The global hydrogen fuel cell vehicle market was estimated at $0.94 billion in 2022. Fast forward to 2040, and detailed analysis indicates an impressive growth trajectory, with the market anticipated to expand to a significant $80.4 billion. This journey will be marked by a steady Compound Annual Growth Rate (CAGR) of 28% from 2022 to 2040.

In this report, we are going to cover the main three technologies: Battery Electric Vehicles, Hydrogen Fuel Cells, and Hydrogen combustion Technology.

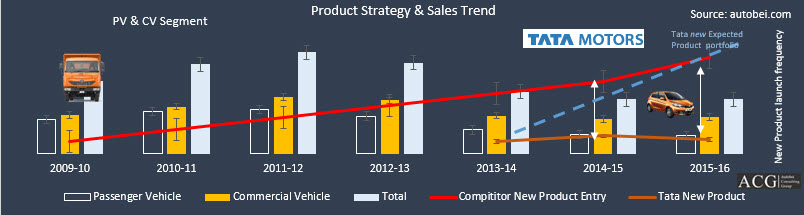

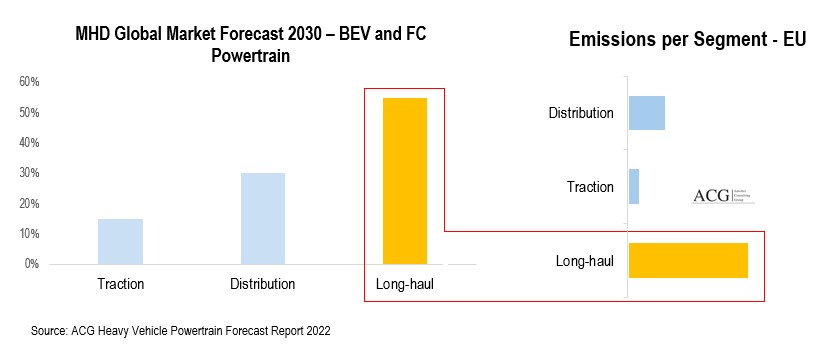

Market Potential: The market potential is based on the Segment of the commercial vehicle. The long-haul segment was selected as the primary focus due to its significant volume and substantial contribution to emissions.

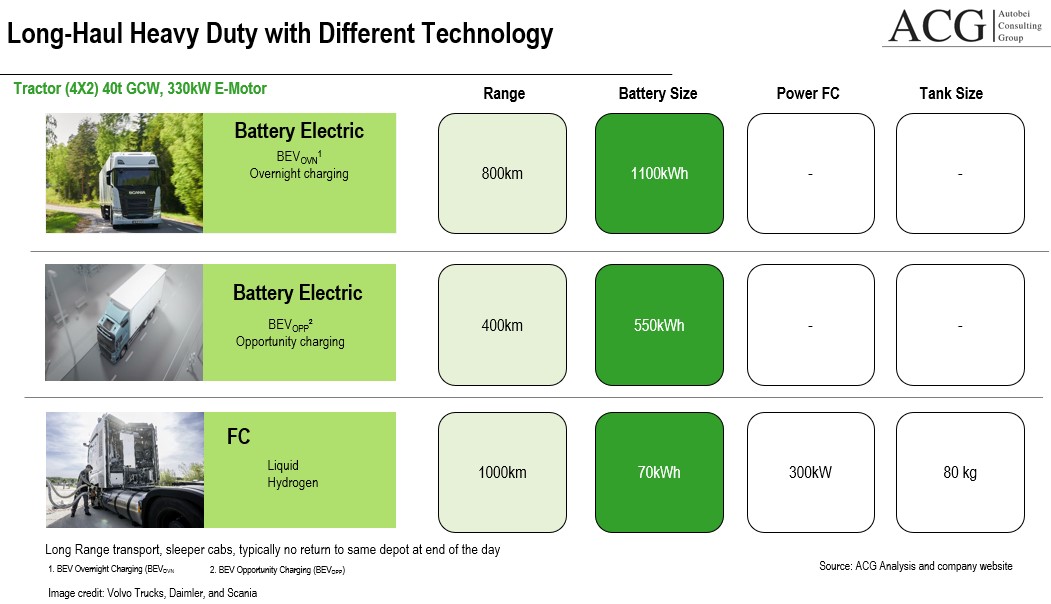

An analysis was conducted on three different configurations:

- An example of the BEV Overnight Charging approach is Tesla’s practice of overnight depot charging using chargers.

- Approach example most European OEMs charge overnight and regular breaks after 4 ½ hours of driving (750-1000 kW charger)

- Fuel Cell generates electricity & battery as energy buffer

Introducing one of the most progressive frontiers in Commercial and Passenger Vehicle technology—Hydrogen Fuel Cell. As advancements continue to unravel, the trajectory points towards an initial embrace by Heavy Commercial vehicles, followed by the integration into the Cars and SUV segment. While the road is not without its challenges for fuel cell implementation, the march of improved technology holds the promise of transforming obstacles into opportunities, particularly catering to niche domains like Medium and Heavy Commercial Vehicles. A standout feature of fuel cell electric vehicles is their lightning-fast refuelling, a mere matter of minutes. Yet, as tradition would have it, the landscape of technological evolution is adorned with a series of challenges waiting to be conquered.

The forefront of innovation witnesses the endeavours of New Hydrogen, as it pioneers a revolutionary technology directed towards the economical production of green hydrogen, leveraging renewable energy sources. Hydrogen, renowned for its status as the universe’s premier clean and abundant fuel, boasts a peerless attribute—emission neutrality—emanating only water vapour upon utilization. Unfortunately, Earth withholds pure hydrogen, compelling its extraction from hydrogen-containing sources. This paradigm shift in hydrogen production aligns with New Hydrogen’s quest for sustainable solutions, propelling a promising avenue in energy advancement.

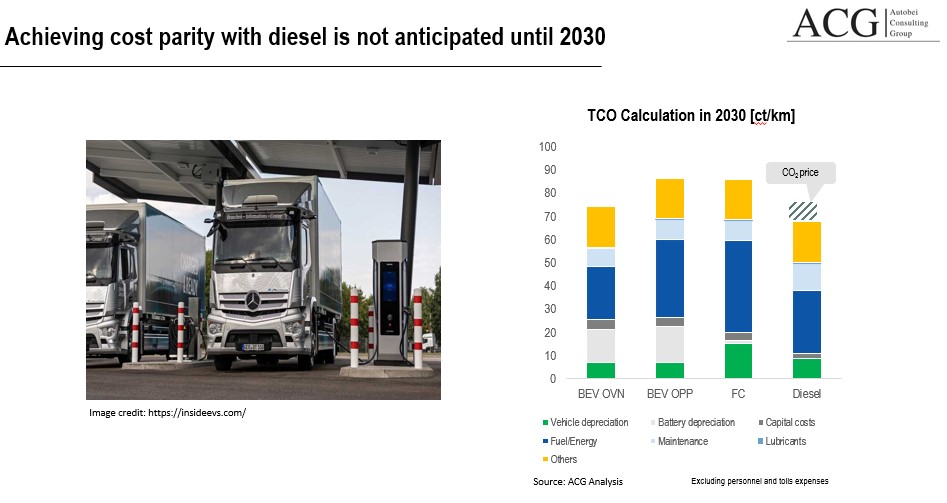

- Fuel consumption stands out as the primary driving factor for total cost of ownership (TCO)

- A fuel cell system with a substantial hydrogen cost results in the highest fuel expenses

- Battery Electric Vehicles (BEVs) incur higher initial costs primarily due to the expense of batteries, but this is counterbalanced by their lower ongoing fuel expenditures.

- BEV (OVN) best ZE solution TCO – for LDT and MDT segment but battery life cycle still an issue

For a long history, the technique of splitting water into its elemental building blocks, hydrogen and oxygen, has been a longstanding scientific understanding. This process, facilitated by an electrolyzer, has, however, remained confined by its substantial cost. NewHydrogen now emerges as a vanguard of change, poised to engineer a series of innovative components that will pave the way for the dawn of an affordable electrolyzer generation. The company’s central mission revolves around the reduction and replacement of expensive rare earth materials. This strategic alignment echoes the grander ambition of catalyzing the advent of the green hydrogen age—a transformative endeavour forecasted by Goldman Sachs to burgeon into a market worth an astounding $12 trillion. The ensuing exploration delves into New Hydrogen’s journey of reshaping the electrolyzer landscape, becoming an instrumental part of the unfolding energy sector narrative.

Technology Comparison:

For emerging product categories like fuel cells, the holistic assessment of both ownership and operational costs emerges as a pivotal determinant in their path to commercialization. This assessment is intricately interwoven with the levels of functionality and performance they deliver, collectively steering the course of their market acceptance.

When evaluating the total cost of ownership for power systems like fuel cells, it involves considering several integral components. These components encompass factors such as fuel expenditures, additional operational costs like maintenance, and the initial equipment investment. Notably, the initial equipment cost significantly influences the competitive standing of fuel cells in the market landscape.

This report directs its focus towards hydrogen electrification via proton-exchange membrane fuel cells (PEMFCs). These fuel cells are widely acknowledged to have reached a state of commercial readiness, especially within the realm of automotive applications. Vehicles such as logistics vehicles, buses, and taxi fleets have very minimum reliance on hydrogen infrastructure, which makes them more viable and can be put to use.

Take a glance at how the inner things operate :

Fuel cell technology encompasses a diverse array of types, yet at its core, it consists of three fundamental components: an anode, a cathode, and an electrolyte. This amalgamation facilitates the seamless movement of ions—often in the form of positively charged hydrogen ions (protons)—across the cell.

At the anode, a catalyst instigates oxidation reactions within the fuel, giving rise to ions (predominantly positively charged hydrogen ions) and electrons. These ions traverse the electrolyte, journeying from the anode to the cathode. Concurrently, electrons embark on an external circuit from anode to cathode, culminating in the production of direct current electricity.

The cathode, in turn, is home to a distinct catalyst that triggers a reaction involving ions, electrons, and oxygen. The outcome is the formation of water and, potentially, other secondary products.

While the generation of electricity is a primary output, fuel cells also produce valuable by products—water and heat. Depending on the fuel source, there might also be trace emissions, like minimal quantities of nitrogen dioxide.

Efficiency in fuel cells typically hovers between 40% and 60%, with a potential for remarkable upticks to around 85% if waste heat is harnessed through cogeneration mechanisms.

Shifting the spotlight onto hydrogen fuel cell vehicles, they utilize hydrogen fuel cells to power their electric motors. The process involves activating the fuel cell with hydrogen, leading to the generation of electricity. What distinguishes these cars is their potential to greatly reduce emissions in transportation, in sharp contrast to conventional diesel and gasoline vehicles that emit greenhouse gases while operating.

Prominent companies such as Bosch and Nikola are dedicating significant resources to drive the expansion and profitability of this technology. Concurrently, BMW is heavily involved in the development of hydrogen fuel cell automobiles. Japan is preparing for large-scale hydrogen vehicle production, while India is actively investigating hydrogen fuel cell technology, receiving substantial investments from Reliance and Adani. Successful trials have been conducted with vehicles like BharatBenz Buses and Ashok Leyland vehicles. The Ministry of Transport has undoubtedly taken notice of all these advancements in the field. These developments have propelled them into a phase where they are willingly spearheading efforts to thoroughly explore hydrogen fuel cell technology and implement essential measures to drive its progress in the days ahead.

Key Highlights of the Full the Report:

- The Potential market size of the battery Electric Truck and Hydrogen Fuel Cell

- Technology Roadmap of components suppliers like Battery, Motor, Inverter, Axle, Power Module, Semiconductor, and Technology Topology

- New Technology Development Analysis and Forecast

- Regions included: USA, Europe, China, and RoW

- Key OEMs in manufacturing of Electric vehicle and Fuel cell – Daimler, MAN, Iveco, DAF, Scania, Nikola, Paccar, Volvo, Volta, Tesla, Geely

- Technology requirement and challenges

- Charging and Hydrogen fuel pump Infrastructure requirement

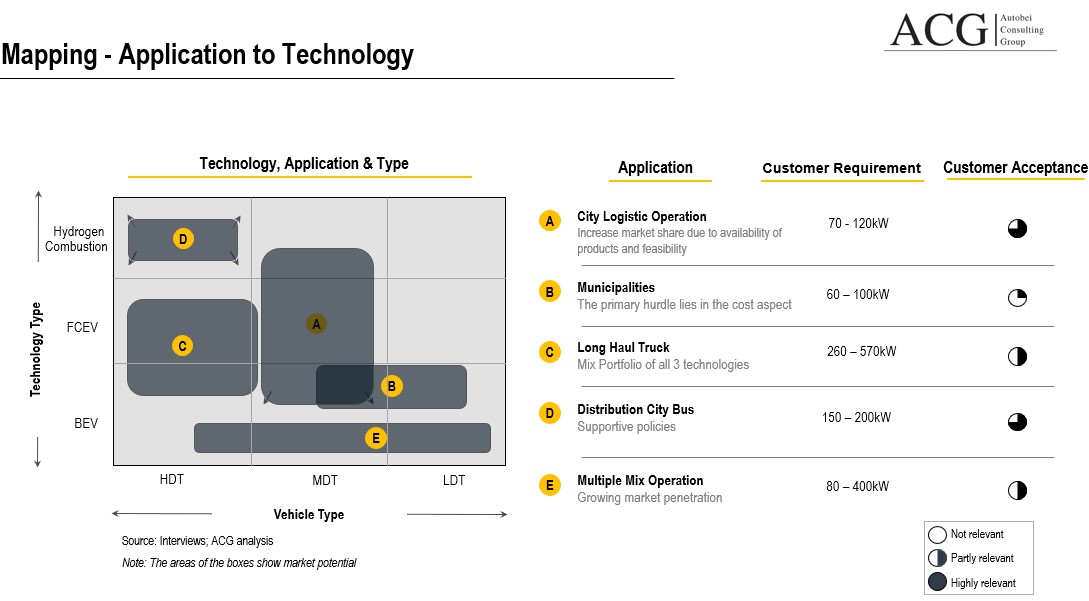

- Mapping the Technology feasibility to sub segment of heavy Commercial Vehicle like Light Duty Truck, Medium Duty Truck, Heavy Duty Truck, Tipper, Long Haul, Special Application, City Bus

- Technology to application of the Truck and Bus suitability

- Component Suppliers or stake holders Analysis

- Truck architecture and component functions Analysis

- Cost Analysis of the vehicle

- Comparison between establish and Startups OEMs in this segment