Pricing Trend Analysis of Commercial Vehicle is our exclusive detail Analysis Report. In Our detail analysis, 700 Bus variants and 1,000 Truck variants included. After BS-IV and GST, we have found some specific trend in Commercial vehicle pricing.

Pricing Strategy depends on many factors, Models, Market dynamics, Demand, Technical specs, Driveline, Tyre, Body type, Application of the vehicle and other parameters.

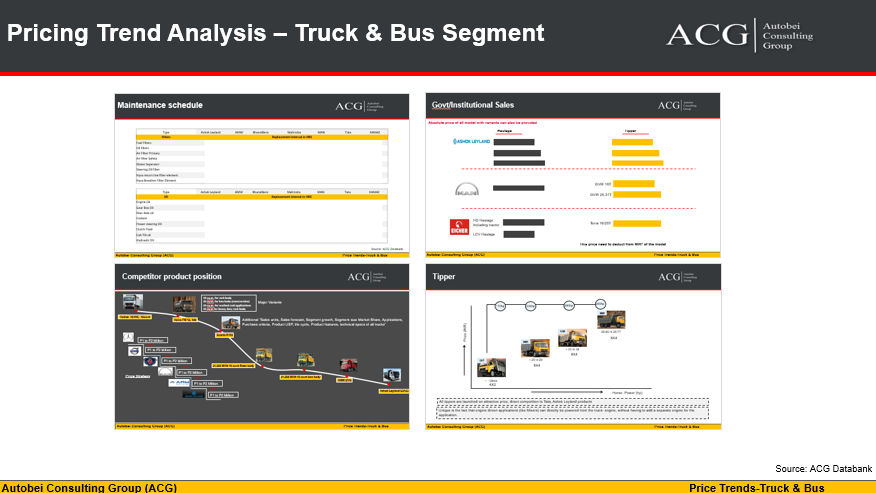

It gives pricing trend of Truck and Bus since 2011 to 2017.

Report Highlights:

- Product Category (Fully Built & Chassis): Truck and Bus – 1 to more than 49T GVW

- Popular price bracket with Product features and Technical specs

- Brand, Model, and Variant wise Analysis – MRP, Discount, Dealer Margin, Govt & Institutional price

- Segment: Small Commercial Vehicle, Light Commercial Vehicle, Medium Commercial Vehicle, and Heavy Commercial Vehicle

- Price Bracket Analysis and mapping to Market size & Segment

- OEMs Pricing strategy

- Competitive analysis

- Factors influence the price

- Sub-segment :

- Truck: Mini Truck, Pick up Truck, Light Duty Truck, Medium Duty Truck and Heavy Duty Truck, Rigid Haulage, Tipper, Tractor Trailer, Concrete Mixer, Boom pumps and Special Application

- Bus: School, Staff, Low Floor, City Bus, Intercity, Luxury, Tarmac, Moffusil, Light Duty Bus, Medium Duty Bus and Heavy Duty Bus

- Labour Charges: Authorized dealers & Service center

- Spare parts Price Analysis: Genuine parts price, Non-Genuine (Direct OEM Suppliers) price

- Spurious parts

- Secondary market

- Types of Customer segment, Type of fleet owners, Behaviour & Psychology

OEMs included:

- BharatBenz

- Tata Motors

- Scania India CV

- MAN

- Ashok Leyland

- VECV – Eicher

- VECV – Volvo

- Mahindra & Mahindra

- Force Motors

- Piaggio

- SML Isuzu