win in the market. It also saves budget and time by investing in variants that have demand. This is a ready-made recipe to win the market.

Electric Bus Component manufacturers:

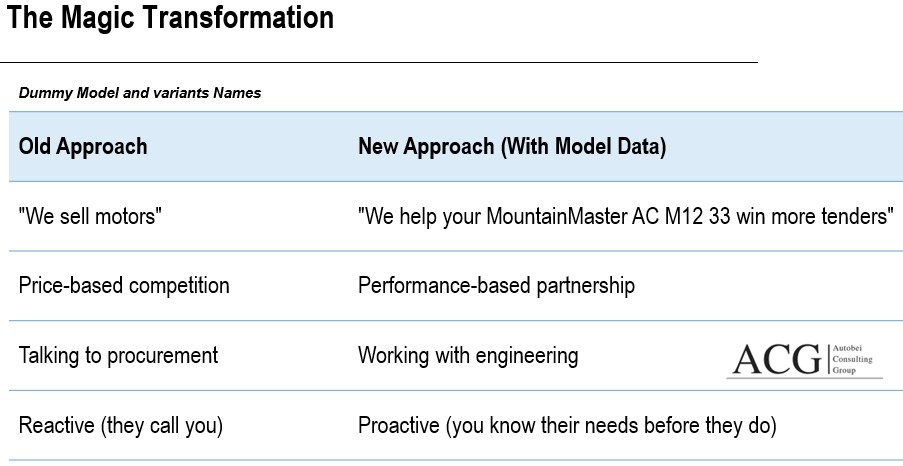

You’re not selling your components or product; you’re offering a competitive advantage and solving the problem.

The cold could be like this:

Mr. Vinod, I see your MountainMaster AC M12 33 is winning tenders in North India. Our Electric Bus data, by variant, shows that 65% of winning bids in these regions require 200 kW or more of motor power.

We’ve developed a 220kW motor specifically optimized for this type of hill application, achieving 98% efficiency above 2,000m, unlike current solutions that drop to 88%.

With your AC M12 33 variant targeting tenders in Himachal Pradesh and some northern states next month, we’d like to schedule a technical review with your engineering team this week.

Model Variant Electric Bus data turns component sales from a “commodity business” (low margins, high competition) into a “solutions business” (high margins, strategic partnerships).

You stop being “another motor supplier” and become “the motor partner for EcoTrans’s winning hill-state variants.”

That is worth 10x more, creates long-term contracts, and makes you indispensable.

For Charging and Energy management providers:

Electric Bus OEMs:

The million-dollar question is which features, specifications, and price matter to customers and buyers. The competitor is selling a variant 33D threefold more than you, 25D. This data provides you with immediate key insights into which products are in demand. Since you do not need to develop multiple variants to check which one can win the market. It saves millions of dollars and priceless time. It also provides a pricing strategy blueprint and helps you adjust your pricing to increase sales. Sometimes, a slight price change can shift market share exponentially.

OEMs included in the Database:

- Tata Motors

- Ashok Leyland

- Switch Mobility

- Olectra

- JBM

- Eicher

- PMI

Technical specs and features:

- Battery capacity

- Battery Chemistry

- Voltage

- Charging rate

- Voltage Architecture

- Motor Power and Motor Type

- Torque

- Transmission

- Range

- Bus Length

- Energy efficiency

- Charging time with AC and DC

- various Bus features like AC, Non-AC, CCTV survilence and others

In a similar way Insurance and Financial companies will also have a direct Electric Bus Market intelligence product and Market.