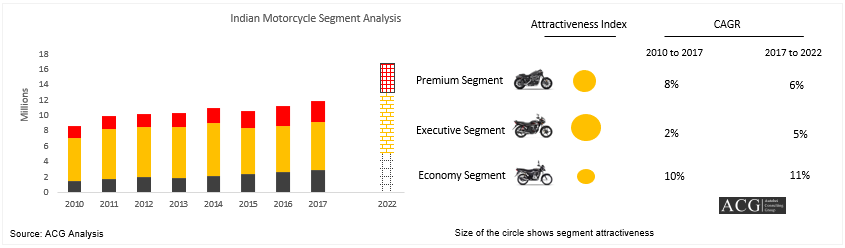

Indian Two Wheeler Industry Analysis is our latest Analysis which cover multiple market dynamics, Trend, and Forecast. Premium Bike segment is growing 8 percent CAGR from 2010 to 2017, an Executive segment which is also largest segment is growing just 2 percent CAGR in the same period and Economy which is a popular segment for entry buyers is growing at the rate of 10 percent compound growth rate.

Report Highlights:

- Two Wheeler (Scooter, Motorcycle, and Moped) Market Size, Trend, and Outlook (INR & Volumes)

- Latest Industry Development

- Entry, Executive, and Premium Segment Analysis- Sales, Market Share, Key Product, Price, Features, Target Segment, Shifting of the segment, Trend, and Outlook

- Market Share Analysis

- Sales, Production, and Export – Last 5 years Trend and Next 5-year Forecast

- Short Term & Long Term Qualitative Analysis

- Brand & Model-wise Sales and Production Analysis

- Product Analysis – Product USP, Product Lifecycle, Product Features, New Product launch and Product position

- Dealer Network Analysis

- How Electric Vehicle is changing the Two Wheeler Industry

- SWOT Analysis

- Advertising and Branding Strategy

- OEMs Strategy Analysis: Bajaj Auto, Hero MotoCorp, TVS, Piaggio, Harley Davidson, Kawasaki, Honda Two Wheeler, Royal Enfield, Mahindra, Suzuki, Triumph, and Yamaha

- Customer needs and Habit Analysis including Social Media influence

- Impact of Digital Technology

- Product planning forecast

- Two Wheeler Market Drivers

- Opportunities and Challenges for OEMs & Industry

- Key Models Analysis

- Spare parts Price Analysis

- New Players entry into Two Wheeler Electric Vehicle segment

- Potential Segment Analysis

- Macro Economy and Employment Analysis