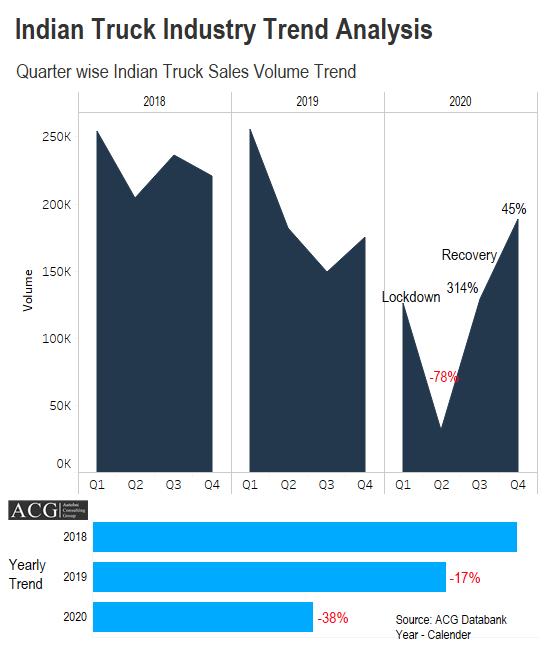

The degrowth has been a common phenomenon that shook the entire world in the year 2020. A Turnaround of the Indian Truck Market 2021 after the New reforms and Economic booster became one of the key growth drivers.

The Indian Truck Market size diminished in the year 2020, as its degrowth stood at 42% compared to the year 2019. The revival rate that was showcased by the Truck segment is really commendable as the market was able to rejuvenate itself at a rapid pace. The same can be concluded while we take a look at the data of the Q4 CY 2020 to Q4 CY 2019, as the degrowth was brought down to 8%.

The contribution made by the Indian Truck segment for the year 2020 was at 94% as compared to the 90% that was seen in 2018 for the total CV market in India.

Indian government played a pivotal role in empowering the transport infrastructure of the nation, which eventually is the need of the hour. The government has launched Infra projects worth Rs.103 Lakh crore, apart from this they have also contributed a whopping amount of about Rs.1.70 Lakh crore for improvising the transport infrastructure as well as the focus has been laid on accelerating the construction of Highways. The Infrastructure development is on Government’s Radar, as they believe it is the much-needed booster for economic growth, and it’s very evident when we see as many as 6,500 Infra Projects flagged up across sectors under the NIP (National Infrastructure Pipeline).

The Union Government has taken a special interest in this cause and will fuel Rs.18,000 Crore to strengthen Public transport in Indian cities and they have procured 20,000 buses for the same. This move by the government will mark the beginning of good days and render Impetus for the Bus segment, which had traversed a rough path as its sales crashed due to the negative impact of COVID-19.

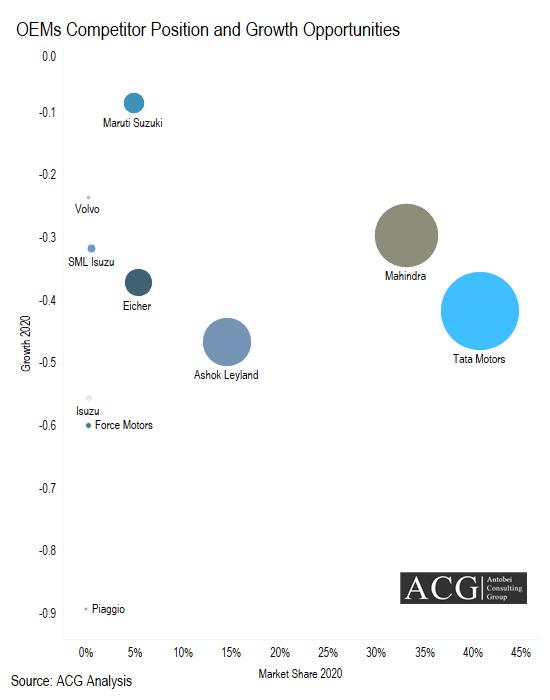

Tata trucks, one of the pioneers in the segment lost 3% of their market share in 2020 compared to CY 2019 and 5% as compared to 2018. Mahendra, on the other hand, amplified its growth by 3%, Ashok Leyland conceded a 3% loss, Maruthi grew its share by 2%. The sales of Volvo trucks were also ill plunged, but if only the Premium Truck segment is taken into consideration then we can note that its performance was Satisfactory compared to Scania.

Surprisingly, After the lockdown, Mahendra lost its market share by 8%, Ashok Leyland gained 2% Market share in Q4 of 2020 compared to the Q3 of 2020. The Q4 proved to be an improvement period for Maruthi and Eicher as both enhanced their Market share by 1% in 2020.

OEM’S continued to run an uninterrupted show, as all the major OEMs except Mahendra showed better growth rate and this was higher than the Industry growth for the 2nd and 3rd quarter.

Operating costs have gone up as they have a proportionality with the price hike. The increase rate is at 30% for a daily commuting truck that commutes 300 km per day. For the TCO chart, this contributes to almost 50% of the cost. However, this relationship keeps varying for the truck segment and other models as the demand is on the lower end.

The Infrastructure development has attracted a huge amount of investment in Budget 2021. The existing scrappage policy will revolutionize the growth saga of India. The above steps taken by the government have embarked on the demand of Tipper in West Bengal, Tamilnadu, and Kerala.

Even the rural sector has also created a healthy demand, but the fleet utilization hasn’t quite picked up yet, as many trucks are stagnant in the parking because of the demand drop.

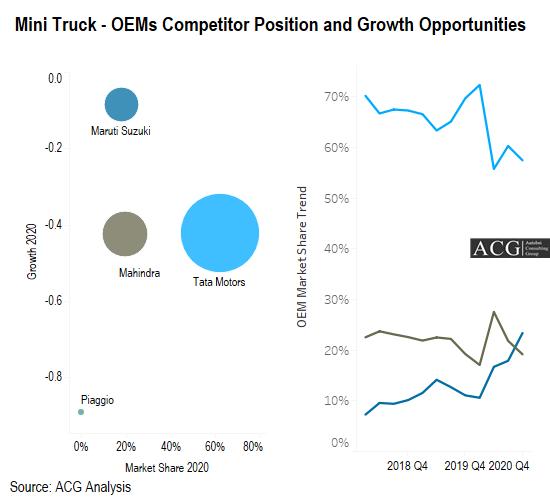

Mini Truck:

The losing streak has continued to haunt Mahendra and Tata motors since 2018. But in 2020, Maruthi was able to expand its Market share from 9% to 18% in just 3 years. A similar trend has been noticed after the lockdown and in the Q4 of 2020, Maruthi is dominant as it’s commanding 23% Market share. This segment witnessed 38% degrowth in 2020 compared to 2019.

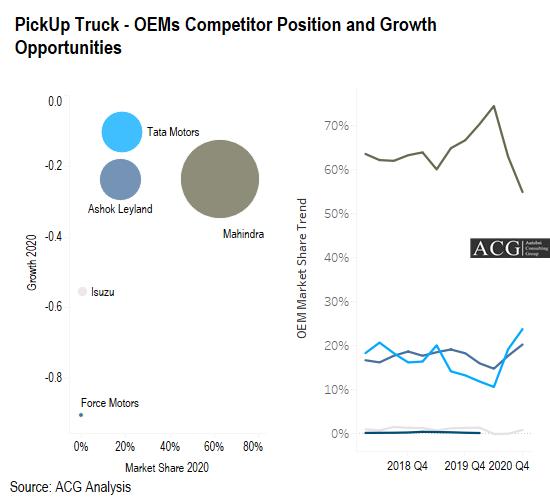

Pickup Truck:

This segment has seen degrowth at 22% in 2020. The year-end quarter turned fruitful for the segment as it managed to achieve double-digit growth in the segment. Mahendra continues to be the top-notch performer in the segment. The new product launch by Tata motors aided them to enhance their market share by 2% in 2020.

In the Q4 of 2020, the likes of Ashok Leyland and Tata Motors were successful in snatching a share of 2% and 4% from the segment giant Mahendra.

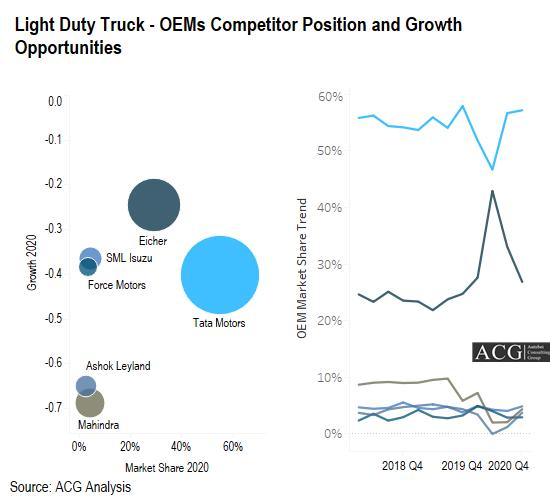

LDT segment:

Tata motors have held a dominant position and are the market leaders in this segment by amassing more than 55% market share in 2020. Eicher is slowly climbing up the ladder by launching its new trucks to cater to the E-commerce segment. This performance has pulled the Market traction of Mahindra, Ashok Leyland and has redirected the same to Eicher.

In Q4 of 2020, Tata Motors, Ashok Leyland, SML, Isuzu, and Mahendra enhanced their Market share post lockdown.

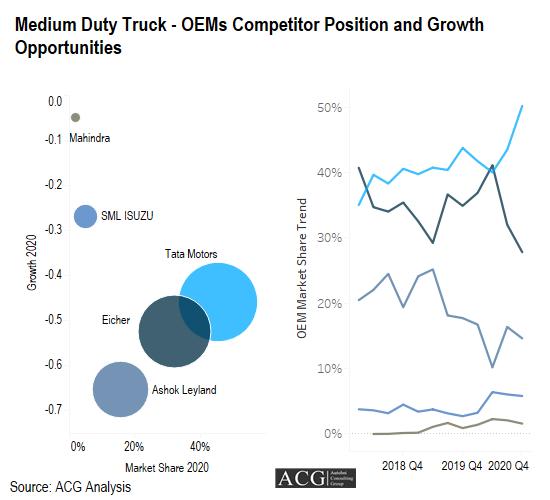

MDT segment:

The MDT saw the worst of 2020, as its market size shrank to half of what it had in 2019. Tata on the other hand rose to a respectable position by adding 5% Market share in 2020. Ashok Leyland and Eicher didn’t have the best of 2020, as they lost market share in CY 2020.

The period after lockdown rendered a red carpet welcome to TATA as it became even more invincible by garnering an additional 10% market share.

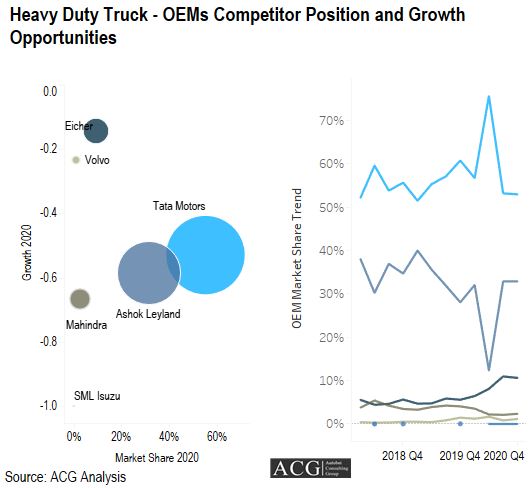

HDT segment:

The HDT segment has 3 subsegments viz. Rigid, Tipper, Special Application, and a tractor-trailer. Though the HDT segment saw degrowth of 50% in 2020, it had the last laugh in the Q4 of 2020 by seeing a spike of growth. The highest growth in the segment was seen by Eicher, as its newer model catalyzed the company to enhance its sales by more than 2 folds in Q4 2020.

The market share that was grabbed by Eicher was at 9%, which is 4% higher compared to last year. In the Q4 of 2020, Eicher went past the double-digit growth. Ashok Leyland and Mahendra lost a 4% share at the same time.

The pandemic brought the Tractor trailer to a standstill position with absolutely no growth. The Market size scaled down from 80k to 12k in 3 years.

Ashok Leyland loosened its hold by a little more than 20%, and Tata tightened its grip by adding 20% market share in 2020. The momentum of Ashok Leyland continued to dip further and worsened as it lost 9% in Q4 compared to Q3 2020. Tata Motors continued to stun its rivals by elevating itself to the leadership position by taking 70% market share in Q4 2020.

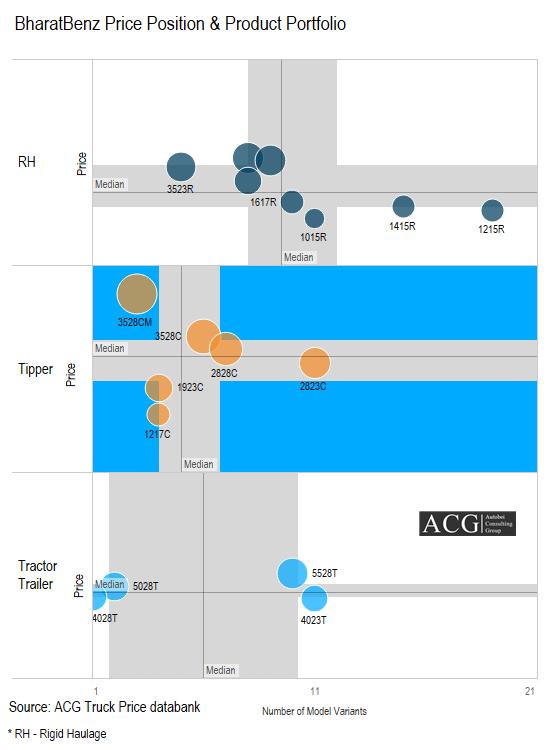

BharatBenz Case Study:

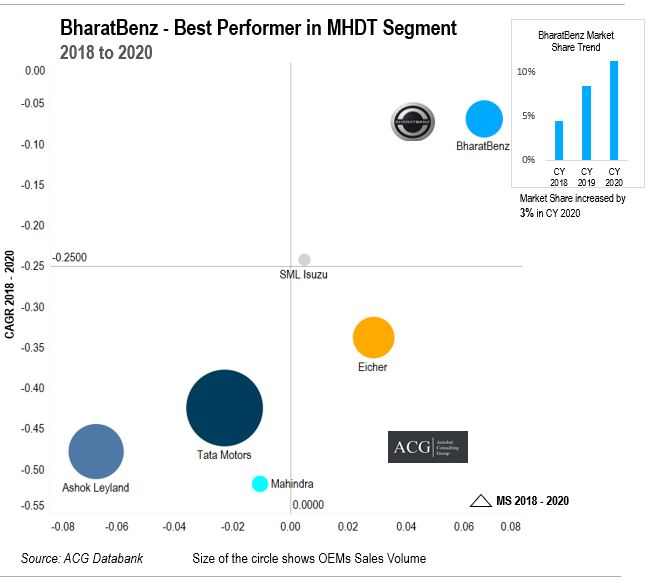

BharatBenz registered 36% regrowth in the MHDT segment but its market share increased by 3 percent in CY 2020 compared to CY 2019.

BharatBenz product portfolio and Pricing Strategy play a key role in the growth story.