Indian Tractor Trailer Strategy Analysis and Forecast is our exclusive detail report. Indian Tractor Trailer market is flourishing in India. It has a registered impressive growth in last 3 years. This segment will gain quantum advantages of GST implementation and this is one of the biggest fiscal reforms since independence. It is the right time to enter into the Tractor business or launch new product/ Update existing product portfolio. The segment is divided into Low cost, Budget, and Premium segment.

(Subscription our Annual service package and get unlimited exclusive reports)

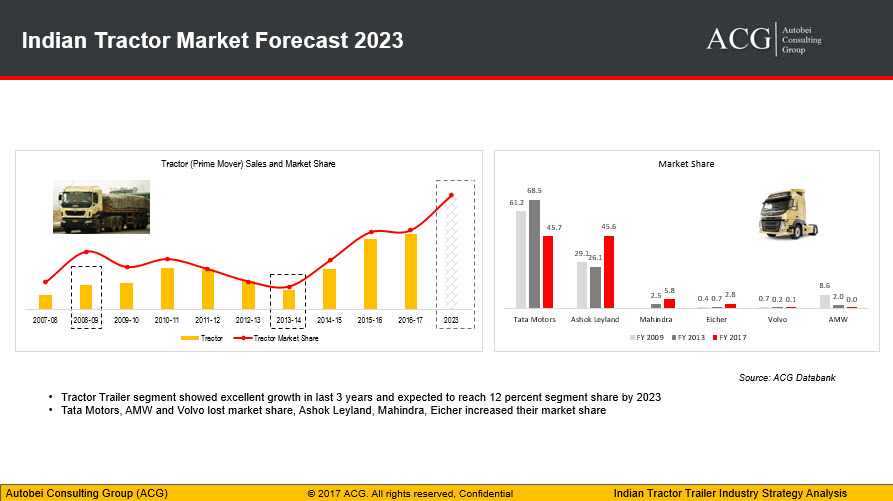

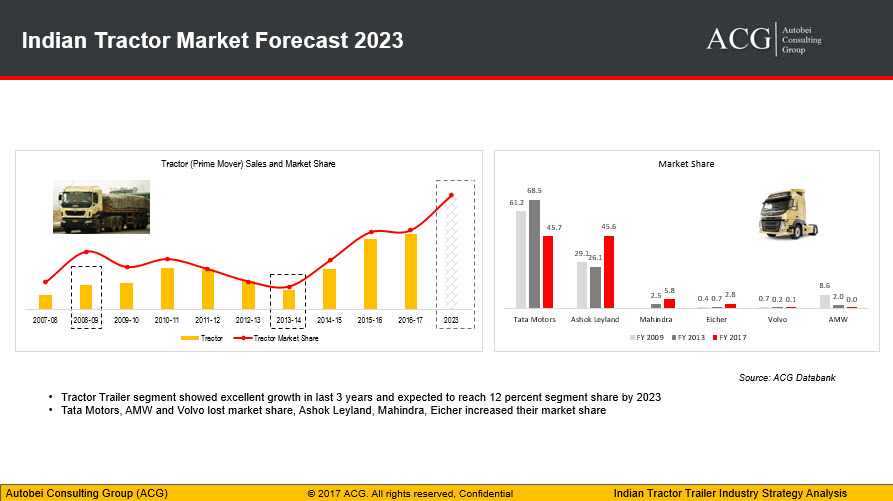

From 2013 to 2017, the CAGR of the segment was 27.9 percent and now, it is expected to 7.9 percent by 2023.

The market size has become more than double in last 10 years. The market size was around 25,000 units in FY 2008 and it is 53,000 units in FY 2017.

Tata Motors and Ashok Leyland are having an almost equal market share, however, Ashok Leyland gained 19.5 percent market share and on the other hand, Tata Motors lost 22.8 percent, Mahindra and Eicher gained 3.3 percent, Volvo and AMW lost 0.1 percent and 2 percent market share.

There is nothing called good or bad tractor, but it all depends on its application. The Tractor is suitable for many long-distance loads carrying, special application and heavy loads transportation. Some of the Applications are Agriculture, ODC, Space, Defence, Vehicle transportation, Gas, Machinery high-density material, coal, Construction Material, Machinery, Steel, Container, Bulker, ODC, Marbles, Tanker etc.

Every state is having different market dynamics, Market Size, Growth Driver, Opportunities, and Challenges. Our full report covered a very critical analysis of this segment.

It covers the long distance, after-sales, Driver comfort, Safety features, Cabin size, Mileage, payload, and Speed plays a vital role.

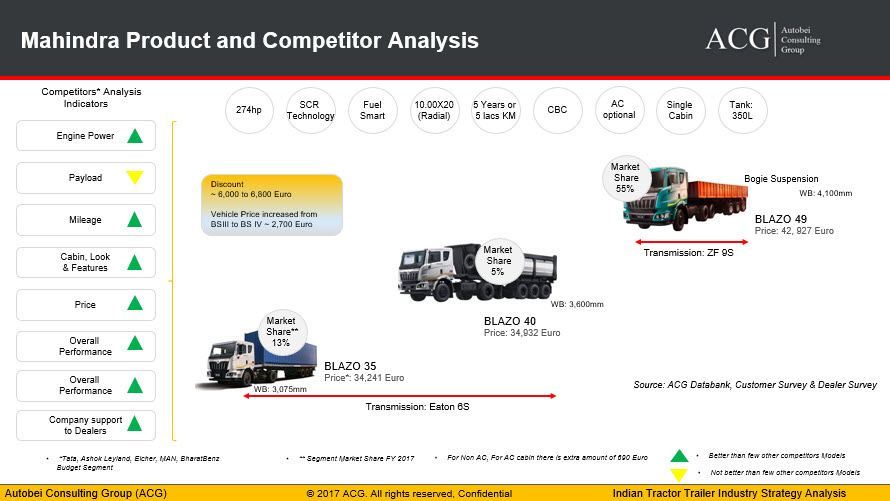

The market trend is moving from low cost to Budget segment, most of the products already moved but the premium segment is stagnant.

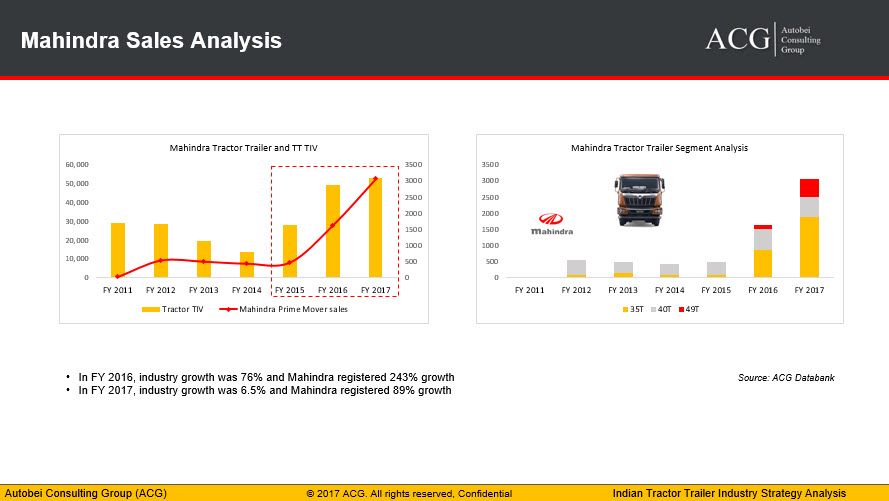

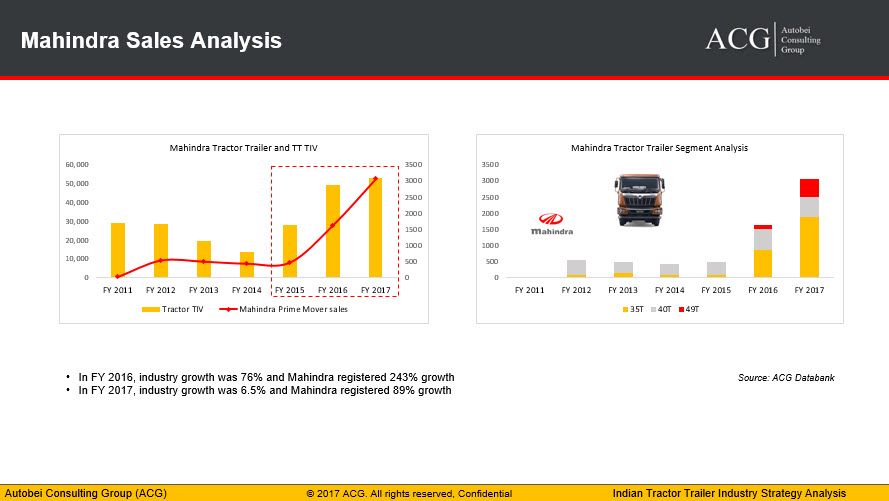

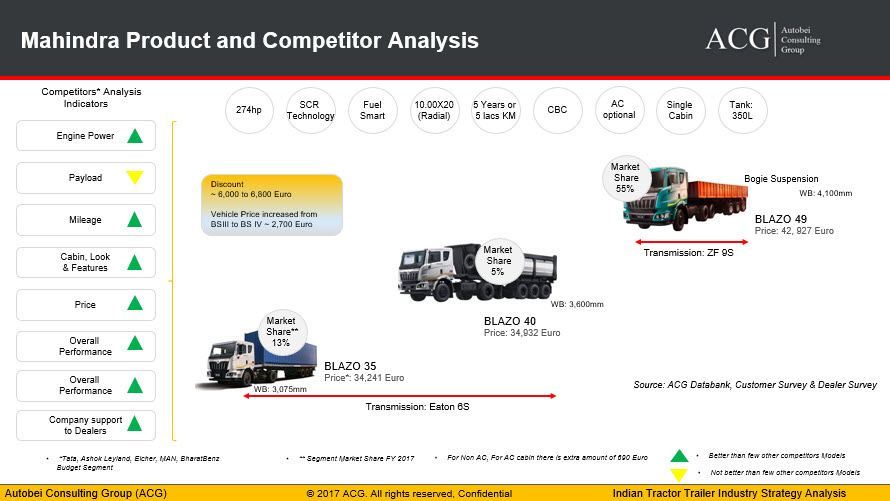

Mahindra Blazo performance is an excellent and its mileage challenge looks work to gain customers confidence. Mileage is one of the most important criteria for tractor vehicle. The Tractor sales increased from 500 units to 3,075 units in FY 2017.

Mahindra Product and Sales Analysis:

On our detail report, we have analyzed what are the reasons for this market share fluctuation.

We have analyzed in brief that the great impact of GST is overloading banned, improve road infrastructure, logistic sector growth, Elimination of the checkpoint, Lower turnaround time, Expected changes in Supply chain changes, E-way bills, Fleet Utilization etc.