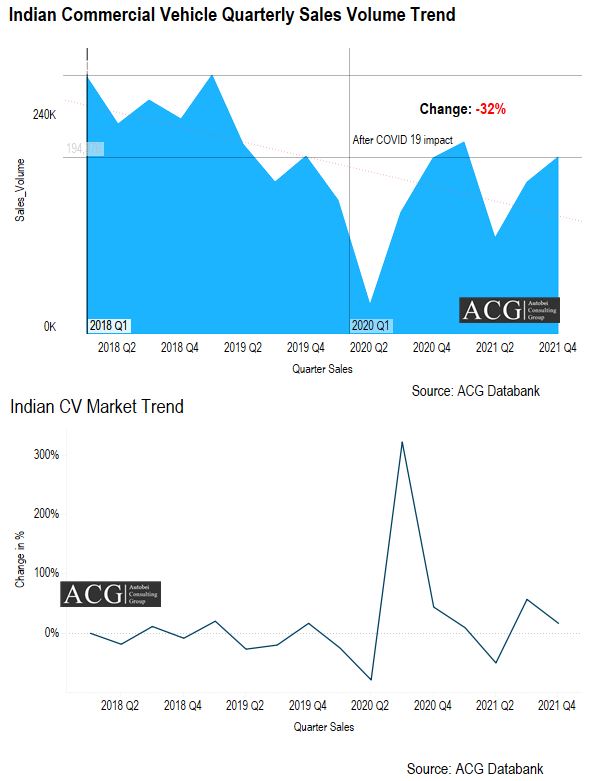

ACG released Indian Commercial Vehicle Market Report 2022 and Outlook. The Indian Commercial Vehicle sales done in 2021 are 0.67 million units compared to slightly more than half a million in CY 2020.

The year 2020 was completely hit by the pandemic. Indian CV had hit the rock bottom owing to the COVID-19. Surprisingly, the year that followed 2020, witnessed an overall boom in regards to the sales figure of Indian Commercial Vehicle. ACG already predicted a good market growth in the year 2021 for the Commercial vehicles.

Indian Commercial vehicles showed 34 percent growth in CY 2021 compared to CY 2020.

Post Q2 2020, the Commercial Vehicle segment in India received a warm welcome from its buyers, and this shoot up the cumulative unit sales of Commercial vehicles comprising of the Small, Light, Medium, and Heavy-duty segment. Notably, the heavy commercial vehicle segment has topped the list in terms of growth achieved compared to the Ill-fated year of 2020.

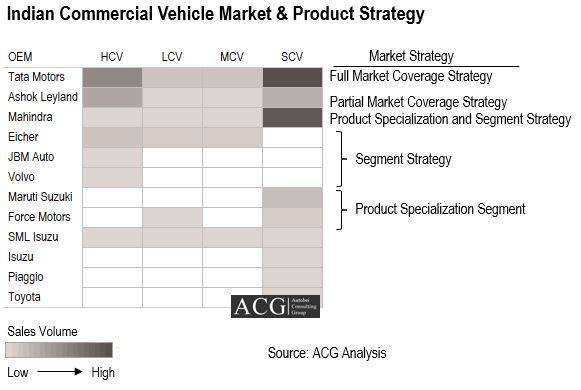

OEMs wise Commercial Vehicle Product Portfolio and Planning:

There are mainly 3 kinds of Product Strategies that OEM follows: Full Market strategy, Segment level Strategy, and Application based specialized Product Strategy.

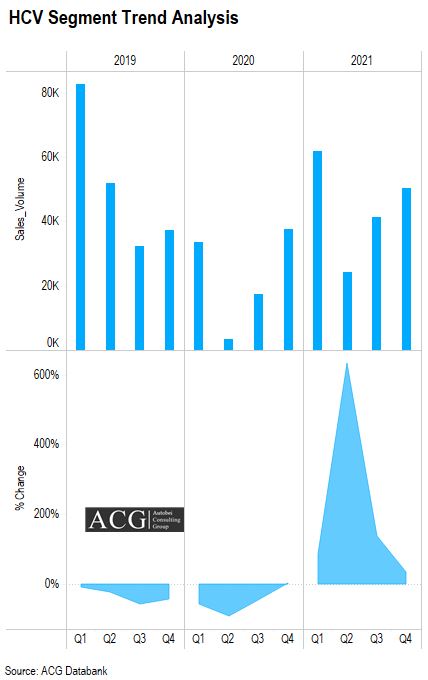

Heavy Commercial Vehicle Segment (HCV):

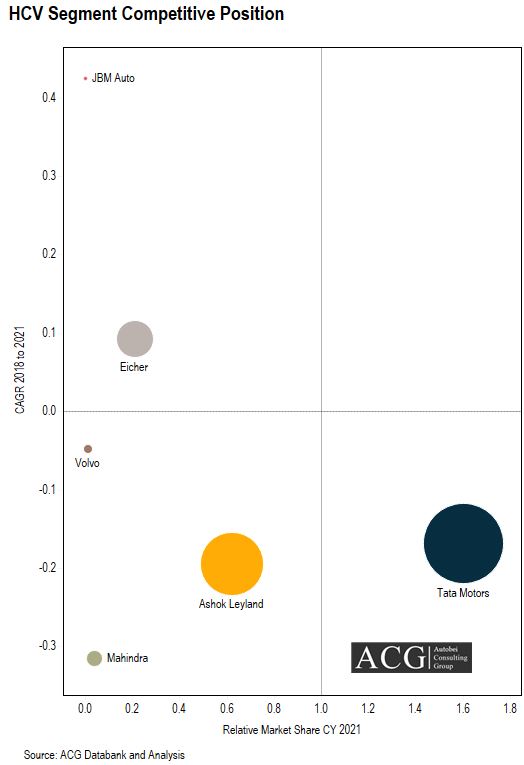

Indian Heavy Commercial Vehicle segment registered 92 percent growth in CY 2021 compared to CY 2020. Diving deep into the statistical analysis of HCV reveals that Tata Motors with 52% presence has established its unanimous hold in this segment and the pandemic seems to have not bothered it.

Eicher is the fastest-growing OEM in HCV Segment. It registered 41% CAGR between 2019 to 2021.

While its close counterpart Ashok Leyland has diminished its market share by about 6% during the last 2 years.

Over the years the competition to hold a key position in OEMs is getting intense. And astonishingly Eicher had its last laugh in this domain by evolving as a leading player. Also, it strengthened its presence by adding up 6% more in the last 2 years to its present value in the year 2021. Contrary to this, the other competitors in the market such as Volvo had to lose their share by a marginal value approximating at about 0.5%. Though the value seems to be negligible, it did hit hard for those companies. Shortage of kits due to Covid 19 is also one of the reason to loose market share. Recently, the demand has increased for Tipper models in coal mining application.

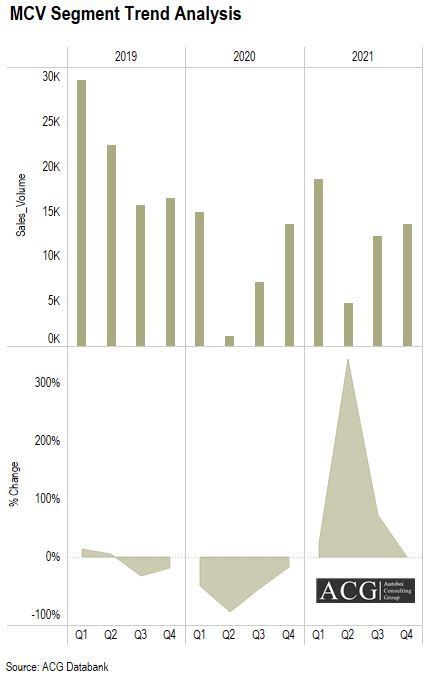

Medium Commercial Vehicle Segment (MCV):

Indian Medium Commercial Vehicle segment registered 35 percent in CY 2021 compared to CY 2020. However, for the Manufacturing commercial vehicles growth was not only good but turned out to be excellent. There was a sharp rise in the demand and within no time a sprawling growth of about 34% was seen in the year 2021.

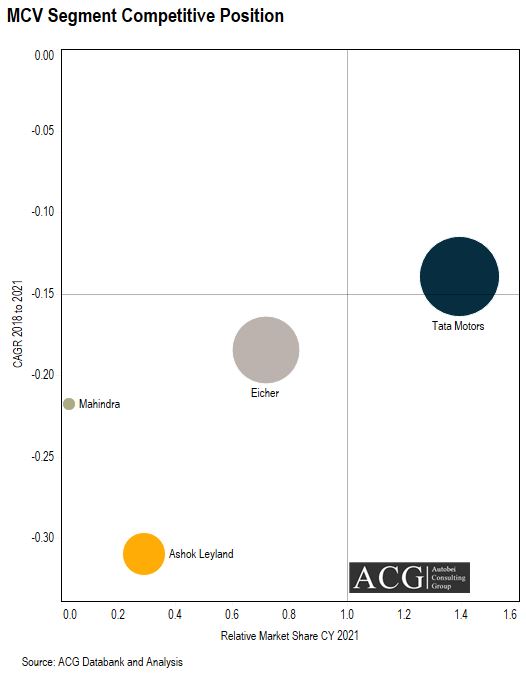

Tata’s dominance seemed to have absolutely no stopping at all, as they did turn out their magic by clinching the top position with the exponential growth of about 7% from the previous years. All these made them stand strong in the segment with an overall presence of 46%.

The year 2021 proved to be a year that was extremely conducive for OEMs. Eicher was also successful in bettering its presence in the market. It went on to be the second leading OEM’s in the country with a prominent hold of 32% market share. But Ashok Leyland couldn’t replicate the success of Tata and Eicher as they failed to register any growth during this period but in turn had to concede their Market share by 8% over these 3 years.

Light Commercial Vehicle Segment (LCV):

Indian Light Commercial Vehicle segment registered 10 percent growth in CY 2021 compared to CY 2020. The market dynamics didn’t much change for the light commercial vehicles (LCV). The growth saga of Tata and Eicher was uninterrupted and they made the most of the opportunity they got. One can imagine the reckoning presence of both these companies as they share a whopping 80% of business with each other. Overall the hyper-competitiveness in LCV resulted in capturing a 12% market share in the year 2021.

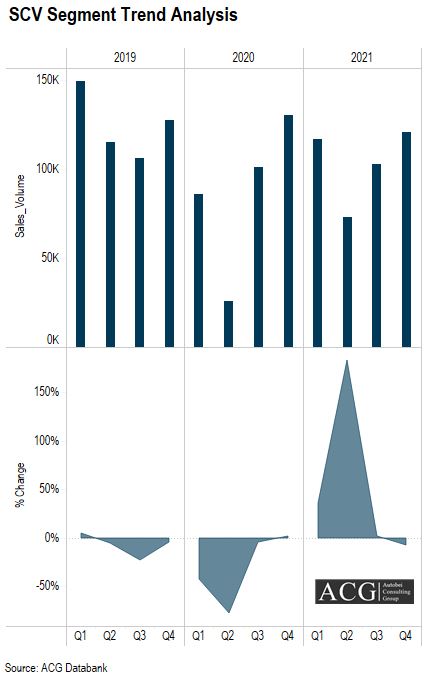

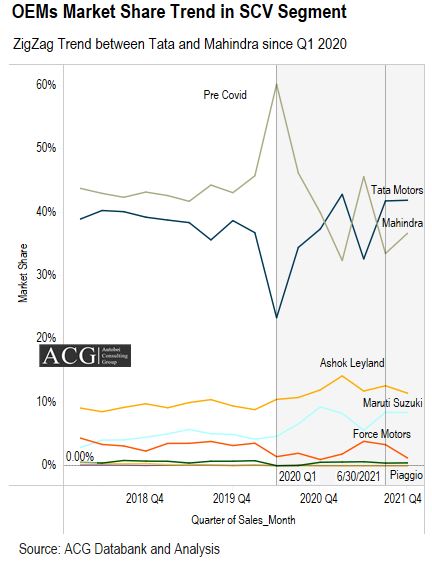

Small Commercial Vehicle Segment (SCV):

Indian Small Commercial Vehicle segment registered 20 percent growth in CY 2021 compared to CY 2020.

Lastly, we will conclude by taking a look at the performance of small commercial vehicles (SCV) during the post-pandemic period. Numbers suggest that this particular segment also had a good run during 2021 and overall growth of 20% was recorded.

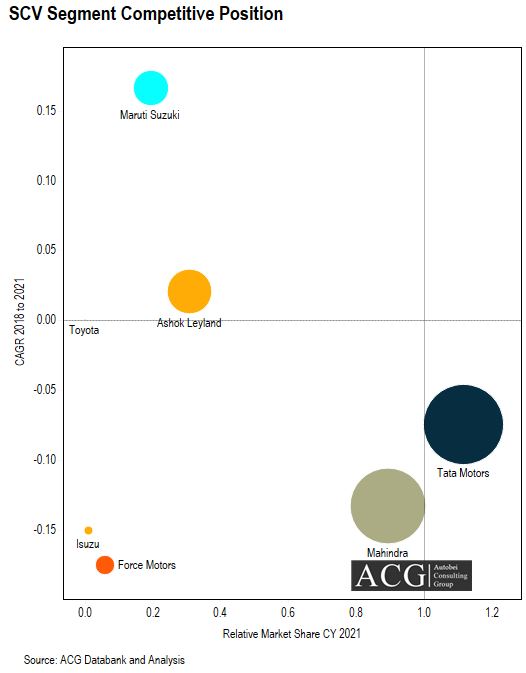

Tata continued to be an undisputed king of the market even for this segment with an unmatchable 40% share in the arena. It was then closely followed by Mahindra with almost 36.2% overall hold in the market.

Apart from these two prominent players in the segment, Ashok Leyland too tried to find its products feasible traction from the customers and they indeed were successful in stepping up by 3.3% by taking their market contribution to 12.5%. By observing all the growth trends in the Commercial vehicles we can formulate that the post-pandemic period did render an opportunity for the CV to rejuvenate themselves and establish their hold in the market.

To buy the full “Indian Commercial Vehicle Market Report 2022 and Outlook”, please contact us.

We have exclusive Indian CV Model-wise Export Data, please click here to get the detail.