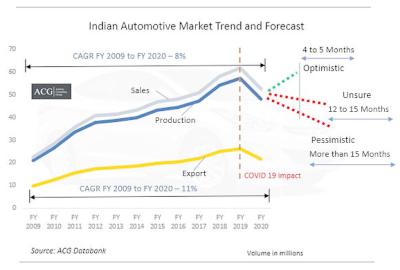

Indian Automotive Industry, unfortunately, is going through a rough time just like any other automotive market. Reason? COVID-19, New Emission norms, Weak consumer and economic sentiments! Coronavirus will change the future of the automotive industry and is believed to produce a long-lasting impact on a large scale. ACG forecast on the Indian Automotive market is produced in 3 different ways – Optimistic, Pessimistic, and Unsure. The Indian GDP forecast shows there will be an absolute drop of around 2.8% in FY 2021. The CAGR of the Indian automotive industry’s sales between FY 2009 and FY 2020 comes around 8%. The Passenger Car segment registered a 5% growth rate, Commercial vehicle 6%, 2-wheelers 8%, and 3-wheelers segments registered a 6% growth rate between FY 2009 and FY 2020.

The dreary fact is that March and April remained the most challenging months of 2020 for the auto sector, for the 40 days lockdown produced nil sales and zero production. However, OEMs gave financial support and helped dealers during these difficult times.

Production: Re-establishing production facilities will be more challenging than shutting them down. It requires a thoughtful approach to revive the supply chain, equating the volume to actual demand, and, most importantly, shielding the workforce, who are indeed the backbone of every successful industry. The passenger vehicle sales declined by 50%, Commercial vehicles to 88%, Two Wheelers to 40%, and three Wheelers registered 60% in March 2020. Besides, in the CV segment, almost all major OEMs recorded more than 85% decline in sales. Overall sales declined by 45% in March 2020 compared to March 2019.

When it comes to Passenger vehicles, Tata Motors, Volkswagen, Mahindra, Skoda, Honda, and Ford recorded massive degrowth in the history of their service in India.

Similarly, in the two Wheeler segments, all top OEM firms recorded more than 40% degrowth in March 2020. Similarly, Indian Auto Industry sales dropped to 18% and Production volume to 15% although exports registered a 3% growth in FY 2020.

The size of the Indian Automotive market is lessened to 2,15,50,494 units with an 18% degrowth in FY 2020. Among which, commercial vehicle market is declined to 7,17,688 units with a 29% degrowth, three Wheeler market is declined to 6,36,539 units with a 29% reduction, passenger vehicle declined to 27,75,679 units with an 18% degrowth and Two Wheeler market declined to 1,74,17,616 units which again is an 18% degrowth in FY 2020. However, the SUV/MUV and MHCV are two sub-segments that showed minor growth.

Maruti Suzuki gained around 3.5% market share in the car segment, and in the SUV/MUV segment Mahindra lost a 6% market share; however, Hyundai improved its performance in the SUV segment and increased 5% market share in FY 2020.

Sales trend:

Among the commercial vehicles, Mahindra had increased its market share from 25% to 28% in FY 2020. Whereas, Tata Motors and Ashok Leyland had lost their 2% market share. In the MHCV Bus segment, Ashok Leyland increased its market share by around 4%, and among the MHCV Truck segments, Ashok Leyland lost 4% market share but Eicher increased its share by 2% in FY 2020. In the LCV Bus segment, Force Motors holds its authority status by adding another 3% market share; whereas, in the LCV Truck segment, Tata Motors lost its 2% market share. Among the Two-Wheelers market, Honda has improved its performance and increased its market share by 2%. While in the Motorcycle segment, Hero still manages to take the top spot by yielding a 50% motorcycle sales share in India.

Key Highlights of the report:

- Indian Automotive market trend from FY 2008 to Fy 2020 and Forecast

- Sales, Production and Export Analysis

- Pricing Analysis

- Product Life cycle

- Truck, Bus, Two Wheeler, Passenger Vehicle – Car, SUV, MUV and Van, Commercial Vehicle, and Three Wheeler market Analysis

- Competitor Analysis

- New players in the Indian Automotive market and impact

- Challenges after COVID 19 for OEMs, Suppliers, and Dealers

- SWOT Analysis, and

- Entry Strategy