Every Indian state is having different market dynamics like Market Size, Forecast, Vehicle Application, Brand position, Product position, Sales Outlook, Customer buying habits, Culture, Languages, Economy and vehicle requirements.

ACG State-wise Indian Commercial Vehicle Market Report is a detailed report which has been prepared with quantitative and qualitative data analysis.

Report Highlights:

- Indian Commercial Vehicle Overview and Macro Economy Analysis

- Commercial Vehicle Trend and Forecast – By Volume and By Value

- Truck and Bus Segment

- GVW-wise Sales Analysis

- Model-wise/ Brand wise Production and Sales

- State-wise Volume and Market Share

- State-wise GDP Analysis

- Price and Discount Analysis

- Key Drivers of the Industry

- Application and Industry Analysis

- Product Analysis

- OEMs Strategy Analysis

- Case Study: MAN, Scania, and Tata Prima Product

- Driveline Analysis

- New Technology Analysis and Forecast

Table of Contents:

- Indian Commercial Vehicle Market Overview

- Economy

- Market Size

- Segment and Sub-Segment Overview

- Major players

- Key Market Dynamics

- Executive Summary

- Key Findings

- Segment Overview

- Historical & Future Trend

- Industry Drivers

- Regulatory Factors

- Research Scope, Objectives, Background, and Methodology

- Research Scope

- Research Objectives & Aims

- Research Methodology

- Research Background

- Key Questions this Study Will Answer

- OEM/Stake holders Covered in this Study

- Product Segment Analysis: Goods & Passenger Vehicle

- Small/Mini Commercial Vehicle Segment Analysis

- By Units

- By Worth (USD)

- Segment growth analysis

- New Product launched analysis and its impact

- Segment Share analysis

- Segment Driveline analysis

- Price bracket

- Product Application wise analysis

- After sales & factor analysis

- After Sales Strategy and Challenges

- After Sales Commercial vehicle trend

- Used vehicle market analysis

- Trend Analysis

- Buyers category

- Segment Dynamics analysis

- Forecast

- Light Commercial Vehicle Segment Analysis

- By Units

- By Worth (USD)

- Segment growth analysis

- New Product launched analysis and its impact

- Segment Share analysis

- Segment Driveline analysis

- Price bracket

- Product Application wise analysis

- After sales & factor analysis

- After Sales Strategy and Challenges

- After Sales Commercial vehicle trend

- Used vehicle market analysis

- Trend Analysis

- Buyers category

- Segment Dynamics analysis

- Forecast

- Medium Commercial vehicle

- By Units

- By Worth (USD)

- Segment growth analysis

- New Product launched analysis and its impact

- Segment Share analysis

- Segment Driveline analysis

- Price bracket

- Product Application wise analysis

- After sales & factor analysis

- After Sales Strategy and Challenges

- After Sales Commercial vehicle trend

- Used vehicle market analysis

- Trend Analysis

- Buyers category

- Segment Dynamics analysis

- Forecast

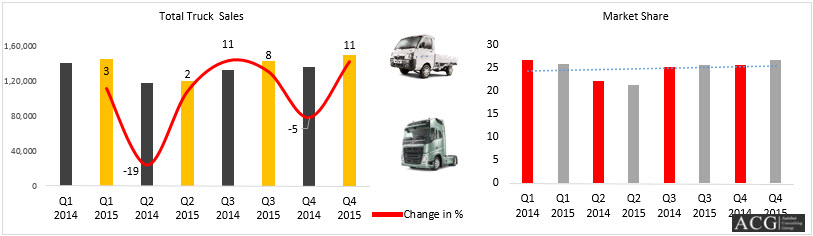

- Heavy Commercial Vehicle

- By Units

- By Worth (USD)

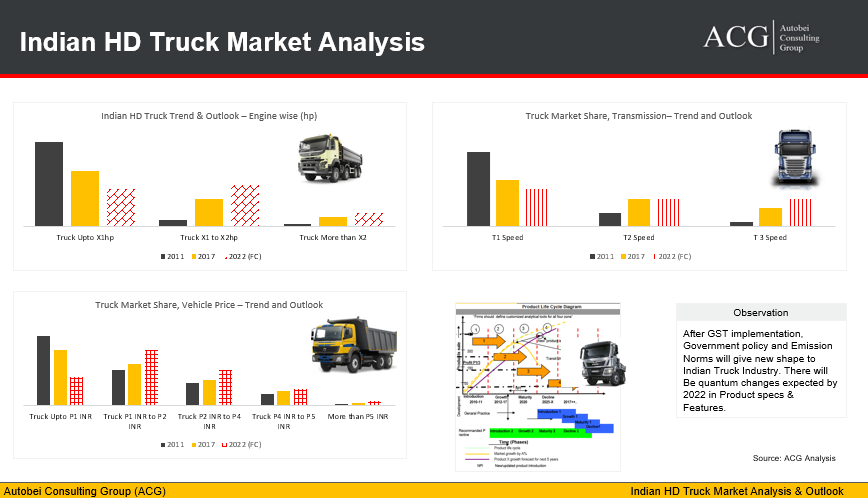

- Segment growth analysis

- New Product launched analysis and its impact

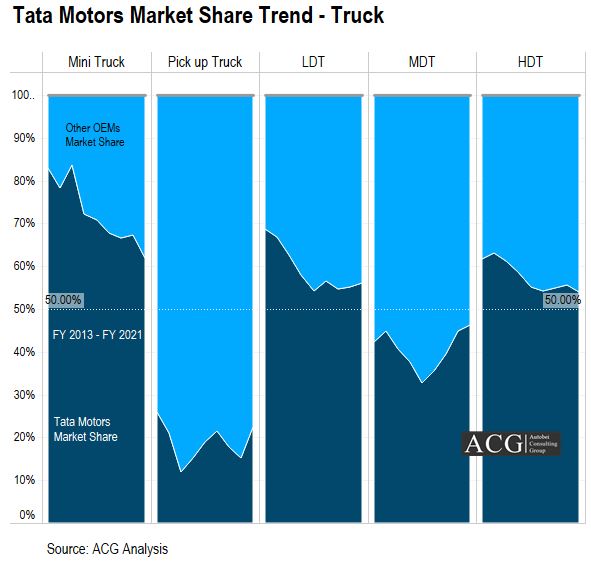

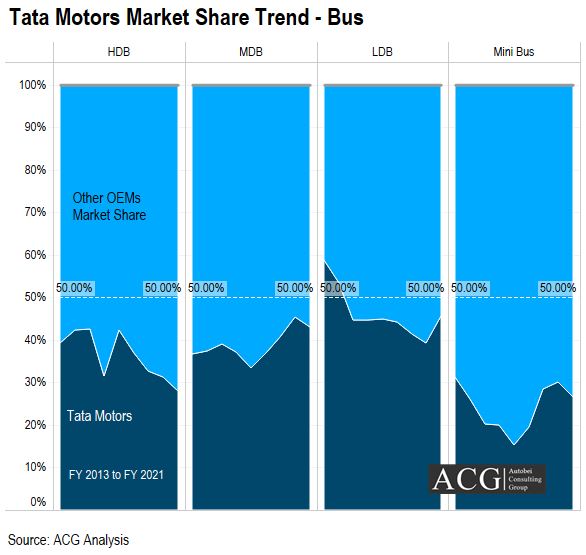

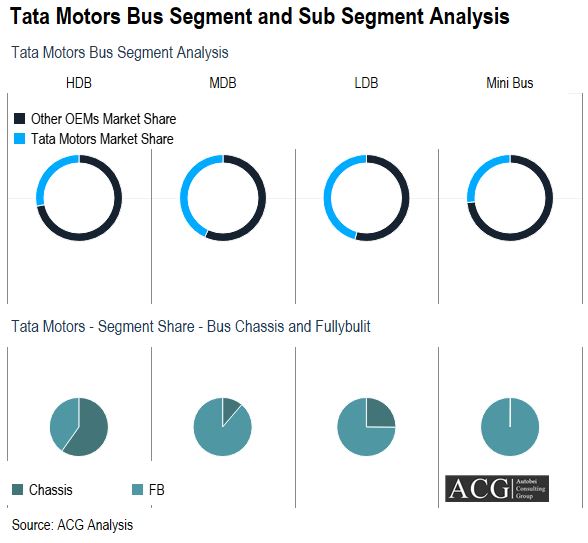

- Segment Share analysis

- Segment Driveline analysis

- Price bracket

- Product Application wise analysis

- After sales & factor analysis

- After Sales Strategy and Challenges

- After Sales Commercial vehicle trend

- Used vehicle market analysis

- Trend Analysis

- Buyers category

- Segment Dynamics analysis

- Forecast

- Commercial Vehicle Product Analysis

- Product segment wise market size

- Application wise Analysis

- Product Price Analysis

- Product Type wise

- Category wise analysis

- Engine Specs analysis

- Transmission specs analysis

- Fully built option

- Chassis option

- Cabin & Chassis option

- CV Product Gap analysis

- Product USP analysis

- Product Life Cycle – major Models

- Market dynamics

- Mapping of Commercial vehicle application and model

- Small/Mini Commercial Vehicle Segment Analysis

- Commercial Vehicle Vehicle Type:

- Tipper

- Product portfolio

- Key Models

- Technical Analysis

- Price range

- Application

- Sales and Market share analysis

- Competitive Analysis

- After Sales Analysis

- Customer profile

- Buyers pattern

- Rigid Haulage

- Product portfolio

- Key Models

- Technical Analysis

- Price range

- Application

- Sales and Market share analysis

- Competitive Analysis

- After Sales Analysis

- Customer profile

- Buyers pattern

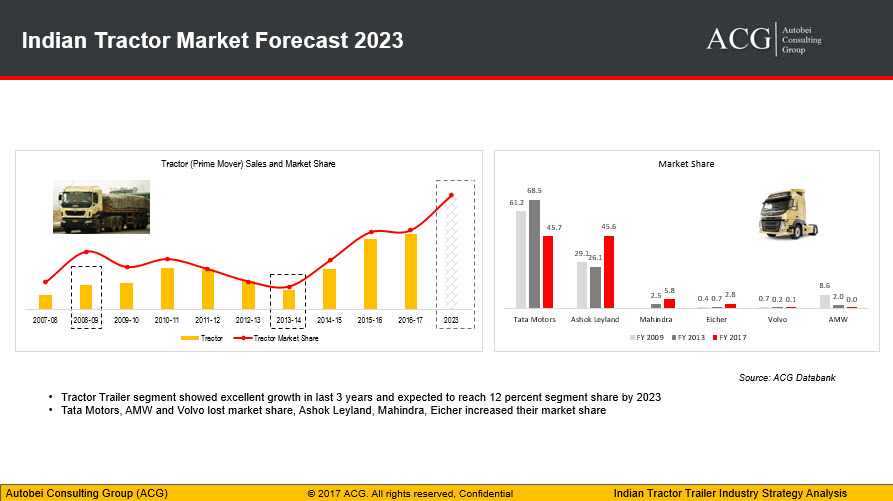

- Tractor – Long Haulage

- Product portfolio

- Key Models

- Technical Analysis

- Price range

- Application

- Sales and Market share analysis

- Competitive Analysis

- After Sales Analysis

- Customer profile

- Buyers pattern

- Special or Customized Application

- Product portfolio

- Key Models

- Technical Analysis

- Price range

- Application

- Sales and Market share analysis

- Competitive Analysis

- After Sales Analysis

- Customer profile

- Buyers pattern

- Tipper

- Customer Behaviour analysis

- Psychology trend

- Behavior parameter outlook

- Product Trend Analysis

- Customer Segment analysis

- Commercial Vehicle buying factors

- Customer Loyalty

- CV Product Segment Analysis:

- Low Budget Segment

- Description of segment

- Price range

- Key Models analysis

- Application & product analysis

- Customer segment and key buying motivates

- Segment Trend – Historical and Future

- Segment dynamics analysis

- Medium Budget

- Description of segment

- Price range

- Key Models analysis

- Application & product analysis

- Customer segment and key buying motivates

- Segment Trend – Historical and Future

- Segment dynamics analysis

- High Budget

- Description of segment

- Price range

- Key Models analysis

- Application & product analysis

- Customer segment and key buying motivates

- Segment Trend – Historical and Future

- Segment dynamics analysis

- Premium

- Description of segment

- Price range

- Key Models analysis

- Application & product analysis

- Customer segment and key buying motivates

- Segment Trend – Historical and Future

- Segment dynamics analysis

- Low Budget Segment

- Zone wise Commercial Vehicle Market Analysis

- North Zone

- Market size

- Market Trend

- Market forecast

- Market dynamics

- Market share

- OEMs wise analysis

- Major Application

- Demand Analysis

- Market Drivers

- The Major States for Commercial Vehicle sales

- Zone wise Customer behavior

- North Zone

-

- South Zone

- Market size

- Market Trend

- Market forecast

- Market dynamics

- Market share

- OEMs wise analysis

- Major Application

- Demand Analysis

- Market Drivers

- The Major States for Commercial Vehicle sales

- Zone wise Customer behavior

- South Zone

-

- West Zone

- Market size

- Market Trend

- Market forecast

- Market dynamics

- Market share

- OEMs wise analysis

- Major Application

- Demand Analysis

- Market Drivers

- The Major States for Commercial Vehicle sales

- Zone wise Customer behavior

- West Zone

-

- East Zone

- Market size

- Market Trend

- Market forecast

- Market dynamics

- Market share

- OEMs wise analysis

- Major Application

- Demand Analysis

- Market Drivers

- The Major States for Commercial Vehicle sales

- Zone wise Customer behavior

- East Zone

- State wise Analysis

- Karnataka

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Karnataka

-

- Andhra Pradesh

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Andhra Pradesh

-

- Tamilnadu

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Tamilnadu

-

- Kerela

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Kerela

-

- Jharkhand

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Jharkhand

-

- Madhya Pradesh

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Madhya Pradesh

-

- Uttar Pradesh

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Uttar Pradesh

-

- Himachal Pradesh

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Himachal Pradesh

-

- Delhi/NCR

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Delhi/NCR

-

- Chhattisgarh

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Chhattisgarh

-

- Rajasthan

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Rajasthan

-

- Uttaranchal Pradesh

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Uttaranchal Pradesh

-

- Jammu & Kashmir

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Jammu & Kashmir

-

- Gujarat

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Gujarat

-

- Maharashtra

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Maharashtra

-

- Orissa

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Orissa

-

- Bihar

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- Bihar

-

- West Bengal

- Market size

- Market Forecast

- Market Dynamics

- State Macro Economy

- Market Trend

- Commercial Vehicle Application analysis

- OEMs wise plotting against market dynamics

- Sales Strategy

- Top Players

- Upcoming New Projects

- Product and Segment category demand analysis

- Network Analysis

- State GDP

- Key Industries

- West Bengal

- Pricing Trend Analysis: MRP & Discount Trend

- Small Commercial Vehicle

- Light Duty Commercial Vehicle

- Medium Duty Commercial Vehicle

- Heavy Duty Commercial Vehicle

- Competitive price position of Tata, Ashok Leyland, BharatBenz, AMW, MAN, Piaggio, Force Motors, Mahindra, Volvo, Scania, SML Isuzu, Isuzu, Eicher

- Business Environment

- Major challenges

- Opportunities

- Global Impact

- Business Sentiments

- Political & Economy

- FDI and Exchange rate

- Major Export Market

- OEM Analysis

- Key Export markets

- Application Industry Analysis

- Construction

- Road

- Real Estate Development

- Port

- Mining

- Logistics

- E Commerce Industry and its impact on Commercial Vehicle Industry

- Cement Industry

- ODC

- Light & heavy Machinery

- Manufacturing Industry

- Local Transport

- Used Commercial Vehicle Analysis

- Market size

- Commercial and Technical challenges

- Buying pattern

- Trend Analysis

- Business practice

- Advantages

- Disadvantages

- Finance challenges

- Advertising

- Commercial Vehicle Industry traditional way

- Most effective ad strategy

- Competitor Ad strategy

- Electronic

- TV Commercial

- Digital

- Company Analysis

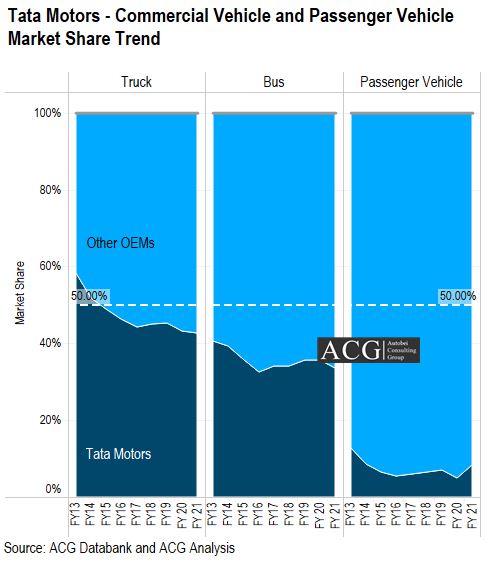

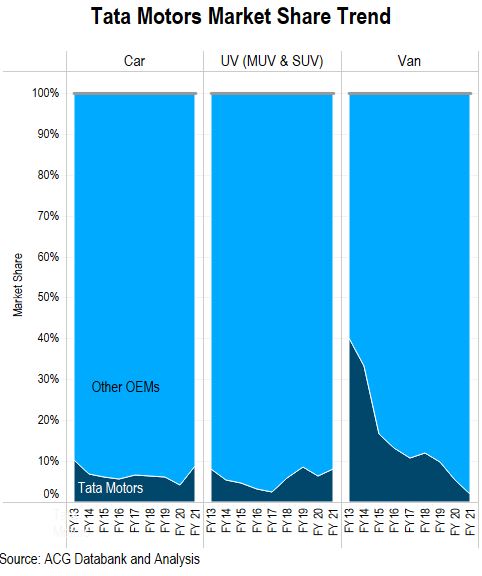

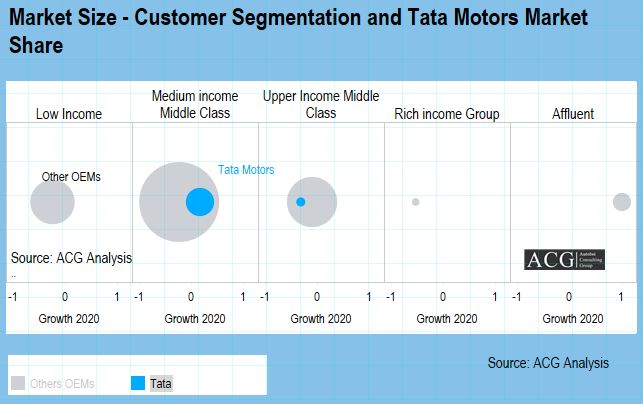

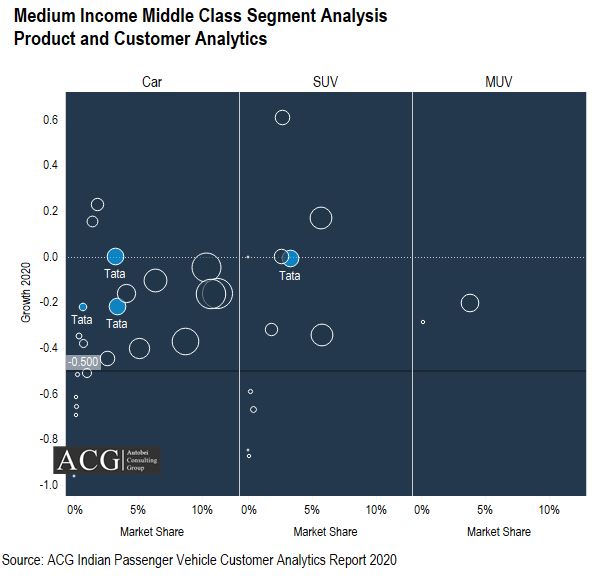

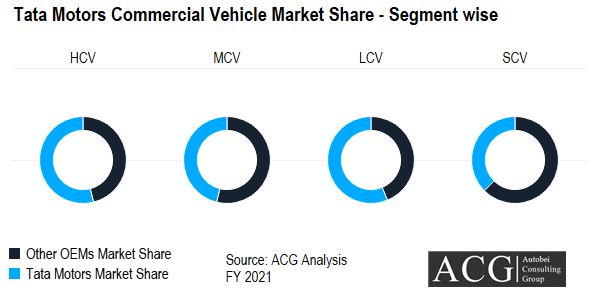

- Tata Motors

- Latest Developments

- Product portfolio

- Product age

- Product life cycle

- Application analysis

- Strategy

- Segment Analysis

- Customer profile

- Brand perception

- USP

- Key persons

- Tata Motors

-

- Ashok Leyland

- Latest Developments

- Product portfolio

- Product age

- Product life cycle

- Application analysis

- Strategy

- Segment Analysis

- Customer profile

- Brand perception

- USP

- Key persons

- Ashok Leyland

-

- Eicher Motor

- Latest Developments

- Product portfolio

- Product age

- Product life cycle

- Application analysis

- Strategy

- Segment Analysis

- Customer profile

- Brand perception

- USP

- Key persons

- Eicher Motor

-

- Volvo

- Latest Developments

- Product portfolio

- Product age

- Product life cycle

- Application analysis

- Strategy

- Segment Analysis

- Customer profile

- Brand perception

- USP

- Key persons

- Volvo

-

- Scania

- Latest Developments

- Product portfolio

- Product age

- Product life cycle

- Application analysis

- Strategy

- Segment Analysis

- Customer profile

- Brand perception

- USP

- Key persons

- Scania

-

- Force Motors

- Latest Developments

- Product portfolio

- Product age

- Product life cycle

- Application analysis

- Strategy

- Segment Analysis

- Customer profile

- Brand perception

- USP

- Key persons

- Force Motors

-

- Piaggio

- Latest Developments

- Product portfolio

- Product age

- Product life cycle

- Application analysis

- Strategy

- Segment Analysis

- Customer profile

- Brand perception

- USP

- Key persons

- Piaggio

-

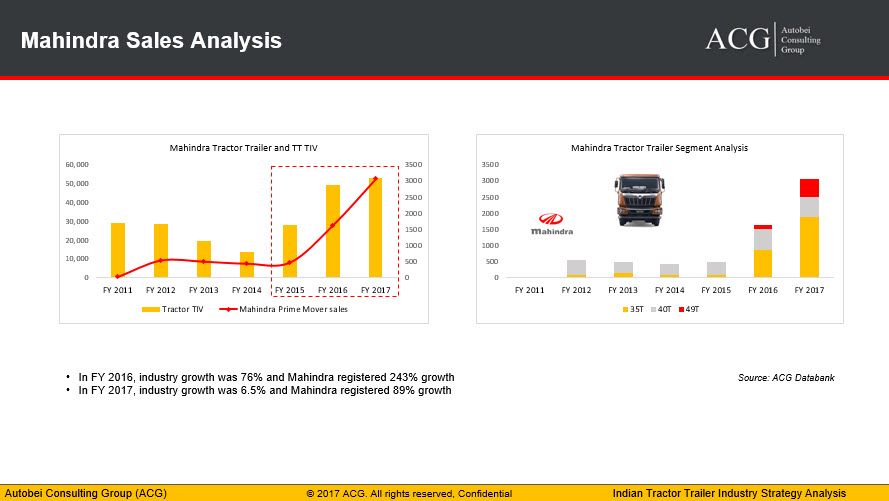

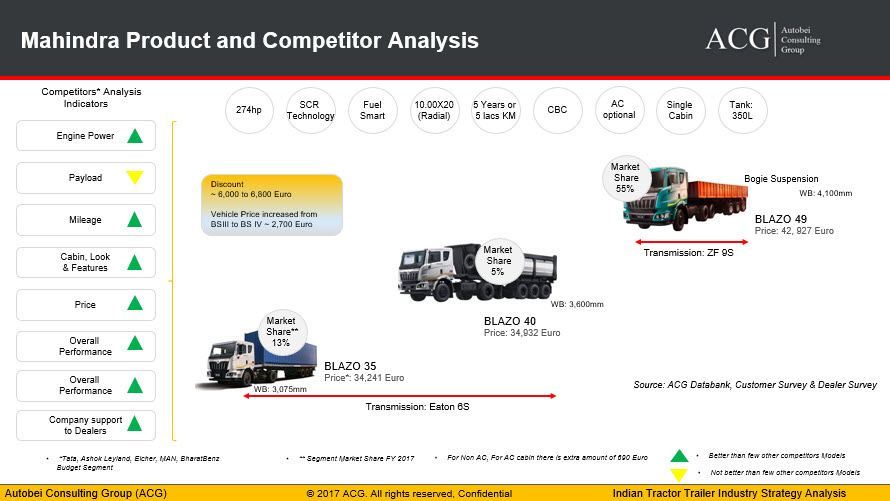

- Mahindra

- Latest Developments

- Product portfolio

- Product age

- Product life cycle

- Application analysis

- Strategy

- Segment Analysis

- Customer profile

- Brand perception

- USP

- Key persons

- Mahindra

-

- Daimler India Commercial Vehicle (DICV)

- Latest Developments

- Product portfolio

- Product age

- Product life cycle

- Application analysis

- Strategy

- Segment Analysis

- Customer profile

- Brand perception

- USP

- Key persons

- Daimler India Commercial Vehicle (DICV)

-

- Isuzu Motors

- Latest Developments

- Product portfolio

- Product age

- Product life cycle

- Application analysis

- Strategy

- Segment Analysis

- Customer profile

- Brand perception

- USP

- Key persons

- SML Isuzu

- Latest Developments

- Product portfolio

- Product age

- Product life cycle

- Application analysis

- Strategy

- Segment Analysis

- Customer profile

- Brand perception

- USP

- Key persons

- Isuzu Motors

The can be customize as per the requirement. Every time, updated version of the report is available along with Excel and Power Point version.