Overview of Indian Automotive Market in February 2019 and Cumulative

The sale of automobiles is facing a bit slow down in Feb 2019 which is temporary in nature and is due to an election which is about to take place in the next month. Apart from the phase of pre-election, there are several other factors such as tight liquidity condition which plays a major role in impacting the behavior of the consumers.

The market of automobiles is continuing to exhibit the subdued demand sentiments because of the fact of high-interest rates, slowing economic activity, the lagging effect of implementation of new norms for axle load, decreasing index of IIP growth and the slowing industrial output. In addition to this, the base effect is also a major factor that plays an important role in the very slow growth of the CV industry with respect to H2 of the financial year 2018.

After the implementation of the new norms for axle load, the freight carrying capacity of MHCV parc has gone up by twenty percent, but on the other hand, the freight growth has not been able to take this enhanced capacity. This, in turn, has resulted in decreasing demand for the new trucks. Now, talking about the segment of tipper has kept on showing a very good growth of about 22 percent on the back of road construction, irrigation as well as affordable housing projects.

This is one of the segments which has not been affected very much by the changing of the axle load norms. The introduction of the new products in the very quick growing segment of 15 T – 16 T is seen to have been accepted by the customers very well. The demand in a segment of M & LCV has been readily propelled by the e-commerce sector as well as increased rural consumption both of which is very well supported by the introduction of the new products.

Coming to SCV Cargo and the segment of the pickup was back in form in the previous month that is February 2019. With the evolution of the hub-spoke model, the increasing want for the last mile connectivity across the rural as well as the urban markets, along with the initiatives of Swachh Bharat have led to the rise in demand in this segment.

The launch of New Product & Market updates

Honda Cars India has finally launched the All New 10th Generation Honda Civic in the Indian market which is its iconic and much-awaited model This new launch Honda Civic promises to deliver the users with an all driving experience. The car with its fantastic sporty design, great driving performance, an advanced set of key technologies as well as innovations along with premium quality and an upscale interior is all set to give the users complete satisfaction. The model Civic from Honda is the longest – running automotive nameplate and its largest selling model throughout the world.

The model Harrier which is an SUV from Tata Motors has received a very good response in the Indian market. Tata Motors is expecting to increase its production volumes in the months to come. Tata Motors grabbed the order of a total of 1045 buses from Gujarat State Roadways Transport Corporation which included 695 fully-built Midi-buses and 350 12m chassis. Another order which was more than about a thousand Winger Ambulances that are AIS 125 standard complaint from the governments of Uttar Pradesh, Gujarat, Himachal Pradesh, and Haryana. In addition to this, about 812 was received in the last quarter from the government of Uttar Pradesh and 400 CNG BRTS buses from Pune Mahanagar Parivahan Mahamandal Ltd. (PMPML).

Passenger Car, SUV, MUV, and Van Industry Overview

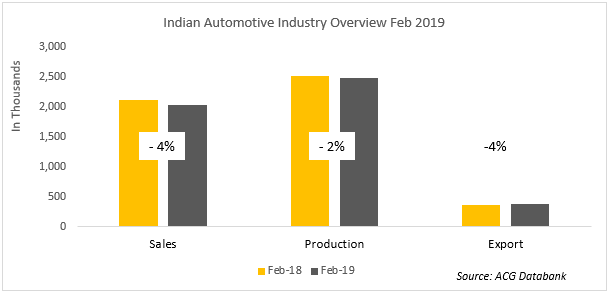

In the month of February 2019, the Indian automotive market showed very low degrowth of about four percent in sales and about two percent declination in production. On the other hand, the export showed a growth of about four percent. However cumulative, the Indian automotive production market showed nine percent growth, sales showed a rise of seven percent and the export registered a total growth of 16. In the last month, a total of 1,71,372 cars were sold which was four percent decline whereas the segment of SUV/MUV registered a growth of four percent where there was a sale of 83,245 units. Cumulative, the segment of car sales showed growth of three when compared to the same time period in the previous year. The segment of SUV and MUV rose by two percent and the segment of van rose by thirteen percent when compared with the same time period in the previous year.

The segment mini Car showed a sharp declination of 33 percent in February 2019 as compared to February 2018. However, the share of the two major OEMs that is Maruti & Renault rose from 76 percent to 83 percent and from 14 percent to 17 percent respectively in this sub-segment.

The segment of the compact car increased by 2 percent, where the vital players are Maruti, Hyundai, and Tata Motors. The market share of Hyundai in this segment is stagnant but the share of Marui share increased by 2 percent and the share of Tata Motors decreased by 2 percent whereas in this segment the share of Honda just simply doubled in February 2019. The segment of super compact fell thirteen percent as compared to the same month of the previous year. The mid-size segment is another of the major one which in February 2019 showed a declination of 21 percent when compared with February 2018. But the shares of Honda, Hyundai, and Skoda rose by two, one and three percent respectively in the month of February. But the struggling player Volkswagen showed a massive growth of more than doubling its market share in the last month.

The segment of affordable SUV that is Maruti, Mahindra and Hyundai ended with an increased market share in the last month. Tata Motors gained two percent market share and this segment showed growth of one percent in the previous month as compared to February 2018 which is the key highlight. A growth of 25 percent was shown by the budget segment but on the other hand, the premium segment of SUV/MUV showed negative growth. Jeep which is one of the most successful models also started losing its grip incurring a loss of ten percent market share. The market share of Fortuner is almost the same without any movement.

Commercial Vehicle Industry Feb 2019

The market of Indian commercial vehicle also remained the same in the month of February 2019. The segment mini truck showed a growth of 18 percent as compared to February 2018. In this segment, Maruti Suzuki Supercarrier attracted a lot of customers from its competitors. Market share lost by Tata Motors & Mahindra was three and one percent respectively Suzuki gained four percent market share. Overall, the segment showed growth by 18 percent in February 2019 as compared to February 2018.

The segment of pickup truck rose by one percent in February 2019 as compared to February 2018. In this segment, Mahindra and Tata Motors both lost one percent market share.

The light duty truck also fell by one percent. In the segment of 3.5T to 6T, Eicher lost two percent and in the category of 6 to 7.5T Eicher lost seven percent market share in February 2019. In the same sub-segment, the gain of market share was two percent by Ashok Leyland.

The segment of the medium-duty truck rose by seven percent in February 2019. Eicher showed a loss in its grip in the segment of MDT. In the same segment, the other majors such as Ashok Leyland, Tata Motors showed a better performance.

The segment of the heavy-duty truck fell by fourteen percent in February 2019 as compared to February 2018. In HDT, the rigid truck segment showed a negative growth of three percent in February 2019. The segment of 31T and above 31T GVW recorded the highest negative growth of 21 percent in this subcategory but in another segment showed good growth.

The performance of Ashok Leyland is quite a good one which has increased its market share in each of the sub-segments. On the other hand, Tata Motors which is its closest competitor lost market share in each of the sub-segment of Rigid HD segment.

Negative growth of 35 percent was noticed in the tractor-trailer segment in February 2019.

The segment of the bus is the same and no changes are noticed in terms of the volume of buses. In the segment of 5T, Tata Motors ranked first which registered an increase in market share of 20 percent from 16percent to 36 percent. 17 percent market share was lost by Force Motors which came down to 52 percent from 69 percent.

Another of the sub-segment of 5T and seating capacity of more than 13 saw negative growth of 15 percent but Force Motors is a gainer in this segment.

The segment of the medium-duty bus of 5 to 7.5T registered a growth of seven percent whereas Eicher, Tata Motors and Force Motor lost market share of 2 percent, 3 percent & 1 percent respectively. The segment of the medium-duty bus of 7.5T to 12T showed a negative growth of three percent. At the same time, Tata Motors and SML Isuzu lost market share in February 2019 as compared to February 2018. The segment of heavy-duty bus showed a growth of 8 percent where Ashok Leyland gained 12% market share from 55 to 67% and Tata Motors lost 11% market share.

Indian Two Wheeler Industry Feb 2019

The industry of Indian Two-Wheeler showed a negative growth of five percent in the month of February 2019. The segment of scooter increased by one percent but the segment of the motorcycle segment came down by 12%. In the category of 75 to 125cc, the market share lost by Honda was four percent and Suzuki gained a market share of five percent February 2019. The market share of TVS remained constant at 15 percent. In the category of 75 to 110cc, the segment of motorcycle rose up grew by eight percent in February 2019 as compared to the same month of the last year.

In the category of 110 to 125cc, the negative growth was of 17percent. In this category, the market share lost by Hero MotoCorp was six percent whereas the market share of Honda increased by 12 percent in February 2019.

In the category of 125 to 150cc, there was a growth twelve percent in which Bajaj increased market share from 42% to 59% but the loss of market of Honda was 16 percent. In the category of 150 to 200cc, there was a negative growth of 13 percent in February 2019 as compared to February 2018. Here the gain in market share by TVS was 9 percent but Suzuki and Honda lost market share by 8 percent and 5 percent respectively.

In the higher segment of 200 to 250cc, there was degrowth of 61 percent where Yamaha gained 3 percent market share and Bajaj lost 5 percent market share. In the category of 250 to 350cc, there was again a negative growth of 15 percent where Royal Enfield was the supreme dominator the segment with 99% market share. In the category of 300 to 500cc, the degrowth was 67 percent where Royal Enfield showed an improvement in its performance by gaining 11% market share. In the category of 500 to 800cc, there was a growth of 415 percent in February 2019.

In the three-wheeler segment, a negative growth of four percent was registered. The segment of passenger three-wheeler showed degrowth of four percent and the goods three-wheeler segment showed growth of six percent.

Please contact us to get Monthly Automotive Detail Analysis