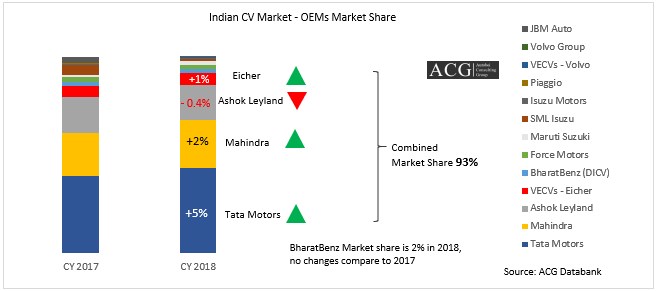

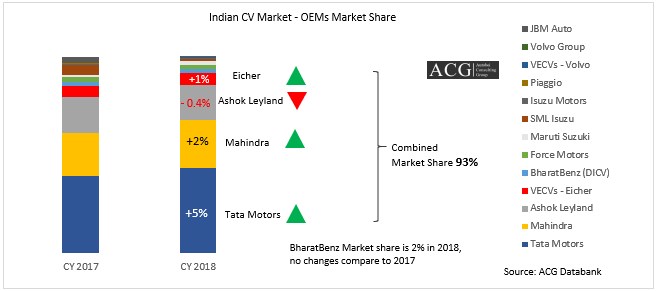

Indian Commercial Vehicle registered 27 percent growth in CY 2018 compared to CY 2017. Market sentiments indicate that Industry maintains at least double-digit growth in the next 2 years.

Tata Motors, Mahindra, and Eicher gained market share in CY 2018 but Ashok Leyland lost market share in most of the segments of CV.

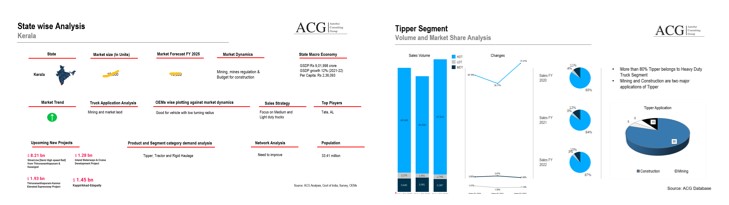

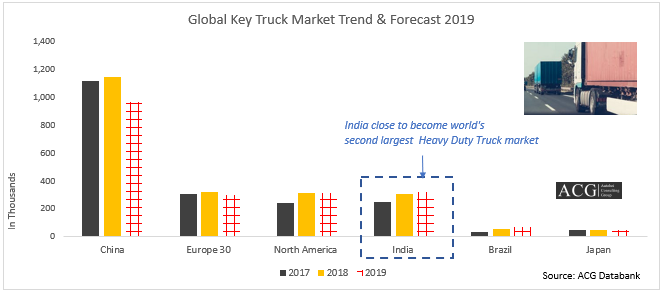

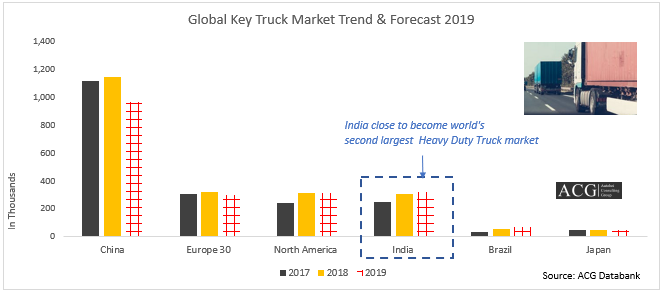

The heavy-duty truck market of India is rapidly developing on a regular basis. This can be very well proved from the robust growth of the Mini/Pick up and heavy-duty trucks market in India in recent times and further growth is expected in the time to come. It is expected that the market will keep up the positive momentum. In India, the truck market touched a high level in 2018, but demand weakened due to the crash crunch to vehicle finance.

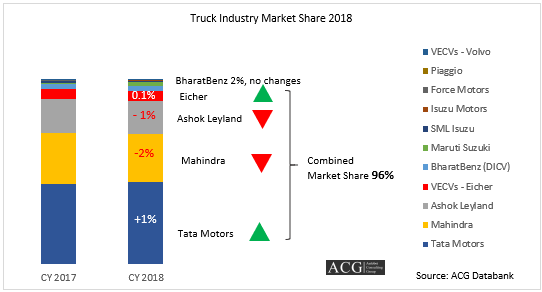

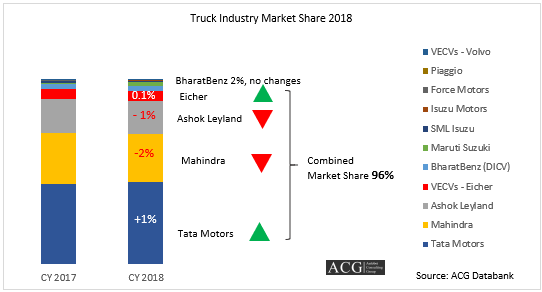

As shown in Graph, Tata Motors gained a 1 percent market share, Mahindra lost 2 percent market share, Ashok Leyland also lost 1 percent market share, and Eicher market share is almost stagnant.

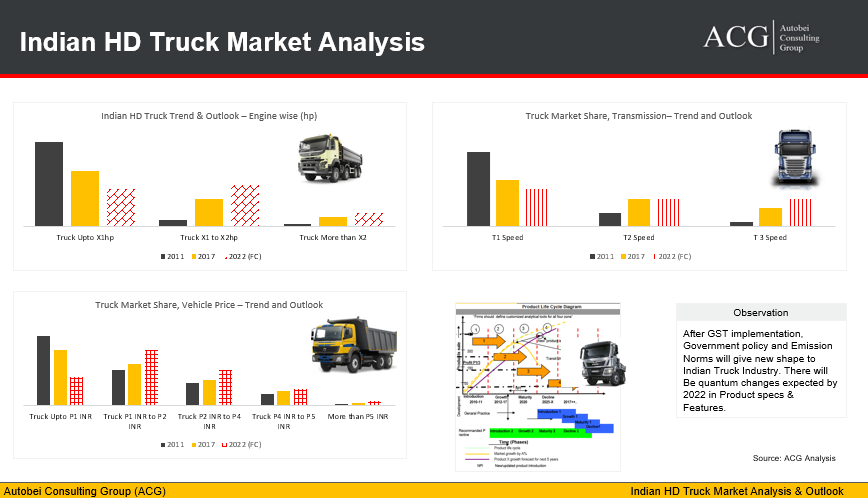

A noticeable price increase of 7 to 10 percent at the time of migration from BS III to BS-IV. On the other hand, at the time of changing BS IV to BS VI will have a minimum 10 to 15% price increase which will necessarily have a significant impact on the sales growth and OEMs margin.

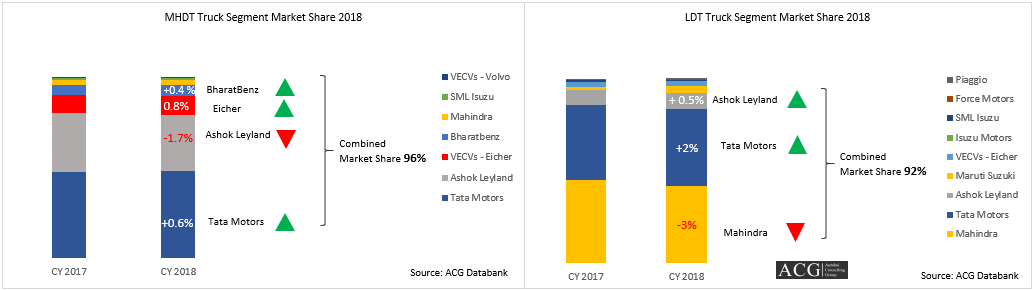

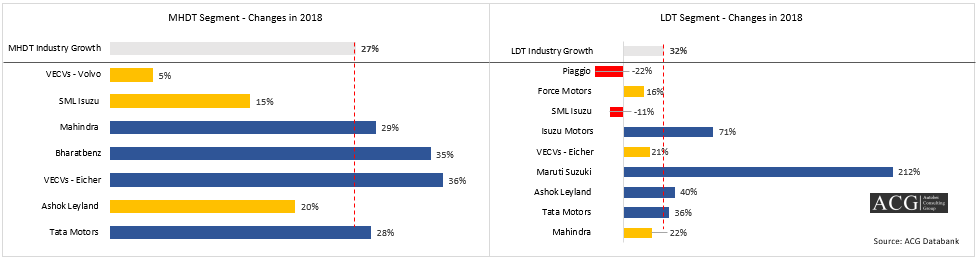

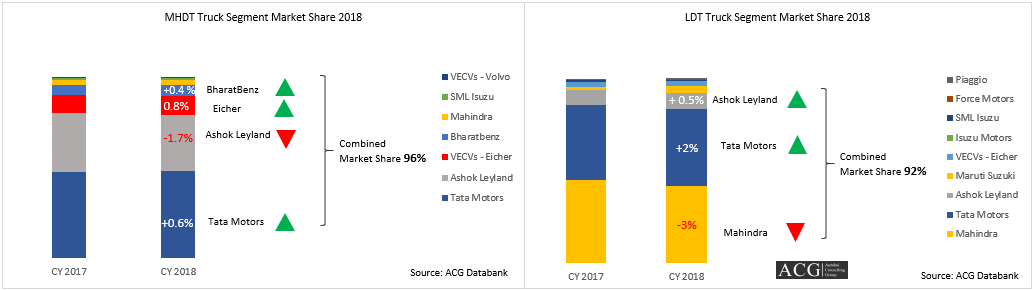

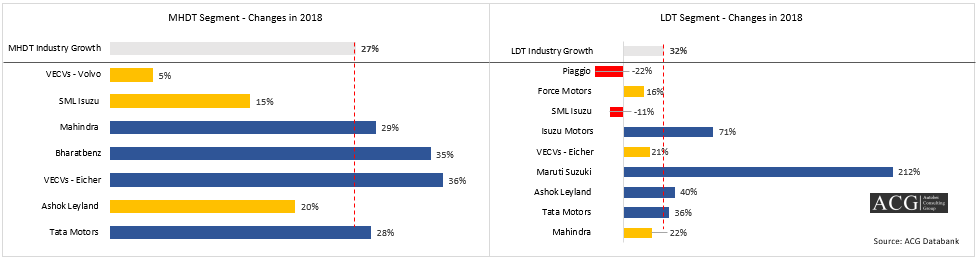

MHDT and LDT Truck Segment: LDT segment registered 32 percent and MHDT segment registered 30 percent growth in 2018 compared to CY 2017. BharatBenz registered second the highest growth of 35% after VECV.

In both MHDT and LDT, Tata Motors regain its market share. In LDT segment Mahindra lost 3 percent market share even after doing aggressive promotion. We will discuss later on how Tata Motors regain market share in every segment.

In the MHDT segment, all OEMs registered double-digit growth except Volvo (It is also not relevant to compare due to its premium segment presence). In LDT segment, Piaggio and SML Isuzu registered de-growth in 2018.

One issue that pops up at the present time is axle load norms but it does not impact light & medium-duty truck and premium truck category. The impact is on higher tonnage trucks such as 37T and tractor-trailer. Now, the vehicle would be able to carry an extra load of up to 25% which is of great benefit to the customers. Most importantly, it plays a vital role in the help in the modernization process of the industry. Two axle truck which is currently 16.2T GVW is raised to 18.5T GVW. The popular category of 25T is increased to 28.5T GVW, and the 5 axle truck of 37T is increased to 43.5T GVW. The tractor-trailer GVW is increased by up to 36% GVW. OEMs necessarily need to make a lot of changes in the overall truck architecture such as tires, brakes, steering systems, etc. accompanied by an increase in the cost as well. As the overloading comes down significantly, this new norm will certainly have a positive impact on Industry.

A discussion with the transporters made it even clearer that the impact of such norms is limited to only 30 to 40 percent volume at the time of carrying goods that have a high density such as copper, marble, cement, copper coil, sand, etc. About 60 to 70 percent of the volume will be not be impacted as a result of the low density of carrying material. Thus, it would be a good step if the norms are implemented at the time of the introduction of BS-VI since all the required changes in the architecture of the vehicle will be done at one time.

As a result of improvement in infrastructure, mining, the growth of GDP, and pre-buying of implementation of BS-VI, the industry is all set to see a growth of about 30 percent in the year 2019. The infrastructural activities will enable the tipper to have double-digit growth in the year 2019 from the previous 6 percent in the year 2018.

The heavy-duty truck market of India shows constant signs of healthy growth, particularly among the medium and the larger fleets which are on the verge of expansion. Throughout the market segments, it has been observed that about one in every four fleet managers and owners were planning to upgrade to value trucks thereby resulting in the creation of a significant upmarket sales potential.

Overall, this movement will certainly have a positive impact on the sales of trucks. The greater is the load-carrying capacity, more will be the generation of revenue and transporters will go for reinvestment in buying new trucks.

A scrape policy is all set to be introduced for commercial vehicles that are more than 20 years old. This is will have a maximum impact on the heavy-duty trucks. About 80,000 new vehicles are expected to replace the old vehicles. Now, if we combine the impact of BS-VI norms (Downturn impact) and the scrape policy, the result will certainly be positive for the volume.

The two giants in this field Tata Motors and Ashok Leyland will have the maximum impact on the norms and VECV Eicher will have a minimum impact of these norms due to its insignificant presence in this segment.

Almost all Indian fleet owners want to buy reliable vehicles in the future. Mining, construction truck and, the logistics companies who work in the long-distance transport segment will be the drivers of growth in the time to come.

The transportation industry of India is on the verge of taking a new shape. There are several logistic parks which are built near the major towns and cities. This new transportation design will result in the boosting up of the small and heavy-duty truck volume.

Tata Motors was struggling for appropriate gains in the market share and margin improvements on their home turf in the Indian markets. MAN decided to shut down its operation in India and another major player AMW also stopped its operation in India. Several other players are facing a similar issue and hence the opportunity is quite open to Tata, Ashok Leyland, Eicher, and BharatBenz.

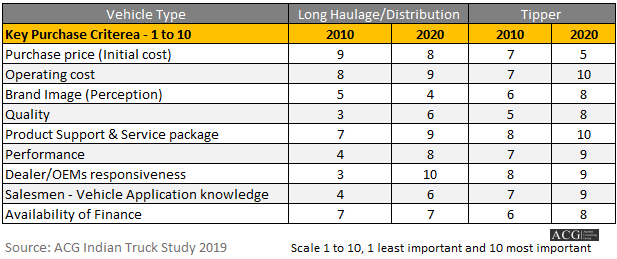

Indian truck manufacturers can excel in their home markets and create a competitive advantage by focusing on the needs of the customers in the domestic market. ACG has interviewed more than 3,000 customers over a period of 30 years to get a detailed idea about factors that the customers find most important at the time of deciding on which truck supplier to use. This report, which focuses on the opportunity in India, reports on our third and most recent survey of 550 buyers of Mini, Pick up, LDT, MDT, and HDT trucks in six key states of India.

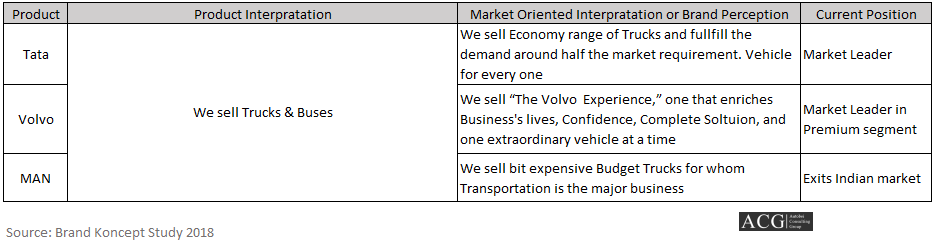

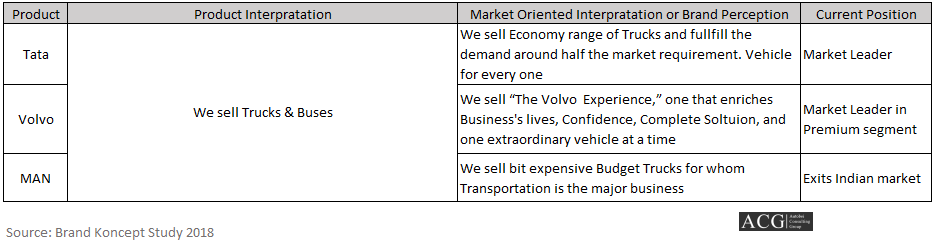

Product and Brand Perception:

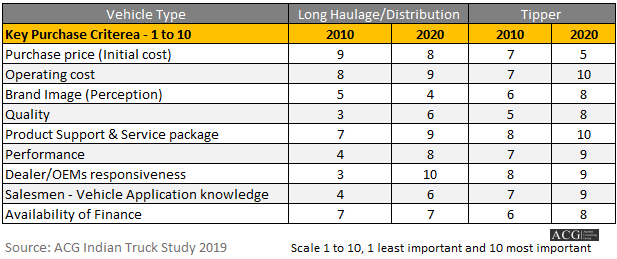

Key Purchase Criteria Trend:

After leaving MAN and rumors about Scania give strong reasons to buy in the Indian makes. Among our findings, we have learned that the buyers are increasingly making purchasing decisions as per the best value they get for their money, which necessarily includes the purchase price, operating costs, maintenance cost, and the performance of the truck. Very few buyers are of the viewpoint that the brand image plays a role in purchasing decisions, but they necessarily value good relationships with the dealers, service points as well as the manufacturers. The brand image and experience play an important role in mining and ODC application.

Tata Motors is an extremely good example in this regard. After losing significant market shares in several segments of CV, the company started increasing its engagement with the customers, dealers and other stakeholders. The company also made its product portfolio rich in order to gain market shares and focused on repeat purchases as well as referral sales. The reduction of cost to keep the margin high and launching new products also helped a great deal for regaining the market share. Tata Motors launched about 70 new products in the financial year 2018.

Brand differentiation Strategy:

At this point in time, it is getting much harder to differentiate trucks of the same segment. Several different brands have reached a minimum level of performance, beyond which it is difficult to get paid for superior performance. But now the meaning of “truck performance” is shifting a lot from the driveline (engine and gearbox) performance to several other factors such as fuel efficiency, cost, dealer relationships and quality of service. OEMs need to shift from Product to service provider concept. We certainly believe that these factors will necessarily become the main differentiators for truck manufacturers in the years to come.

OEMs can make differentiation with the help of the strategies mentioned below:

- Availability of service and parts network

- New product launches keep the primary focus on the customers

- Development of end to end customer support system

- Uptime guaranty

- Extended Warranty