Indian Two Wheeler Product and Market Analysis is the most detailed report which covers all segment, Brand, Market Dynamics, Trend, Product age, Product life cycle, Aftersales, Buying behavior, Production forecast, Export analysis, Sales, Marketing Strategy, Sales Strategy, Dealer Network, Role of the Internet to buy the vehicle, Model wise critical analysis and its mapping with customers, etc.

The Indian (2W) industry enrolled sales in volumes of ~ 15.1 million units in 2020-21, which was a degrowth of 13% over the earlier year FY 2019-20. The 13% degrowth recorded by the 2W business is comparatively less to the growth expected that enlisted some time ago.

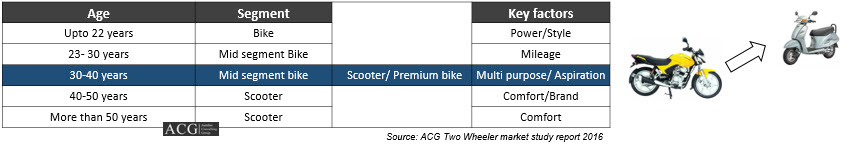

Buying behavior Analysis:

Indian Two Wheeler Export and OEM wise OEM Market Share:

Buying behavior Analysis:

The Scooter segment has demonstrated a 20% degrowth, though Motorcycles have demonstrated 11% degrowth this year.

The Indian and foreign 2W organizations concentrate more on exports, particularly from India, the Asia Pacific (Vietnam, Thailand, Indonesia, the Middle East and Latin America, and so forth), and African nations where the 2W business sector is exhibiting colossal potential. Piaggio has as of late dispatched its Vespa model and plans to fare its units from India. Then again, Mahindra needs to resuscitate its brand position, product value, and in particular, its Brand Image in the present business sector.

Entry, Executive, and Premium Segment segment share is changing every year.

Two Wheeler market is too dynamic. Customers are shifting from one parameter to another one frequently and choose a product that gives some value.

Report Highlights

- Indian Automobile Industry overview

- Two Wheeler Industry Analysis

- Segment Analysis

- Pricing Strategy

- Customer behavior

- Product portfolio analysis

- Brand Strategy

- Market Drivers – Segment wise

- Historical & Future Trend Analysis

- Competitive Landscape

- Macro Economics Analysis & Industry

- Company Business Reviews